Uncategorized

Where All the SEC Cases Are

The U.S. Securities and Exchange Commission has dropped or paused over a dozen ongoing cases (and lost one) since U.S. President Donald Trump retook office just over two months ago and appointed Commissioner Mark Uyeda as acting chair.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

One left?

The narrative

The U.S. Securities and Exchange Commission appears to have closed almost all of its outstanding crypto-related cases — at least the publicly disclosed ones — in the last two months since Mark Uyeda took over as acting chair of the agency. In many of the court filings, the SEC argued that it needs to pull these cases while the regulator’s new crypto task force reassesses how exactly it applies securities laws to digital assets, though in at least some of these cases the SEC is leaving itself no recourse to sue again should it find some cryptos from previously active suits are indeed securities.

Why it matters

TKTK

Breaking it down

Ripple: Ripple announced it had reached an agreement with the SEC to drop both the SEC’s appeal of a federal judge’s 2023 ruling and RIpple’s cross-appeal. Ripple will receive back $75 million of the $125 million fine it was assessed by a federal judge. The agreement does not yet appear to be on the public court docket.

Coinbase: Coinbase announced last month it had reached an agreement with the SEC to drop the regulator’s ongoing case against it. The SEC filed to withdraw the case with prejudice — meaning it cannot bring the same charges again — and a judge signed off on the withdrawal at the end of February. The SEC alleged that Solana (SOL), Cardano (ADA), Polygon (MATIC), Sandbox (SAND), Filecoin (FIL), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), Near (NEAR), Voyager (VGX), Dash (DASH) and Nexo (NEXO) all appeared to be traded as securities in its initial lawsuit.

ConsenSys: The SEC said it would drop its case against ConsenSys over the MetaMask wallet, CEO Joe Lubin said last month, and a joint stipulation dismissing the case with prejudice was filed on March 27. A court docket entry dated March 28 said the civil case was terminated.

Kraken: The SEC told Kraken it would drop its case against the exchange alleging it violated securities laws and commingled customer and corporate funds earlier this month. A joint stipulation dismissing the case was filed on March 27, though a judge does not appear to have signed off just yet.

Cumberland DRW: The SEC told Cumberland DRW it would drop its case alleging it was acting as an unregistered securities dealer earlier this month. The SEC and Cumberland filed a motion to stay proceedings on March 18, saying «the parties have agreed in principle to dismiss this litigation with prejudice» but needed three weeks to work out the details. The judge overseeing the case granted the motion, ordering the parties to file a joint status report by April 8 unless the dismissal filing is on the docket by then.

Pulsechain: A federal judge dismissed the SEC’s suit against Pulsechain and HEX, saying the agency did not plausibly show that the project targeted U.S. investors and that it had jurisdiction over the case. The SEC has until April 21 to file an amended complaint.

Immutable: The SEC told Immutable Labs it closed its investigation into the Web3 gaming firm, it said earlier this week.

Yuga Labs: The SEC closed its investigation into Yuga Labs, the NFT firm said earlier this month.

Robinhood: The SEC told trading platform Robinhood it closed its investigation into the company, it said late last month.

OpenSea: The SEC closed its investigation into OpenSea, the NFT marketplace’s CEO said late last month.

Uniswap: The SEC closed its investigation into Uniswap Labs, the firm announced last month.

Gemini: The SEC closed its investigation into Gemini, co-founder Cameron Winklevoss said last month.

Binance: The SEC and Binance (alongside the various affiliated parties/co-defendants) filed to pause the regulator’s case for 60 days in early February. The judge overseeing the case paused the case until April 14, ordering the parties to file a joint status report by then. The SEC alleged commingling violations alongside securities law violations, as well as allowing U.S. persons to trade on the global platform.

Tron Foundation: The SEC and the Tron Foundation (alongside the various affiliated parties/co-defendants named) filed to pause the SEC’s case for 60 days in late February. The judge overseeing the case granted the motion, which should bring the new deadline to around April 27 (a Sunday). The SEC alleged market manipulation and fraud, alongside securities law-related registration violations.

Crypto.com: Crypto.com announced on March 27 that the SEC had closed its case into the crypto exchange and would not take any enforcement action. Trump Media, the company behind Truth Social, is also partnering with the exchange to issue exchange-traded products.

Unicoin: Unicoin appears to be the only publicly-disclosed ongoing investigation by the SEC, though its CEO has asked the agency to close that investigation as well.

HAWK: On Thursday, Haliey Welch, whose «HAWK» token appeared to pump and dump (falling from a $491 million market cap to under $100 million within minutes) when it launched last year, told TMZ that the SEC had closed its investigation into her as well.

Stories you may have missed

Trump-Backed World Liberty Financial Confirms Dollar Stablecoin Plans With BitGo: World Liberty Financial is launching USD1, a stablecoin, on the Ethereum and BNB Chain networks.

Trump Media Wants to Partner with Crypto.Com for ETP Issuance: Trump Media, the company behind the Truth Social social network, wants to launch crypto exchange-traded products with Crypto.com.

U.S. House Stablecoin Bill Poised to Go Public, Lawmaker Atop Crypto Panel Says: The House’s latest stablecoin bill draft more closely aligns with the Senate’s GENIUS Bill, which passed out of committee already, Rep. Bryan Steil said at the Digital Chamber’s annual conference.

Trump-Tied World Liberty Financial Pitches Its Stablecoin in Washington With Don Jr.: Donald Trump Jr. and other World Liberty Financial leaders promoted its new stablecoin at the Chamber event.

SEC Drops Investigation into Web3 Gaming Firm Immutable: The U.S. Securities and Exchange Commission has dropped another investigation, this time into Immutable.

Shuttered Russian Crypto Exchange Garantex Rebrands as Grinex, Global Ledger Finds: Garantex is an exchange sanctioned by the U.S. and seized by international law enforcement officials. That does not appear to have stopped some of its operators from rebranding it as Grinex and launching anew, based on on-chain and off-chain data.

Crypto Bill to Combat Illicit Activity Gets New Push After Passing U.S. House in 2024: Reps. Zach Nunn and Jim Himes have reintroduced the Financial Technology Protection Act.

President Trump Pardons Arthur Hayes, 2 Other BitMEX Co-Founders: U.S. President Donald Trump pardoned Arthur Hayes, Ben Delo and Sam Reed, the co-founders of BitMEX. The three had all previously pleaded guilty to Bank Secrecy Act violations and were sentenced to parole.

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain: This headline is self-explanatory, though I would love to know more about what it would mean to put individuals’ genetic data on an immutable public ledger.

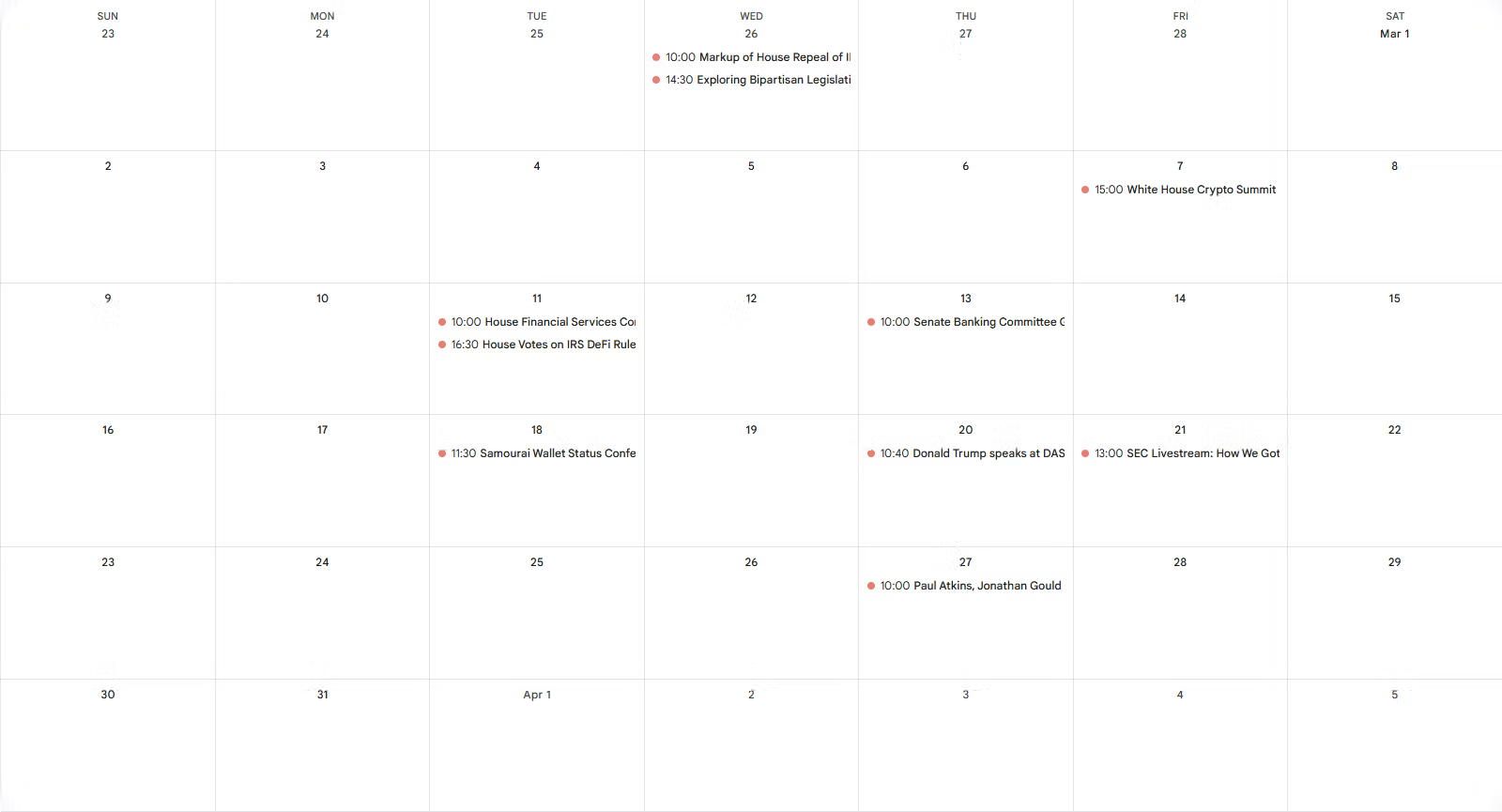

This week

Thursday

14:00 UTC (10:00 a.m. ET) Paul Atkins and Jonathan Gould (among others) faced the Senate Banking Committee for their confirmation hearing. Outside of Sen. John Kennedy (R-La.) asking questions about Sam Bankman-Fried’s parents (and a few other passing references to FTX’s collapse), there were no crypto-related questions.

Elsewhere:

(The Atlantic) Jeffrey Goldberg, the editor-in-chief of The Atlantic, said he was inadvertently added to a Signal group chat by National Security Advisor Michael Waltz, which contained other key figures in the Trump Administration and where Defense Secretary Pete Hegseth shared details about an imminent strike on Yemen hours before it occurred. Middle East envoy (and World Liberty Financial investor) Steve Witkoff confirmed that he was part of the group through one of his «personal devices,» rather than his government-issued secure phone. Tulsi Gabbard, the director of national intelligence and John Ratcliffe, the director of the CIA, said the messages were not classified, and The Atlantic published them.

(Wired) A Venmo account named «Michael Waltz» that Wired reports was «connected to accounts bearing the names of people closely associated with him» left its transactions public until after the news organization reached out about it.

(The Verge) U.S. President Donald Trump fired Federal Trade Commissioners Alvaro Bedoya and Rebecca Slaughter, both Democrats, reportedly in violation of a Supreme Court precedent. Both have since sued Trump contesting the firings.

(The Washington Post) The IRS is projecting it will collect $500 billion less in 2025 than 2024, the Post reported.

(The New York Times) «SpaceX is positioning itself to see billions of dollars in new federal contracts or other support,» the Times reported.

(The Washington Post) Plainclothes officers arrested Tufts University Ph.D student Rumeysa Ozturk and relocated her to a Louisiana facility. The Department of Homeland Security said she «engaged in activities in support of Hamas,» but has not published any evidence supporting the claim. Secretary of State Marco Rubio said he canceled Ozturk’s visa because she was «creating a ruckus,» but does not appear to allege she committed any crimes.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars