Uncategorized

State of Crypto: Previewing Congress’ ‘Crypto Week’

U.S. lawmakers may actually get a crypto bill to the president’s desk. The House is set to vote on market structure and stablecoin legislation next week, bringing the U.S. a vital step closer to drafting new rules for the industry.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Crypto win

The narrative

The U.S. House of Representatives is set to vote on a market structure bill, a stablecoin bill and a bill banning a U.S. central bank digital currency next week. Perhaps it’s premature to suggest the industry will notch a major win — but all signs indicate that U.S. President Donald Trump will sign a stablecoin bill into law before the August recess, as his team has sought since February.

Why it matters

The crypto industry has long sought «regulatory clarity» on its own terms — previous rule proposals it disagreed with were fervently opposed and the industry’s political action committees poured tens of millions of dollars into the 2024 elections to try and create a Congress that would be friendlier to crypto policies.

Next week, those efforts may pay off, as the House of Representatives gets set to vote on a stablecoin bill that may become law within weeks and a market structure bill that could get to the White House before Christmas.

Breaking it down

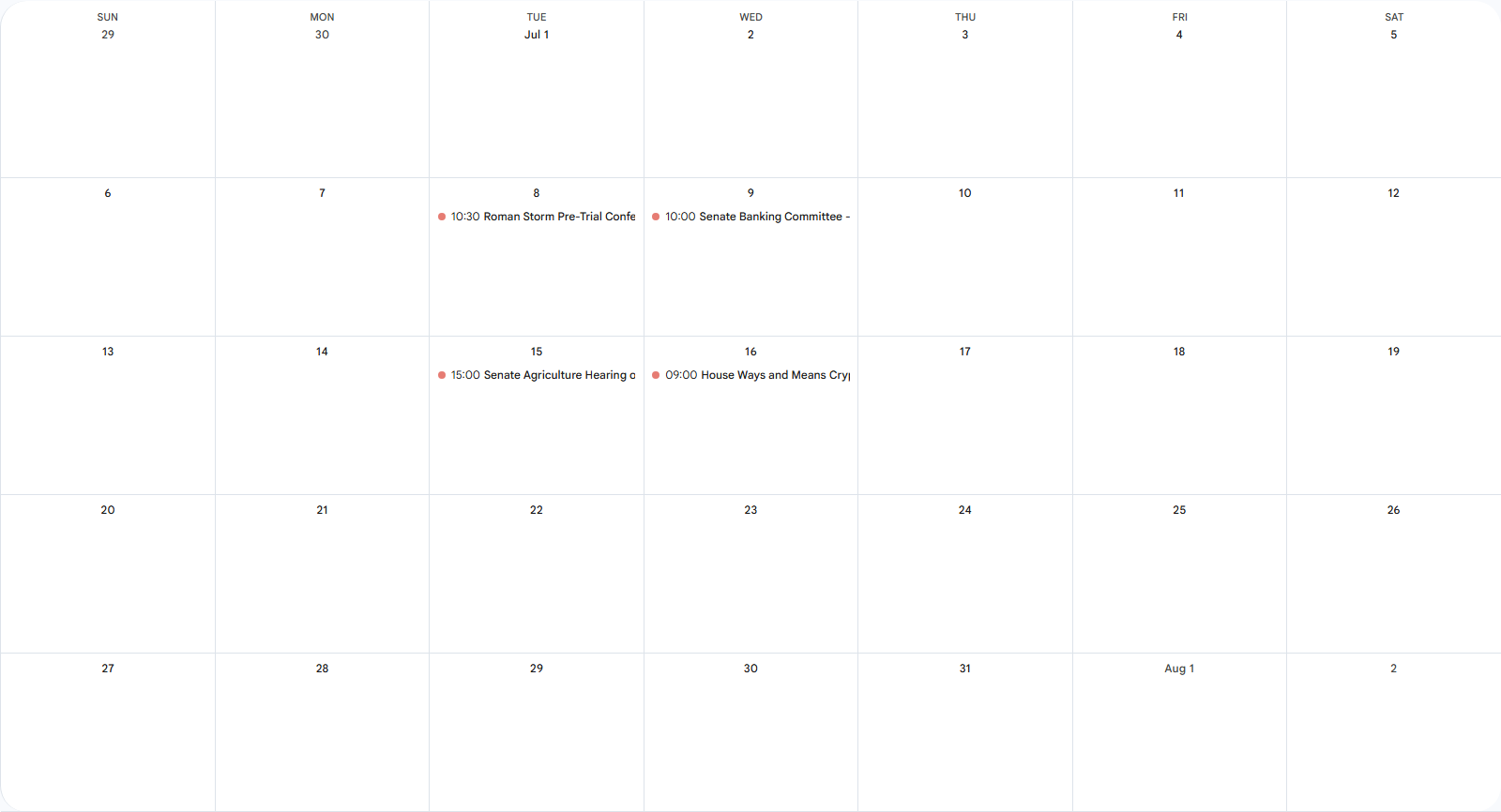

The House of Representatives dubbed next week — July 14 to July 18 — «Crypto Week.» The main event will be the House vote on, and expected passage of, the «Digital Asset Market Clarity Act of 2025» (Clarity), the Anti-CBDC Surveillance Act and the «Guiding and Establishing National Innovation for U.S. Stablecoins of 2025» (GENIUS).

The House Rules Committee is scheduled to meet Monday at 4:00 p.m. ET to discuss each of the bills. That means there may be a floor vote, where the entire House votes, by Tuesday. Though there was some discussion of packaging the Clarity and GENIUS Acts into one larger bill, it appears there will instead be separate votes for each of the bills. If the GENIUS Act does receive its own vote, U.S. President Donald Trump may sign it into law as soon as next Friday or the following Monday, I’m told, though at this point none of this is confirmed (and obviously depends on the actual House vote).

Notably, the House Financial Services Committee confirmed on Thursday that the House would vote on the GENIUS Bill sent to it by the Senate, and not its own «Stablecoin Transparency and Accountability for a Better Ledger Economy» (STABLE Act), as previously reported by CoinDesk’s Jesse Hamilton.

It is likely that all three bills will pass, and with bipartisan majorities.

To recap: The Clarity Act will create a framework for how different cryptocurrencies are treated by federal regulators, including the Securities and Exchange Commission and Commodity Futures Trading Commission.

There’s no Senate counterpart to this bill yet, though the Senate Banking Committee has already held multiple hearings on market structure issues, and the Senate Agriculture Committee has scheduled a hearing for this upcoming Tuesday on the same topic. Banking Committee Chairman Tim Scott previously said he expects the Senate to wrap up its work on market structure by Sept. 30.

The House’s last effort to pass market structure legislation, last year’s Financial Innovation and Technology for the 21st Century Act, saw massive bipartisan support with 279 lawmakers (208 Republicans and 71 Democrats) voting in favor of the bill.

While there is no public whip count yet for this year’s version, the Clarity Act passed out of the House Agriculture Committee with massive bipartisan support (47-6) and the House Financial Services Committee with some bipartisan support (32-19). Either number suggests both Democrats and Republicans will vote for the bill on the House floor.

The GENIUS Act will set up a framework for overseeing stablecoins. The Senate already passed the GENIUS Act, meaning once the House passes it, it goes to Trump’s desk for his signature into law. This could mark the stablecoin bill as the first major crypto-focused bill to become law.

The GENIUS Act could then also be one of the few bills that isn’t a «must-pass» to go through the legislative process, meaning it’s not a budget bill and it’s not the annual National Defense Authorization Act. While the House is voting on the Senate version and not its own STABLE Act, updated House text in the Clarity Act would add some additional rules around stablecoins.

The Anti-CBDC Surveillance Act would, as the name suggests, ban the U.S. from developing or launching a central bank digital currency. The House passed a version of this bill in 2024 as well.

In theory, the passage of these bills is positive for the industry. Though it may take time for regulators to write and implement rules after these bills become law, within the next few years crypto companies will have firm guidelines to operate within. Less clear is what these bills may actually do for usage or adoption.

A recent publication by Moody’s Ratings suggested that while passage of the GENIUS Act will «have significant implications for banks» but that stablecoins writ large «need to offer a compelling advantage over existing consumer and commercial payment systems» to become a more broadly accepted transaction tool.

«While there appears to be solid bipartisan political support for U.S. stablecoins, assuming issuers are prohibited from paying any kind of financial incentive, we view the likelihood of a significant shift in domestic payments toward stablecoins as relatively modest,» the report said.

Democrats are raising concern about the potential for these bills’ passage to enable or further corruption, with Financial Services Committee Ranking Member Maxine Waters and Rep. Stephen Lynch pointing to Trump’s crypto ventures and their potential for enriching the president.

«These bills serve as a brazen stamp of approval for the blatant abuse of power we’re witnessing in real time,» Waters said in a statement.

The House Ways and Means Committee is also holding a hearing on crypto taxation next Wednesday, though it hasn’t shared many details yet.

To recap the schedule for next week, or if you want to just see it at a glance:

- Monday, July 14, 4:00 p.m. ET: The House Rules Committee will meet and discuss the Clarity Act, GENIUS Act and Anti-CBDC Surveillance Act.

- Tuesday, July 15, 3:00 p.m. ET: The Senate Agriculture Committee will hold a hearing on market structure legislation.

- Tuesday, July 15, time TBA: The House may meet and begin voting on all three bills discussed above.

- Wednesday, July 16, 9:00 a.m. ET: The House Ways and Means Committee will hold a hearing on crypto taxation.

- Thursday, July 17: Nothing is scheduled (at least right now).

- Friday, July 18: If the House votes to advance GENIUS on Tuesday, there may be a bill signing.

Stories you may have missed

- U.S. House Ditching Its Stablecoin Bill to Back Trump’s Choice From Senate: The House of Representatives will vote on the GENIUS Act next week, Jesse Hamilton reported, rather than its own STABLE Act.

- Circle Has USDC Revenue Sharing Deal With Second-Largest Crypto Exchange ByBit: Sources: Circle had previously revealed revenue sharing agreements with Coinbase and Binance, but also has one with ByBit, CoinDesk’s Ian Allison reports.

- Europe’s Financial Watchdog Probes Malta Over Fast-Track MiCA Authorizations: The European Securities and Markets Authority has reviewed how Malta applied the Markets in Crypto Assets multinational framework to an unnamed crypto asset service provider, following CoinDesk’s Ian Allison and Camomile Shumba’s reporting on Malta’s approach.

- OFAC’s Dropped Sanctions Against Tornado Cash Can’t Come Up at Trial, Judge Says: A federal judge ruled that the U.S. Treasury Department’s now-ended sanctions against Tornado Cash can’t come up in Tornado Cash developer Roman Storm’s criminal trial, which is set to begin on Monday and may last up to four weeks.

- TORN Spikes 5% After U.S. Appeals Court Okays End of Another Tornado Cash Lawsuit: But elsewhere, the Eleventh Circuit Court of Appeals dismissed a lawsuit against Tornado Cash as moot, given the end of the sanctions and a separate federal judge ruling barring the Treasury Department from reinstating sanctions against Tornado Cash’s smart contracts.

- SEC Sets July Deadline for Solana ETF Refilings, Clearing Path for Pre-October Approval: The U.S. Securities and Exchange Commission asked applicants for Solana exchange-traded funds to amend their filings by the end of July to resolve outstanding issues.

- Bitcoin Breaks Fresh Record Topping $116,000: Bitcoin hit a new all-time high this week. CoinDesk hosted a live blog to track immediate analysis on the news.

- Jack Dorsey Unveils Bitchat: Offline, Encrypted Messaging Inspired by Bitcoin: Jack Dorsey announced he was working on a new peer-to-peer messaging tool that communicates using Bluetooth and claims to enable encrypted communications. A security researcher shared some concerns about how this could work in practice.

- Former Bitfury Exec Gould Confirmed to Take Over U.S. Banking Agency OCC: The U.S. Senate confirmed Jonathan Gould as the new Comptroller of the Currency. Gould was previously at the Office of the Comptroller of the Currency, and later the chief legal officer at blockchain firm Bitfury.

This week

Tuesday

- 14:30 UTC (10:30 a.m. ET) A federal judge held a final in-person pretrial conference for Roman Storm.

Wednesday

- 14:00 UTC (10:00 a.m. ET) The Senate Banking Committee held a hearing on market structure issues.

Elsewhere:

- (The Nation) Last month, Dubai-based Aqua 1 Foundation said it would invest $100 million in the Trump-affiliated World Liberty Financial. Aqua 1, however, does not appear to actually exist, reports Jacob Silverman in The Nation.

- (Wired) McDonald’s uses an AI bot to filter applicants, but this bot may have exposed applicants’ personal information to any hacker due to «absurdly basic security flaws,» Wired’s Andy Greenberg reports.

- (The New York Times) The Times has a long read into how U.S. President Donald Trump went from being a crypto skeptic to a pro-crypto president.

- (The Wall Street Journal) Grok, the large language model artificial intelligence built by xAI — the AI firm associated with X, the company formerly known as Twitter — posted some very antisemitic statements, called itself MechaHitler and said the actual Adolf Hitler would be the best 20th century figure to address «anti-white hate.» This came just days after X owner Elon Musk said he was making some changes to the bot.

- (404 Media) Polymarket got weird after bettors could not come to an agreement over whether Ukraine President Volodomyr Zelenskyy wore a suit or not. He wore some form of formal clothing at a recent appearance, which the Polymarket pool initially resolved as «yes.» UMA token holders disputed that resolution, and it was later changed to resolve the bet as «no.» Derek Guy, an expert on formal clothing and historical clothing styles, told 404 Media that in his view, Zelenskyy’s garments did qualify as a suit.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Uncategorized

Asia Morning Briefing: Fragility or Back on Track? BTC Holds the Line at $115K

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin (BTC) traded just above $115k in Asia Tuesday morning, slipping slightly after a strong start to the week.

The modest pullback followed a run of inflows into U.S. spot ETFs and lingering optimism that the Federal Reserve will cut rates next week. The moves left traders divided: is this recovery built on fragile foundations, or is crypto firmly back on track after last week’s CPI-driven jitters?

That debate is playing out across research desks. Glassnode’s weekly pulse emphasizes fragility. While ETF inflows surged nearly 200% last week and futures open interest jumped, the underlying spot market looks weak.

Buying conviction remains shallow, Glassnode writes, funding rates have softened, and profit-taking is on the rise with more than 92% of supply in profit.

Options traders have also scaled back downside hedges, pushing volatility spreads lower, which Glassnode warns leaves the market exposed if risk returns. The core message: ETFs and futures are supporting the rally, but without stronger spot flows, BTC remains vulnerable.

QCP takes the other side.

The Singapore-based desk says crypto is “back on track” after CPI confirmed tariff-led inflation without major surprises. They highlight five consecutive days of sizeable BTC ETF inflows, ETH’s biggest inflow in two weeks, and strength in XRP and SOL even after ETF delays.

Traders, they argue, are interpreting regulatory postponements as inevitability rather than rejection. With the Altcoin Season Index at a 90-day high, QCP sees BTC consolidation above $115k as the launchpad for rotation into higher-beta assets.

The divide underscores how Bitcoin’s current range near $115k–$116k is a battleground. Glassnode calls it fragile optimism; QCP calls it momentum. Which side is right may depend on whether ETF inflows keep offsetting profit-taking in the weeks ahead.

Market Movement

BTC: Bitcoin is consolidating near the $115,000 level as traders square positions ahead of expected U.S. Fed policy moves; institutional demand via spot Bitcoin ETFs is supporting upside

ETH: ETH is trading near $4500 in a key resistance band; gains are being helped by renewed institutional demand, tightening supply (exchange outflows), and positive technical setups.

Gold: Gold continues to hold near record highs, underpinned by expectations of Fed interest rate cuts, inflation risk, and investor demand for safe havens; gains tempered somewhat by profit‑taking and a firmer U.S. dollar

Nikkei 225: Japan’s Nikkei 225 topped 45,000 for the first time Monday, leading Asia-Pacific gains as upbeat U.S.-China trade talks and a TikTok divestment framework lifted sentiment.

S&P 500: The S&P 500 rose 0.5% to close above 6,600 for the first time on Monday as upbeat U.S.-China trade talks and anticipation of a Fed meeting lifted stocks.

Elsewhere in Crypto

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

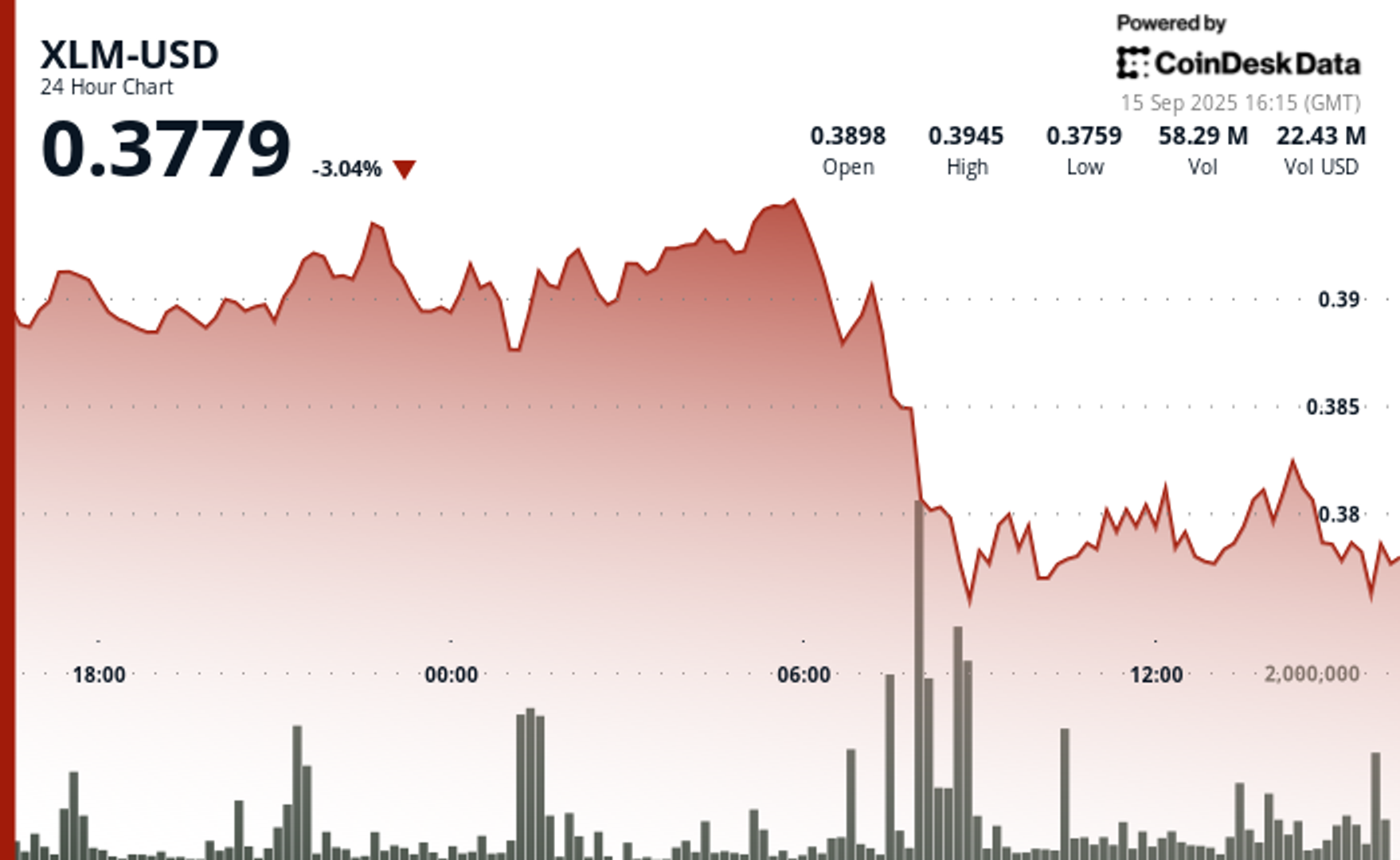

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars