Uncategorized

The Protocol: Solana’s Allure for Devs; Avalanche’s Big Upgrade

Welcome to The Protocol, CoinDesk’s weekly wrap-up of the most important stories in cryptocurrency tech development. I’m Marc Hochstein, CoinDesk’s deputy editor-in-chief for features, opinion and standards.

In this issue:

Solana was the biggest draw for new crypto developers in 2024

No wonder: Solana’s transaction volume is off the charts

Coinbase alums take next step toward no-code blockchain development

Kraken’s ‘Ink’ layer-2 goes live

Avalanche activates biggest-ever upgrade

Ethereum’s ENS picks Consensys’ tech for its L2

Bitcoin’s Stacks L2 gets an automated market maker for Runes

Most Influential 2024: EigenLayer’s Sreeram Kannan

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday.

Network News

NEW DEVS ❤️SOLANA: The Solana ecosystem, ground zero for the memecoin craze, was the most popular blockchain among new developers this year, according to a report released last week by Electric Capital. In July, this community became the first since 2016 to bring on board more devs than Ethereum. Solana attracted 7,625 new developers in 2024, the most of any chain and a little over 1,000 more than Ethereum. The results underscore the challenge Ethereum faces as rival smart contract platform Solana’s low fees and fast transactions attract investment and talent. Read more.

SPEAKING OF SOLANA: Solana’s network activity has lit up as the Pudgy Penguins NFT project debuted its native token, PENGU, on the programmable blockchain. Solana registered a total transaction tally of 66.9 million Tuesday, the highest daily volume since its inception in 2020, according to data source Artemis. To highlight how busy it was, Solana’s transaction count eclipsed the total of all other major chains combined. Read more

THE INK IS DRY: Kraken, the seventh-largest crypto exchange, said its layer-2 rollup network, built on top of the Ethereum blockchain, has gone live. The network, called Ink, is Kraken’s answer to Base, the highly successful blockchain launched by rival exchange Coinbase. Like Base, Ink is based on the OP Stack, a customizable framework that lets developers build their own rollups using Optimism’s technology. The team had originally planned for Ink to go live in early 2025, so the launch of its main network is ahead of schedule. Read more

AVALANCHE UPGRADE: Avalanche, a layer-1 blockchain launched in 2020 that’s now the tenth-largest by total value locked (TVL), activated its highly anticipated Avalanche9000 upgrade Monday, marking the ecosystem’s biggest technical changes to date. The network has been prepping for these changes for months, with new features that will cut the costs for sending transactions, operating validators and building applications on the network. Leaders at Avalanche previously said that part of the goal with the upgrade is to attract developers to Avalanche and encourage them to create customized blockchains using its technology, known as subnets, or “L1s.» Read more.

A BOON FOR RUNES: Crypto degens have a new – and, if all goes according to plan, faster, cheaper and safer – way to trade Runes, the Bitcoin ecosystem’s answer to memecoins. An automated-market maker (AMM) for the Runes protocol went live on Wednesday on Stacks, following the unveiling of the layer-2 network’s native BTC-backed asset sBTC on Tuesday. It’s the first AMM for such tokens on Stacks. The teams behind decentralized exchange (DEX) Bitflow Finance and Bitcoin bridge Pontis developed the AMM. Runes launched in April and spurred a flurry of activity, paying 78.6 BTC ($8.18 million) in fees in the first 90 minutes. However, less than a month later, this excitement waned considerably, with fees dropping more than 50%. Bitflow’s aim is for its AMM to help Runes scale and address some of the shortcomings holding it back. Read more.

ENS PICKS L2 TECH: ENS Labs, the company behind the Ethereum Name Service, has picked Linea’s technology to build its upcoming layer-2 network, Namechain. Linea is a zero-knowledge rollup that came out in July 2023 and was built by Ethereum infrastructure giant Consensys. It is the seventh-largest rollup network, according to L2Beat, with $1 billion locked in its ecosystem. Rollups are a special type of blockchain where one can transact faster and at a lower cost. There are two kinds of rollups: optimistic and zero-knowledge. Optimistic rollups use optimistic proofs, which have a seven-day window to dispute transactions before they are finalized. Zero-knowledge rollups, by contrast, finalize proofs within minutes. ENS has been described as «the phone book for Web3,» but a more precise analogy is the web’s domain name service (DNS). The domain name «CoinDesk.com» is easier to remember and type than a numerical IP address. Similarly, ENS handles like parishilton.eth, which the namesake heiress acquired in 2021, are more relatable than the strings of letters and numbers that make up Ethereum wallet addresses. For this service, «we need fast finality,” said Nick Johnson, the founder and lead developer of ENS. That’s because “you want to be able to update your ENS name and have the chain reflect it in the smallest interval possible. And to do that and have it remain decentralized and secure, we need fast finality, and optimistic roll-ups can’t deliver that.» Read more.

NO CODE, NO PROBLEM? Patchwork, a startup focused on simplifying blockchain and smart-contract development founded by former Coinbase employees, has released the next version of its low-to-no-code tools for building decentralized applications (dapps). Currently linked to Coinbase’s Base and backed by Coinbase Ventures, the “Create-Patchwork” picks-and-shovels approach lowers the barriers to building blockchain applications and attaching data to them. Following the trend toward easily generated content, the complex world of blockchains and smart-contract design is on a path to no-code applications, or a “text-to-app” experience. Create-Patchwork is the first of several features the team plans to roll out in early 2025 and a foundational step to enable creators to generate contracts and applications in seconds using natural language inputs. “Patchwork is an Ethereum protocol that makes it really easy to build dynamic on-chain applications,” co-founder Kevin Day said in an interview. “It lets on-chain things own other on-chain things, and it allows anyone to attach programmable data to on-chain things.” Read more

EIGENLAYER’S SREERAM KANNAN: KING OF THE PROFESSOR COINS

For a crypto founder who’s attracted so much controversy, Sreeram Kannan is surprisingly sanguine.

In a wide-ranging interview after his selection as one of CoinDesk’s “Most Influential” figures in crypto for 2024, the EigenLayer founder was generous with his time, chatting more than an hour beyond our scheduled slot. I was surprised at his openness because the last time we spoke, a colleague and I had just published an investigation into potential conflicts of interest at his company, Eigen Labs, and in the interim Kannan had disavowed our reporting point-by-point on a Blockworks podcast.

This time, Kannan emerged in a different light. Whatever his misgivings about CoinDesk’s past coverage, they didn’t seem top-of-mind.

What emerged wasn’t the portrait of a defensive tech founder, but rather that of a driven, thoughtful academic-turned-entrepreneur still adjusting to a spotlight few in this industry ever enjoy. Instead of bitterness or evasion, I found ambition, reflection and a quiet kind of excitement.

Kannan seemed as astonished as anyone by how swiftly EigenLayer had transformed from a concept into one of crypto’s most talked-about experiments, telling CoinDesk that he continued to view EigenLayer as a “scrappy startup.”

Over the past 12 months, EigenLayer — which allows emerging blockchain applications to borrow Ethereum’s robust security — went from a relative unknown to an industry heavyweight. The platform raised more than $100 million from venture firms including Andreessen Horowitz and, before even fully launching, drew hundreds of millions of dollars in deposits from crypto users seeking extra yield. Many were incentivized by a viral points program that investors hoped would translate into a lucrative future token airdrop.

EigenLayer’s success during the bear market was striking, and Kannan may have played a larger role than any other entrepreneur in revitalizing decentralized finance on Ethereum. But not everything went according to plan. Industry critics took issue with the EIGEN token distribution plan — which locked up tokens for months and barred claimants from certain geographies — as well as the platform’s slower-than-expected feature rollout and concerns about “rehypothecation,” or the reuse of collateral for multiple purposes. In August, the CoinDesk investigation (that Kannan disputed in the podcast) raised questions about EigenLayer’s conflict-of-interest policies, which may have allowed employees preferential access to tokens powered by its platform.

None of this seemed to derail Kannan’s intellectual ascent. Beyond running Eigen Labs, he still holds a position as an affiliate professor of electrical and computer engineering at the University of Washington, and his theory of “restaking” — letting people reuse staked Ethereum assets to secure other networks — has sparked a wave of innovation and copycats. He’s become a familiar face on the conference circuit, where he unpacks his vision of blockchains as tools for solving humanity’s endless “coordination problems.”

Blockchains, Kannan says, “are the biggest upgrade to human civilization since the U.S. Constitution.”

CLICK HERE FOR THE FULL PROFILE BY COINDESK’S SAM KESSLER:

Money Center

‘Wrapped’ in intrigue

Coinbase Says It Nixed wBTC Because Justin Sun Posed ‘Unacceptable Risk’

WBTC Episode ‘Reopened Old Wounds’ of Centralized Failures: Bitcoin Builders Association

Deals and grants

Stablecoin Payments Platform BVNK Raises $50M to Fuel U.S. Expansion

RWA-Focused Plume Raises $20M from Brevan Howard, Others Ahead of Mainnet Launch

Custody Firm Taurus Partners With Temenos Bringing Crypto Wallets to Thousands of Banks

Regulatory and policy

Next U.S. Senate Banking Chair Calls Crypto ‘Next Wonder’ of World

Calendar

Jan 9-12, 2025: CES, Las Vegas

Jan. 15-19: World Economic Forum, Davos, Switzerland

January 21-25: WAGMI conference, Miami.

Jan. 24-25: Adopting Bitcoin, Cape Town, South Africa.

Jan. 30-31: PLAN B Forum, San Salvador, El Salvador.

Feb. 1-6: Satoshi Roundtable, Dubai

Feb. 19-20, 2025: ConsensusHK, Hong Kong.

Feb. 23-24: NFT Paris

Feb 23-March 2: ETHDenver

March 18-19: Digital Asset Summit, London

May 14-16: Consensus, Toronto.

May 27-29: Bitcoin 2025, Las Vegas.

Uncategorized

Ethereum Surges After Holding $2,477, Fueled by Very Heavy Trading Volume

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with ETH showing resilience despite broader market uncertainty.

The second-largest cryptocurrency is currently navigating a critical technical zone between $2,500-$2,530, which analysts identify as immediate resistance that must be overcome for continued upward movement.

Institutional interest remains strong, with spot Ethereum ETFs recording consecutive days of positive inflows, signaling growing confidence from larger investors despite the recent volatility.

Technical Analysis Highlights

- 24-hour ETH price action revealed a substantial 3.5% range ($99.85).

- Sharp sell-off during midnight hour saw price plummet to $2,477.40, establishing a key support zone.

- Extraordinary volume (291,395 units, nearly 3x average) confirmed the significance of the support level.

- Buyers stepped in at the $2,467-$2,480 support band, confirmed by high-volume accumulation during the 08:00-09:00 period.

- Recent price action shows bullish momentum with ETH reclaiming the $2,515 level.

- Potential higher low pattern suggests the correction may have found its bottom.

- $2,520-$2,530 area remains the immediate resistance to overcome for continued upward movement.

- Significant bullish surge at 13:35 saw price jump from $2,515.85 to $2,521.79, accompanied by exceptional volume (5,839 units).

- Sharp reversal occurred at 14:00, with price dropping 5.07 points to $2,508.02 on heavy volume (4,043 units).

- Hourly range of 14.46 points ($2,508.02-$2,522.48) demonstrates market indecision.

External References

- «Ethereum Holds Above Key Prices – Data Points To $2,900 Level As Bullish Trigger«, NewsBTC, published May 24, 2025.

- «Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level«, Bitcoinist, published May 25, 2025.

- «Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?«, CryptoPotato, published May 25, 2025.

Uncategorized

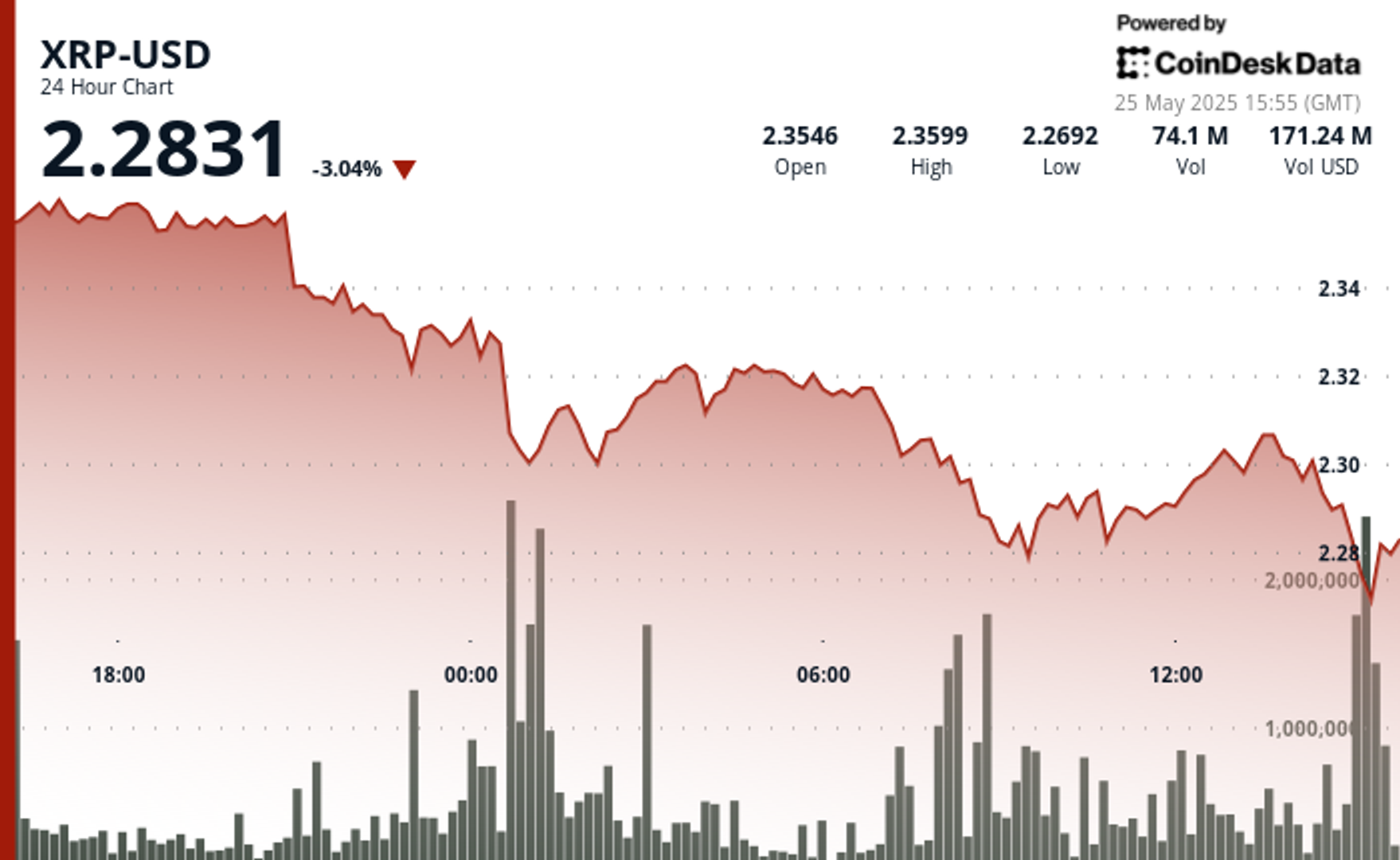

XRP Plunges Below $2.30 Amid Heavy Selling Pressure

Global economic tensions are weighing heavily on cryptocurrency markets as XRP experiences a significant correction amid heavy selling pressure.

The recent announcement of potential 50% tariffs on European Union imports by the US government has triggered widespread market uncertainty, with XRP falling alongside most major cryptocurrencies despite Bitcoin recently reaching new all-time highs.

Technical analysts point to critical support at the $2.25-$2.26 range, with market watchers warning that a break below this level could trigger deeper corrections toward the $1.55-$1.90 zone.

Meanwhile, institutional interest remains strong with Volatility Shares launching an XRP futures ETF and leveraged ETF inflows surging despite the price dip, suggesting Wall Street continues accumulating positions during market weakness.

Technical Analysis Highlights

- XRP underwent a notable 3.46% correction over the 24-hour period, with price declining from $2.361 to $2.303, creating an overall range of $0.084 (3.57%).

- The most significant price action occurred during the midnight hour (00:00), when XRP plummeted to $2.297 on exceptionally high volume (37.1M), establishing a strong volume-based support zone.

- A secondary sell-off at 08:00 saw price touch the period low of $2.280 with the highest volume spike (39.9M), confirming a double-bottom formation.

- In the last hour, XRP experienced significant volatility with a recovery attempt following the earlier correction.

- After reaching a low of $2.297 at 13:11, price formed a base around $2.298 before staging a substantial rally beginning at 13:27, peaking at $2.307 at 13:36-13:39 with exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $2.307, which was tested multiple times.

- The final 15 minutes saw profit-taking pressure emerge, with price retracing to $2.300, establishing a short-term support level that aligns with the psychological $2.30 threshold.

External References

- «XRP Price Watch: Consolidation or Collapse? Market Holds Breath Near $2.35«, Bitcoin.com News, published May 24, 2025.

- «XRP Price Prediction For May 25«, CoinPedia, published May 25, 2025.

- «XRP Risks Fall To $1.55 If This Support Level Fails – Analyst«, NewsBTC, published May 25, 2025.

Uncategorized

Bitcoin Drops Below $107.5K as Trump Tariff Threat Triggers Crypto Sell-Off

Bitcoin’s recent pullback has established strong volume-based resistance near $108,300, with support forming in the $106,700-$107,000 zone.

The correction accelerated with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal.

Technical analysis suggests Bitcoin is now trading within a compression zone, trapped between two major fair value gaps that will determine the upcoming market direction.

If bulls reclaim the $109K to $110K area, price could push toward resistance beyond $112K, while a break below $107,000 might test liquidity around $106K.

Technical Analysis Breakdown

- The decline accelerated during the 22:00-23:00 hour on May 24th with exceptionally high volume (16,335 BTC), establishing a strong volume-based resistance near $108,300.

- Support has formed in the $106,700-$107,000 zone where buyers emerged during the 09:00-10:00 period on May 25th, though recovery attempts have been modest with price consolidating around $107,500.

- The overall technical structure suggests a short-term bearish trend with potential for further consolidation before directional clarity emerges.

- Bitcoin experienced significant volatility with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal that saw prices decline to $107,393 by 14:00.

- The most substantial price movement occurred during the 13:35 minute candle where BTC jumped nearly $150 with exceptionally high volume (148.76 BTC), establishing temporary resistance around $107,630.

- Support formed near $107,400 where buyers emerged during the final minutes of the period, though the overall technical structure suggests continued consolidation within the broader correction from the $109,239 high.

External References

- «Bitcoin Price Prediction for May 25: Will Bulls Defend $108K or Is a Deeper Drop Ahead?«, Coin Edition, published May 24, 2025.

- «Why is Bitcoin Price Dropping Now? Will BTC Price Go Down to $100K?«, CoinPedia, published May 24, 2025.

- «Bitcoin Price Analysis: BTC Displays Signs of Weakness Following New All-Time High«, CryptoPotato, published May 25, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors