Uncategorized

XRP’s Indecisive May vs. Bullish Bets – A Divergence Worth Watching

XRP, used by Ripple to facilitate cross-border transactions, ended May with signs of indecision. Still, activity on the dominant crypto options exchange, Deribit, suggests that bulls aren’t ready to back down yet.

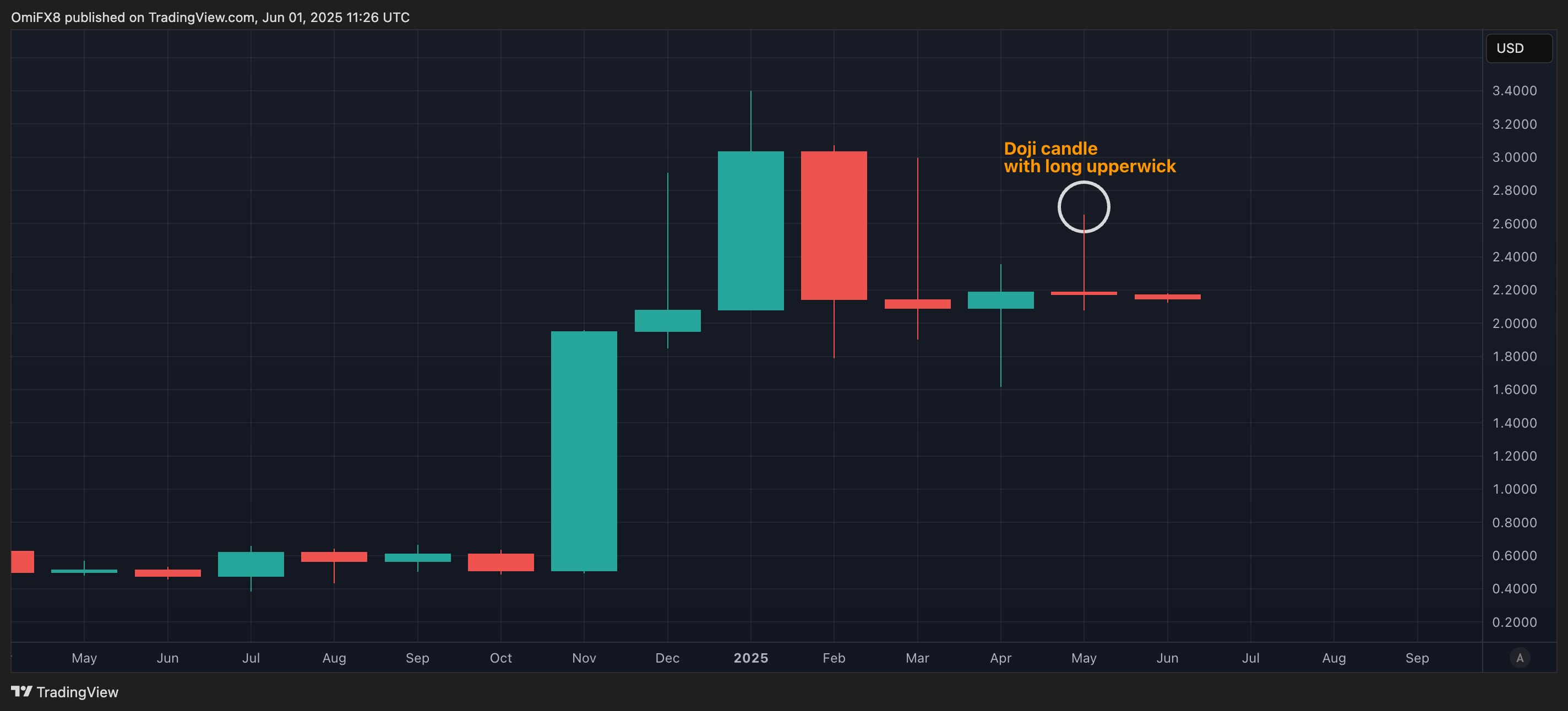

The payments-focused cryptocurrency formed a «doji» with a long upper shadow in May, a classic sign of indecision in the market, according to charting platform TradingView.

The long upper wick suggests that bulls pushed prices higher to $2.65, but bears stepped in and rejected those levels, driving prices down to near the level seen at the start of the month.

The appearance of the doji suggests the recovery rally from the early April lows near $1.60 has likely run out of steam. Doji candles appearing after uptrends often prompt technical analysts to call for bull exhaustion and a potential turn lower.

Accordingly, last week, some traders purchased the $ 2.40 strike put option expiring on May 30. A put option offers insurance against price drops.

Bullish options open interest

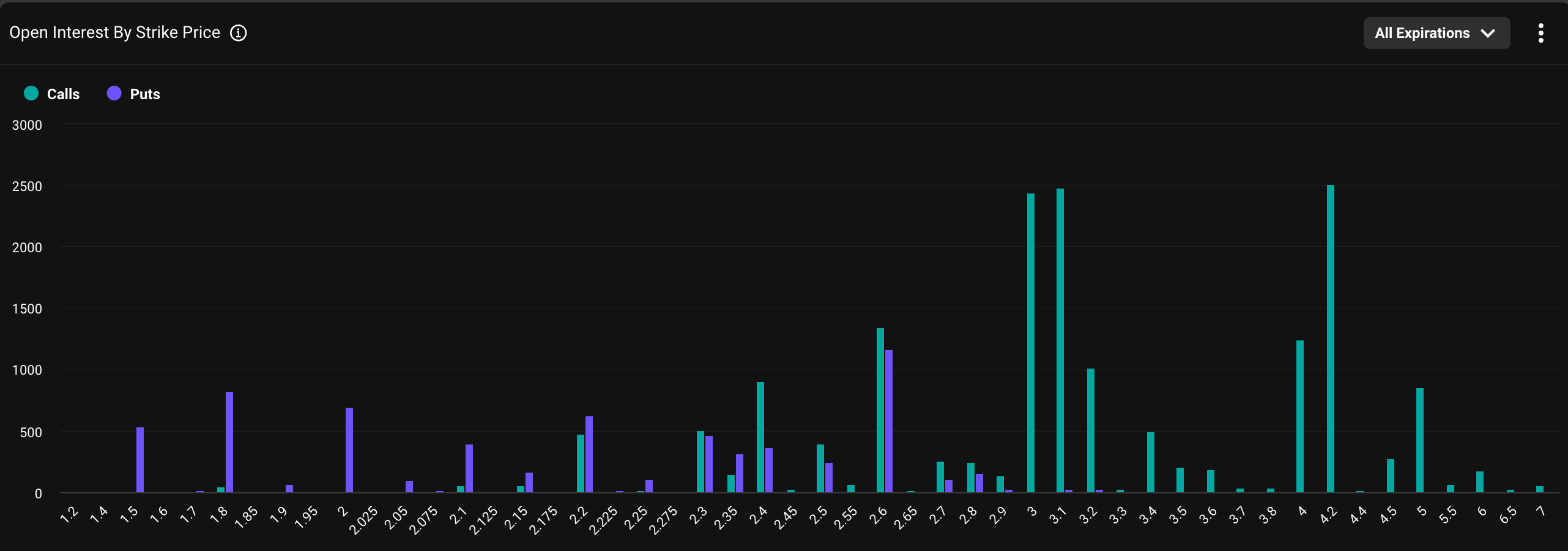

The overall picture remains bullish, with options open interest concentrated in higher-strike calls in a sign of persistent positive sentiment. Open interest refers to the number of active contracts at a given time. A call option gives the purchaser an asymmetric upside exposure to the underlying asset, in this case, XRP, representing a bullish bet.

«XRP open interest on Deribit is steadily increasing, with the highest concentration of strikes clustered on the upside between $2.60 and $3.0+, reflecting a notably bullish sentiment while the spot price currently trades at $2.16,» Luuk Strijers, CEO of Deribit, told CoinDesk.

The chart shows that the $4 call option is the most popular, with a notional open interest of $5.39 million. Calls at the $3 and $3.10 strikes have an open interest (OI) of over $5 million each. Notional open interest refers to the dollar value of the number of active contracts.

«XRP option open interest is split across June and September expiries, with monthly notional volumes approximating $65–$70 million, of which over 95% is traded on Deribit,» Strijers said.

The bullish mood likely stems from XRP’s positioning as a cross-border payments solution and mounting expectations of a spot XRP ETF listing in the U.S. Furthermore, the cryptocurrency is gaining traction as a corporate treasury asset.

Ripple, which uses XRP to facilitate cross-border transactions, recently highlighted its potential to address inefficiencies in SWIFT-based cross-border payments. The B2B cross-border payments market is projected to increase to $50 trillion by 2031, up 58% from $31.6 trillion in 2024.

Uncategorized

ARK Invest Sold $95M of Coinbase Shares After COIN’s Surge to Record Highs

ARK Invest offloaded nearly $43.8 million worth of shares of cryptocurrency exchange Coinbase (COIN) on Monday.

The sale follows similar moves last week for a total of 270,984 COIN shares offloaded in the last three trading days, worth just under $95 million based on Monday’s closing price of $350.49.

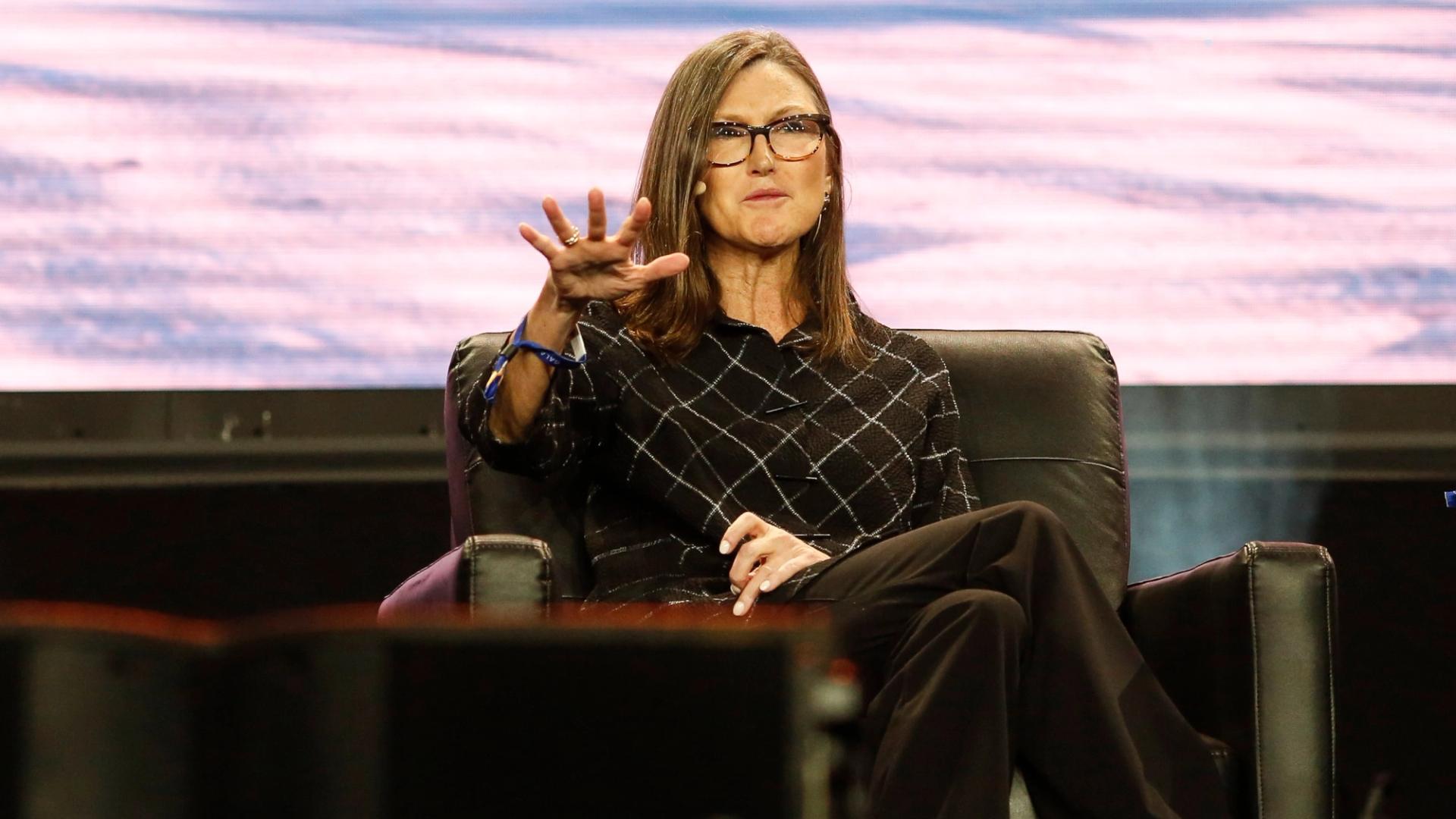

Coinbase shares surged to a record high of over $380 on June 26, which necessitated the sales from ARK. Cathie Wood’s investment managing firm has a target weighing of its exchange-traded funds (ETFs), whereby no individual holding exceeds 10% of its total value.

This leads to a trend of ARK selling large numbers of particular shares when their prices rally and acquiring them when they dip.

ARK holds COIN in three of its ETFs: Innovation (ARKK), Next Generation Internet (ARKW) and Fintech Innovation (ARKF).

Read More: ARK Invest Continues to Dump Circle Shares, Buys Robinhood and Coinbase

Uncategorized

Germany’s Public Savings Bank Network Sparkassen to Offer Bitcoin Trading to Clients: Report

Sparkassen, a group of savings banks operating across Germany since the first established in Hamburg in 1778, has decided to introduce cryptocurrency trading services for their customers, according to a report by Bloomberg.

The group will enable private clients to trade cryptocurrencies, including bitcoin (BTC) and ether (ETH), directly through their mobile banking apps via the group’s securities platform, DekaBank, with the facility expected to go live by summer 2026.

The news comes months after DekaBank introduced crypto trading and custody services for institutional clients and represents the growing acceptance of digital assets within traditional banking systems.

The German Savings Bank Association (DSGV) reportedly backed the decision to enable crypto trading, citing growing demand and the prevalence of legal framework under the so-called European MiCAR Regulation.

Earlier this year, Matthias Diessl, president of the Savings Banks in Bavaria, said in a Bloomberg interview that savings banks should offer customers the opportunity to trade cryptocurrencies, deviating from a three-year-old committee recommendation cautioning against enabling crypto trading.

That said, despite warming up to the idea, DGSV still considers digital assets as highly speculative investments, according to Bloomberg.

Read more: Boerse Stuttgart Partners With DekaBank to Offer Crypto Trading for Institutional Clients

Uncategorized

Bitcoin ETP With DeFi Yield Goes Live in Europe

A bitcoin (BTC) exchange-traded product (ETP) that generates yield from decentralized finance (DeFi) markets has debuted on Tuesday, in what issuer Fineqia calls a first of its kind.

The Fineqia Bitcoin Yield ETP (YBTC), listed on the Vienna Stock Exchange, targets a 6% annual yield by deploying investor capital into DeFi strategies. It is issued by Fineqia’s Liechtenstein-based subsidiary and advised by Psalion Yield, a digital asset investment firm focused on blockchain-based yield.

Unlike existing crypto yield ETPs that rely on derivatives or structured notes, YBTC maintains one-to-one exposure to bitcoin while generating returns directly from DeFi protocols.

“It allows investors to earn more BTC while they hold it, combining long-term conviction with compounding returns, all inside a regulated wrapper,” said Fineqia CEO, Bundeep Singh Rangar.

The ETP also supports in-kind transfers, meaning that digital asset holders can contribute BTC directly to the product without the need to first convert into cash incurring a taxable event.

YBTC arrives at a time when investor interest in crypto-focused investments is growing. These investment products has brought digital assets closer to traditional investors, allowing them to invest in digital assets in a familiar way through brokerage accounts without the need of crypto wallets and blockchain transactions.

Bitcoin exchange-traded products enjoyed rapid growth over the past year and have gobbled up $150 billion of assets, Fineqia said.

Read more: BlackRock to List Bitcoin ETP in Europe in First Crypto Foray Outside U.S.

-

Business9 месяцев ago

Business9 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion9 месяцев ago

Fashion9 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business9 месяцев ago

Business9 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Tech9 месяцев ago

Tech9 месяцев ago5 Crowdfunded products that actually delivered on the hype