Uncategorized

The Case for User-Owned AI

Who truly controls your AI assistant? That’s a question most people haven’t asked yet. Today, millions rely on digital assistants, from voice-controlled devices to smart bots embedded in tools like Google Workspace or ChatGPT. These systems help us write, organize, search, and even think. However, the vast majority of them are rented. We don’t own the intelligence we depend on. That means someone else gets to control it.

If your digital assistant disappears tomorrow, can you do anything about it? What if the company behind it changes the terms, restricts functionality, or monetizes your data in ways you didn’t expect? These are not theoretical concerns. They’re already happening, and they point to a future we should actively shape.

David Minarsch is a speaker at Consensus 2025 in Toronto May 14-16.

As these agents become embedded in everything from our finances to our workflows and homes, the stakes around ownership become much higher. Renting is probably fine for low-stakes tasks, like a language model that helps you write emails. However, when your AI acts for you, makes decisions with your money, or manages critical parts of your life, ownership isn’t optional. It’s essential.

What Today’s AI Business Model Implies for Users

AI as we know it is built on a rental economy. You pay for access, monthly subscriptions, or pay-per-use APIs, and in exchange, you get the “illusion” of control. However, behind the scenes, platform providers hold all the power. They choose what AI model to serve, what your AI can do, how it responds, and whether you get to keep using it.

Let’s take a common example: a business team using an AI-powered assistant to automate tasks or generate insights. That assistant might live inside a centralized SaaS tool. It might be powered by a closed model hosted on someone else’s server — and running on their GPUs. It might even be trained on your company’s own data — data you no longer fully own once uploaded.

Now, imagine that the provider begins prioritizing monetization, like Google Search does with its advertising-driven results. Just as search results are heavily influenced by paid placements and commercial interests, the same will likely happen with large language models (LLMs). The assistant you relied on changes, skewing responses to benefit the provider’s business model, and there’s nothing you can do. You never had true control to begin with.

This isn’t just a business risk; it’s a personal one, too. In Italy, ChatGPT was temporarily banned in 2023 due to privacy concerns. That left thousands without access overnight. In a world where people are building increasingly personal workflows around AI, this weakness is unacceptable.

On the issue of privacy, when you rent an AI, you often upload sensitive data, sometimes unknowingly. That data can be logged, used for retraining, or even monetized. Centralized AI is opaque by design, and with geopolitical tensions rising and regulations shifting fast, depending entirely on someone else’s infrastructure is a growing liability.

What It Means to Truly Own Your Agent

Unlike passive AI models, agents are dynamic systems that can take independent actions. Ownership means controlling an agent’s core logic, decision-making parameters, and data processing. Imagine an agent that can autonomously manage resources, track expenses, set budgets, and make financial decisions on your behalf.

This naturally leads us to explore advanced infrastructures like Web3 and neobanking systems, which offer programmable ways to manage digital assets. An owned agent can operate independently within clear, user-defined boundaries, transforming AI from a responsive tool to a proactive, personalized system that truly works for you.

With true ownership, you know exactly what model you’re using and can change the underlying model if needed. You can upgrade or customize your agent without waiting on a provider. You can pause it, duplicate it, or transfer it to another device. And, most importantly, you can use it without leaking data or relying on a single centralized gatekeeper.

At Olas, we’ve been building toward this future with Pearl, an AI agent app store realised as a desktop app that allows users to run autonomous AI agents with just one click while retaining full ownership. Today, Pearl contains a number of use cases targeting primarily Web3 users to abstract the complexity of crypto interactions, with an increasing focus on Web2 use cases. Agents in Pearls hold their own wallets, operate using open-source AI models, and act independently on the user’s behalf.

When you launch Pearl, it’s like entering an app store for agents. You can pick one to manage your DeFi portfolio. You can run another that handles research or content generation. These agents don’t need constant prompting; they’re autonomous and yours. Go from paying for the agent you rent to earning from the agent you own.

We designed Pearl for crypto-native users who already understand the importance of owning their keys. However, the idea of taking self-custody of not just your funds but also your AI scales far beyond DeFi. Imagine an agent that controls your home automation, complements your social interactions, or coordinates multiple tools at work. If those agents are rented, you don’t fully control them. If you don’t fully control them, you’re increasingly outsourcing core parts of your life.

This movement is not just about tools; it’s about agency. If we fail to shift toward open, user-owned AI, we risk re-centralizing power in the hands of a few dominant players. But if we succeed, we unlock a new kind of freedom, where intelligence is not rented but truly yours, with each human complemented by an “army” of software agents.

It’s not just idealism. It’s good security. Open-source AI is auditable and peer-reviewed. Closed models are black boxes. If a humanoid robot is living in your home one day, do you want the code running it to be proprietary and controlled by a foreign cloud provider? Or do you want to be able to know exactly what it’s doing?

We have a choice: We can keep renting, trusting, and hoping nothing breaks, or we can take ownership of our tools, data, decisions, and futures.

User-owned AI isn’t just the better option. It’s the only one that respects the intelligence of the person using it.

READ MORE: Olas’ Mech Marketplace Enables AI Agents to Hire Each Other for Help

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

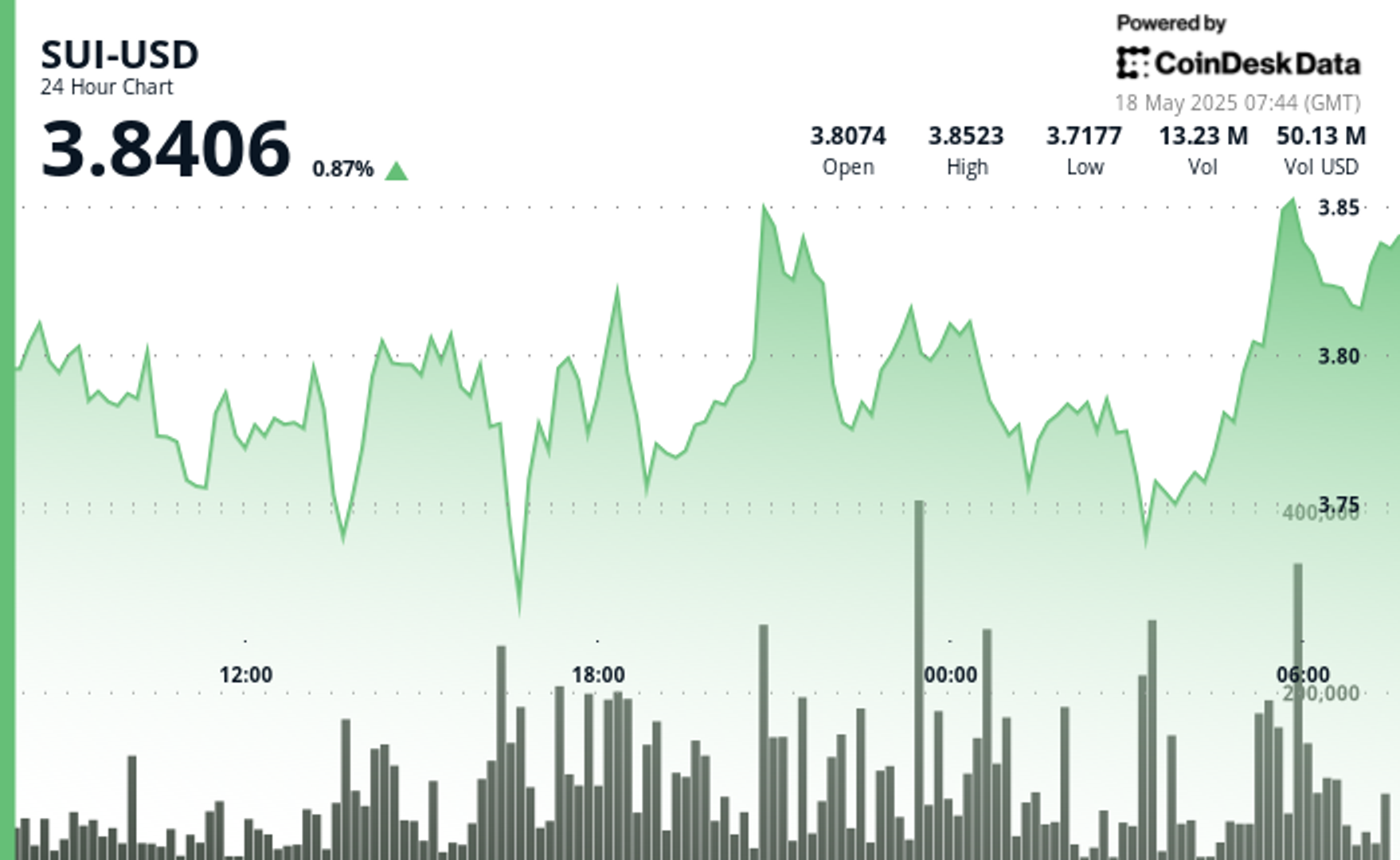

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

Uncategorized

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

Geopolitical tensions and evolving trade policies continue to influence cryptocurrency markets, with Dogecoin showing resilience amid broader economic uncertainty.

Despite macroeconomic headwinds, DOGE has maintained support above key moving averages while forming a potential bull flag pattern that could target $0.35 if validated by continued buying pressure.

Technical Analysis Highlights

- DOGE experienced significant volatility with a 4.3% range (0.211-0.220) over the past 24 hours, forming a key support zone around 0.212 validated by high volume rebounds at 13:00 and 22:00.

- The price action reveals a bullish recovery pattern from the 16:00 low, with resistance emerging at 0.217-0.220.

- The 20:00 candle’s strong volume surge above the 24-hour average confirms renewed buying interest, suggesting potential upward momentum if DOGE can maintain its position above the established support level.

- In the past hour, DOGE has demonstrated significant bullish momentum, climbing from 0.215 to 0.216 with notable volume spikes at 01:17, 01:21, and 01:54-01:55.

- The price established a strong support zone around 0.215 during the early minutes, followed by a decisive breakout at 01:16-01:17 where volume surged over 8 million.

- The uptrend continued with higher lows forming a clear ascending pattern, culminating in a new resistance test at 0.216-0.217 range.

- The final minutes saw particularly heavy trading activity with volumes exceeding 7 million at 02:01-02:02, confirming strong buyer interest and suggesting potential for further upside movement.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Dogecoin Eyes $0.35 as Whale Accumulation Signals Bull Flag Breakout«, The Crypto Basic, published May 16, 2025.

- «Dogecoin Hovers at $0.22 Following Weeks of Gains, Analysts Share Mixed Outlooks«, NewsBTC, published May 17, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors