Uncategorized

Why OFAC Delisted Tornado Cash

Last month, the U.S. Treasury Department’s Office of Foreign Asset Control delisted Tornado Cash from its sanctions list, months after an appeals court ruled that the watchdog could not designate the mixer’s smart contracts.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Fair winds

The narrative

In November 2024, a Fifth Circuit Court of Appeals panel ruled that the Treasury Department’s Office of Foreign Assets Control (OFAC) couldn’t sanction smart contracts tied to crypto mixer Tornado Cash. Last month, OFAC delisted Tornado Cash entirely, though it left developer Roman Semenov on its Specially Designated Nationals list.

Why it matters

Whether Tornado Cash could be sanctioned to begin with has been a point of contention for the crypto industry. The Fifth Circuit ruling sparked a rally in the TORN token’s price and raised hopes that it would be more difficult for the U.S. government to block legal uses of mixers.

Breaking it down

Tornado Cash’s delisting included smart contract addresses and other components of the overall mixer, and followed November’s ruling. The delisting may have been an effort to preempt a court ruling that would force OFAC to permanently delist Tornado Cash.

Backing up a little: A group of developers sued OFAC after Tornado Cash was first sanctioned with backing from crypto exchange Coinbase. That case, Van Loon v. Treasury, received an initial ruling from a district court judge that was favorable to the Treasury Department. On appeal, however, the Fifth Circuit ruled — somewhat narrowly — that smart contracts were outside the scope of OFAC’s jurisdiction. The appeals court panel threw the case back down to the district court to sort out next steps.

On March 21, the same day it removed Tornado Cash from its sanctions list, OFAC filed a notice telling the court that the removal meant the legal case remedies cot «the matter is now moot.»

Peter Van Valkenburgh, the executive director at Coin Center, said the November decision left OFAC with few options.

«They could have waited for the court to invalidate the sanctions or they could have delisted them themselves, and they delisted themselves,» he said. «You can read that two ways. You can read that as ‘I want to try and preserve some ability to fight in the future or [make] some other listing,’ [and] that’s really tough because that Fifth Circuit opinion is really bad for them.»

The other read for the delisting is OFAC just wanted the matter resolved quickly, he said.

Leah Moushey, an attorney with Miller & Chevalier, said the court may choose to reject OFAC’s filing because there’s an open question as to whether Tornado Cash can be redesignated in the future. She pointed to a Supreme Court case with thematic similarities.

The court said in that case, FBI v. Fikre, that the U.S. government had not sufficiently proven that just removing an individual from a no-fly list meant he would never be placed back on the list.

OFAC may have to show in this case that Tornado Cash can’t be designated again.

Another open question for Tornado Cash is whether the delisting has any bearing on the U.S. Department of Justice’s criminal case against developer Roman Storm. After the Fifth Circuit ruling, Storm’s attorneys filed a motion asking the judge overseeing the criminal case to dismiss the indictment, but the judge has already ruled that the case should move forward.

«The judge determined that the scope of the conduct went beyond the interactions with the smart contract,» Moushey said. The Fifth Circuit ruling did not discuss Tornado Cash as an entity.

Van Valkenburgh noted that OFAC left its sanctions against Semenov in place, and the DOJ will continue to try and argue Storm conspired to violate sanctions.

The Storm case is currently set for trial in July.

Stories you may have missed

Illinois to Drop Staking Lawsuit Against Coinbase: Illinois has become the latest state to announce it would drop its lawsuit against Coinbase, joining Kentucky, Vermont and South Carolina. New Jersey and Washington regulators say their investigations remain open.

Tron’s Justin Sun Bailed Out TUSD as Stablecoin’s $456M Reserves Were Stuck in Limbo, Filings Show: Justin Sun loaned Techteryx nearly $500 million after the company lost access to its reserves’ liquidity through what Sun and Techteryx allege are mismanagement by First Digital Trust, the Hong Kong-based fiduciary managing the TrueUSD reserves, legal documents claim.

First Digital to ‘Pursue Legal Action’ Over Justin Sun Allegations as FDUSD Drops: First Digital threatened a lawsuit against Justin Sun, saying his allegations that it was «effectively insolvent» was a «smear campaign.»

U.S. SEC Staff Clarifies That Some Crypto Stablecoins Aren’t Securities: The SEC’s latest staff statement addresses stablecoins, with the usual caveats about it being a staff statement and not commissioner guidance.

Stablecoin Giant Circle Files for IPO After $1.7B Stablecoin Reserve Windfall: Stablecoin issuer Circle filed to go public.

Circle’s IPO Filing Tests Crypto Market Confidence After Trump’s Tariff Shock: A number of companies looked set to go public before the entire stock market tanked this week. Circle was on that list.

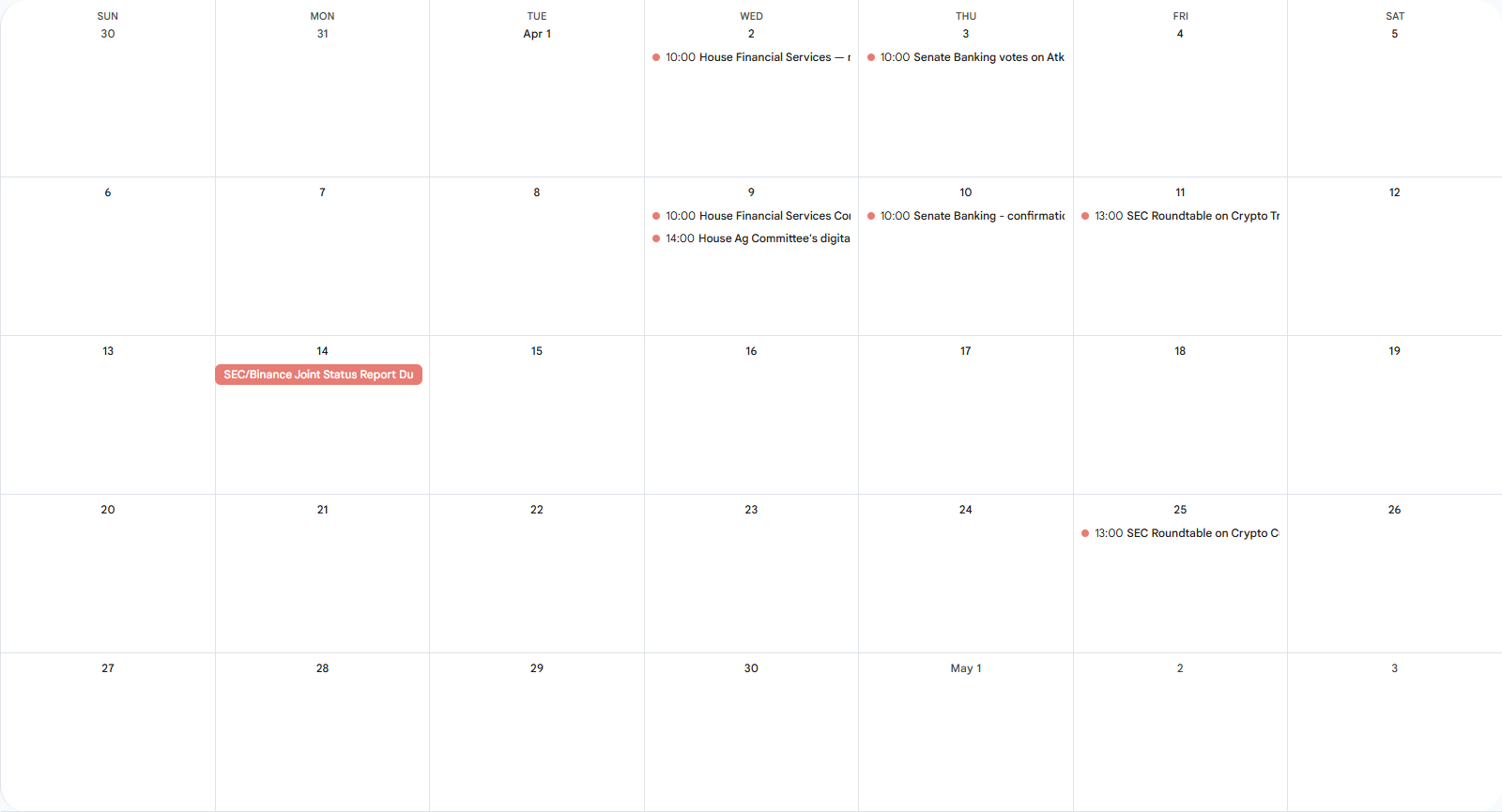

This week

Wednesday

14:00 UTC (10:00 a.m. ET) The House Financial Services Committee held a markup on the STABLE Act, Financial Technology Protection Act and the CBDC Anti-Surveillance State Act, ultimately passing all three bills — after a daylong session addressing some 40 different proposed amendments.

Thursday

14:00 UTC (10:00 a.m. ET) The Senate Banking Committee voted to advance the nominations of Securities and Exchange Commission Chair Paul Atkins and Comptroller Jonathan Gould.

Elsewhere:

(404 Media) T-Mobile offers a GPS tracker for parents to keep tabs on their children. Last week, 404 Media reports, some parents found they were unable to track their own kids but did receive the location data for other kids.

(The New York Times) The Times reported on a Ponzi scheme that used crypto promises to sucker a large number of people in an Argentinian town. These kinds of scams are very common.

(The Atlantic) The Trump administration said in a court filing it had sent an individual with protected legal status to an El Salvador prison camp without holding a hearing through an «administrative error.» A federal judge ordered the administration to bring him back to the U.S. on Friday. White House Press Secretary Karoline Leavitt responded with a statement saying «we are unaware of the judge having jurisdiction or authority over the country of El Salvador.»

(The Wall Street Journal) New Jersey Democrat Cory Booker broke the U.S. Senate record for longest floor speech after giving a marathon 25-hour address in protest of President Donald Trump’s policies.

(The New York Times) Donald Trump unveiled a whole set of tariffs on countries around the world, saying they were reciprocal against tariffs imposed by the U.S.’s trading partners. «The markets are going to boom,» Trump said in remarks.

(Yahoo! Finance) The markets «cratered on Friday,» following an equally rough Thursday.

(Wired) Among the countries and places tariffed by the U.S. is the Heard and McDonald Islands, which is uninhabited by humans and does not export goods.

(ABC News) The White House said its tariff rate against individual countries was half of those countries’ tariff rates against the U.S. Economists say the actual calculations were done by dividing a country’s trade deficit by its import value, then divided in half, ABC News reported.

(Reuters) The other effect of the renewed tariffs appears to be rising recession odds, according to a J.P. Morgan note shared by Reuters.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars