Uncategorized

What’s Next for BTC, ETH, SOL, ADA, XRP After Trump Tariffs? Here’s How Traders Playing the Dip

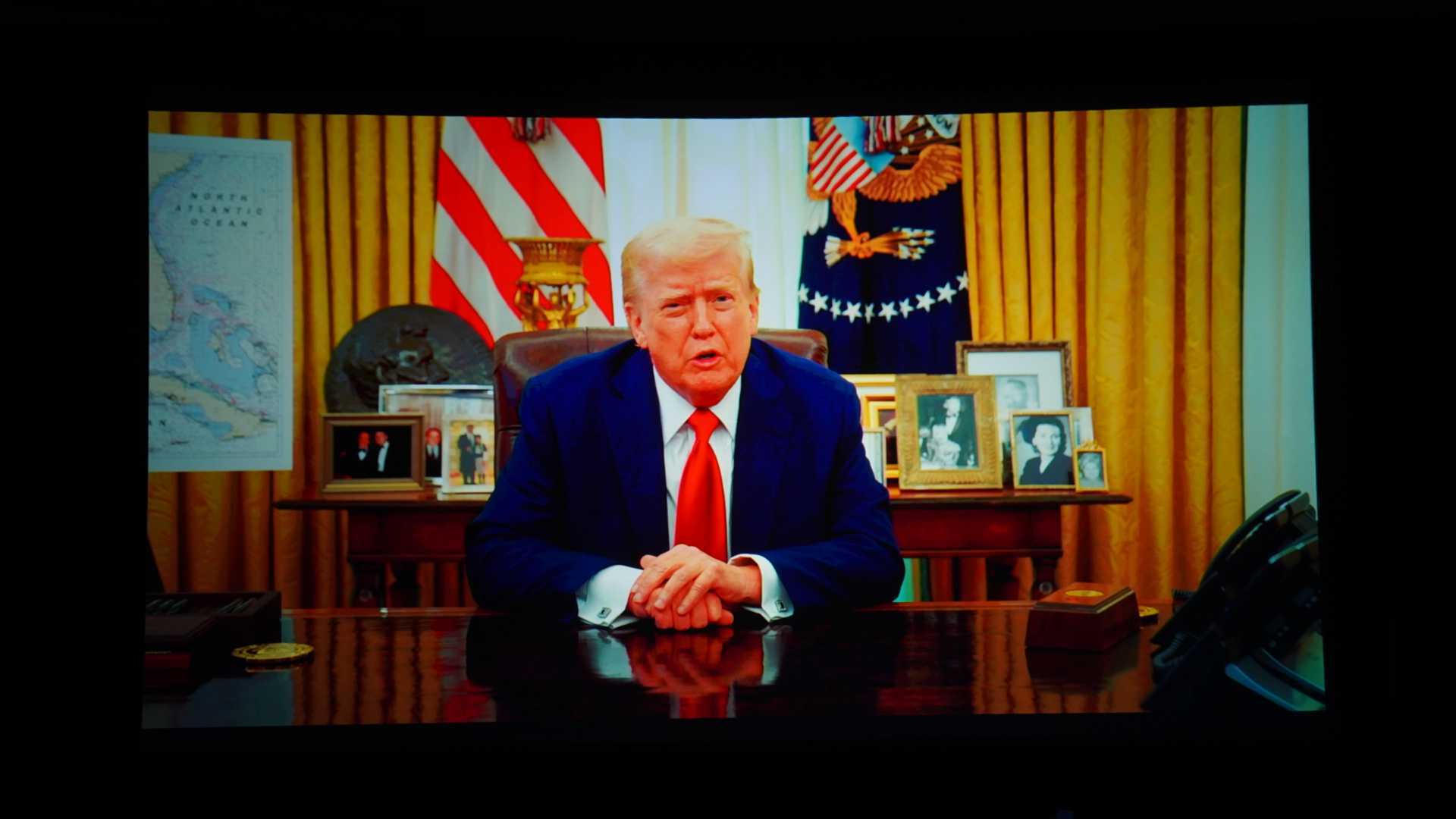

The kickstart of heavy tariffs under the Trump administration has ushered in a new chapter of uncertainty and opportunity for the crypto market, one that tends to ebb and flow with changes in the global economy.

Tariffs, by design, increase the cost of imported goods, often leading to higher inflation, shifts in supply chains, and fluctuations in currency valuations. A stronger U.S. dollar, driven by tariff-induced trade imbalances, might initially pressure crypto prices downward as investors flock to traditional safe havens.

However, prolonged economic uncertainty could fuel bitcoin’s appeal as a store of value, especially if central banks respond with loose monetary policies.

Here’s how crypto traders and market watchers are approaching the coming months — largely expecting muted price action in the near term but bullish in the medium to long term.

Rick Maeda, Research Analyst at Presto Research

Trump’s tariffs, jumping to 34% on China and 25% on cars from the 10% baseline levy, unnerved global markets and crypto was no exception.

Bitcoin sold-off into the $82k level while Ethereum got hit harder, dipping below 1,800.

Options flow-wise, there was put buying across tenors as traders hedged against further downside, but implied volatility term structures held relatively steady.

Crypto continues to be haunted by Trump’s trade policies as it faced a similar shock earlier this year when tariffs on Mexico and Canada — 25% each — were floated. Lacking a strong intrinsic narrative, the asset class remains firmly tethered to macro forces, with its macro beta keeping it closely bound to trade war developments. Structurally, a prolonged trade war could continue to batter crypto as it continues to identify as a risk asset rather than the digital gold it once was.

Enmanuel Cardozo, Market Analyst at Brickken

«Trump’s tariffs that rolled out yesterday on April 2, 2025, for a long list of countries, are stirring up the crypto industry in a big way. We saw how bitcoin was at $88,500 flirting with the $90K level but in a span of 4hrs dropped down to around $82,000.

In the short term, these tariffs are fueling a lot of volatility in what seems to me a sideways consolidation zone—, as economic uncertainty drives retail investors toward safer bets like gold or traditional investment vehicles while institutional investors continue to accumulate Bitcoin.

Add to that the broader risk-off sentiment—JPMorgan’s survey shows 51% of institutional traders see inflation and tariffs as the top market shapers this year. But looking past the immediate turbulence, there’s a potential upside for crypto in the long run.

These tariffs could weaken the dollar’s dominance by making imports pricier, which might position bitcoin as a go-to hedge against inflation.

As global trade gets more murky, crypto’s utility for cross-border transactions could potentially gain more appeal, especially with stablecoins stepping up as a workaround for tariff barriers as we’re already seeing hints of this with government-backed stablecoin adoption.

Trump’s tactic—where tariffs might act by weakening the dollar—adds another layer. If the easing effect wins, bitcoin could benefit long-term. Either way, I’ll be watching how these tariffs interact with Fed policy and market sentiment to see how crypto adapts to this scenario.»

Alvin Kan, COO at Bitget Wallet

«Trump’s proposed tariffs risk triggering stagflation—rising prices without growth—which could undermine confidence in fiat, especially the U.S. dollar. As capital seeks protection from inflation and trade war uncertainty, bitcoin stands out as a neutral, decentralized hedge. If dollar dominance erodes and volatility spikes, BTC demand could rise fast.

In a fragmented, protectionist world, bitcoin becomes less about speculation and more about preservation, and smart traders are already positioning accordingly.»

Augustine Fan, Head of Insights, SignalPlus

«Trade partners promised retaliation, while cross assets saw a massive risk-off move, leading to a similar drop in BTC to recent lows. Compared to the move in US equities, which breached recent lows, crypto prices outperformed relatively, with BTC holding above the $80k level as the weaker dollar and stronger gold move is providing markets with a convenient excuse to give bitcoin a little bit of a flight to quality bid.

A bold statement from Secretary Bessent blaming the sell-off as a «Mag-7 problem» compounded the negative sentiment.

Risk off will likely be the consensus move here, as it’s hard to imagine Trump pulling a quick 180-degree move after such an aggressive show of force, with US assets likely underperforming with economic growth to show tangible weakness in the near future.

We like buying BTC on aggressive dips towards the 76-77k area.»

Ryan Lee, Chief Analyst at Bitget Research

«Trump’s unexpectedly harsh tariffs, including 10-49% tariffs on imports, may have sparked a panic-driven sell-off in the wider market, with ETH and SOL dropping ~6%, and the market shifting to stablecoins as fear spiked.

Beyond the initial shock, these tariffs threaten the U.S. economy, which could ripple into crypto markets. Higher import costs—particularly from key partners like China —could accelerate inflation, with some models projecting a 2-3% CPI uptick by Q2 2025 if trade wars escalate.

Concurrently, the Atlanta Fed’s GDPNow estimate of a 2.8% GDP decline for Q1 2025 may worsen as consumer spending and business investment falter under tariff pressures.

A weakening dollar from economic strain and potential Fed easing could boost BTC as a hedge, with data showing early accumulation trends. However, altcoins may need stronger fundamentals to benefit in the long term.»

Read more: Why Trump’s Tariffs Could Actually be Good for Bitcoin

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars