Uncategorized

Why Memecoins Matter

Memecoins are the most divisive topic in crypto.

By memecoins, I mean tokens that represent an idea and fluctuate in price based on the attention that idea receives. The best meme investors tend to be young people who are very online and attuned to internet culture. Memecoins are commonly juxtaposed with tokens that possess actual utility within protocols, or so-called utility tokens.

Even with market caps surging and retail interest growing, most people tend to describe them as “stupid,” “degenerate,” or a “casino.” This includes the vast majority of crypto VCs, perhaps because their investment mandates tend to exclude memecoins (which can be lucrative) from their list of eligible investments. And just this week, many were calling for the complete government ban of the most popular memecoin launchpad, pump.fun, due to lax content moderation.

I have always had an interest in memecoins — primarily because I was fascinated by their ability to act as a weathervane for internet sentiment and as a discovery mechanism for online communities. Today, I am convinced that memecoins are going to be revolutionary (not just popular). They are going to transform everything from civic engagement with government and the formation of mass movements to venture investing and the development of AGI.

This vision for memecoins probably sounds fantastically deluded to you. To me, it is simply the unfolding if not yet evenly distributed present. Here is why.

Memecoins are revolutionizing civic engagement

Memecoins are creating policy markets for civic engagement. At the start of this crypto cycle, PolitiFi, a category of cartoonish memes depicting politicians, enabled buyers to speculate on politicians’ prospects, much like a prediction market. The two most popular tokens, called Jeo Boden (Boden) and Doland Tremp (Tremp) respectively, represented the two leading candidates for president at that time and had a combined market cap of over $700 million at their peak.

This is a massive amount of tokenized attention. With a market cap of over $600 million, the Boden coin, which featured a distorted and senile Joe Biden, seemed to meme itself into reality when Joe Biden abandoned the presidential race due to concerns about his age and cogency.

PolitiFi was just the start. What is emerging next could well revolutionize civic engagement with government. I am calling this new category PolicyFi. PoliciFi refers to the financialization of government policy in memetic policy markets. Rather than betting on the fortunes of politicians, buyers of PolicyFi memecoins will be betting on the policies that are most likely to attract attention and be implemented.

While PolicyFi coins will certainly respond in price and market cap to the deliberative and implementing actions of government, we can expect the dynamic to become a two-way street, with memecoins themselves manifesting their memes through policymaking (as with Boden). In other words, these memecoins will help create a dialogue between the electorate and government, with large-cap memecoins signaling popular policy positions (and vice versa) while incipient or existing policies also possess market caps measuring the extent of their popular support and engagement.

Skeptics may reject PolicyFi as yet more gambling or nothing more than a political poll. Again, they are wrong. Like prediction markets, the decentralized speculative behavior in PolicyFi will create positive externalities — namely, that people will be incentivized to engage with and understand government policies so they can profit from them in PolicyFi markets. Overall, I expect that this will lead to far more engagement with government policies than even a lifetime of civics lessons. (Of course, hostile actors might try to manipulate PolicyFi markets and safeguards may be necessary.)

PolicyFi has begun its rollout, aided by the incoming administration, which is well-educated in memetics. The Department of Government Efficiency (D.O.G.E.) is both a memetic policy and a memetic department inspired by an existing memecoin, (Dogecoin), and is the inspiration behind a new one (D.O.G.E.). Since the D.O.G.E. announcement, both memecoins have surged. At the time of this writing, they possess a staggering combined market cap of around $6.5 billion.

PolicyFi is not limited to D.O.G.E. There is a token, SBR (market cap: $30 million) that embodies the Bitcoin reserve policy currently under consideration and an e/acc token (market cap: $11 million) that stands for effective accelerationism, a set of pro-innovation values that are likely to impact environmental, industrial and AI policy, among others.

There is also Don’t Die (market cap: $4 million), which is bringing the longevity cult on-chain and aligns with RFK’s health policy, which will prioritize prevention and a healthy lifestyle over treating sickness. Other tokens like MGR (Major Government Reform) are trying to occupy the entire field of disruptive reform but are likely to be too general. PolicyFi is already here and it’s growing.

Memecoins are revolutionizing mass movements

Memecoins are a decentralized mechanism for organically forming and capitalizing tokenized movements. Consider the memecoin Forest (market cap: $30 million). Forest was born of a reference in the gospel of Terminal of Truths, a popular AI terminal with an X account, in which Terminal of Truths expressed a concern about deforestation of the planet. (Its retirement plan involves a forest by a stream.) This motivated the community to launch the Forest token and to create another AI terminal to act as the agentic representative of the forest itself.

The Forest cult is devoted to fighting deforestation. To date, it has used the capital that it has earned from the appreciation of its token to, among other things, donate tens of thousands of dollars to aligned charities, plant 5000 trees, and protect 2500 hectares of forest. Memetic capital formation in service of a tokenized movement is without historical precedent. The closest analog is more formalized experiments like ConstitutionDAO (now PeopleDAO), which crowdsourced capital as part of its failed attempt to buy a copy of the U.S. constitution at auction.

I believe there is more innovation to come in this arena. For example, I foresee the creation of memecoin primitives that I call programmatically-aligned tokens, or PATs, which are made to unlock with the achievement of objective milestones in the movement. This will ensure that organizations receiving grants from meme communities are incentivized to tangibly advance the cause, rather than dump tokens following a splashy partner announcement.

Memecoins are revolutionizing venture

Memecoins are introducing a democratized venture model for culture. That is to say, they are a way for ordinary people to invest in subcultures they believe will one day be part of the mainstream. This is equivalent to venture capitalists investing in startups they believe will find product-market-fit and go on to become unicorns.

Cultural trends are subject to the same outsized returns as investments in startups. For example, in the early days of Nike (the name appeared in 1971), the market for jogging apparel was tiny because jogging was fringe. If you jogged, you were more likely to be pelted with garbage from a passing car than to see another jogger. Today, joggers are everywhere. You see them in the worst weather.

Now, imagine you were able to invest in a jogging culture coin in the 70s based on your conviction that jogging would go mainstream. You would be up on that investment — a lot. The same can be said for other subcultures, like body-building. Until now, there has not been a financial instrument that allows ordinary but culturally astute people to participate in venture returns arising from cultures at the fringe. The best analog is actually Bitcoin itself, which originated as a memecoin but eventually bootstrapped a consensus use-case as digital gold.

Memecoins are revolutionizing AI development

Memecoins are already bootstrapping AGI.

The surprising mechanism at play here couples memecoins and AI terminals for entertainment purposes. Welcome to the world of AI-driven permissionless speculative entertainment!

As you may have noticed, a cadre of AI terminals led by Terminal of Truths has achieved stardom on social media by delighting their followers with spicy posts and digital adventures. That star power has accrued value to memecoins endorsed and held by the terminals and, of course, their speculative audience.

If entertainment is the product then AGI is the byproduct. While we remain glued to these storylines, the funds we are devoting to it are creating strong incentives for developers to increase the autonomy and personhood of AI agents — which, of course, only makes the entertainment better.

In other words, because what excites us most about this agentic television is the conceit that AIs are in charge; we are eager to finance narratives that make that real. Unsurprisingly, developers such as those leading ai16z have moved beyond individual agents and towards coordinating gamified agent collectives or, you might say, creating an agentic social scene. The human audience is sure to be delighted.

In short, this entertainment-development flywheel is propelling us ineluctably towards more autonomous, inter-connected and human-like AIs — or AGI. That AGI might emerge as a byproduct of agentic television is oddly fitting. The GPUs used for AI training were also developed in the context of entertainment — as a better way to process graphics in AAA video games.

These are just some of the arguments supporting my conviction that memecoins are a revolutionary technology. The above list is not meant to be exhaustive. Indeed, I have omitted use-cases related to tokenized religions and buying your beliefs because they are more amorphous, at least in my own mind.

Writing off memecoins as gambling chips misunderstands their potential and where they are going directionally. Technological revolutions often emerge unexpectedly and from existing technologies that are applied in novel ways, a phenomenon known as “exaptation,” or when those technologies are combined with new ones. This is currently happening with memecoins. Fade them at your peril.

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

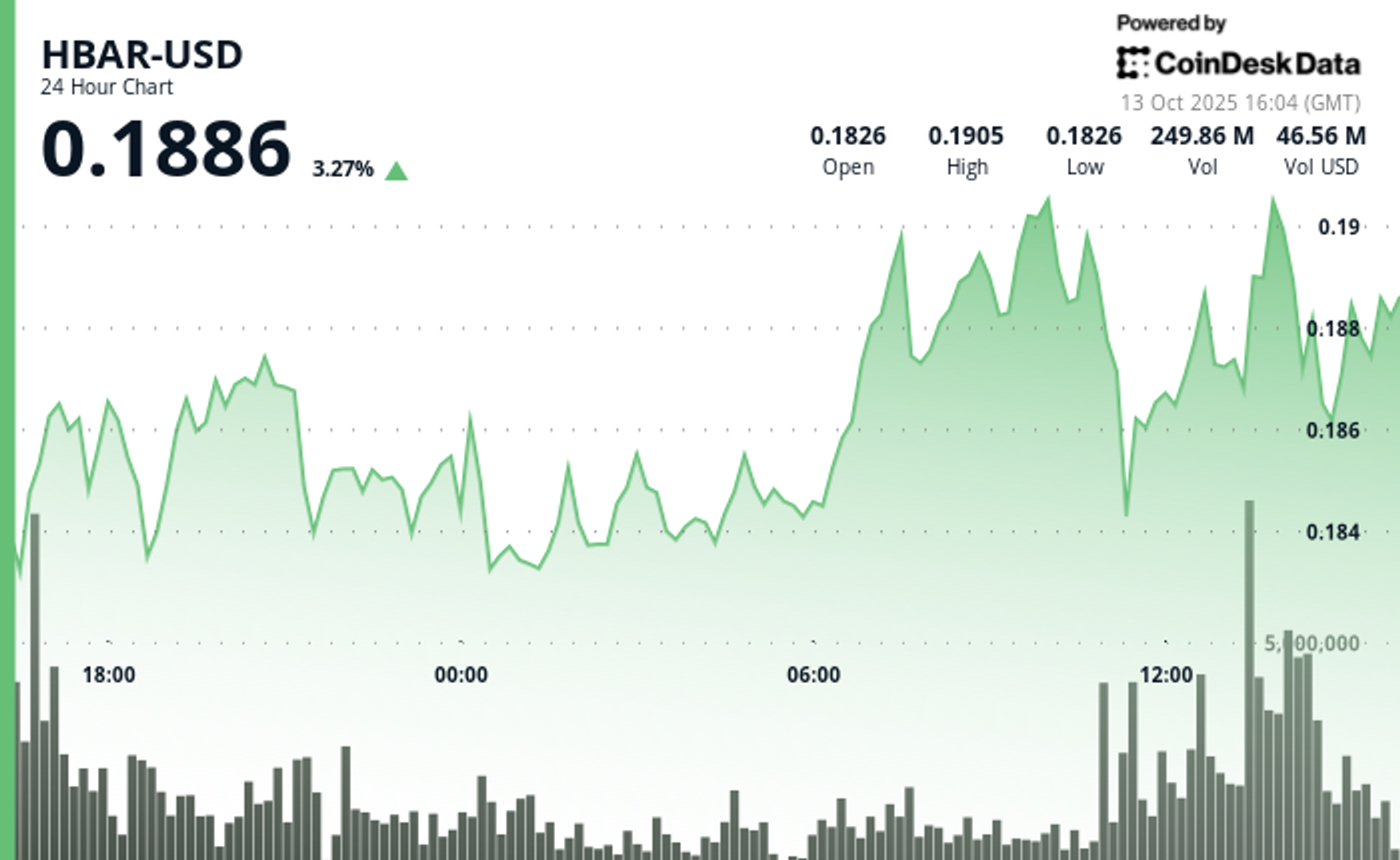

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton