Uncategorized

The Future Is AI-Centric, and Blockchains Need to Be as Well

Every few decades, a new technology emerges that changes everything: the personal computer in the 1980s, the internet in the 1990s, the smartphone in the 2000s. And as AI agents ride a wave of excitement into 2025, and the tech world isn’t asking whether AI agents will similarly reshape our lives — it’s asking how soon.

But for all the excitement, the promise of decentralized agents remains unfulfilled. Most so-called agents today are little more than glorified chatbots or copilots, incapable of true autonomy and complex task-handling — not the autopilots real AI agents should be. So, what’s holding back this revolution, and how do we move from theory to reality?

The current reality: true decentralized agents don’t exist yet

Let’s start with what’s out there today. If you’ve been scrolling through X/Twitter, you’ve likely seen a lot of buzz around bots like Truth Terminal and Freysa. They’re clever, highly engaging thought experiments — but they’re not decentralized agents. Not even close. What they really are are semi-scripted bots wrapped in mystique, incapable of autonomous decision-making and task execution. As a result they can’t learn, adapt or execute dynamically, at scale or otherwise.

Even more serious players in the AI-blockchain space have struggled to deliver on the promise of truly decentralized agents. Because traditional blockchains have no “natural” way of processing AI, many projects end up taking shortcuts. Some narrowly focus on verification, ensuring AI outputs are credible but failing to provide any meaningful utility once those outputs are brought on-chain.

Others emphasize execution but skip the critical step of decentralizing the AI inference process itself. Often, these solutions operate without validators or consensus mechanisms for AI outputs, effectively sidestepping the core principles of blockchain. These stopgap solutions might create flashy headlines with a strong narrative and sleek Minimum Viable Product (MVP), but they ultimately lack the substance needed for real-world utility.

These challenges to integrating AI with blockchain come down to the fact that today’s internet is designed with human users in mind, not AI. This is especially true when it comes to Web3, since blockchain infrastructure, which is meant to operate silently in the background, is instead dragged to the front-end in the form of clunky user interfaces and manual cross-chain coordination requests. AI agents don’t adapt well to these chaotic data structures and UI patterns, and what the industry needs is a radical rethinking of how AI and blockchain systems are built to interact.

What AI agents need to succeed

For decentralized agents to become a reality, the infrastructure underpinning them needs a complete overhaul. The first and most fundamental challenge is enabling blockchain and AI to “talk” to each other seamlessly. AI generates probabilistic outputs and relies on real-time processing, while blockchains demand deterministic results and are constrained by transaction finality and throughput limitations. Bridging this divide necessitates custom-built infrastructure, which I’ll discuss further in the next section.

The next step is scalability. Most traditional blockchains are prohibitively slow. Sure, they work fine for human-driven transactions, but agents operate at machine speed. Processing thousands — or millions — of interactions in real time? No chance. Therefore, a reimagined infrastructure must offer programmability for intricate multi-chain tasks and scalability to process millions of agent interactions without throttling the network.

Then there’s programmability. Today’s blockchains rely on rigid, if-this-then-that smart contracts, which are great for straightforward tasks but inadequate for the complex, multi-step workflows AI agents require. Think of an agent managing a DeFi trading strategy. It can’t just execute a buy or sell order — it needs to analyze data, validate its model, execute trades across chains and adjust based on real-time conditions. This is far beyond the capabilities of traditional blockchain programming.

Finally, there’s reliability. AI agents will eventually be tasked with high-stakes operations, and mistakes will be inconvenient at best, and devastating at worst. Current systems are prone to errors, especially when integrating outputs from large language models (LLMs). One wrong prediction, and an agent could wreak havoc, whether that’s draining a DeFi pool or executing a flawed financial strategy. To avoid this, the infrastructure needs to include automated guardrails, real-time validation and error correction baked into the system itself.

All this should be combined into a robust developer platform with durable primitives and on-chain infrastructure, so developers can build new products and experiences more efficiently and cost-effectively. Without this, AI will remain stuck in 2024 — relegated to copilots and playthings that hardly scratch the surface of what’s possible.

A full-stack approach to a complex challenge

So what does this agent-centric infrastructure look like? Given the technical complexity of integrating AI with blockchain, the best solution is to take a custom, full-stack approach, where every layer of the infrastructure — from consensus mechanisms to developer tools — is optimized for the specific demands of autonomous agents.

In addition to being able to orchestrate real-time, multi-step workflows, AI-first chains must include a proving system capable of handling a diverse range of machine learning models, from simple algorithms to advanced AIs. This level of fluidity demands an omnichain infrastructure that prioritizes speed, composability and scalability to allow agents to navigate and operate within a fragmented blockchain ecosystem without any specialized adaptations.

AI-first chains must also address the unique risks posed by integrating LLMs and other AI systems. To mitigate this, AI-first chains should embed safeguards at every layer, from validating inferences to ensuring alignment with user-defined goals. Priority capabilities include real-time error detection, decision validation and mechanisms to prevent agents from acting on faulty or malicious data.

From storytelling to solution-building

2024 saw a lot of early hype around AI agents, and 2025 is when the Web3 industry will actually earn it. This all begins with a radical reimagining of traditional blockchains where every layer — from on-chain execution to the application layer — is designed with AI agents in mind. Only then will AI agents be able to evolve from entertaining bots to indispensable operators and collaborators, redefining entire industries and upending the way we think about work and play.

It is increasingly clear that businesses that prioritize genuine, powerful AI-blockchain integrations will dominate the scene, providing valuable services that would be impossible to deploy on a traditional chain or Web2 platform. Within this competitive backdrop, the shift from human-centric systems to agent-centric ones isn’t optional; it’s inevitable.

Uncategorized

Ethereum Surges After Holding $2,477, Fueled by Very Heavy Trading Volume

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with ETH showing resilience despite broader market uncertainty.

The second-largest cryptocurrency is currently navigating a critical technical zone between $2,500-$2,530, which analysts identify as immediate resistance that must be overcome for continued upward movement.

Institutional interest remains strong, with spot Ethereum ETFs recording consecutive days of positive inflows, signaling growing confidence from larger investors despite the recent volatility.

Technical Analysis Highlights

- 24-hour ETH price action revealed a substantial 3.5% range ($99.85).

- Sharp sell-off during midnight hour saw price plummet to $2,477.40, establishing a key support zone.

- Extraordinary volume (291,395 units, nearly 3x average) confirmed the significance of the support level.

- Buyers stepped in at the $2,467-$2,480 support band, confirmed by high-volume accumulation during the 08:00-09:00 period.

- Recent price action shows bullish momentum with ETH reclaiming the $2,515 level.

- Potential higher low pattern suggests the correction may have found its bottom.

- $2,520-$2,530 area remains the immediate resistance to overcome for continued upward movement.

- Significant bullish surge at 13:35 saw price jump from $2,515.85 to $2,521.79, accompanied by exceptional volume (5,839 units).

- Sharp reversal occurred at 14:00, with price dropping 5.07 points to $2,508.02 on heavy volume (4,043 units).

- Hourly range of 14.46 points ($2,508.02-$2,522.48) demonstrates market indecision.

External References

- «Ethereum Holds Above Key Prices – Data Points To $2,900 Level As Bullish Trigger«, NewsBTC, published May 24, 2025.

- «Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level«, Bitcoinist, published May 25, 2025.

- «Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?«, CryptoPotato, published May 25, 2025.

Uncategorized

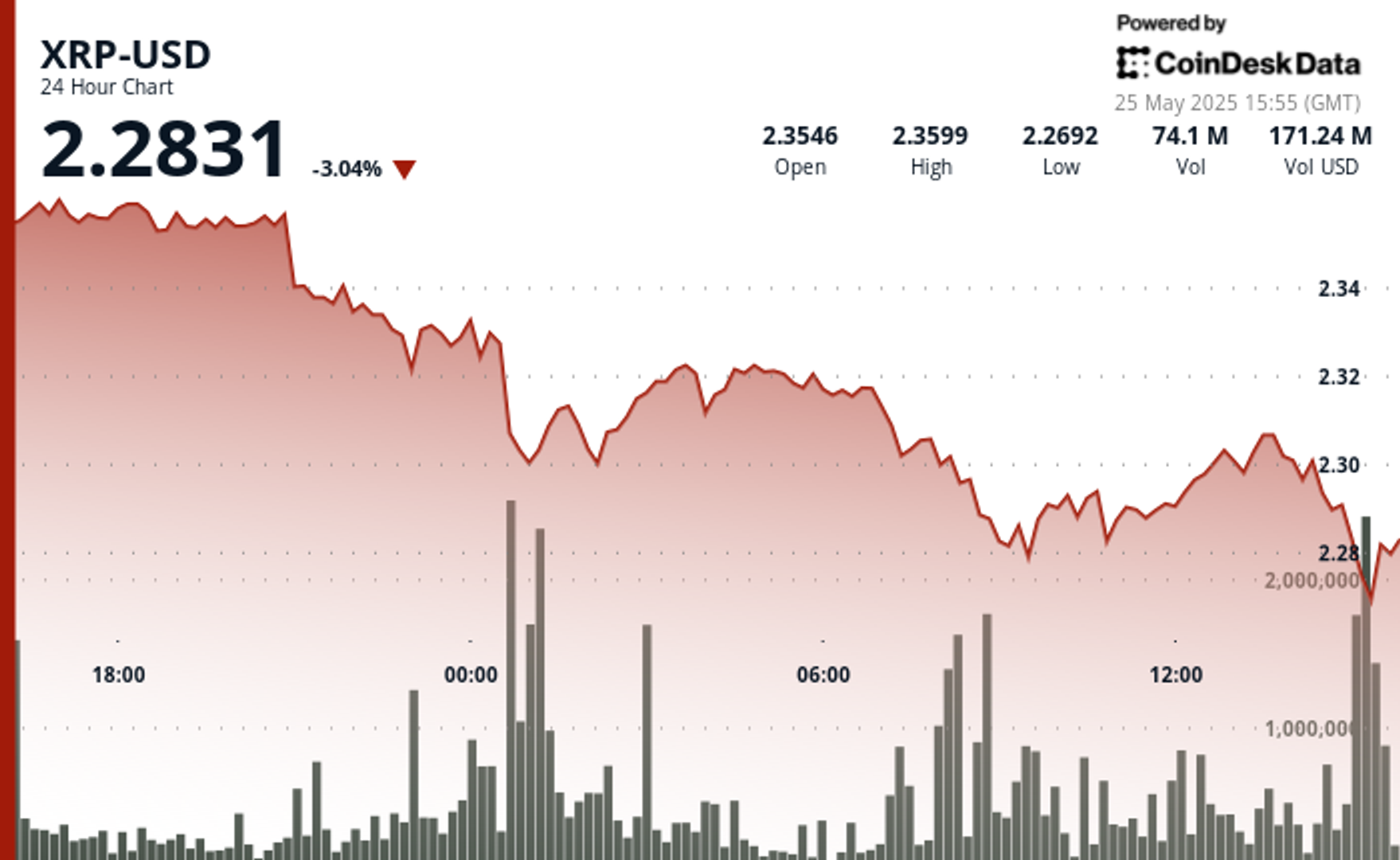

XRP Plunges Below $2.30 Amid Heavy Selling Pressure

Global economic tensions are weighing heavily on cryptocurrency markets as XRP experiences a significant correction amid heavy selling pressure.

The recent announcement of potential 50% tariffs on European Union imports by the US government has triggered widespread market uncertainty, with XRP falling alongside most major cryptocurrencies despite Bitcoin recently reaching new all-time highs.

Technical analysts point to critical support at the $2.25-$2.26 range, with market watchers warning that a break below this level could trigger deeper corrections toward the $1.55-$1.90 zone.

Meanwhile, institutional interest remains strong with Volatility Shares launching an XRP futures ETF and leveraged ETF inflows surging despite the price dip, suggesting Wall Street continues accumulating positions during market weakness.

Technical Analysis Highlights

- XRP underwent a notable 3.46% correction over the 24-hour period, with price declining from $2.361 to $2.303, creating an overall range of $0.084 (3.57%).

- The most significant price action occurred during the midnight hour (00:00), when XRP plummeted to $2.297 on exceptionally high volume (37.1M), establishing a strong volume-based support zone.

- A secondary sell-off at 08:00 saw price touch the period low of $2.280 with the highest volume spike (39.9M), confirming a double-bottom formation.

- In the last hour, XRP experienced significant volatility with a recovery attempt following the earlier correction.

- After reaching a low of $2.297 at 13:11, price formed a base around $2.298 before staging a substantial rally beginning at 13:27, peaking at $2.307 at 13:36-13:39 with exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $2.307, which was tested multiple times.

- The final 15 minutes saw profit-taking pressure emerge, with price retracing to $2.300, establishing a short-term support level that aligns with the psychological $2.30 threshold.

External References

- «XRP Price Watch: Consolidation or Collapse? Market Holds Breath Near $2.35«, Bitcoin.com News, published May 24, 2025.

- «XRP Price Prediction For May 25«, CoinPedia, published May 25, 2025.

- «XRP Risks Fall To $1.55 If This Support Level Fails – Analyst«, NewsBTC, published May 25, 2025.

Uncategorized

Bitcoin Drops Below $107.5K as Trump Tariff Threat Triggers Crypto Sell-Off

Bitcoin’s recent pullback has established strong volume-based resistance near $108,300, with support forming in the $106,700-$107,000 zone.

The correction accelerated with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal.

Technical analysis suggests Bitcoin is now trading within a compression zone, trapped between two major fair value gaps that will determine the upcoming market direction.

If bulls reclaim the $109K to $110K area, price could push toward resistance beyond $112K, while a break below $107,000 might test liquidity around $106K.

Technical Analysis Breakdown

- The decline accelerated during the 22:00-23:00 hour on May 24th with exceptionally high volume (16,335 BTC), establishing a strong volume-based resistance near $108,300.

- Support has formed in the $106,700-$107,000 zone where buyers emerged during the 09:00-10:00 period on May 25th, though recovery attempts have been modest with price consolidating around $107,500.

- The overall technical structure suggests a short-term bearish trend with potential for further consolidation before directional clarity emerges.

- Bitcoin experienced significant volatility with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal that saw prices decline to $107,393 by 14:00.

- The most substantial price movement occurred during the 13:35 minute candle where BTC jumped nearly $150 with exceptionally high volume (148.76 BTC), establishing temporary resistance around $107,630.

- Support formed near $107,400 where buyers emerged during the final minutes of the period, though the overall technical structure suggests continued consolidation within the broader correction from the $109,239 high.

External References

- «Bitcoin Price Prediction for May 25: Will Bulls Defend $108K or Is a Deeper Drop Ahead?«, Coin Edition, published May 24, 2025.

- «Why is Bitcoin Price Dropping Now? Will BTC Price Go Down to $100K?«, CoinPedia, published May 24, 2025.

- «Bitcoin Price Analysis: BTC Displays Signs of Weakness Following New All-Time High«, CryptoPotato, published May 25, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors