Uncategorized

Worried About Timing the Bitcoin Market? A ‘Lookback Call’ Might Be the Answer

Imagine you’re a bitcoin (BTC) bull, confident prices will rally, but anticipating a pullback first. Like many people, however, you are not adept at perfectly timing such market entries and feel you may miss the optimal moment to load up on bullish exposure.

For traders facing this common predicament, a structured product known as a lookback call may offer a compelling solution.

A lookback call is an exotic option that gives the holder the right to buy the underlying asset at its lowest observed price during the so-called lookback period.

For instance, instead of trying to pick the exact bottom of the current BTC price pullback from record highs, a trader may consider a three-month lookback with a one-month lookback period.

That means the strike price is set at the lowest value in the first month, and the call can be exercised at that level anytime before the option expires three months after it’s issued. So if the BTC price dropped to $100,000 in the initial month before rising to, say, $140,000 within three months, the holder could require the issuer to sell BTC at $100,000.

The option’s unique structure ensures the call buyer benefits from securing the perfect dip, maximizing their profit potential by eliminating the need for precise market timing. That’s in stark contrast a traditional call option from a centralized exchange, where traders must select a fixed strike price, significantly increasing the risk of a suboptimal entry.

«BTC spot remains near its highs, but implied volatility has collapsed. This combination makes lookback options particularly attractive from a risk-reward perspective,» Pulkit Goyal, head of trading at Orbit Markets, told CoinDesk. «With implied volatility at such low levels, the lookback feature offers perfect entry for limited extra cost.»

Orbit Markets, an OTC desk specializing in options and structured products, suggested a three-month lookback call to its clients, which will set the strike to the lowest bitcoin price over the next four weeks. The suggestion underscores a growing demand for sophisticated risk-management tools and highlights the increasing maturity of the crypto derivatives market.

The benefit of perfect entry comes at a cost, meaning the Orbit’s lookback call was priced at 12.75% volatility, somewhat higher than the 0.25% volatility for the regular call option. The issuer of the option is taking on the risk that BTC might drop, forcing them to give you a more favorable strike price. As a buyer, you pay extra that unique benefit.

What if BTC doesn’t drop?

It’s perfectly possible that BTC immediately rallies from the going market rate of around $115,000 and stays higher over the next four weeks before rallying further to $140,000 by the end of the three months.

In this case, the strike price is fixed at $115,000 after the one-month lookback period ends, giving the call holder the right to buy BTC at $115,000 on expiry.

In other words, even though the prices didn’t dip initially, the call buyer still got a good entry, profiting from the subsequent upward move.

Risk profile

The buyer of the lookback call option stands to lose the initial volatility premium paid if BTC crashes to levels below the strike price fixed after one month.

The risk profile, therefore, is similar to that of a standard call option.

Uncategorized

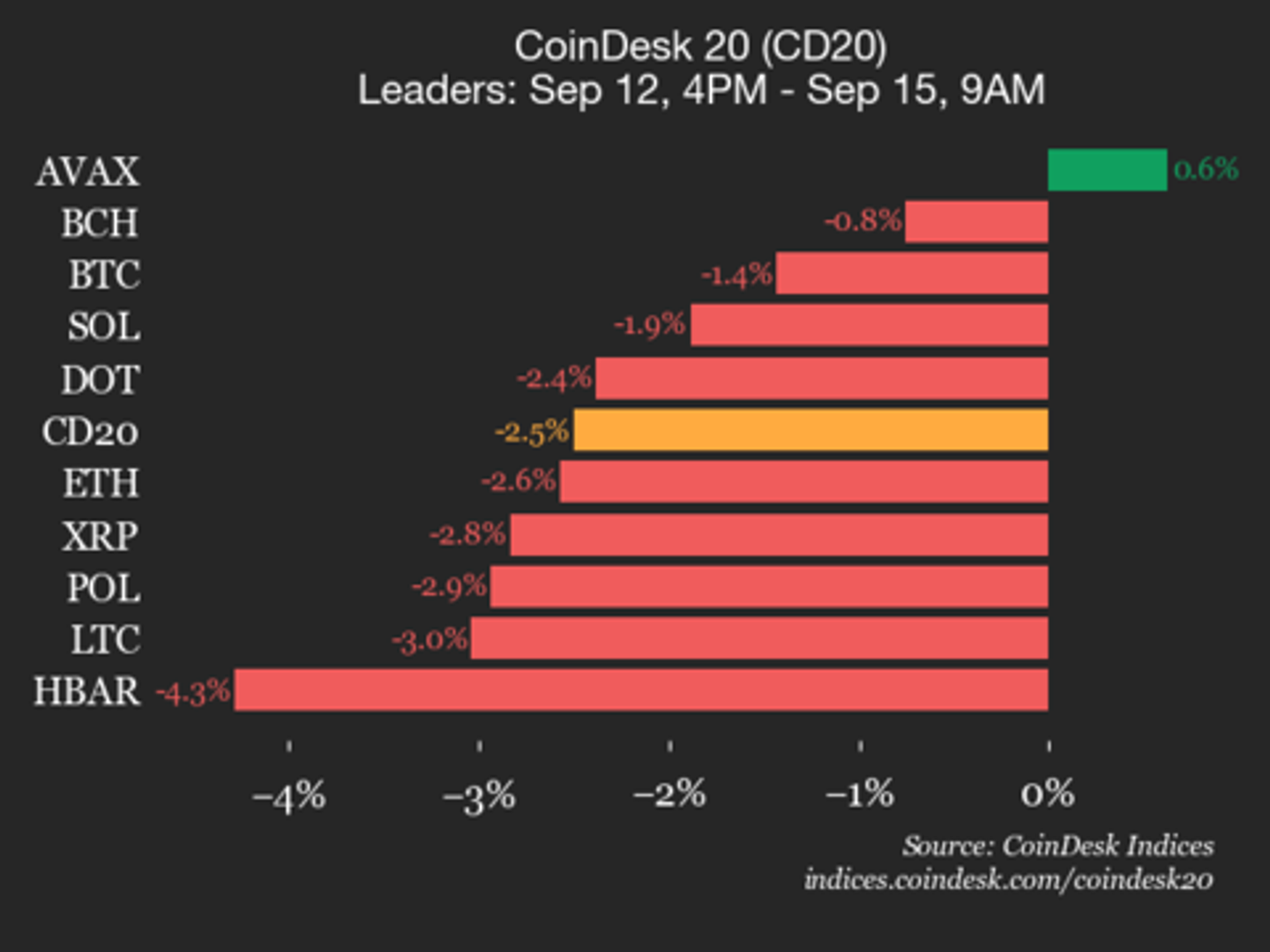

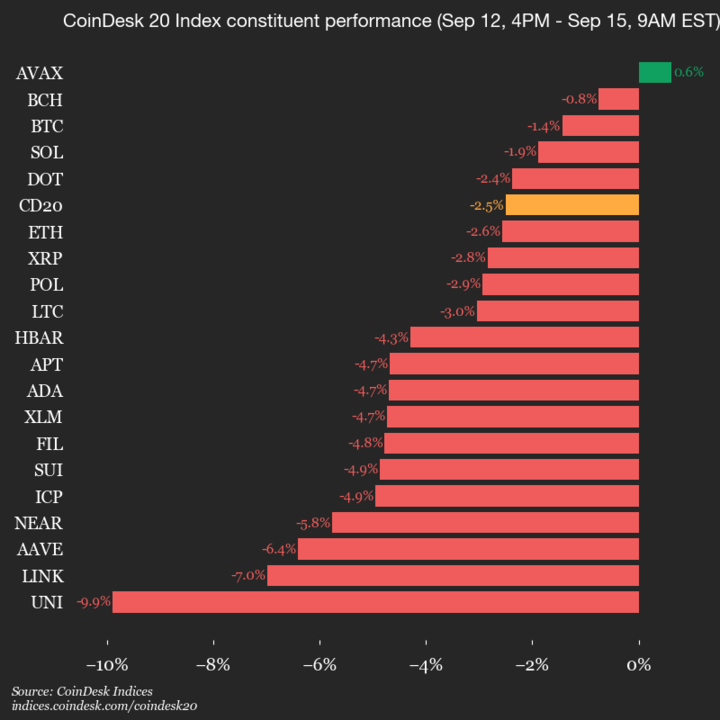

CoinDesk 20 Performance Update: Index Drops 2.5% as Nearly All Constituents Decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4248.74, down 2.5% (-109.09) since 4 p.m. ET on Monday.

One of 20 assets is trading higher.

Leaders: AVAX (+0.6%) and BCH (-0.8%).

Laggards: UNI (-9.9%) and LINK (-7.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200%

Helius Medical Technologies (HSDT) announced on Monday it’s raising more than $500 million in a private financing round to create a Solana-focused treasury company.

The vehicle will hold SOL, the native token of the Solana blockchain, as its reserve asset and aims to expand to more than $1.25 billion via stock warrants tied to the deal, the press release said.

The financing was led by Pantera Capital and Summer Capital, with participation from investors including Animoca Brands, FalconX and HashKey Capital.

Shares of the firm rallied over 200% above $24 in pre-market trading following the announcement. Solana was down 4% over the past 24 hours.

The firm is joining the latest wave of new digital asset treasuries, or DATs, with public companies pivoting to raise funds and buy cryptocurrencies like bitcoin (BTC), ether (ETH) or SOL.

Helius is set to rival with the recently launched Forward Industries (FORD) with a $1.65 billion war chest backed by Galaxy Digital and others. That firm confirmed on Monday that has already purchased 6.8 million tokens for roughly $1.58 billion last week.

Helius’ plan is to use Solana’s yield-bearing design to generate income on the holdings, earning staking rewards of around 7% as well as deploying tokens in decentralized finance (DeFi) and lending opportunities. Incoming executive chairman Joseph Chee, founder of Summer Capital and a former UBS banker, will lead the firm’s digital asset strategy alongside Pantera’s Cosmo Jiang and Dan Morehead.

«As a pioneer in the digital asset treasury space, having participated in the formation of the strategy at Twenty One Capital (CEP) with Tether, Softbank and Cantor, Bitmine (BMNR) with Tom Lee and Mozayyx as well as EightCo (OCTO) with Dan Ives and Sam Altman, we have built the expertise to set up the pre-eminent Solana treasury vehicle,» Cosmo Jiang, general partner at Pantera Capital, said in a statement.

«There is a real opportunity to drive the flywheel of creating shareholder value that Michael Saylor has pioneered with Strategy by accelerating Solana adoption,» he added.

Read more: Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges

Uncategorized

Boundless Launches Mainnet on Base, Ushering in Universal Zero-Knowledge Compute

Boundless, the zero-knowledge (ZK) compute marketplace incubated by RISC Zero, has officially launched its Mainnet on Base, giving every blockchain access to verifiable compute.

The milestone builds on the network’s incentivized testnet, which went live in July and stress-tested Boundless’ architecture under real-world conditions.

During that Beta phase, Boundless operated like a decentralized marketplace where developers seeking ZK proofs for applications such as rollups, bridges and privacy protocols could connect with independent provers, or ZK miners, who generated those proofs.

The launch introduced Proof of Verifiable Work, an incentive mechanism that rewards provers based on the volume, speed and complexity of their computations. Community participation was strong, fueled in part by the anticipation of $ZKC token rewards.

With Monday’s mainnet launch, those capabilities are now operational at scale. The team behind Boundless says it can deliver verifiable compute across chains, enabling developers to build applications that preserve privacy while scaling seamlessly between ecosystems.

Some key protocols have started to integrate Boundless into their systems. Wormhole is integrating Boundless to add ZK verification to Ethereum consensus, making cross-chain transfers more secure.

BOB, a hybrid Bitcoin rollup, is tapping Boundless to allow EVM applications to interoperate with Bitcoin using proofs that inherit Bitcoin’s security while drawing on Ethereum’s liquidity. And staking protocol Lido is deploying Boundless to secure validator exits with transparent proofs, strengthening trust and auditability for its crypto assets.

“For the first time, developers on any chain can access abundant zero-knowledge compute to build complex applications that scale across ecosystems without sacrificing decentralization,” said Shiv Shankar, the CEO of Boundless.

Read more: Risc Zero’s ‘Boundless’ Incentivized Testnet Goes Live

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars