Business

SharpLink Gaming Set to Tokenize Its Equity on Ethereum With Superstate

SharpLink Gaming (SBET), the Ethereum treasury firm led by Joseph Lubin, unveiled plans on Thursday to tokenize its equity on the Ethereum blockchain as the stock tokenization trend is gaining steam.

The Minnesota-based firm said it has tapped tokenization specialist Superstate as its digital transfer agent, while its equity token will be natively issued through Superstate’s Opening Bell platform, a system designed to issue SEC-registered shares directly on blockchain rails.

The move comes as tokenization of financial instruments such as equity is gaining momentum across crypto markets. A slew of tokenized equity offerings debuted in the past few months predominantly for investors outside the U.S., including by Robinhood, Gemini with Dinari, Ondo Finance’s Global Markets and xStocks by Kraken and Backed Finance. However, some products drew concerns such as limited shareholder rights and fragmented regulation.

SharpLink’s tokenized stock will be legally identical to traditional equity, while it can be stored in digital wallets and integrated with on-chain protocols, the press release said.

Beyond issuance, SharpLink and Superstate also plan to explore how such shares could eventually trade on decentralized exchanges and automated market makers (AMMs). That step, if approved, would test how tokenized securities can circulate in markets built around smart contracts while remaining compliant with U.S. securities rules.

SharpLink’s initiative follows digital asset investment firm Galaxy’s (GLXY) similar effort to tokenize its Class A common shares on Solana (SOL) with Opening Bell.

SBET is lower by 7% in early trading Thursday alongside a steep slide in the price of ETH to below $4,000.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

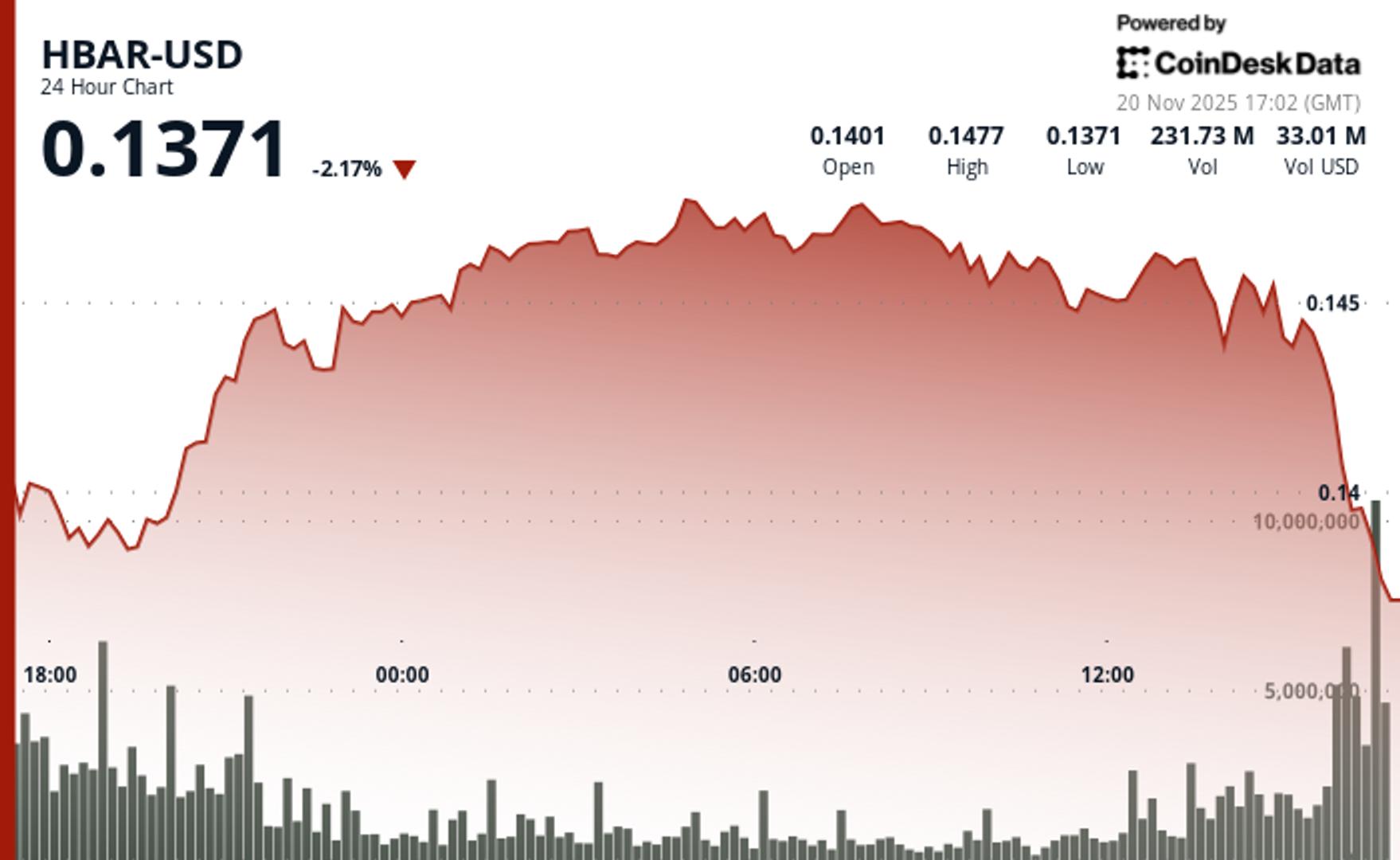

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton