Uncategorized

The Protocol: Ethereum’s Pectra Upgrade Finally Goes Live

Welcome to The Protocol, CoinDesk’s weekly wrap-up of the most important stories in cryptocurrency tech development. I’m Margaux Nijkerk, the Ethereum protocol reporter on CoinDesk’s Tech team.

In this issue:

- Ethereum Activates ‘Pectra’ Upgrade, Raising Max Stake to 2,048 ETH

- Bitcoin Developers Plan OP_RETURN Limit Removal in Next Release

- Sam Altman’s World Crypto Project Launches in US With Eye-Scanning Orbs in 6 Cities

- Aztec’s Privacy Rollup Hits Testnet Amid Growing Demand

Network News

PECTRA FINALLY GOES LIVE ON ETHEREUM: Ethereum activated its long-awaited “Pectra” upgrade on Wednesday, marking the blockchain’s most significant overhaul since the Merge in 2022. The update aims to streamline staking, enhance wallet functionality, and improve overall efficiency. It arrives as Ethereum contends with rising competition and internal debates over its direction. A key element of the upgrade involves increasing the amount of ETH one can stake from 32 to 2,048. This change could help speed up and streamline operations for stakers, the vast network of companies and individuals who help keep the Ethereum network afloat. Previously, staking at scale required setting up multiple validators; now, stakers can consolidate up to that amount under a single node. — Margaux Nijkerk Read more.

BITCOIN CORE DEVS TO REMOVE OP_RETURN LIMIT, SPARKING DEBATE: The debate over Bitcoin’s OP_RETURN heats up, as developers of Bitcoin Core – the most popular node software – said they plan to scrap OP_RETURN entirely in the next release. The OP_RETURN limit is an 80-byte cap on the amount of arbitrary data that can be embedded in a Bitcoin transaction using a special, unspendable output field. The debate centered on whether lifting the 80-byte OP_RETURN limit promotes transparency and simplifies data use on Bitcoin, or whether it opens the door to abuse, spam, and a shift away from Bitcoin’s financial focus. — Sam Reynolds Read more.

WORLDCOIN COMES TO 6 U.S. CITIES: Sam Altman’s blockchain project, World, is launching in the U.S. – and said it intends to roll out 7,500 eye-scanning “orbs” in cities across the country by the end of the year. World’s orbs — chrome, bowling ball-shaped devices that scan a person’s eyeballs to confirm their identity — will initially be available to Americans in six “key innovation hubs,” the company said: Atlanta, Austin, Los Angeles, Miami, Nashville and San Francisco. Those who decide to take the plunge and gaze into the orb will gain access to the World app and receive an airdrop of World’s WLD token. By the end of the year, the project aims to have enough orbs spread throughout the U.S. to give 180 million Americans, more than half the population, access to World’s network.— Cheyenne Ligon and Margaux Nijkerk Read more.

AFTER 8 YEARS, AZTEC TESTNET IS LIVE: Aztec, a layer-2 rollup focused on privacy, shared that its testnet has finally gone live. The announcement comes as a wave of new privacy-focused solutions begins to capture the interests of large institutions that need confidentiality with large transaction batches. The team behind Aztec said that they have been working on the product for over 8 years, bringing the cutting-edge technology one step closer to the mainnet. — Margaux Nijkerk Read more.

In Other News

- Movement Labs, the development firm of the Movement network, has rebranded to «Movement Industries» and cut ties with co-founder Rushi Manche following controversy surrounding undisclosed MOVE token deals. The announcement came via the company’s X account early Tuesday, stating that “Movement Labs has terminated Rushi Manche’s employment and all affiliations with the company effective immediately.” The decision follows a CoinDesk report that first revealed secret agreements between Movement-linked entities and market makers during the project’s token launch. — Shaurya Malwa Read more.

- The price of gold has surged almost 29% this year, solidly beating the 3.8% gain in bitcoin (BTC). Even so, that’s failed to deter investors eager to add the largest cryptocurrency to their portfolios. BlackRock’s spot bitcoin ETF (IBIT) has attracted a net $6.96 billion in inflows since the start of the year, the sixth-largest amount of all exchange-traded funds, according to data from Bloomberg’s senior ETF analyst, Eric Balchunas. SPDR Gold Trust (GLD), the world’s largest physically backed gold ETF, slipped to the number seven position Monday with net inflows of $6.5 billion. IBIT’s outperformance indicates institutions’ persistent confidence in bitcoin’s long-term prospects despite the relatively dour price performance. — Omkar Godbole Read more.

Regulatory and Policy

- Democrats in the U.S. House of Representatives derailed what was supposed to be a joint hearing on crypto policy efforts on Tuesday, insisting that President Donald Trump’s personal crypto dealings were too urgent to allow other discussion on instituting industry regulations. — Jesse Hamilton Read more.

- New Hampshire has become the first state to allow the investment of its public funds into crypto assets with its governor signing the new law on Tuesday. The state beat a number of others to the punch this year as what had started as a surge in state lawmaker momentum had run into roadblocks over recent weeks. As the first to authorize its treasurer to set up such a reserve, New Hampshire could very well beat the U.S. government in forming a stockpile, too. — Jesse Hamilton Read more.

Calendar

- May 14-16: Consensus, Toronto

- May 19-23: Solana Accelerate, New York City

- May 20-22: Avalanche Summit, London

- May 27-29: Bitcoin 2025, Las Vegas

- May 27-29: ETHPrague, Prague

- June 8-22: Berlin Blockchain Week, Berlin

- June 30-July 3: EthCC, Cannes

- Sept. 22-28: Korea Blockchain Week, Seoul

- Oct. 1-2: Token2049, Singapore

- Dec. 11-13: Solana Breakpoint, Abu Dhabi

Uncategorized

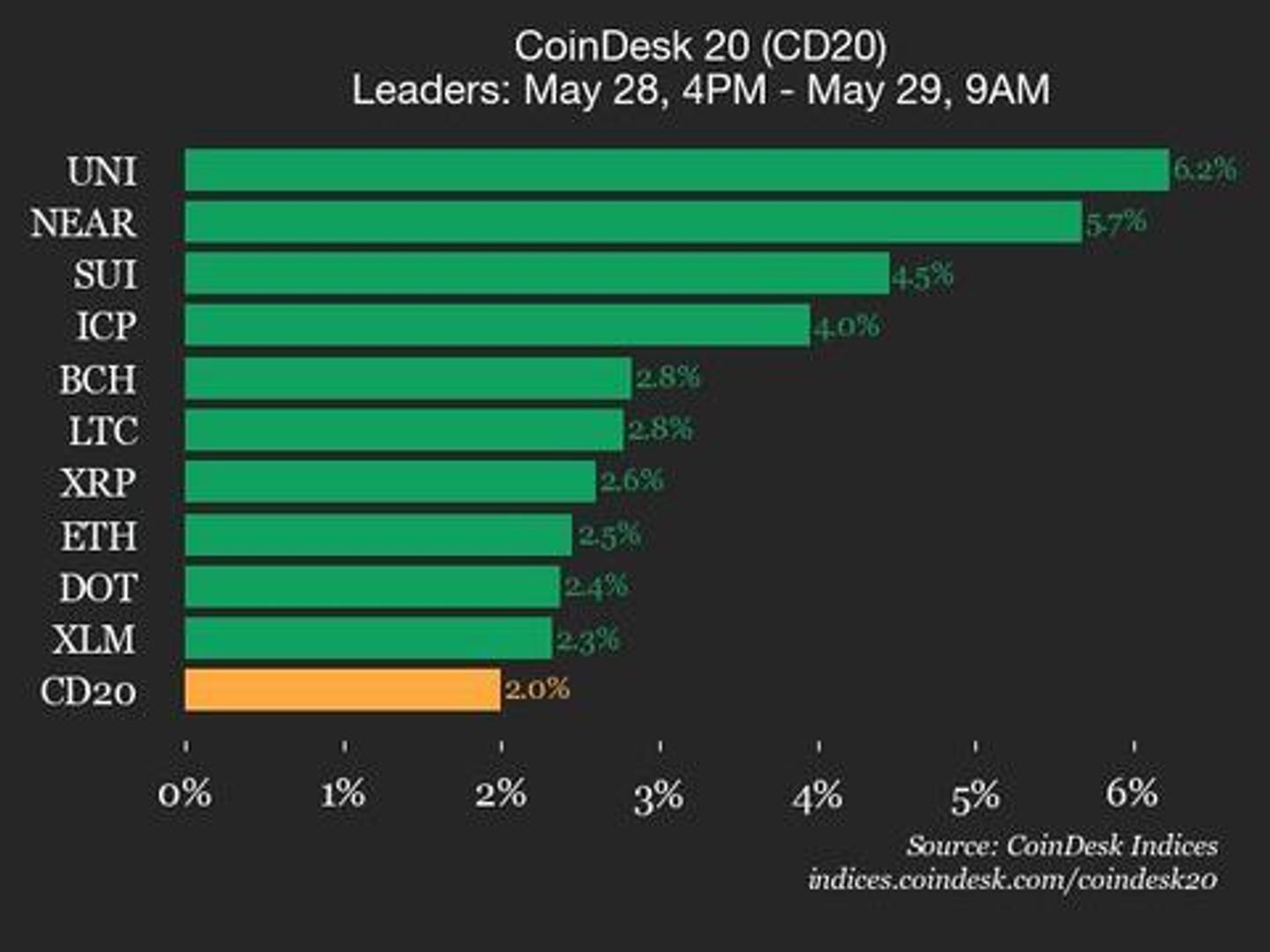

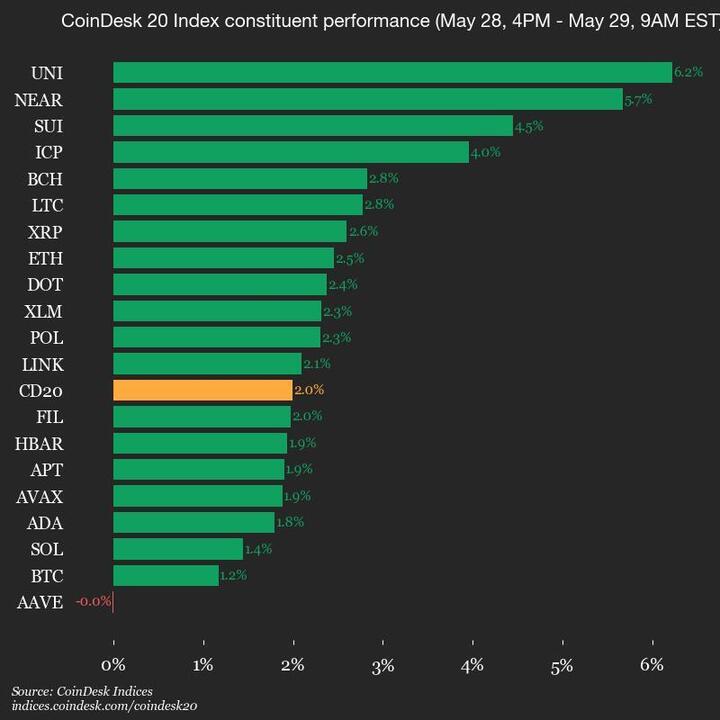

CoinDesk 20 Performance Update: Uniswap (UNI) Gains 6.2%, Leading Index Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3264.85, up 2.0% (+63.87) since 4 p.m. ET on Wednesday.

Nineteen of 20 assets are trading higher.

Leaders: UNI (+6.2%) and NEAR (+5.7%).

Laggards: AAVE (+0.0%) and BTC (+1.2%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Solana’s 18 Month Long Bull Run Against Ether is Over; XRP Ends Mini-Uptrend

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Programmable blockchain Solana is on course to flip its rival and leading smart contract blockchain Ethereum in terms of market capitalization, several observers have said it in recent months.

However, for now, Ethereum’s native token ether ETH seems to have an upper hand over Solana’s SOL SOL , according to technical analysis.

The SOL/ETH ratio has dived out of an upward sloping trendline connecting lows in September 2023, June 2024 and December 2024, per data source TradingView. In other words, tables have turned in ETH’s favor and the token could outperform SOL in the near-term.

Additionally, the weekly chart MACD histogram is printing red, indicating a strengthening of the downside momentum.

The immediate support is seen at 0.055 (the Feb. 25 low). The pair needs to move back above the Ichimoku cloud to negate the SOL bearish outlook.

XRP loses uptrend

Another coin showing a shift in market trend is XRP, the cryptocurrency designed for cross-border payments.

XRP has dived out of a bullish ascending channel, marking the recovery from the early April lows near $1.6.

The breakdown has exposed support at $2, which acted as floor several times early this year. Should the buyers fail to defend that, a deeper slide to $1.60 could be seen.

On the higher side, the recent high of $2.65 is the level to beat for the bulls.

Uncategorized

Vaulta, Fosun Team Up to Power Blockchain Infrastructure in Hong Kong

Vaulta, formerly known as EOS Network, and its digital banking platform have teamed up with Fosun Wealth Holdings to bring blockchain infrastructure to Hong Kong’s financial sector, the companies said.

The partnership centers around “FinChain,” a virtual asset business launched by Fosun Wealth Holdings, which is part of the Fosun International conglomerate.

That conglomerate includes various businesses, including regional insurance and healthcare leaders in Europe, Asia, and the Americas.

Vaulta will supply its full BankingOS suite, while exSat, Vaulta’s digital banking platform, will serve as the on-chain banking layer for asset issuance, yield generation, and crypto payments, according to a press release shared with CoinDesk.

The deal allows Vaulta and exSat to tap into Fosun’s existing financial licenses and real-world asset (RWA) issuance capabilities, giving them a regulatory springboard to scale blockchain-native banking services.

For Zhao Chen, Director of Digital Assets at Fosun Wealth, the collaboration brings the necessary infrastructure to roll out next-gen financial products.

«Vaulta and exSat bring the product vision and digital banking capabilities we need to make FinChain a reality,» he said in the announcement.

The initiative is part of Vaulta’s broader rebrand and expansion into institutional-grade blockchain finance. The partnership is expected to lead to more collaborations focused on Web3 financial infrastructure across Asia and beyond.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors