Uncategorized

Stablecoin Legislation Must Ensure Financial Privacy

Both the U.S. Senate and House are considering bills creating a regulatory framework for stablecoins, and all of the usual crypto-skeptic refrains have been sung, including the hymn that crypto is for crime.

For instance, Senator Elizabeth Warren (D-MA) warned that the Senate’s GENIUS Act “will supercharge the financing of terrorism.” During debate on the House’s STABLE Act, Representative Brad Sherman (D-CA) worried about the use of “unhosted wallets to evade” anti-money laundering provisions.

Not surprisingly, both the GENIUS and STABLE Acts include significant sections on illicit finance, including subjecting stablecoin issuers to the Bank Secrecy Act (BSA). But lawmakers must ensure that the bills’ anti-money laundering measures don’t open the door to unfettered financial surveillance of stablecoin users.

Stablecoins are crypto tokens that are pegged to the value of another asset, like the U.S. dollar. The general idea is that the stable value of these tokens will promote their use as a digital medium of exchange. Stablecoins can be thought of both as an improvement to existing payment rails and as a way to bring the U.S. dollar “on-chain.” In other words, stablecoins are a 21st-century upgrade to cash. The Senate and the House have both advanced bills that would create a regulatory regime for “permitted stablecoin issuers” aimed, in part, at ensuring that stablecoins are, in fact, stable.

But these days, conversations about the dollar, financial services, and crypto seem to go hand-in-hand with conversations about preventing illicit finance. The BSA requires financial institutions to help federal agencies detect and prevent money laundering and other crimes by, among other things, keeping records of transactions and filing reports with the government. Both the GENIUS Act and the STABLE Act tackle illicit finance concerns by stating clearly that a permitted stablecoin issuer “shall be treated as a financial institution for the purposes of the Bank Secrecy Act.”

Designating a permitted stablecoin issuer as a financial institution is comparatively non-controversial. Putting aside the question of whether the BSA is a good (or constitutional) way to manage illicit finance risks, permitted stablecoin issuers look a lot like other entities, like banks and trust companies, that are already BSA financial institutions. But it’s not quite so simple.

The BSA’s surveillance framework requires financial institutions to “know their customers” and to monitor transactions taking place through the institution. However, such surveillance does not extend to transactions that take place between individuals without the involvement of an institution. For example, the BSA doesn’t apply when cash changes hands between two people, allowing individuals to transact privately.

While it’s infeasible to track cash transactions in the manner prescribed by the BSA, stablecoins can be tracked across a blockchain as they move between holders, even when the transfers happen between wallets that are unhosted by intermediaries. This characteristic is tempting to those who may want to extend BSA surveillance beyond its already expansive (and constitutionally infirm) boundaries.

Fundamentally, digital asset transactions that are genuinely peer-to-peer should not be subject to greater government surveillance than peer-to-peer transactions in cash. Applying anti-money laundering provisions to unhosted wallets — which more closely resemble physical wallets holding cash than bank accounts — would be a massive expansion of financial surveillance and an unwelcome intrusion into the abilities of Americans to order their financial lives outside the eyes of the government.

Both the GENIUS and STABLE Acts make clear — to varying degrees — that stablecoin issuers must have customer identification programs only for customers who either hold accounts “with the permitted payment stablecoin issuer” (GENIUS) or who are “initial holders” of a payment stablecoin (STABLE).

But the other BSA requirements the bills would impose on stablecoin issuers, including maintaining anti-money laundering compliance programs, retention of records of stablecoin transactions, monitoring and reporting suspicious activity, are not so clearly limited. This leaves the door open to the imposition of broader surveillance requirements on stablecoin transactions that take place away from the issuer, which would be a major encroachment on Americans’ rights to transact privately.

Fortunately, the sponsors of both bills seem to read the surveillance obligations narrowly. Representative Bryan Steil (R-WI), one of the sponsors of the STABLE Act, explained during the bill’s markup that requiring BSA surveillance of “every single self-hosted wallet” would “be a dramatic invasion of personal liberty” and that “Americans should not be treated the same as financial institutions.” And Senator Bill Hagerty (R-TN), one of the sponsors of the GENIUS Act, said during that bill’s markup that “[r]equiring issuers to monitor transactions on various blockchains would be costly and . . . time-consuming.”

This sentiment about the scope of the BSA obligations imposed must be clearly reflected in the text of both bills to definitively close the door to more expansive future interpretations.

Despite the characterizations by some skeptical members of Congress, preserving financial privacy is not simply a gift to criminals. Easy government access to financial information poses risks to everyone, particularly those with unpopular political views or anyone otherwise in the minority. Such surveillance is at odds with the rights of free people (including rights recognized in the U.S. Constitution) to live without unwarranted governmental monitoring.

One step to ensuring that those rights are not further infringed is to guarantee that the stablecoin legislation under consideration unequivocally protects from surveillance stablecoin transactions occurring without a financial intermediary.

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

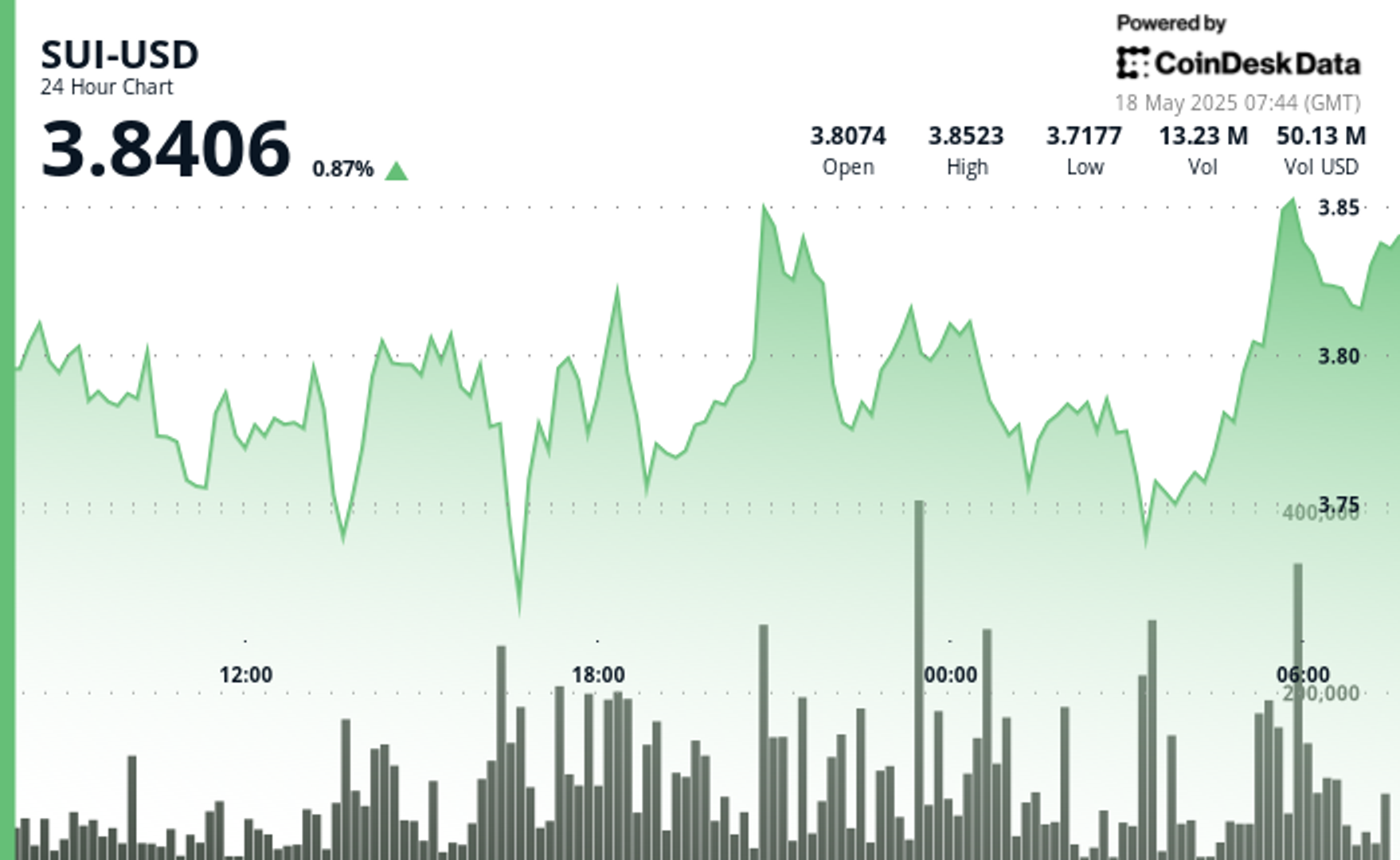

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

Uncategorized

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

Geopolitical tensions and evolving trade policies continue to influence cryptocurrency markets, with Dogecoin showing resilience amid broader economic uncertainty.

Despite macroeconomic headwinds, DOGE has maintained support above key moving averages while forming a potential bull flag pattern that could target $0.35 if validated by continued buying pressure.

Technical Analysis Highlights

- DOGE experienced significant volatility with a 4.3% range (0.211-0.220) over the past 24 hours, forming a key support zone around 0.212 validated by high volume rebounds at 13:00 and 22:00.

- The price action reveals a bullish recovery pattern from the 16:00 low, with resistance emerging at 0.217-0.220.

- The 20:00 candle’s strong volume surge above the 24-hour average confirms renewed buying interest, suggesting potential upward momentum if DOGE can maintain its position above the established support level.

- In the past hour, DOGE has demonstrated significant bullish momentum, climbing from 0.215 to 0.216 with notable volume spikes at 01:17, 01:21, and 01:54-01:55.

- The price established a strong support zone around 0.215 during the early minutes, followed by a decisive breakout at 01:16-01:17 where volume surged over 8 million.

- The uptrend continued with higher lows forming a clear ascending pattern, culminating in a new resistance test at 0.216-0.217 range.

- The final minutes saw particularly heavy trading activity with volumes exceeding 7 million at 02:01-02:02, confirming strong buyer interest and suggesting potential for further upside movement.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Dogecoin Eyes $0.35 as Whale Accumulation Signals Bull Flag Breakout«, The Crypto Basic, published May 16, 2025.

- «Dogecoin Hovers at $0.22 Following Weeks of Gains, Analysts Share Mixed Outlooks«, NewsBTC, published May 17, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors