Uncategorized

XRP Prints Lower Highs, Volume Spikes to 169M in Sharp Reversal

Traders brace for continued downside as resistance caps at $3.04 and $2.93 floor emerges following 169M volume flush.

What to Know

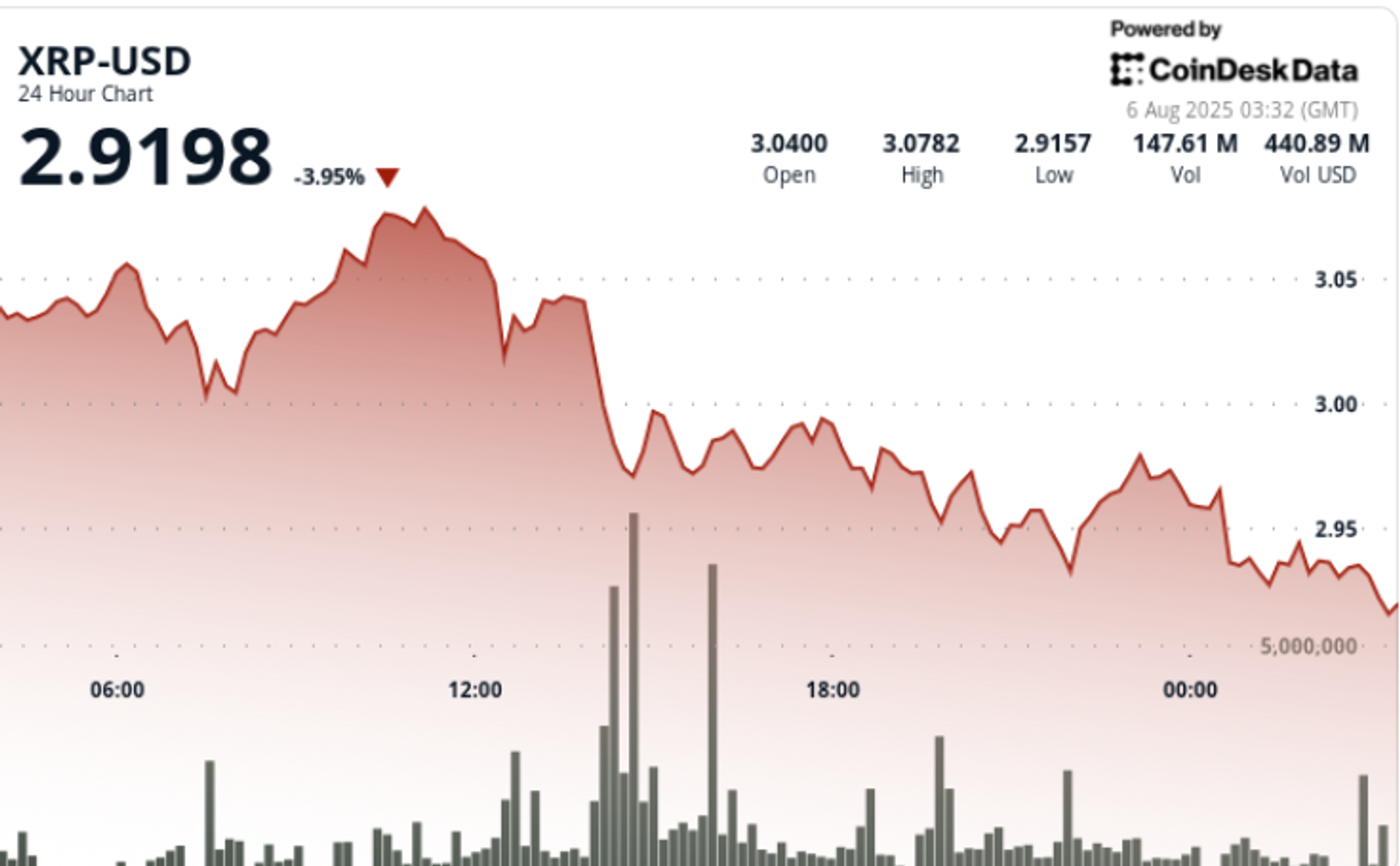

XRP fell 4.2% during the 24-hour session ending August 6 at 02:00, retreating from $3.06 to $2.93 in a volume-driven breakdown. The session’s high of $3.08 was hit at 10:00 before a sharp reversal set in. Price action accelerated at 14:00 when XRP fell from $3.04 to $2.97 on a 169.41 million volume surge — over 3x its 24-hour average of 52.73 million — establishing $3.04 as interim resistance and validating $2.93 as a local support floor.

Final-hour price action confirmed bearish control. XRP slid 1% from $2.94 to $2.92 between 01:15 and 02:14, completing a high-volatility session that saw a $0.13 swing, or 4.2% intraday range. A late 02:11 volume burst of 1.6 million sealed the decline as the token printed fresh intraday lows.

Price Action Summary

- XRP traded within a $0.13 range between $3.08 and $2.93.

- Price collapsed 4.2% on 169.41 million total volume.

- Peak decline occurred between 14:00 and 15:00 with the highest hourly sell volume.

- Final hour saw 1% additional downside, led by a 1.6 million trade at 02:11.

- Resistance caps at $3.04; support forms at $2.93.

- Consolidation range now sits between $2.96 and $2.97.

Technical Analysis

Price structure confirms rejection at $3.04 with immediate downside to $2.93 on above-average volume. The breach of short-term moving averages and failure to sustain above $3.00 point to continuation risk. Volume spikes during key selloff windows support the bearish bias.

Volatility remains elevated with no clear reversal signals printed. If $2.92 fails, next support zones lie near $2.87 and $2.80 based on historical volume nodes.

What Traders Are Watching

- Reclaim of $3.00 psychological level and defense of $2.93 zone.

- Whether bullish divergence emerges on intraday momentum indicators.

- Broader market impact from macro risk-off sentiment driven by geopolitical tensions and renewed trade instability.

Uncategorized

CoinDesk 20 Performance Update: Index Drops 2.5% as Nearly All Constituents Decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

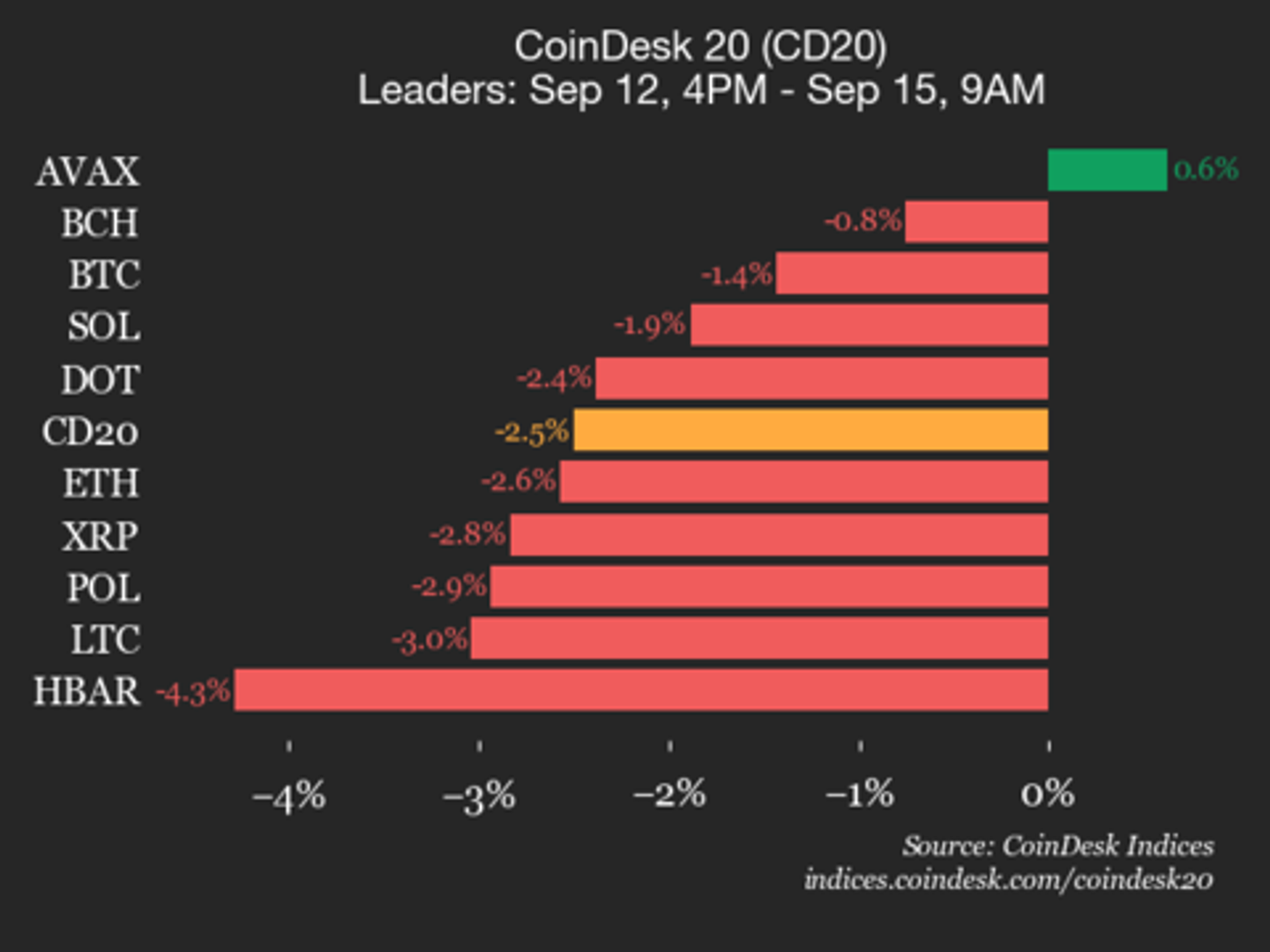

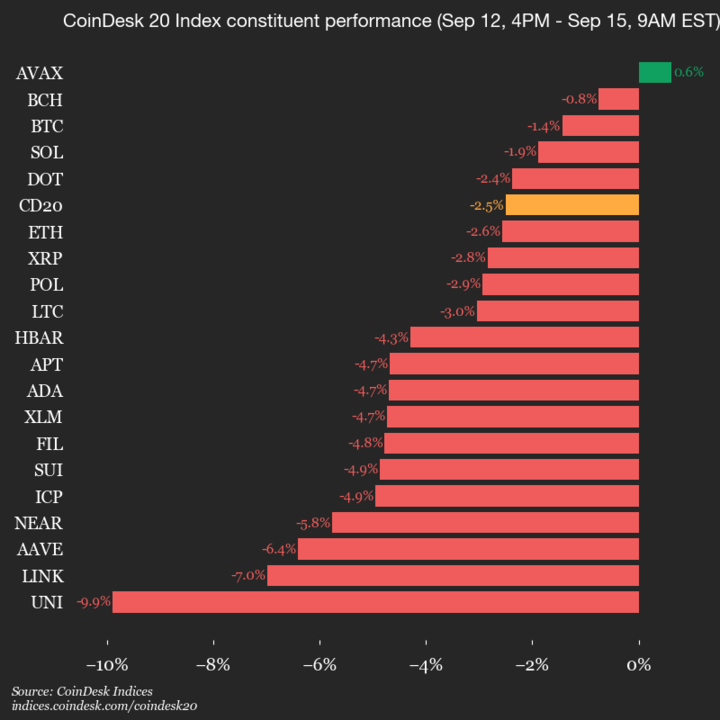

The CoinDesk 20 is currently trading at 4248.74, down 2.5% (-109.09) since 4 p.m. ET on Monday.

One of 20 assets is trading higher.

Leaders: AVAX (+0.6%) and BCH (-0.8%).

Laggards: UNI (-9.9%) and LINK (-7.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200%

Helius Medical Technologies (HSDT) announced on Monday it’s raising more than $500 million in a private financing round to create a Solana-focused treasury company.

The vehicle will hold SOL, the native token of the Solana blockchain, as its reserve asset and aims to expand to more than $1.25 billion via stock warrants tied to the deal, the press release said.

The financing was led by Pantera Capital and Summer Capital, with participation from investors including Animoca Brands, FalconX and HashKey Capital.

Shares of the firm rallied over 200% above $24 in pre-market trading following the announcement. Solana was down 4% over the past 24 hours.

The firm is joining the latest wave of new digital asset treasuries, or DATs, with public companies pivoting to raise funds and buy cryptocurrencies like bitcoin (BTC), ether (ETH) or SOL.

Helius is set to rival with the recently launched Forward Industries (FORD) with a $1.65 billion war chest backed by Galaxy Digital and others. That firm confirmed on Monday that has already purchased 6.8 million tokens for roughly $1.58 billion last week.

Helius’ plan is to use Solana’s yield-bearing design to generate income on the holdings, earning staking rewards of around 7% as well as deploying tokens in decentralized finance (DeFi) and lending opportunities. Incoming executive chairman Joseph Chee, founder of Summer Capital and a former UBS banker, will lead the firm’s digital asset strategy alongside Pantera’s Cosmo Jiang and Dan Morehead.

«As a pioneer in the digital asset treasury space, having participated in the formation of the strategy at Twenty One Capital (CEP) with Tether, Softbank and Cantor, Bitmine (BMNR) with Tom Lee and Mozayyx as well as EightCo (OCTO) with Dan Ives and Sam Altman, we have built the expertise to set up the pre-eminent Solana treasury vehicle,» Cosmo Jiang, general partner at Pantera Capital, said in a statement.

«There is a real opportunity to drive the flywheel of creating shareholder value that Michael Saylor has pioneered with Strategy by accelerating Solana adoption,» he added.

Read more: Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges

Uncategorized

American Express Introduces Blockchain-Based ‘Travel Stamps’

American Express has introduced Ethereum-based ‘travel stamps’ to create a commemorative record of travel experiences, as part of the firm’s revamped travel app.

The travel experience tokens, which are technically NFTs (ERC 721 tokens), are minted and stored on Coinbase’s Base network, said Colin Marlowe , VP, Emerging Partnerships at Amex Digital Labs.

The travel stamps, which can be collected anytime a traveler uses their card, are not tradable NTF tokens, Marlowe explained, and neither do they function like blockchain-based loyalty points – at least for the time being.

“It’s a valueless ERC-721, so technically an NFT, but we just didn’t brand it as such. We wanted to speak to it in a way that was natural for the travel experience itself, and so we talk about these things as stamps, and they’re represented as tokens,” Marlowe said in an interview.

“As an identifier and representation of history the stamps could create interesting partnership angles over time. We weren’t trying to sell these or sort of generate any like short term revenue. The angle is to make a travel experience with Amex feel really rich, really different, and kind of set it apart,” he said.

The Amex travel app also includes a range of tools for travels and Centurion Lounge upgrades, the company said.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars