Uncategorized

XRP Futures Set Open Interest Record at CME, With $3.70 Eyed Next

News Background

- CME Group said its crypto futures suite has surpassed $30 billion in notional open interest for the first time, with SOL and XRP futures each crossing $1 billion. XRP became the fastest contract to hit the milestone, doing so in just over three months.

- The development is viewed as a signal of market maturity and new institutional capital entering derivatives.

- Broader crypto markets remained firm into late August, though regulatory overhang in the U.S. has continued to pressure XRP relative to peers.

- Corporate adoption trends and pilot remittance programs keep XRP in focus for treasury desks, even as volatility spikes test investor conviction.

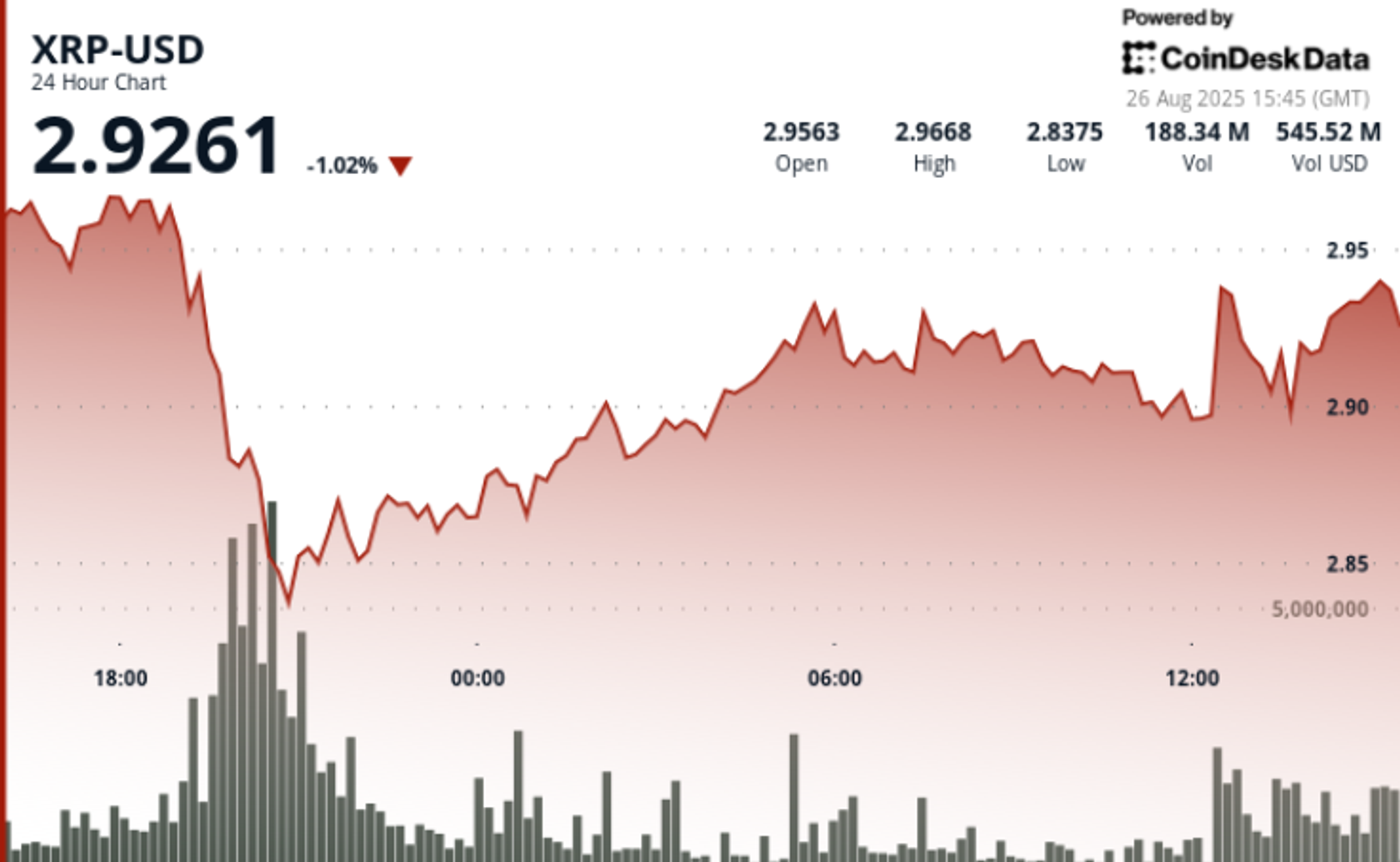

Price Action Summary

- XRP traded through a 5% range between $2.98 and $2.84 in the 24-hour session ending August 26 at 14:00.

- The steepest move occurred on August 25 during evening hours, when XRP dropped from $2.96 to $2.84 on 217.58 million tokens — triple its 72.45 million daily average.

- The token rebounded to $2.92, with the $2.84 level emerging as critical support as institutional flows stepped in.

- In the final hour of trading, XRP rose 0.7% from $2.90 to $2.92 on more than 5.7 million volume, signaling fresh corporate and fund participation.

Technical Analysis

- Support confirmed at $2.84 with high-volume absorption of sell pressure.

- Resistance remains at $2.94–$2.95, with repeated profit-taking capping upside attempts.

- RSI climbed from oversold 42 back into mid-50s, suggesting stabilizing momentum.

- MACD histogram tightening, indicative of potential bullish crossover in coming sessions.

- Weekly momentum divergence patterns point to compressed volatility, setting up for a directional breakout.

- Order books show concentrated institutional bids above $3.60, signaling strategic positioning ahead of regulatory catalysts.

What Traders Are Watching

- Bulls see $3.70 as the next upside target if $2.90–$2.92 base holds.

- Bears flag $2.80 as the downside trigger, with a break below support likely to accelerate losses.

- Derivatives flows now dominate the backdrop: CME’s $1B open interest in XRP futures will be a key barometer of institutional conviction.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton