Business

Trump Tariffs, GDP Rattle Markets, ETFs Bleed: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

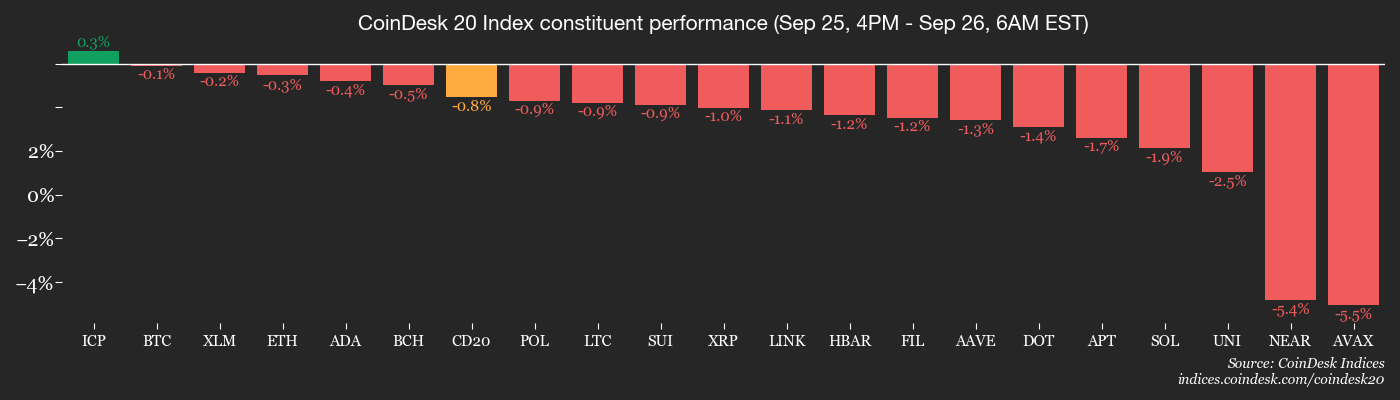

It’s not been a happy 24 hours for crypto bulls, with the CoinDesk 20 Index dropping 5% and market leaders bitcoin (BTC) and ether (ETH) falling nearly 2%.

Major altcoins such as XRP, BNB and SOL lost even more, and ASTR, the native token of Aster DEX, which recently flipped Hyperliquid in 24-hour volume, fell 4% as the decentralized exchange saw abnormal price movements in the XPL-USDT perpetual trading pair. Still, a few coins, including MNT, CRO, KAS, OKB and XMR, managed gains of around 1%.

The downturn coincides with a stronger dollar, pushed higher by Thursday’s U.S. GDP and jobless claims data. Meanwhile, market flow dynamics turned bearish.

“ETF behavior changed from a primary absorber of supply to a net seller this week,» analysts at BRN told CoinDesk. «Yesterday, Bitcoin ETFs posted $258 million of outflows while Ethereum ETFs recorded $251 million of outflows, marking four straight days of red for ETH funds.”

Whales have also become net sellers, offloading 147,000 BTC since Aug. 21, the most since the bull cycle began in early 2023, according to CryptoQuant.

Analysts at Bitunix exchange warned that President Donald Trump’s tariff announcements on Thursday have increased market uncertainty, with sentiment oscillating between “rising inflation” and “slowing growth.”

Trump announced tariffs of as much as 100% on trucks, furniture and pharmaceuticals, effective Oct. 1.

The Fed’s preferred inflation gauge, the core personal consumption expenditure, is due later today. The report is projected to show a 2.9% year-over-year rise in August, matching July. Month-on-month, it’s forecast to have increased 0.2%, slightly below July’s 0.3%, according to FactSet. A softer-than-expected print could temper the dollar’s rally, putting a floor under bitcoin and the wider crypto market.

Traders should remain vigilant about regulatory developments related to digital asset treasuries. A WSJ report on Thursday cited U.S. regulators’ concerns about unusual trading volumes and stock price volatility in over 200 companies linked to crypto treasury strategies. Regulatory pressure on these treasuries, or DATs, could accelerate market sell-offs.

Additionally, geopolitical developments warrant attention, as reports are circulating about Russia’s aerial incursions in Europe. WTI crude oil is already up 4% for the week, the most since June. Stay alert!

What to Watch

- Crypto

- Nothing scheduled.

- Macro

- Sept. 26, 8:30 a.m.: Canada July GDP MoM Est. 0.1%.

- Sept. 26, 8:30 a.m.: U.S. August headline PCE Price Index YoY Est. 2.7%, MoM Est. 0.3%; core YoY Est. 2.9%, core MoM Est. 0.2%.

- Sept. 26, 10 a.m.: (Final) September Michigan Consumer Sentiment Est. 55.4.

- Sept. 26, 1 p.m.: Fed Vice Chair for Supervision Michelle Bowman speech on «Approach to Monetary Policy Decision-Making.»

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

- Governance votes & calls

- DYdX (DYDX) is voting on whether to approve the setting of Rewards C Constant to 0. Voting closes Sept. 26.

- Decentraland DAO is voting on a new veto procedure that lets the council approve major decisions internally, while giving the community 14 days to challenge them through a Veto Proposal. Voting ends Sept. 29.

- Unlocks

- Sept, 28: Jupiter (JUP) to unlock 1.75% of its circulating supply worth $28.89 million.

- Token Launches

- Sept. 26: Hana Network (HANA) to be listed on Binance Alpha, KuCoin, MEXC, BingX, and others.

- Sept. 26: Mira (MIRA) to be listed on Binance Alpha, KuCoin, and others.

Conferences

- Day 2 of 2: Asset Based Finance 2025 (New York)

- Sept. 26: 8th Annual Black Blockchain Summit (Washington)

Token Talk

By Francisco Rodrigues

- Plasma, a new blockchain purpose-built for stablecoins, launched its mainnet beta and native token XPL on Thursday, debuting with a fully diluted valuation that’s now above $12 billion.

- The layer-1 network, backed by Bitfinex, Bybit, Tether CEO Paolo Ardoino and tech billionaire Peter Thiel, entered the market with over $2 billion worth of XPL tokens in circulation.

- Built for high-speed, low-fee stablecoin operations, Plasma aims to serve as the back end for a new class of DeFi applications. At launch, liquidity was already deployed across major platforms including Aave, Ethereum, Euler and Fluid.

- These include Plasma One, which is billed as a “stablecoin-native neobank.”

- Some tokens sold to U.S. investors are locked until mid-2026 due to regulatory restrictions, which may lower the effective float in early trading.

Derivatives Positioning

- Most major tokens, including BTC and ETH continued to experience capital outflows from futures market, leading to a decline in the notional open interest (OI).

- That’s only to be expected as the market soon shakes out overleveraged bets.

- Notably, the BTC and ETH OI have continued to decline in the past couple of hours, raising questions about the sustainability of the minor price recovery.

- Smaller coins like KAS and KCS have seen a moderate increase in OI in the past 24 hours.

- Volume in crypto perpetuals listed on Aster DEX has surged to over $46 billion in the past 24 hours, significantly higher than Hyperliquid’s $17 billion.

- On the CME, BTC futures OI has almost reversed the early September spike from 134K BTC to 149K BTC, representing renewed capital outflows. On the other hand, OI in options continues to rise, approaching the November 2024 high of 56.19K BTC.

- Positioning in ETH futures and options remains elevated on Deribit, with an annualized three-month basis at 7%, a significantly lower yield than SOL’s 15%.

- BTC, ETH options risk reversals continue to lean bearish out to the December expiry, data from Deribit show. In SOL and XRP’s case, pricing is biased bullish for the year-end expiry.

Market Movements

- BTC is up 0.4% from 4 p.m. ET Thursday at $109,669.81 (24hrs: -2.17%)

- ETH is up 0.74% at $3,916.83 (24hrs: -3.12%)

- CoinDesk 20 is up 0.18% at 3,820.89 (24hrs: -3.25%)

- Ether CESR Composite Staking Rate is unchanged at 2.9%

- BTC funding rate is at 0.0049% (5.4082% annualized) on Binance

- DXY is down 0.19% at 98.37

- Gold futures are up 0.21% at $3,778.90

- Silver futures are up 0.56% at $45.37

- Nikkei 225 closed down 0.87% at 45,354.99

- Hang Seng closed down 1.35% at 26,128.20

- FTSE is up 0.37% at 9,247.82

- Euro Stoxx 50 is up 0.38% at 5,465.79

- DJIA closed on Thursday down 0.38% at 45,947.32

- S&P 500 closed down 0.5% at 6,604.72

- Nasdaq Composite closed down 0.50% at 22,384.70

- S&P/TSX Composite closed unchanged at 29,731.98

- S&P 40 Latin America closed down 1.12% at 2,908.21

- U.S. 10-Year Treasury rate is up 0.3 bps at 4.177%

- E-mini S&P 500 futures are unchanged at 6,664.75

- E-mini Nasdaq-100 futures are unchanged at 24,614.25

- E-mini Dow Jones Industrial Average Index are up 0.19% at 46,355.00

Bitcoin Stats

- BTC Dominance: 59.06% (-0.03%)

- Ether-bitcoin ratio: 0.03573 (0.52%)

- Hashrate (seven-day moving average): 1,083 EH/s

- Hashprice (spot): $48.79

- Total Fees: 3.27 BTC / $364,469

- CME Futures Open Interest: 134,940 BTC

- BTC priced in gold: 29.2 oz

- BTC vs gold market cap: 8.24%

Technical Analysis

- XRP is dropping fast toward the key $2.65-$2.70 price level identified by the swing high from May and intraday lows in August and earlier this month.

- A break below would mark a significant weakening of buying demand, potentially yielding a slide toward $2.00.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $306.69 (-4.69%), -0.1% at $306.39 in pre-market

- Circle Internet (CRCL): closed at $124.66 (-5.26%), +0.28% at $125.01

- Galaxy Digital (GLXY): closed at $32.12 (-6.34%), -1.26% at $31.71

- Bullish (BLSH): closed at $61.83 (-8.52%), +0.36% at $62.05

- MARA Holdings (MARA): closed at $16.07 (-8.9%), +0.62% at $16.17

- Riot Platforms (RIOT): closed at $16.74 (-6.95%), +2.69% at $17.19

- Core Scientific (CORZ): closed at $16.84 (-1%), -0.77% at $16.71

- CleanSpark (CLSK): closed at $13.68 (-5.33%), -4.02% at $13.13

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.16 (-6.31%), -1.4% at $41.57

- Exodus Movement (EXOD): closed at $28.9 (-9.69%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $300.7 (-6.99%), +0.31% at $301.62

- Semler Scientific (SMLR): closed at $30.21 (-4.46%), +1.66% at $30.71

- SharpLink Gaming (SBET): closed at $16.31 (-7.22%), -0.98% at $16.15

- Upexi (UPXI): closed at $5.28 (-14.29%), -0.38% at $5.26

- Lite Strategy (LITS): closed at $2.54 (-5.93%), +1.97% at $2.59

ETF Flows

Spot BTC ETFs

- Daily net flows: -$253.4 million

- Cumulative net flows: $57.2 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: -$251.2 million

- Cumulative net flows: $13.39 billion

- Total ETH holdings ~6.57 million

Source: Farside Investors

While You Were Sleeping

- Near $30M Ether Wipeout on Hyperliquid Stands Out as Crypto Market Sees $1B in Liquidation (CoinDesk): Nearly $1.2 billion in leveraged bets vanished as over-leveraged longs dominated losses, exposing overcrowded bullish positioning and rising risks on decentralized perpetual exchanges.

- Key Indicators to Watch in Q4: Bitcoin Seasonal Trends, XRP/BTC, Dollar Index, Nvidia, and More (CoinDesk): Seasonal data show strong fourth-quarter tailwinds for BTC and ETH, while signals from XRP, the dollar index and Nvidia highlight technical and macro risks for traders.

- Trump to Slap New Tariffs on Pharma, Big Trucks (The Wall Street Journal): The president announced Oct. 1 tariffs on imported branded drugs, heavy trucks and home goods, drawing warnings from U.S. pharmaceutical companies that higher costs could undermine domestic manufacturing and research.

- Will China’s Digital Yuan Centre Be a Step Forward for Internationalisation? (South China Morning Post): On Thursday, the People’s Bank of China opened a Shanghai operations center and unveiled three platforms to expand e-CNY’s cross-border role, underlining Beijing’s bid to reduce China’s reliance on the U.S. dollar.

- Curve Finance Founder Michael Egorov Launches Bitcoin Yield Protocol (CoinDesk): Yield Basis, a decentralized automated market maker (AMM) protocol backed by $5 million, debuts with capped pools and veTokenomics to remove impermanent loss and open sustainable bitcoin yield.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

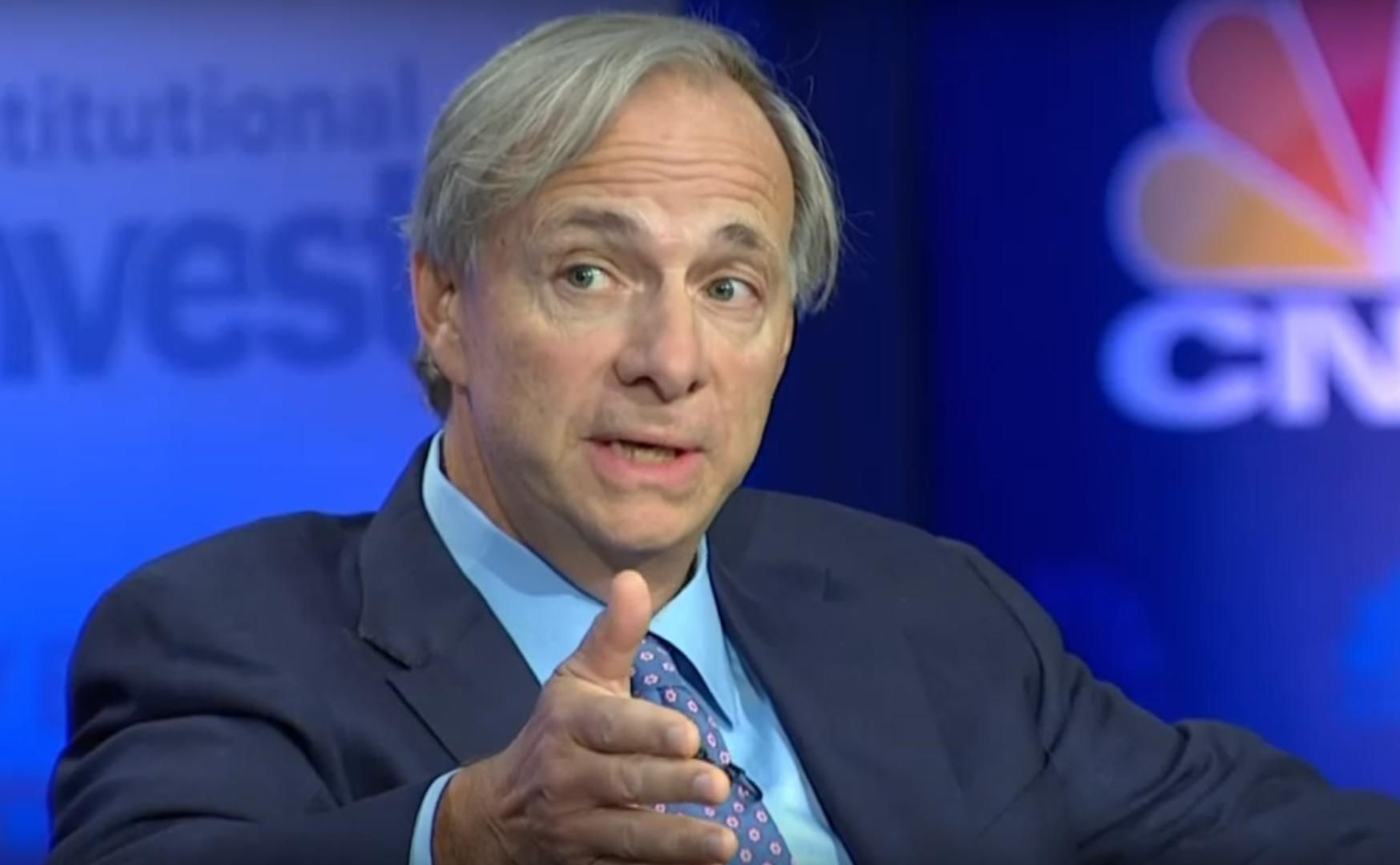

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

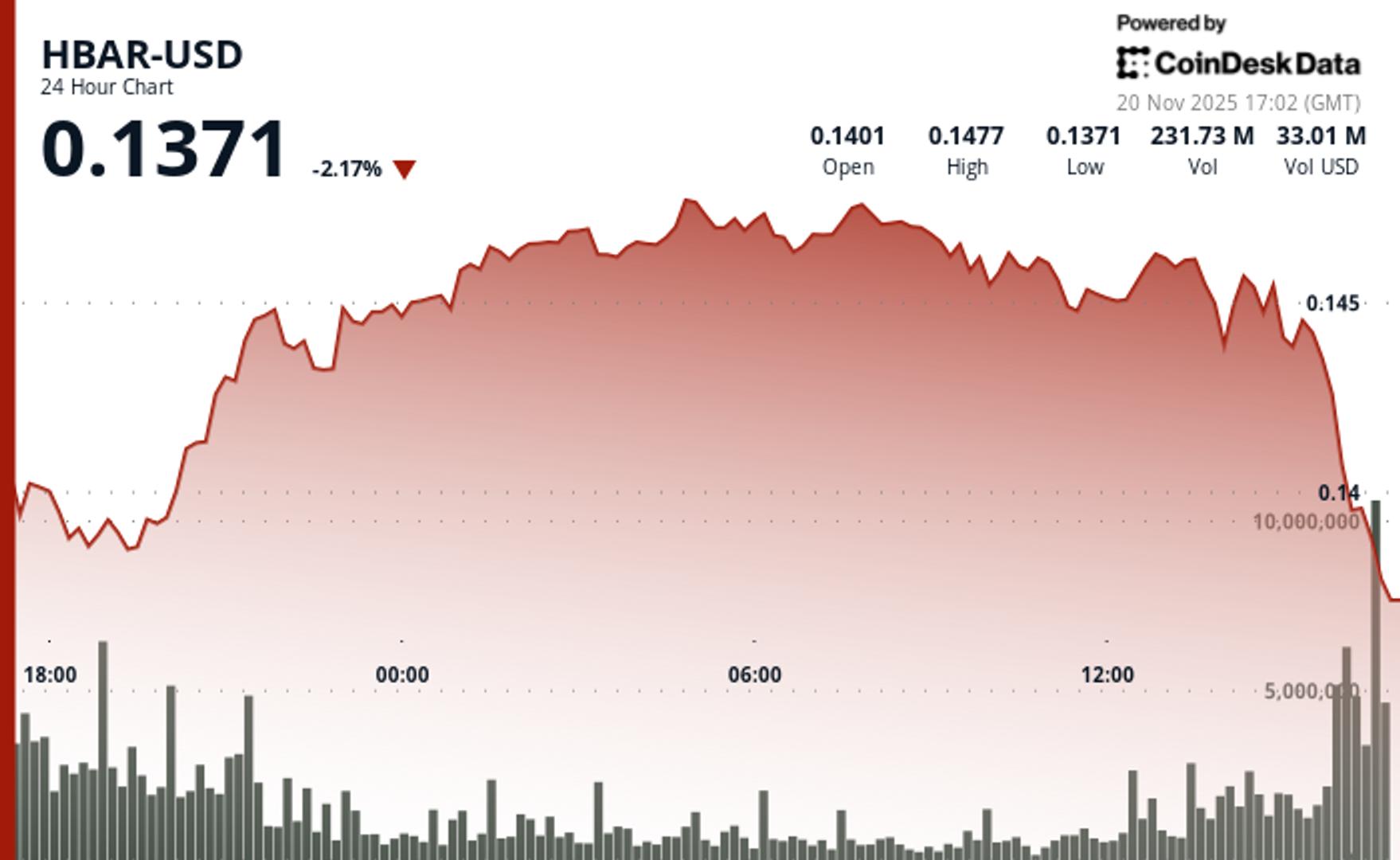

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton