Uncategorized

The Man Who Stabbed CEO of South Korean Crypto Firm Haru Invest Could Face Decade in Prison

A South Korean man who attacked the CEO of collapsed crypto firm, Haru Invest, is now facing a potential decade behind bars, according to local media reports.

Prosecutors in Seoul have requested a 10-year prison sentence for someone local media is only identifying by his last name Kang, a man in his 50s who stabbed Haru Invest CEO Lee Hyung-soo during a court hearing last year.

Haru Invest paused withdrawals in 2023, citing partner issues, without giving a specific reason, before its executives were arrested in 2024 for allegedly stealing $828 million in customer funds.

Kang’s defense argued that he had no intent to kill, noting that he did not target a fatal area and acted in a moment of extreme emotional distress after losing 100 BTC (worth $8.3 million) due to Haru Invest’s collapse.

His lawyers pushed for a reduced charge of aggravated assault rather than attempted murder, citing his severe financial and psychological hardship.

Ahead of the hearing, the local media reported that Haru Invest Victims’ Association held a press conference demanding Kang’s release, arguing that fraud victims like him were being treated unfairly while executives accused of embezzling hundreds of millions of dollars walked free on bail.

Kang is due back in court on April 4 for sentencing.

Uncategorized

Hong Kong Joins Global Race With New Stablecoin Licensing Bill

Hong Kong passed a stablecoin bill that will enable the region to establish a licensing regime for fiat-backed stablecoin issuers.

«Hong Kong’s stablecoins are backed by fiat currency as underlying assets, and we welcome global enterprises and institutions interested in issuing stablecoins to apply in Hong Kong,» legislative council member Johnny Ng said on X on Wednesday.

Institutions are expected to be able to apply for a license from the Hong Kong Monetary Authority by the year-end.

Hong Kong has been working on establishing a stablecoin regime since 2023. The nation had published a consultation paper on stablecoin guidelines towards the end of 2023. It later introduced the Stablecoin Bill, which the Legislative Council of the Hong Kong Special Administrative Region passed in its third reading, Ng’s post said.

The region has been looking to keep up with nations around the world that have been establishing their stablecoin regimes. The European Union started licensing stablecoin issuers last year after passing its wide-ranging bespoke crypto bill, called the Markets in Crypto Assets regulation (MiCa). Meanwhile, the U.S. has a stablecoin bill that is passing through Congress, and the U.K. has been gathering feedback on draft legislation that will also affect stablecoins.

The stablecoin sector has become the hottest trend in recent years, with both crypto and TradFi firms ramping up their exposure to the industry. Ben Reynolds, BitGo’s managing director of stablecoins, said at Consensus 2025 that large banks are increasingly taking notice of the industry, largely out of fear that they will lose market share to the digital dollars.

Read more: Banks Exploring Stablecoin Amid Fears of Losing Market Share, BitGo Executive Says

Uncategorized

Sam Altman’s World Raises $135M in Token Sale to a16z and Bain Capital Crypto

Sam Altman’s blockchain project World Network has raised $135 million in a private token sale of its WLD token.

The sale was to venture capital giants a16z and Bain Capital Crypto and will be used to fund network expansion, the team shared.

WLD is higher by 14% on the news.

The funding comes as the group behind the blockchain announced the project’s in-app functionalities as well as the WLD token has become available as of earlier this month to U.S. users.

“To meet increasing demand for Orb-verified World IDs and support the expansion of the World network throughout the U.S. and beyond, World Assets, Ltd. (a subsidiary of the World Foundation) sold $135M of WLD at market prices to two of the project’s earliest backers, Andreessen Horowitz and Bain Capital Crypto. The circulating supply of WLD has thus increased correspondingly,” the team wrote in a blog post.

The WLD token was created at launch in July 2023, and it currently has a market capitalization of $1.87 billion and is up 55% in the last month, according to CoinMarketCap. WLD though is down roughly 75% from its all time high.

Until earlier this month, U.S. users were unable to use World’s primary product, their orbs, a bowling ball-shaped device that scans a person’s eyeballs to confirm their identity. Once they scan, users can access the World app and receive an airdrop of the WLD token, which can then be used in World’s miniapps ecosystem.

During the announcement earlier this month, Altman shared that the project hopes to have to give 180 million Americans access to Orbs, more than half the country’s population, by the end of the year.

Read more: Sam Altman’s World Crypto Project Launches in US With Eye-Scanning Orbs in 6 Cities

Uncategorized

Bitcoin Overtakes Amazon as the Fifth Largest Asset, Hitting $2.16T Market Cap

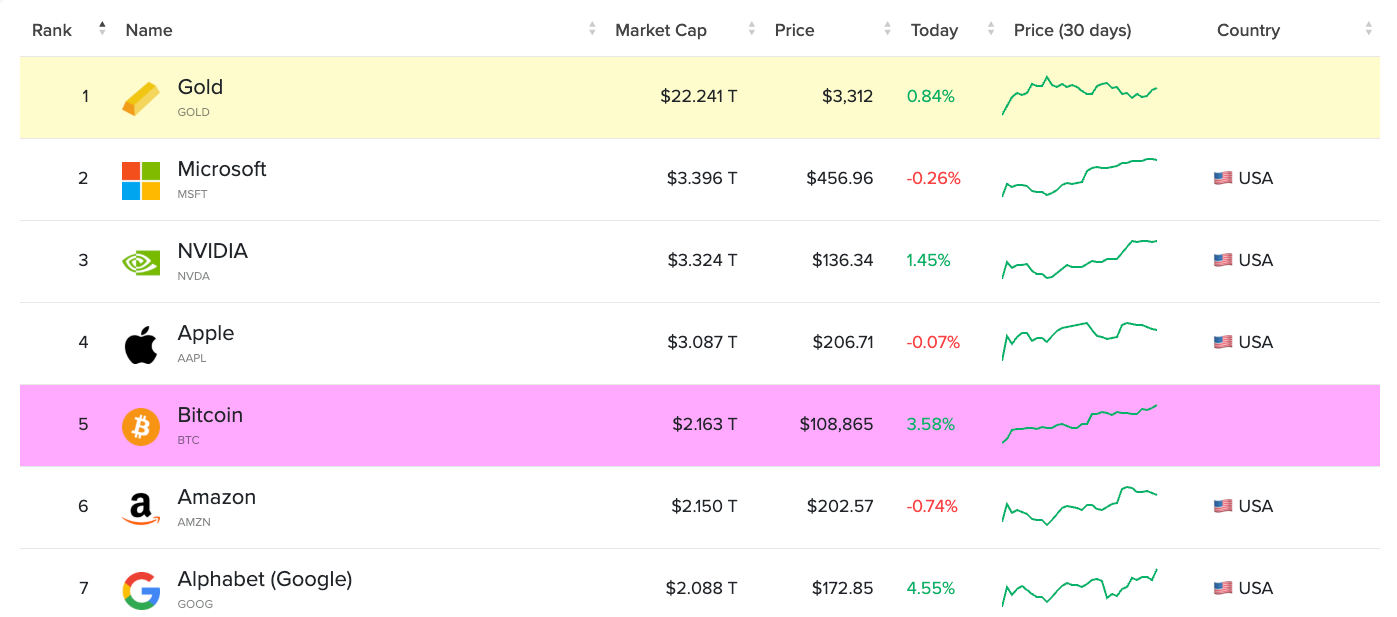

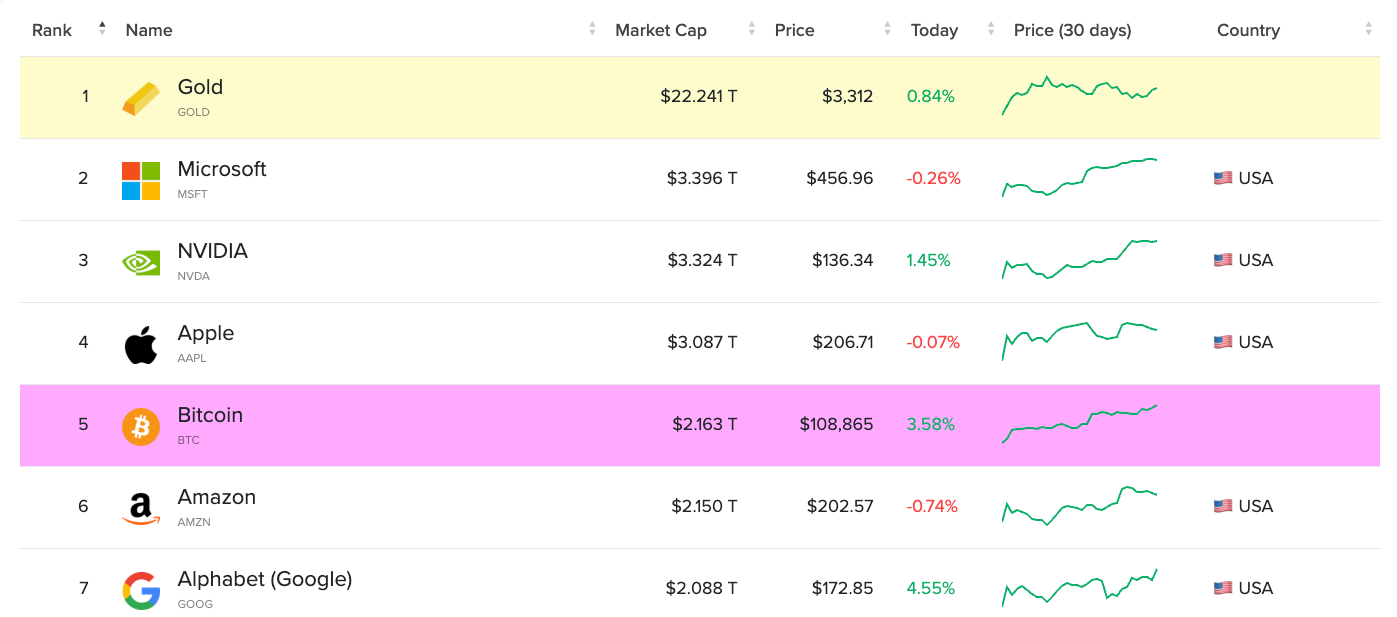

Bitcoin BTC became the world’s fifth-largest asset after hitting a new all-time high on Wednesday, which pushed its market cap to $2.16 trillion.

Though the crypto’s price consolidated lower after hitting a high of $109,400, its market cap passed Amazon (AMZN), which stands at $2.15 trillion.

Bitcoin is up 16.44% year-to-date while shares of the online retailer are down about 8% over the same period. It is currently trading at $108,954.

Gold is the largest asset, by far, standing at a $22 trillion market cap, followed by Microsoft (MSFT), NVIDIA (NVDA) and Apple (AAPL) which stand at $3.1 trillion to $3.4 trillion respectively.

As a result of the surge in bitcoin’s price since the win of U.S. President Donald Trump, BlackRock’s iShares Bitcoin Trust (IBIT) recently became the fifth-largest exchange-traded fund (ETF) by inflows this year as it took in roughly $9 billion from investors, according to data from Bloomberg senior ETF analyst Eric Balchunas.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors