Uncategorized

The Market Reaction to Trump’s Tariffs Signals a Broader Acceptance of Bitcoin’s ‘Digital Gold’ Narrative

In financial markets, making assumptions based on short-term observations is a fool’s errand, as significant trends develop over months and years, not days or weeks. But as investors evaluate bitcoin’s role in their portfolios, the events of April are worth analyzing in order to understand the asset’s emerging reputation as a store of value.

Backdrop of volatility

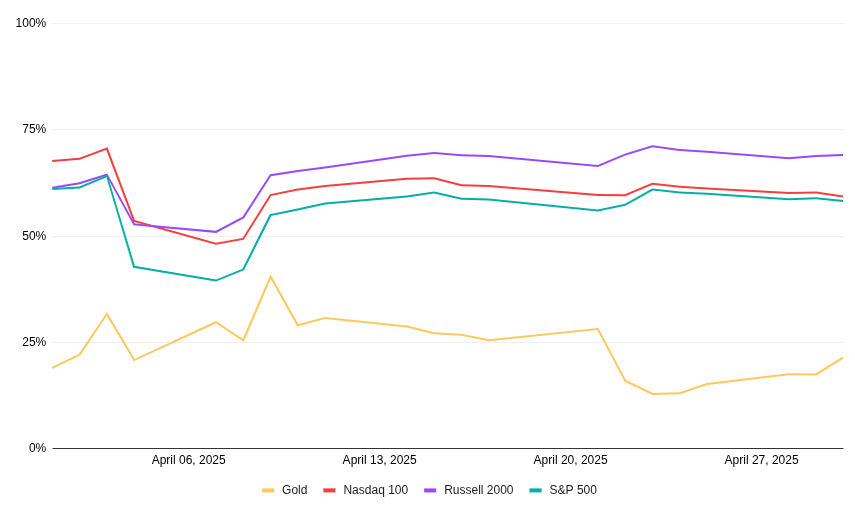

The turbulence sparked by President Trump’s tariffs announcement on April 2 sent stock prices plummeting the following day, with the Nasdaq 100 and S&P 500 falling 4.8% and 5.4%, respectively. Bitcoin followed suit as the VIX Volatility Index hit levels not seen since the early days of COVID and fears of retaliatory trade measures prevailed.

However, bitcoin’s price began to recover sharply within days of the announcement, causing its correlation with both the Nasdaq 100 and S&P 500 to fall below 0.50, before those correlations rose again as the April 9 pause on tariffs brought back “risk-on” mode.

Bitcoin’s correlations to traditional markets in April

Source: Hashdex Research with data from CF Benchmarks and Bloomberg (April 01, 2025 to April 30, 2025). 30-day rolling correlations (considering only workdays) between bitcoin (represented by the Nasdaq Bitcoin Reference Price Index) and TradFi indices.

This short-term observation matters because it supports the changing nature of how investors perceive bitcoin. While some still categorize bitcoin as a high-beta “risk-on” asset, institutional sentiment is beginning to reflect a more nuanced understanding. Bitcoin recovered faster than the S&P 500 in the 60 days that followed the COVID outbreak, Russia’s invasion of Ukraine and the U.S. banking crisis in 2023, events in which it demonstrated resilience and a profile increasingly aligned with that of gold during stress.

These periods of decoupling establish a pattern where bitcoin displays its antifragile properties, allowing allocators to protect capital during systemic events, while still outpacing the performance of stocks, bonds and gold over the long haul.

Bitcoin vs. traditional assets, 5-year returns

Source: CaseBitcoin, Return data from May 1, 2020 to April 30, 2025 (CaseBitcoin.com)

The path to digital gold

Maybe more compelling than bitcoin’s longer-term returns are the long-term portfolio effects. Even a small allocation to bitcoin within a traditional 60% stock/40% bond portfolio would have improved risk-adjusted returns in 98% of rolling three-year periods over the last decade. And these risk-adjusted returns are markedly higher over longer time frames, suggesting that bitcoin’s volatility from positive returns more than counterbalances short-term drawdowns.

It might still be premature to claim that bitcoin has been universally accepted as “digital gold,” but that narrative, supported by its response to geopolitical events, is gaining momentum. The combination of bitcoin’s fixed supply, liquidity, accessibility and immunity to central bank interference gives it properties no traditional asset can replicate. This should be appealing to any investor, large or small, in search of portfolio diversification and long-term wealth preservation.

Uncategorized

GameStop Purchases Over $500M Worth of Bitcoin

Video game retailer GameStop (GME) has purchased 4,710 bitcoin, worth nearly $513 million at the time of writing.

GameStop announced the purchase on X on Wednesday but did not offer further details about when the BTC were acquired or the price paid.

The Grapevine, Texas-based company revealed its plans to pursue a bitcoin treasury strategy in March, offering $1.3 billion in debt to raise the funds for BTC acquisition.

The shares of GME rose more than 4% in U.S. pre-market trading on the news, while bitcoin price remained subdued around $108,000.

Uncategorized

Crypto Daybook Americas: Bitcoin Dominance Tops 64% While Options Indicate Bullish Tilt

By James Van Straten (All times ET unless indicated otherwise)

Since May 22, bitcoin (BTC) has been trading within a narrow 5% range between $106,600 and $111,700, despite a flurry of bullish developments, including the announcement that Trump Media will raise $2.5 billion through equity and bond sales to fund a bitcoin treasury strategy.

This pause in momentum comes even as the U.S. equity market rallies, with the S&P 500 up 22% from its April lows. Notably, bitcoin appears to have front-run traditional markets, with crypto markets now entering a consolidation phase while the S&P 500 still trades 4% below its all-time highs from February.

Meanwhile, the divergence between bitcoin and the broader crypto market continues to widen. Bitcoin market cap dominance now consolidates above 64%, highlighting its growing influence. At current prices near $108,000, bitcoin trades almost $14,000 above its 200-day moving average, which sits just under $94,500, underscoring the strength of its recent performance.

In contrast, ether (ETH) and solana (SOL) remain subdued. Ether has been rejected three times at its 200-DMA ($2,697) and currently trades at $2,633. Similarly, SOL is priced at $173, below its 200-DMA of $181, having also faced repeated rejections.

“Ether and solana have been battling resistance in the form of their 200-day moving averages for more than two weeks now. We seem to be dealing with an indecisive market choosing between a further mighty rally and fading after a rebound. Bitcoin’s rally has the potential to inspire big alts to break out, but for now, we are not there yet,» Alex Kuptsikevich, Chief Market Analyst at FxPro, told CoinDesk.

In the derivatives market, bitcoin options expiring at the end of May show the highest concentration of call interest at $110,000, with June and July expiries skewing more bullish, particularly at $115,000 and $120,000 strikes, according to Kaiko. The highest turnover remains around $110,000, indicating expectations of continued consolidation around current levels.

On the corporate front, Circle, issuer of the USDC stablecoin, has updated its IPO filing with the New York Stock Exchange. The company aims to raise $600 million at a valuation of $5.4 billion, becoming the latest crypto firm to push toward public markets amid renewed interest in institutional crypto adoption. Stay Alert!

What to Watch

- Crypto

- May 30: The second round of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on «DeFi and the American Spirit«

- Macro

- May 28, 2 p.m.: The Fed releases FOMC meeting minutes for May 6-7.

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment rate data.

- Unemployment Rate Est. 6.9% vs. Prev. 7%

- May 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q1 GDP data.

- GDP Growth Rate QoQ 2nd Estimate Est. -0.3% vs. Prev. 2.4%

- GDP Price Index QoQ 2nd Estimate Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ 2nd Estimate Est. -2.5% vs. Prev. 3.3%

- May 29, 2 p.m.: Fed Governor Adriana D. Kugler will deliver a speech at the 5th Annual Federal Reserve Board Macro-Finance Workshop (virtual). Livestream link.

- Earnings (Estimates based on FactSet data)

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

- May 28, 1 p.m.: Sui to host an X Spaces session on Sui DeFi.

- June 10: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $23.76 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $163.22 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.19 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.07 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $60.51 million.

- Token Launches

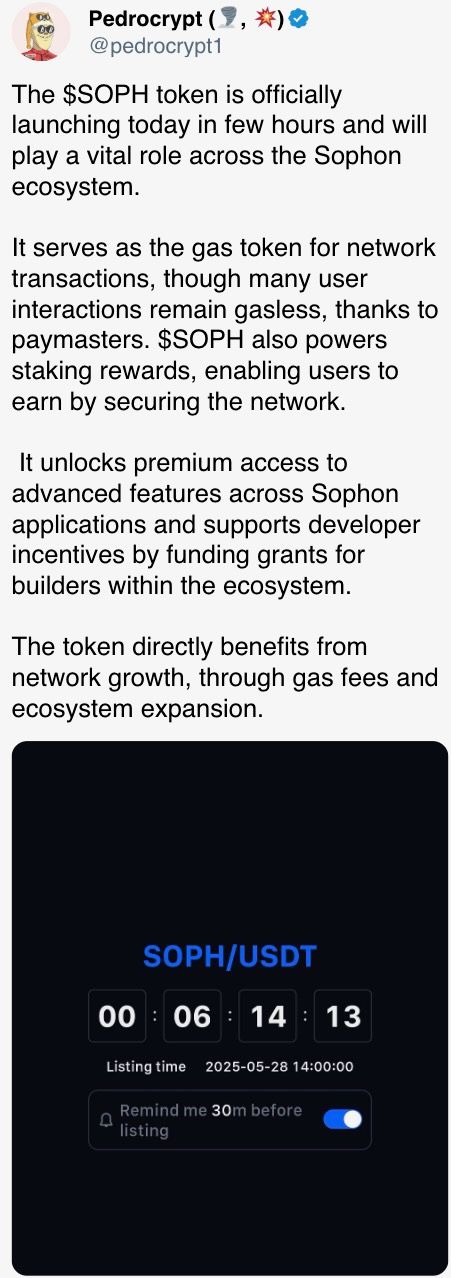

- May 28: Sophon (SOPH) to be listed on Binance, BingX, KuCoin MEXC, OKX, and others.

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 2 of 3: Bitcoin 2025 (Las Vegas)

- Day 2 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- Sui’s SUI jumps 6.5%, Cetus Protocol’s token soars 26% as teams pledge to backstop exploit losses.

- Cetus Protocol, the top DEX on the Sui blockchain, secured a loan from the Sui Foundation to fully reimburse users affected by a $223 million exploit.

- The attacker used spoof tokens like BULLA to manipulate price curves and drain SUI, USDC, and other assets from liquidity pools.

- About $162 million of the stolen tokens were frozen on-chain; the rest were bridged out and may have been laundered through multiple routes.

- Cetus will combine the Foundation’s loan with its treasury reserves to begin immediate repayments for affected users.

- Full recovery hinges on an upcoming community vote that would unlock the frozen funds for user compensation.

- At the time, the exploit caused CETUS to drop 40% and led to a sharp liquidity crunch across the Sui DeFi ecosystem, but the recovery plan has helped spark a strong market rebound.

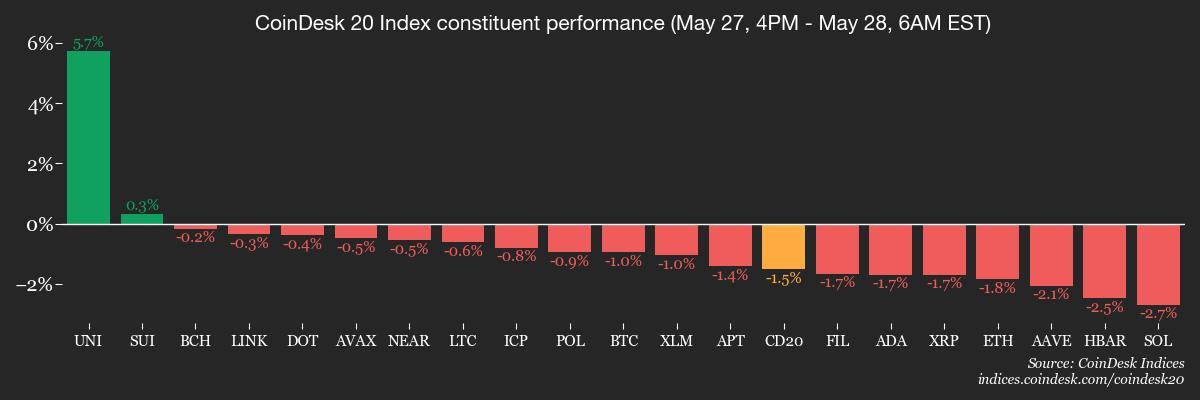

Derivatives Positioning

- Bitcoin CME futures volume rose to $15.96 billion, the highest since Feb. 25. But the growth in open interest has stalled near $17 billion since May 21, suggesting a pause in inflows.

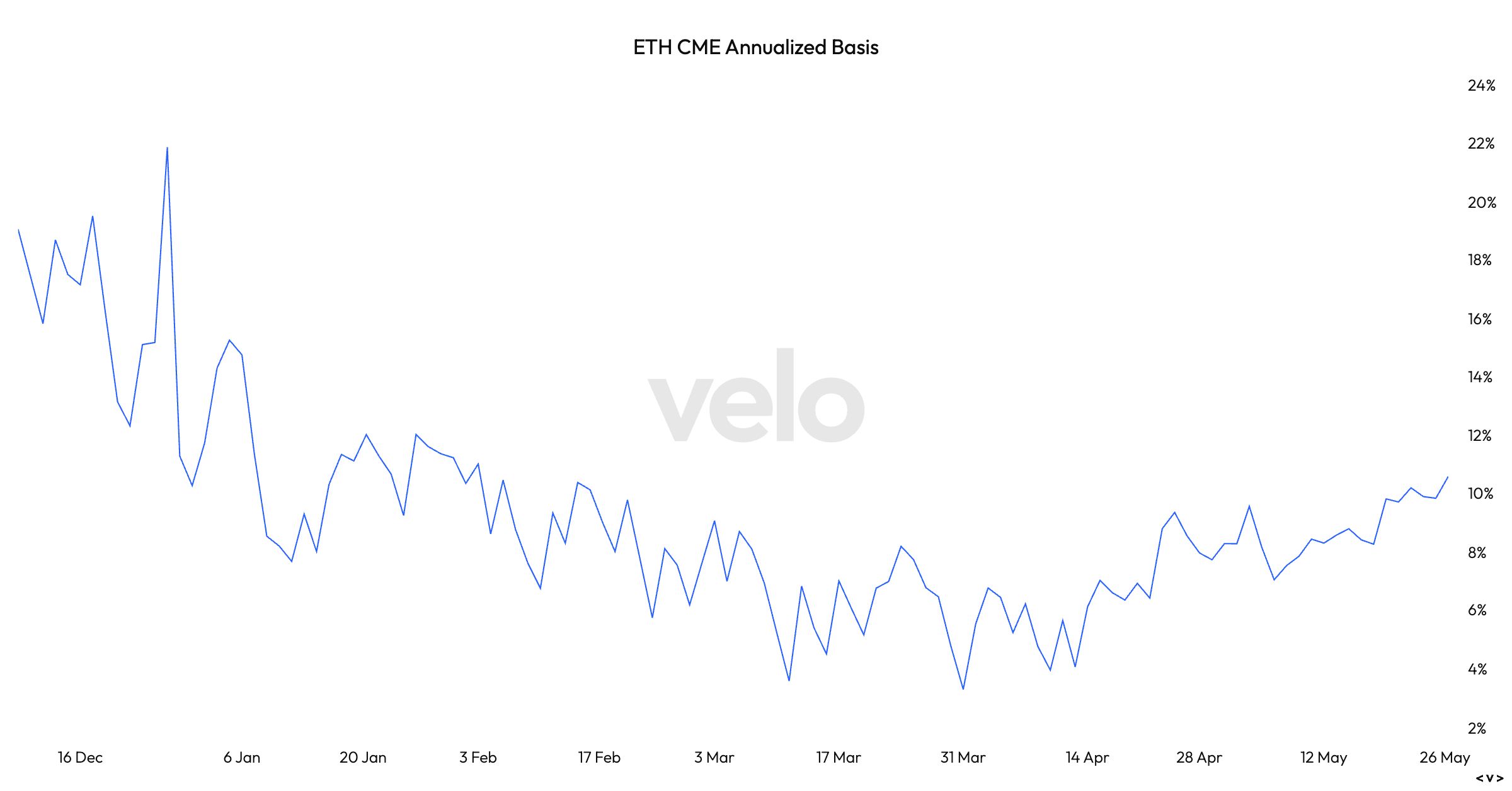

- ETH CME futures volume rose to the highest since Feb. 3, with open interest clocking a three-month high of $3.15 billion.

- On offshore exchanges, BTC and ETH perpetual futures signaled a moderately bullish bias with annualized funding rates holding steady below 10%.

- Monero’s funding rate held above 90%, signaling excessive build of bullish leverage.

- On Deribit, BTC call bias has weakened across the board. Block flows featured short positions in the BTC May expiry call option at the $113K strike alongside demand for June and July expiry ETH call and call spreads.

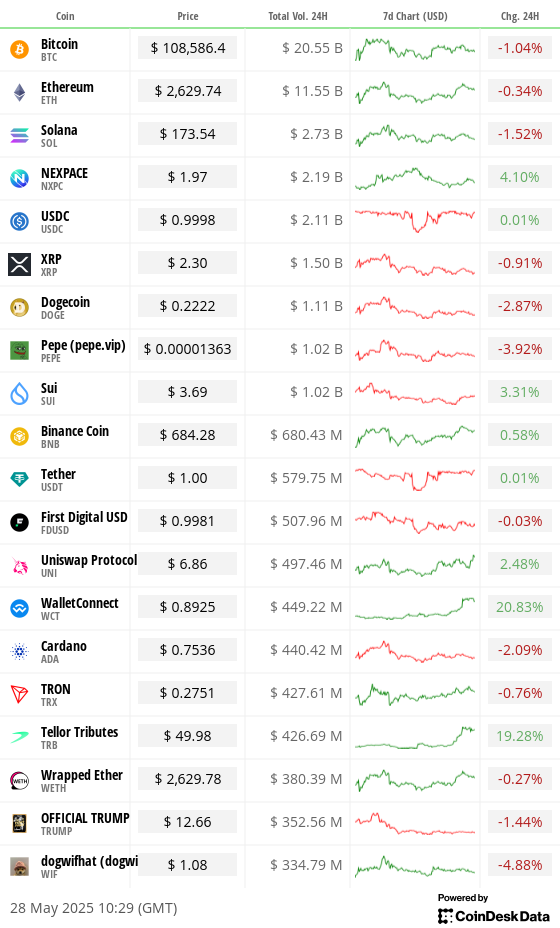

Market Movements

- BTC is down 0.71% from 4 p.m. ET Tuesday at $108,821.26 (24hrs: -1.07%)

- ETH is down 1.54% at $2,628.1 (24hrs: -0.94%)

- CoinDesk 20 is down 1.35% at 3,245.33 (24hrs: -1.06%)

- Ether CESR Composite Staking Rate is up 11 bps at 3.1%

- BTC funding rate is at 0.0023% (2.4922% annualized) on Binance

- DXY is unchanged at 99.52

- Gold is up 0.72% at $3,322.80/oz

- Silver is down 0.68% at $33.22/oz

- Nikkei 225 closed unchanged at 37,722.40

- Hang Seng closed -0.53% at 23,258.31

- FTSE is unchanged at 8,776.80

- Euro Stoxx 50 is down 0.34% at 5,396.83

- DJIA closed on Tuesday +1.78% at 42,343.65

- S&P 500 closed +2.05% at 5,921.54

- Nasdaq closed +2.47% at 19,199.16

- S&P/TSX Composite Index closed +0.65% at 26,269.0

- S&P 40 Latin America closed +0.76% at 2,619.31

- U.S. 10-year Treasury rate is up 2 bps at 4.47%

- E-mini S&P 500 futures are up 2.02% at 5,934.75

- E-mini Nasdaq-100 futures are up 2.32% at 21,461.25

- E-mini Dow Jones Industrial Average Index futures are up 1.79% at 42,422.00

Bitcoin Stats

- BTC Dominance: 64.05 (0.23%)

- Ethereum to bitcoin ratio: 0.02416 (-1.10%)

- Hashrate (seven-day moving average): 894 EH/s

- Hashprice (spot): $57.1

- Total Fees: 6.05 BTC / $622,336

- CME Futures Open Interest: 159,710

- BTC priced in gold: 32.9 oz

- BTC vs gold market cap: 9.31%

Technical Analysis

- Bitcoin is teasing a downside break of the trendline characterizing the rapid price rally from early April lows near $75K.

- Such a move may entice more profit-taking, yielding a deeper pullback.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $372.2 (+0.73%), -1.15% at $367.93 in pre-market

- Coinbase Global (COIN): closed at $266.4 (+1.23%), -0.66% at $264.63

- Galaxy Digital Holdings (GLXY): closed at C$29.97 (-5.16%)

- MARA Holdings (MARA): closed at $16.44 (+11.61%), -1.09% at $16.26

- Riot Platforms (RIOT): closed at $9.14 (+6.9%), -1.2% at $9.03

- Core Scientific (CORZ): closed at $11.28 (+5.62%)

- CleanSpark (CLSK): closed at $9.86 (+5.34%), -1.42% at $9.72

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18.24 (+3.58%)

- Semler Scientific (SMLR): closed at $43.39 (-2.1%), unchanged in pre-market

- Exodus Movement (EXOD): closed at $34.75 (-0.71%), +2.88% at $35.75

ETF Flows

Spot BTC ETFs

- Daily net flow: $385.4 million

- Cumulative net flows: $44.88 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily net flow: $38.8 million

- Cumulative net flows: $2.81 billion

- Total ETH holdings ~ 3.55 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The annualized premium in ether CME futures continues to rise and has now topped the 10% mark for the first time in months.

- The rising premium represents bullish sentiment among sophisticated market participants.

While You Were Sleeping

- Bitcoin Surges Ahead as Strategy Stock Lags (CoinDesk): Divergence grows amid mNAV compression and a shift in Strategy’s funding approach for bitcoin accumulation.

- Sui Network Steps in to Compensate Cetus Losses in Full After $223M Exploit (CoinDesk): The Sui Foundation has extended a loan to Cetus to fully reimburse affected users, with repayment contingent on an upcoming on-chain community vote.

- Are XMR Traders Buying The Dip? Monero Futures Open Interest Surges as Price Falls By Nearly $100 in 3 Days (CoinDesk): Open interest has climbed to a multi-month high alongside persistently positive funding rates, signaling aggressive long positioning despite the recent sharp correction.

- Path of Least Resistance for Stocks Is Higher, Barclays Says (Bloomberg): Investor positioning remains light enough to support further gains, Barclays says, with systematic buying likely to persist absent a shock and Nvidia earnings now key to near-term sentiment.

- Putin Has Retooled Russia’s Economy to Focus Only on War (The Wall Street Journal): Analysts say peace could spark unrest, as winding down arms production may lead to factory job losses and falling incomes in poorer regions that have benefited from heavy defense spending.

- Zelensky Heads to Berlin in Latest Sign of a Warming Relationship (The New York Times): Zelensky has met Germany’s new chancellor three times in as many weeks, highlighting Berlin’s push to assume a stronger role as U.S. support for Ukraine becomes less certain.

In the Ether

Uncategorized

Bitcoin Ordinals Can Now Be Bridged to Cardano Through BitVMX

Cardano has continued to advance its credentials as a venue for Bitcoin Defi (BTCFi), facilitating a transfer of Ordinals to its mainnet.

The on-chain transaction between Bitcoin and Cardano was facilitated by BitVMX, an interoperability protocol built using the BitVM programming language.

The transaction was unveiled by Input | Output (IO), the creator of the layer 1 Cardano, at the Bitcoin 2025 conference in Las Vegas on Tuesday.

The bridge represents a «preview of what is to come,» IO said in an emailed announcement. Its ultimate aim is a full integration between Bitcoin and Cardano, providing DeFi services for BTC users and unlocking huge amounts of liquidity from the value stored in bitcoin.

To this end, IO has developed the «Cardinal» protocol, a portmanteau of Cardano and Ordinals, which harnesses BitVMX to assign Bitcoin-native assets to addresses on Cardano.

The Ordinals protocol was introduced at the start of 2023, enabling the inscription of data onto individual satoshis (the smallest BTC denomination, equivalent to one 100 millionth of a bitcoin), this making them unique and traceable. In effect, this created a Bitcoin equivalent of non-fungible tokens (NFTs).

Read More: Bitlayer Joins Forces With Antpool, F2Pool, and SpiderPool to Supercharge Bitcoin DeFi

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors