Business

SUI Jumps 5% as Sui Blockchain Announces Native Stablecoins Amid Broader Rally

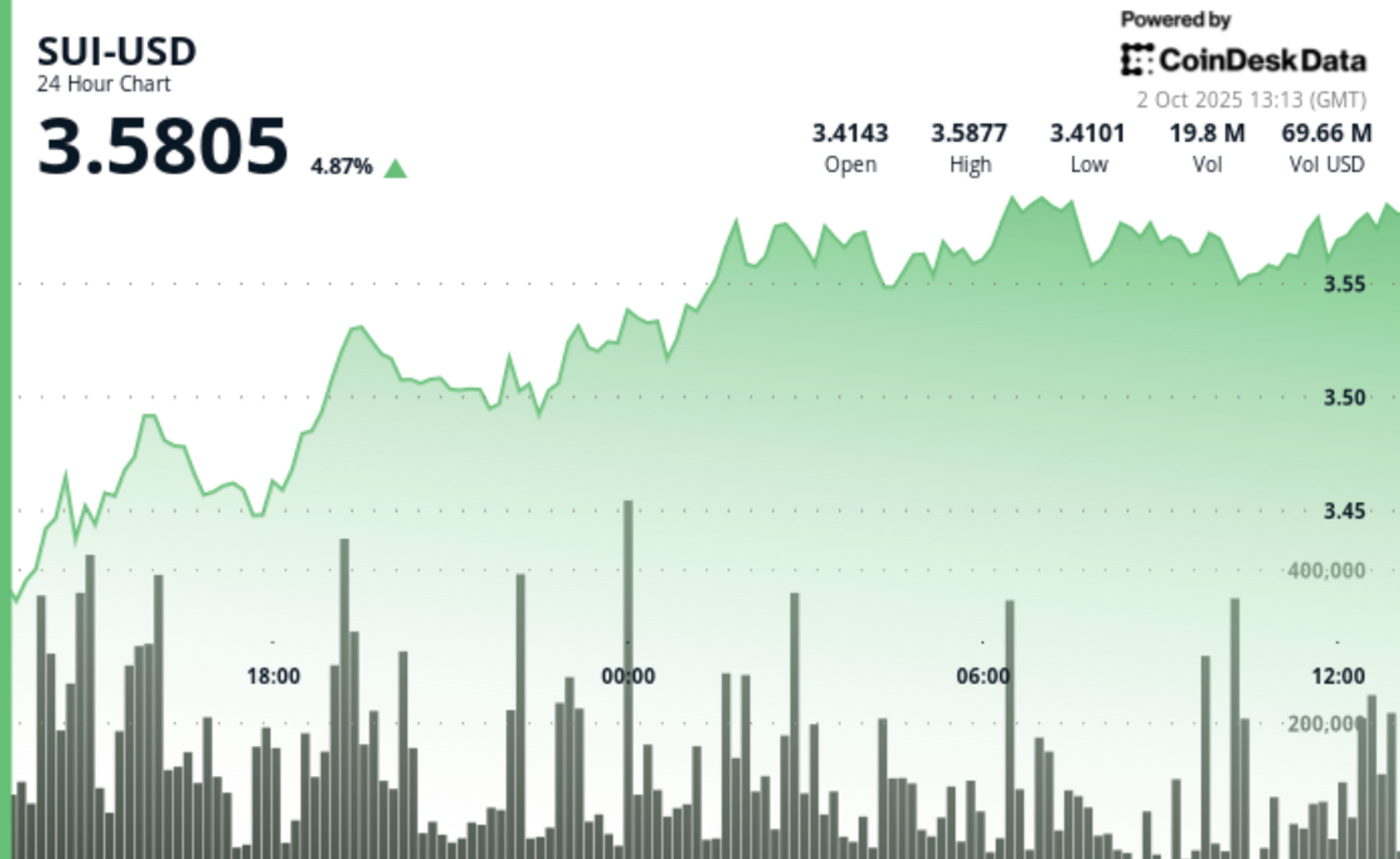

SUI, the native token of the Sui blockchain, rose 5% on Wednesday after the project announced it would introduce its first native stablecoins, USDi and suiUSDe.

The announcement comes at a time when investors are showing renewed interest in SUI, which is now outperforming the broader crypto market. The CoinDesk 20 Index — a gauge of top digital assets — is up 2.5% over the same 24-hour period.

SUI climbed from $3.42 to $3.58 in the session, with technical signals showing clear bullish momentum. The token broke through key resistance at $3.56 and established new support at $3.55, backed by rising trading volume.

Driving the rally are signs of growing institutional adoption. Coinbase Derivatives plans to list SUI futures contracts on October 20, opening the door for more professional traders to take positions in the token.

Retail demand is also growing. In South Korea, t’order — a payments platform focused on the restaurant industry — recently integrated SUI to enable transactions using a Korean-won stablecoin. That move appears to have sparked a surge in volume, with activity spiking past daily averages during the early Asian trading hours.

From a technical standpoint, SUI has traded within a $0.19 range between $3.39 and $3.58. An early morning volume spike of 10.87 million tokens exceeded the 10.44 million daily average, suggesting heavy accumulation. The chart shows a series of higher lows — a classic signal of an uptrend.

If buying pressure continues, SUI could soon test the psychological $3.60 mark. For now, it’s one of the best-performing tokens in the market, drawing strength from both product development and deepening institutional ties.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

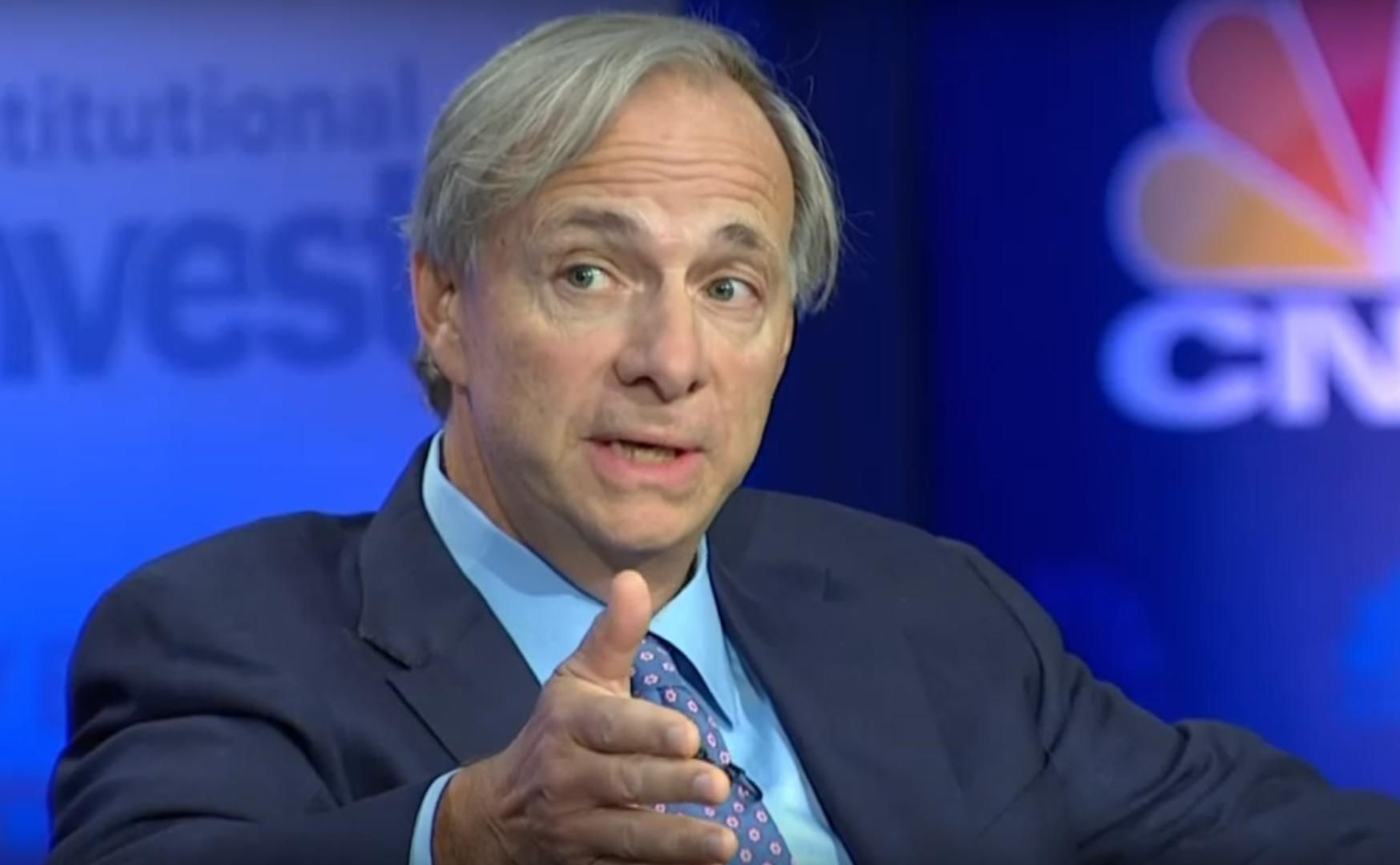

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

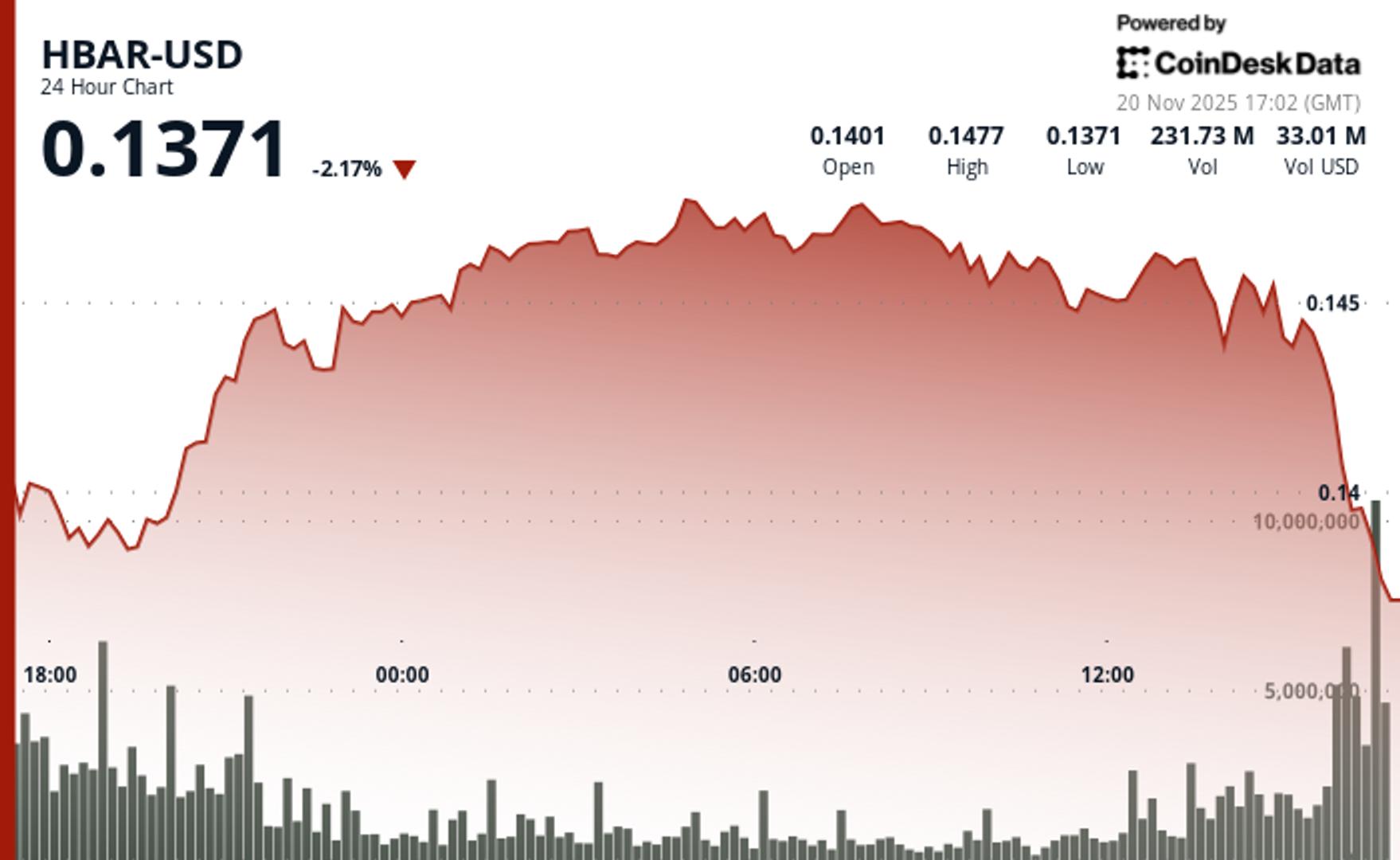

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton