Uncategorized

SEC Poised to Drop Coinbase Lawsuit, Marking Big Moment for U.S. Crypto

The U.S. Securities and Exchange Commission will vote soon on a deal negotiated with Coinbase to entirely drop the agency’s legal pursuit of the crypto exchange, according to the company’s top lawyer.

While the SEC has been making moves almost daily to reverse past positions on digital assets, the pending vote would mark a watershed moment that could start a series of legal dominoes to free other crypto businesses from enforcement actions. Because the deal between Coinbase and SEC staff assumes a dismissal of the case «with prejudice,» said Coinbase Chief Legal Officer Paul Grewal, the regulator’s accusations of securities violations would be shut down permanently.

«It’s a great day for Coinbase, yes, but it’s also a great day for crypto in America,» Grewal said in an interview with CoinDesk. «We have every expectation, based on representations that have been made to us, that that approval will come, and with that, the dismissal will then be filed.»

He restated it in simpler terms: «We win; they lose.»

When the SEC first went after Coinbase — the most prominent of the U.S.-based crypto platforms — it represented a shot across the bow of the industry. The SEC alleged Coinbase violated federal law by not registering as a clearing house, broker or trading venue, based on the agency’s view of the so-called Howey test that determines whether an asset is a security. The company chose to fight the accusations in federal court, and that legal clash had been fierce, most recently seeing a judge side with Coinbase’s effort to elevate an appeal of the central question at dispute: Are these tokens being traded really securities under the SEC’s jurisdiction?

The industry had long expected it might have to wait for the courts — eventually even the U.S. Supreme Court — to rule on former SEC Chair Gary Gensler’s assertion that most tokens are actually crypto securities. But the surrender of the SEC in this dispute is likely to be echoed in other cases, which would put the final word on the legal definition into the hands of Congress.

So, the commission vote could throw the industry’s major focus toward lobbying instead of legal wrangling.

The enforcement meetings for the SEC — currently made up of Acting Chairman Mark Uyeda, Republican Commissioner Hester Peirce and Democrat Commissioner Caroline Crenshaw — typically take place on Thursdays, so the final decision on the staff recommendation may be delayed as long as a week. Crenshaw has been a vocal skeptic of the digital assets industry and its compliance, so it remains unclear whether she’d be willing to sign off on the dismissal.

The SEC didn’t immediately respond to a request for comment on the agreement.

SEC allies

Uyeda and Peirce, who was named the head of the agency’s new Crypto Task Force, had long been sympathetic to the digital assets industry’s contention it was being mishandled by the SEC. Once Donald Trump was sworn in as president, he gave the agency’s gavel to Uyeda on an interim basis, and Uyeda began making swift moves to shift its course on crypto. This is the latest and — assuming a yes vote — arguably the most significant of the changes so far.

Eventually, former Commission Paul Atkins will take over after he secures a Senate confirmation. But Uyeda and Peirce both served Atkins as counsels during his tenure at the SEC, so Atkins is generally expected to follow the same path on crypto that Uyeda is already clearing.

Earlier this week, the agency shifted its enforcement unit — once laser-focused on crypto — to a wider responsibility over «emerging technologies,» suggesting a withdrawal from the era of heavy attention on crypto cases. It also dropped its appeal in the fight to defend its effort to force a wide swath of crypto activity into its recent rule to expand the definition of what makes a «dealer» under SEC oversight.

In another marquee crypto case, the regulator recently asked to hit pause on the Binance enforcement dispute. Those accusations of securities-law violations overlapped to some degree with the complaint against Coinbase, though the Binance suit also included accusations of fraud and conflicts of interest.

The SEC had similarly signaled last week that something was brewing with Coinbase when it asked for a delay in court proceedings, suggesting negotiations were underway toward a resolution and signaling the agency’s new crypto task force would help the enforcement team come up with a «potential resolution.»

The vote

In the coming days, lawyers across the industry will watch the SEC’s Coinbase vote, and then the judge’s response in the U.S. District Court for the Southern District of New York. If the SEC formally backs off the accusations Coinbase improperly listed unregistered securities, it’ll have to do the same in any similar cases.

«I’m hopeful that our getting this case dismissed will offer up a template for other cases to be resolved as well,» Grewal said. «And if that were the case, we’d be delighted, because we felt that Gary Gensler’s entire campaign against crypto was a distortion — frankly, an abuse — of legal process.»

As the agency continues to resolve past actions, it’s signaled that the future intention is to focus on fraud over compliance disagreements. And Uyeda said as recently as Thursday that the SEC’s new task force will be guiding its enforcement.

«One focus of this task force will be to ensure that we deploy enforcement resources judiciously,» he said at an event in Washington.

Grewal acknowledged the next priority quickly becomes U.S. legislation that can establish clear regulations at the federal level. To that end, Coinbase has been among the leading crypto companies delving into the political arena, deploying tens of millions of dollars in the 2024 elections (through the Fairshake PAC) to secure a friendlier Congress. One in 10 members of this Congress were boosted by Fairshake ads in their campaigns last year.

«We’ve seen Congress announce its commitment to legislation as early as the first 100 days,» Grewal noted. «So we’re very eager, with this cloud now lifted, to focus our full attention on getting legislation passed on market structure and stablecoins. That is, frankly, long overdue.»

UPDATE (February 21, 2025, 13:11 UTC): Adds request to SEC for comment.

Uncategorized

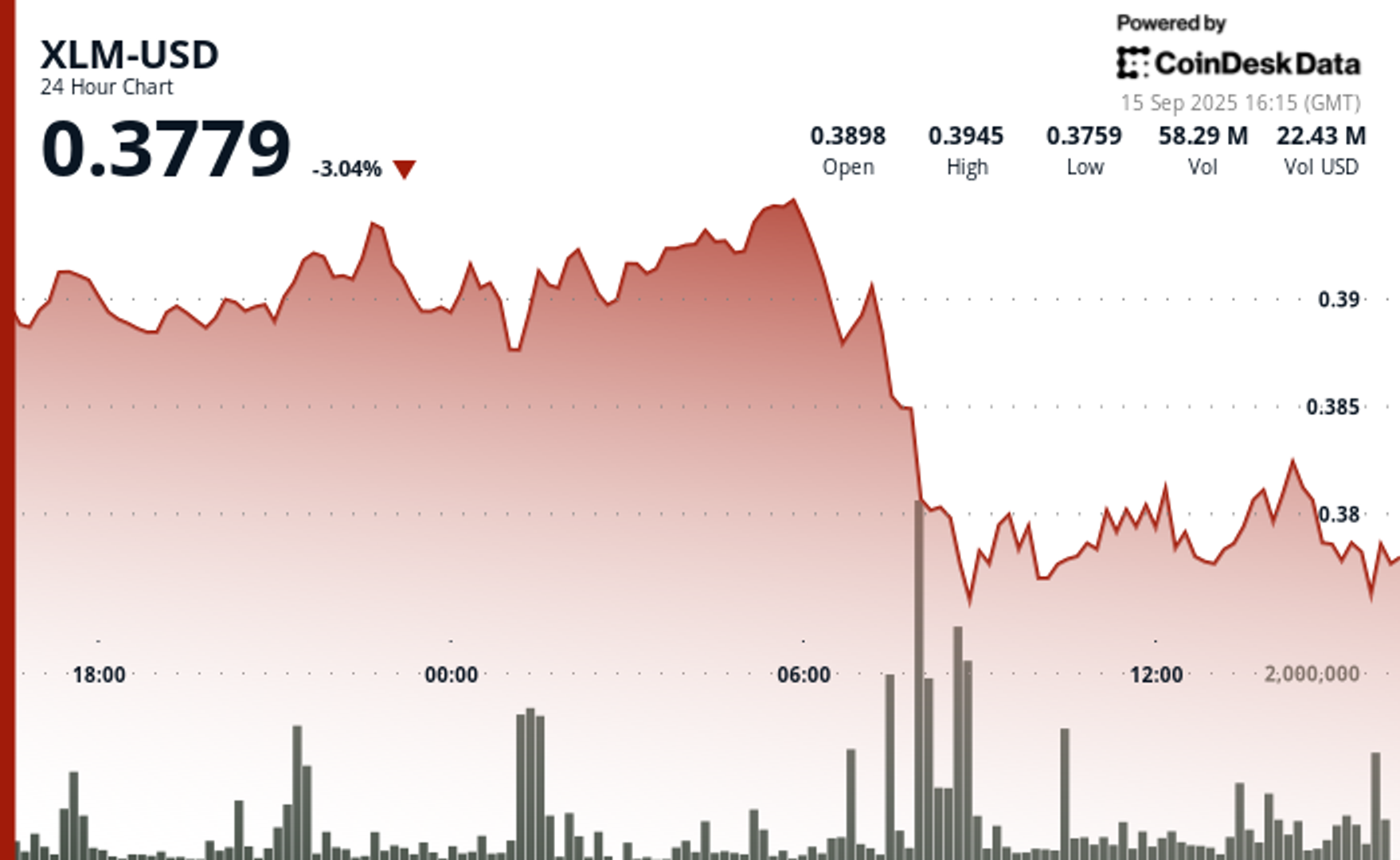

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

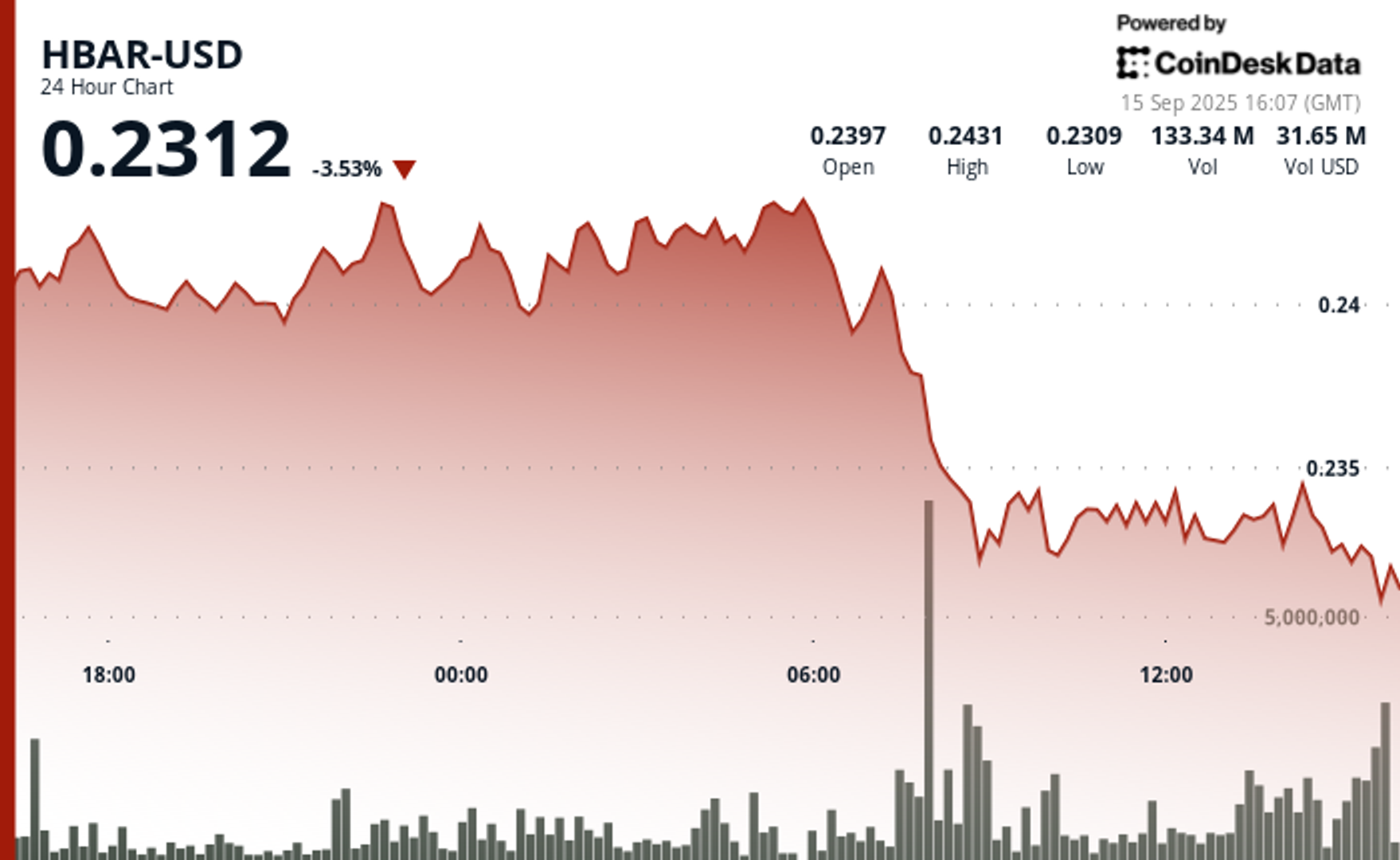

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Dogecoin Inches Closer to Wall Street With First Meme Coin ETF

The first exchange-traded fund (ETF) built around a meme coin could hit the market this week, after multiple delays and much speculation.

The DOGE ETF — formally called the Rex Shares-Osprey Dogecoin ETF (DOJE) — was originally slated to debut last week, alongside a handful of politically themed and crypto-related ETFs. Those included funds tied to Bonk (BONK), XRP, Bitcoin (BTC) and even a Trump-themed fund. But DOJE’s debut never materialized.

Now, Bloomberg ETF analysts Eric Balchunas and James Seyffart believe Wednesday is the most likely launch date, though they caution nothing is certain.

“It’s more likely than not,” Seyffart said. “That seems like the base case.”

Ahead of the introduction of the ETF, DOGE has been among the top performers over the past month, ahead 15% even including a decline of 3.5% over the past 24 horus.

If launched, DOJE would mark a milestone as the first U.S. ETF to focus on a meme coin — cryptocurrencies that generally lack utility or a clear economic purpose. These include tokens like Dogecoin, Shiba Inu (SHIB) and Bonk, which often surge in popularity thanks to internet culture, celebrity endorsements and speculative trading.

Balchunas described DOJE’s significance in a post on X: “First-ever US ETF to hold something that has no utility on purpose.”

DOJE is not a spot ETF. That means it won’t hold DOGE directly. Instead, the fund will use a Cayman Islands-based subsidiary to gain exposure through futures and other derivatives. This approach sidesteps the need for physical custody of the coin while still offering traders a way to bet on its performance within a traditional brokerage account.

The ETF was approved earlier this month under the Investment Company Act of 1940, which is typically used for mutual funds and diversified ETFs. That sets it apart from the wave of bitcoin ETFs that received green lights under the Securities Act of 1933, a framework used for commodity-based and asset-backed products. In short, DOJE is structured more like a mutual fund than a commodity trust.

More direct exposure may be coming soon. Several firms have filed applications to launch spot DOGE ETFs, which would hold the meme coin itself rather than derivatives. These applications are still under review by the U.S. Securities and Exchange Commission (SEC), which has grown more comfortable with crypto ETFs since approving a slate of bitcoin products in early 2024.

The broader crypto market has shown that investor demand can outweigh fundamental critiques. Meme coins have long drawn skepticism for having no underlying value or use case, but that hasn’t kept them from drawing billions in speculative capital.

Seyffart said the ETF market is likely to follow the same path. “There’s going to be a bunch of products like this, whether you love it or need it, they’re going to be coming to market,” he said.

He added that many existing financial products serve no deeper purpose than providing a vehicle for short-term bets. “There’s plenty of products out there that are just being used as gambling or short-term trading,” he said. “So if there’s an audience for this in the crypto world, I wouldn’t be surprised at all if this finds an audience in the ETF and TradFi world.”

Whether the DOJE ETF opens the door to more meme coin funds — or just proves the concept is viable — may depend on how the market responds this week. Either way, it signals a new phase in the merging of internet culture and traditional finance.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars