Business

Riot Platforms Gets Double Upgrade on AI Pivot as JPMorgan, Citi Hike Targets

Riot Platforms (RIOT) picked up back-to-back upgrades from Wall Street on Friday, with JPMorgan and Citigroup both raising their outlooks on the bitcoin miner amid changing industry economics and a shift toward high-performance computing.

JPMorgan boosted Riot to overweight from neutral and raised its price target to $19 from $15, calling it the most attractive among its mining peers. Citi upgraded to buy from neutral and lifted its price target to $24 from $13.75. Both firms pointed to Riot’s pivot into artificial intelligence and cloud services as a potential growth driver as mining profits tighten. Riot was modestly outperforming a sharply lower sector on Friday, declining «just» 1.2% to $16.55.

Alongside its upgrade of RIOT, JPMorgan downgraded the previously very hot-handed IREN to underweight from neutral. Shares are down 9.7% on Friday, but still higher by 300% year-to-date. CleanSpark (CLSK) was cut to neutral and it’s lower by 9.3% Friday and higher by 34% year-to-date.

The bank maintained its buy rating on Cipher Mining (CIFR), and doubled its price target to $12 from $6. The shares were 3.5% lower to $11.20 at publication time.

MARA Holdings (MARA) was kept at overweight, with a reduced price objective of $20, down from $22. The stock was 1% lower around $15.90 in early trading.

JPMorgan’s analysts are assigning a 50% probability that Riot, Cipher, and IREN each secure near-term high performance computing (HPC) colocation agreements, using Core Scientific’s (CORZ) 800 MW CoreWeave (CRWV) deal as a benchmark. The bank values HPC colocation contracts at $3.7 million to $8.6 million per gross megawatt (MW).

Read more: Bitcoin Mining Profitability Fell in August, Jefferies Says

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

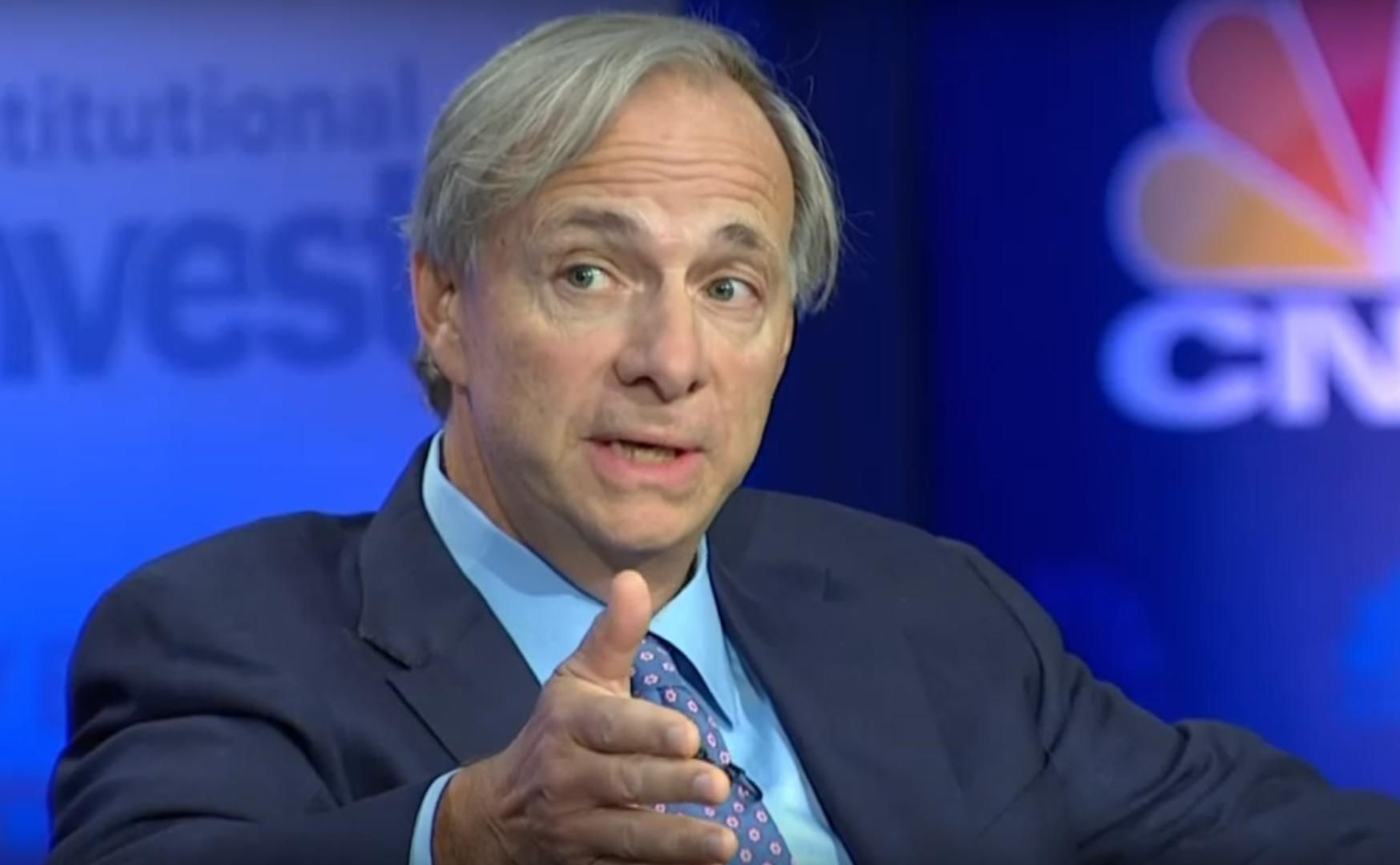

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

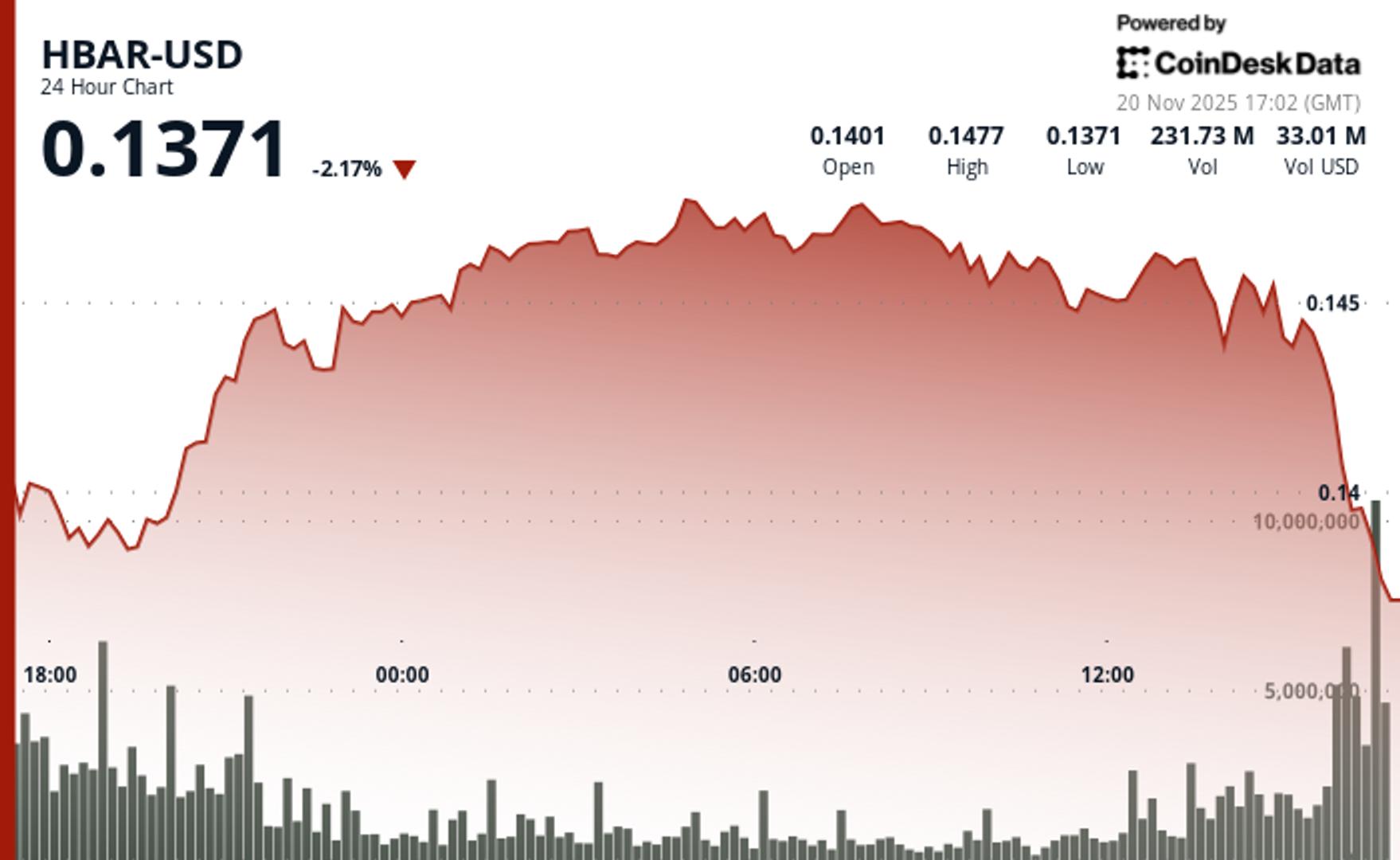

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton