Uncategorized

Stablecoin Retail Transfers Break Records in 2025, Hit $5.8B in August

Stablecoin adoption among retail users has set new records this year, with transaction volumes through August already exceeding last year’s total, a fresh report by CEX.io said.

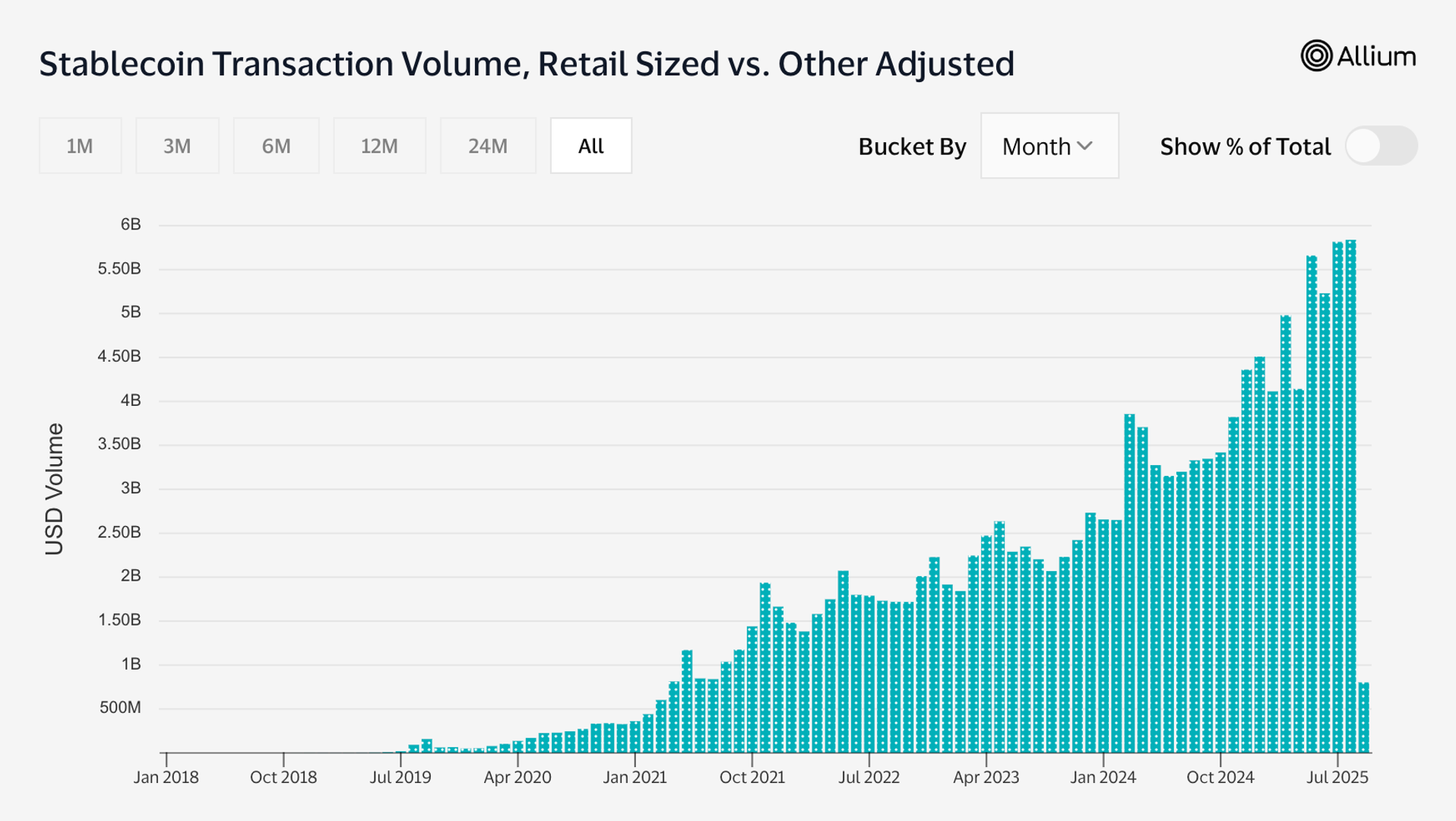

Retail-sized transfers, counting transactions under $250, crossed $5.84 billion in August alone, the highest ever recorded, according to data by Visa and Allium cited in the report. With nearly four months left in the year, 2025 has already become the busiest period yet for stablecoin transfer volume at the consumer level.

The figures underscore stablecoins, a group of cryptos tied to fiat currencies like the U.S. dollar, becoming increasingly embedded into everyday financial activity, from cross-border remittances to microtransactions, the report pointed out.

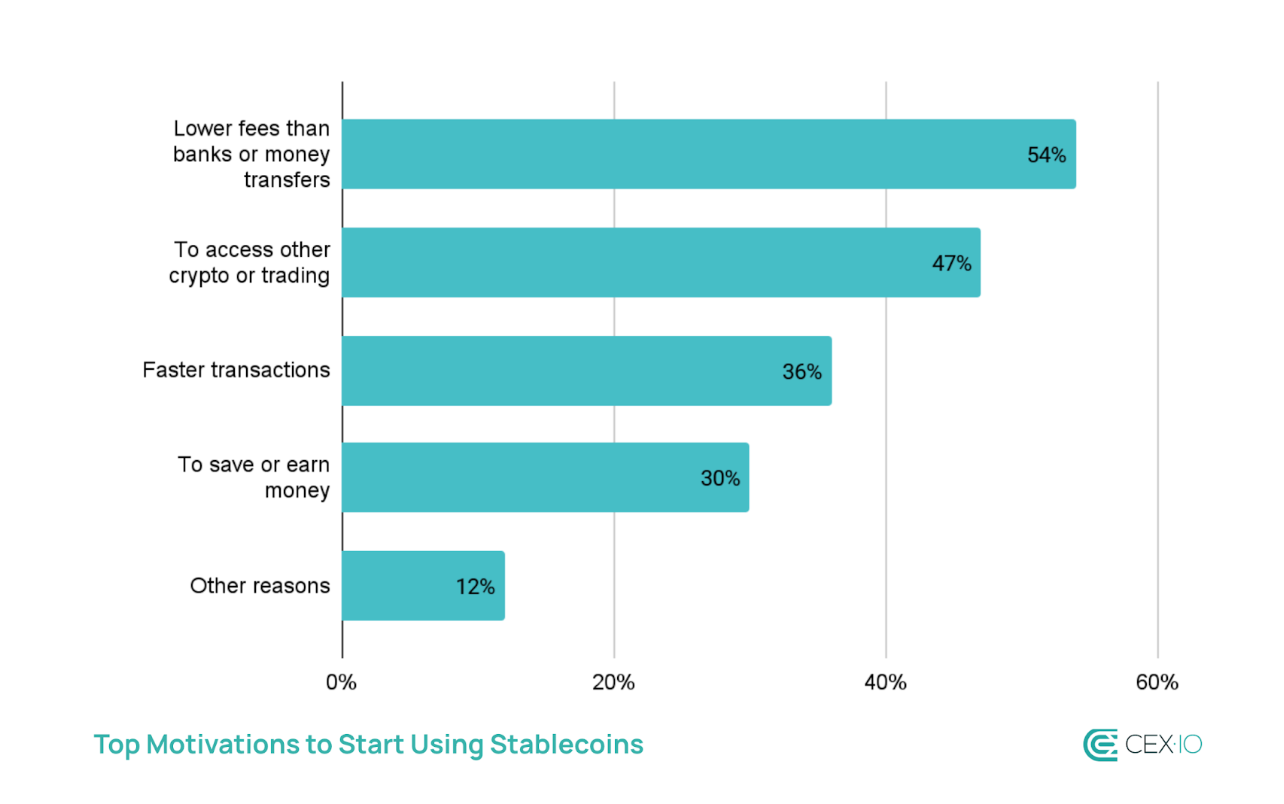

Survey data from emerging markets, asking over 2,600 consumer in Nigeria, India, Bangladesh, Pakistan and Indonesia, reinforced this picture, CEX.io analysts. A majority of respondents said they turned to stablecoins to avoid high banking fees and slow transfers, the report said. Nearly 70% of them reported using stablecoins more frequently than last year, and more than three-quarters expect usage to keep rising, the report said.

Ethereum gains, Tron falls back

The distribution of activity among blockchains have shifted, the report noted. The Tron (TRX) blockchain, traditionally popular for retail transfers due to its low fees and wide support for Tether’s USDT (USDT), has given up market share. Monthly transaction counts fell by 1.3 million, or 6%, and its growth in volume lagged behind its closest competitors.

In its place, Binance Smart Chain (BSC) emerged as the top choice for retail users, capturing nearly 40% of retail stablecoin activity, the report said. The network’s transaction count jumped 75% this year with transfer volume rising 67%. Much of the momentum came after Binance delisted USDT in March for European users and a resurgence of memecoin trading on PancakeSwap on BSC.

The Ethereum complex, with the base chain and layer-2 networks combined, made up over 20% of transfer volume and 31% of transaction counts, the report noted. While small transfers largely took place on L2s, the mainnet enjoyed a significant rise in the retail segment. Sub-$250 transfers on the mainnet rose 81% in volume and 184% in count.

Ethereum has been mostly used for large-value transactions due to its high fees, but transaction costs have dropped more than 70% over the past year, making mainnet transactions more competitive even in the sub-$250 range, the authors said.

Read more: Ripple Brings $700M RLUSD Stablecoin to Africa, Trials Extreme Weather Insurances

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts