Uncategorized

Record Margin Debt in Chinese Stocks Signals Risk-On Momentum for Global Markets and Bitcoin

Chinese investors have borrowed a record amount to buy local stocks, offering risk-on cues to global markets, including cryptocurrencies. However, crypto traders still appear to be more cautious.

According to Bloomberg, margin trades outstanding in China’s onshore equity market surged to 2.28 trillion yuan ($320 billion) on Monday, surpassing the previous 2015 peak of 2.27 trillion yuan.

Margin trading, which involves borrowing money from brokers to purchase securities, represents a form of leverage that reflects investors’ risk appetite and confidence in the market.

This record surge in margin trades underscores a strong risk-on sentiment amid the ongoing stock rally. The Shanghai Composite Index has climbed 15% this year, outpacing the S&P 500’s roughly 10% gain, while the broader CSI 300 Index has advanced 14%.

However, as MacroMicro points out, this new high is occurring against a backdrop of slowing economic growth, unlike 2015 when China’s GDP was relatively stronger.

«CSI 300 at decade highs. Borrowed money chasing stocks in a shrinking economy,» data tracking firm MacroMicro noted on X, adding that the current rally appears more measured than 2015’s, with broader sector participation beyond AI and chips, and a larger deposit base providing some support.

«Yet deflationary pressures continue to erode corporate pricing power—forward earnings are down 2.5%—making debt-funded positions riskier when companies cannot raise prices,» the firm noted.

The potential unwinding of the record high margin debt in Chinese stocks could trigger significant volatility, with potential spillover effects across global markets.

Moderate risk-on in crypto

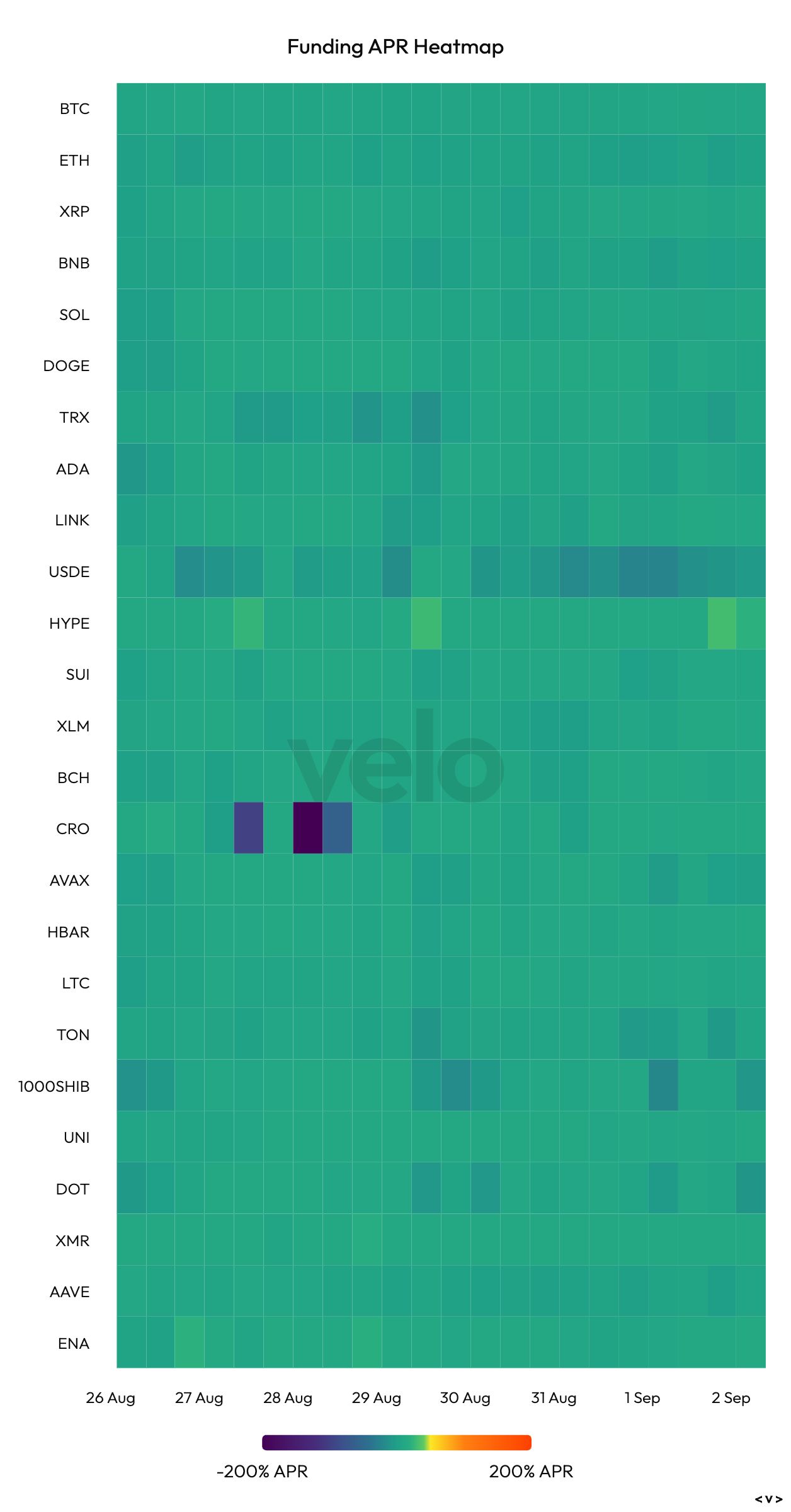

While there is no standardized metric to measure margin debt across the entire crypto industry, traders often use perpetual funding rates as a proxy to gauge overall demand for leverage. These rates indicate the cost of holding leveraged positions and reflect market sentiment toward risk.

Currently, funding rates for the top 25 cryptocurrencies are hovering between 5% and 10%, signaling a moderate level of bullish leverage among traders. This suggests that while there is demand for leveraged long positions, market participants remain cautious, striking a balance between optimism and risk management.

Read more: Bitcoin Floats Around $110K as Traders Look Towards Friday Data for Upside

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts