Uncategorized

Polymarket Retains Loyal User Base a Month After Election, Data Shows

During the dog days of summer, Polymarket’s election betting surged on (correct) speculation that the Democrats would make a «hot swap» of Joe Biden for Kamala Harris as their presidential candidate. Trading volume grew and grew through the fall. All along, <a href=»https://www.coindesk.com/business/2024/08/29/can-prediction-market-boom-continue-after-election-this-crypto-team-has-a-plan» target=»_blank»>doubts lingered</a> about whether the platform’s trader base would hold steady after the ballots were cast.

On Election Day, the research arm of gaming and VC giant Animoca put out a <a href=»https://research.animocabrands.com/post/cm34k8cug43d007mi0zpie48a» target=»_blank»>report</a> with a bold prediction: there’s nothing for Polymarket to worry about. The crypto-based prediction market, according to the report, had a significant base of non-election bettors to carry it through.

Naturally, there would be smaller numbers – what can be as captivating as a political face-off involving Donald Trump? – but it’d be a far cry from a ghost town. Three-quarters of Polymarket users, Animoca noted, trade contracts unrelated to the election.

A month later, that analysis is looking right.

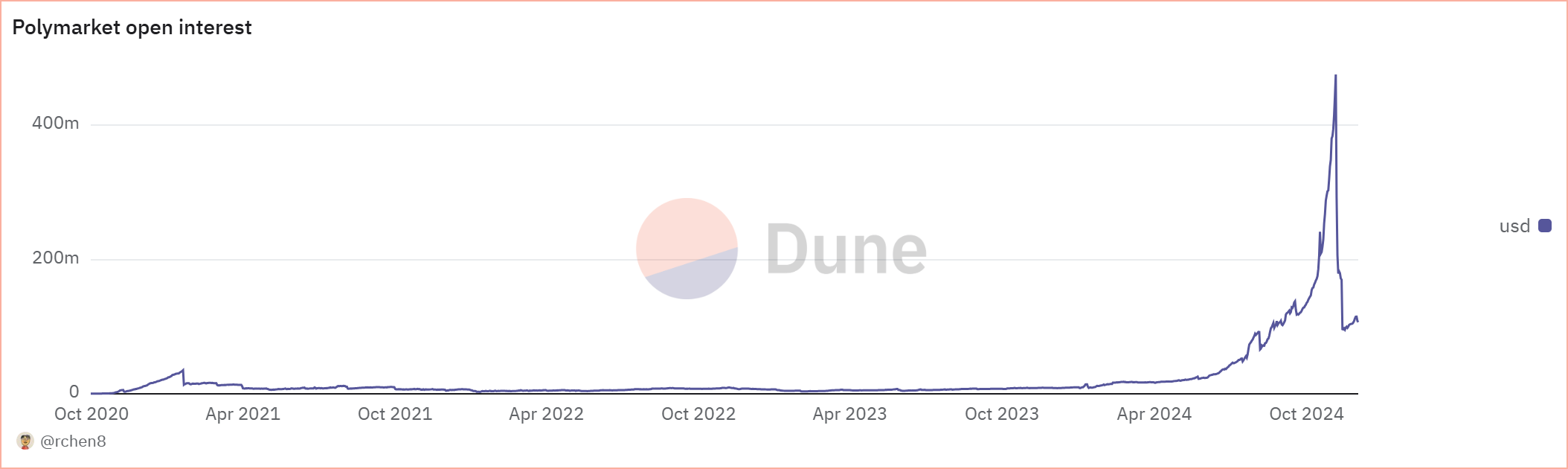

A key data point to track is the open interest on Polymarket. Open interest, which is the total value of active positions in Polymarket’s prediction markets, reflects the platform’s liquidity, user activity, and overall market engagement.

Data from a <a href=»https://dune.com/queries/3343122/5601864″ target=»_blank»>Dune Analytics dashboard</a> shows that while open interest hit peaked just above $475 million on Election Day – and, predictably, significantly declined in the days after – it has been ticking back up in the last week.

The data shows open interest dropped to a low of $93.91 million on November 12, then slowly climbed to $104 million by November 15 and further to $115.25 million by November 30. These aren’t bad numbers for Polymarket by any means, because this is where open interest was in mid-September, when election fever was in full swing.

Similarly, <a href=»https://dune.com/queries/3343108/5601830″ target=»_blank»>daily volumes</a>, while down sharply from their $367 million peak the day after the election, have plateaued in the mid- to high eight figure range, which is still higher than they were in September.

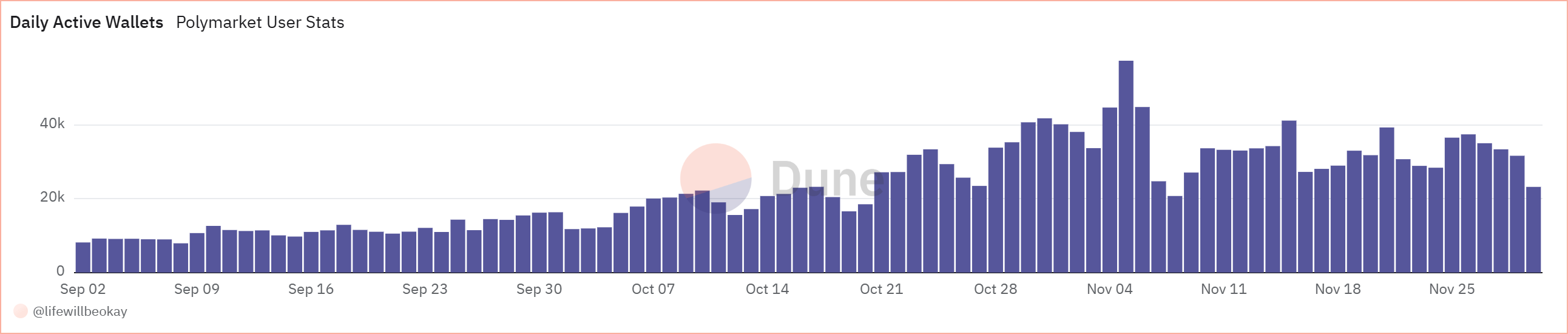

The next metric to look at is the number of active wallets on the platform.

In the last week, this metric – which reflects the number of traders active on the platform – has been hovering around the mid-30,000 mark, which isn’t substantially lower than the weeklong run-up to election day, when there were an average of 39,100 active wallets at work.

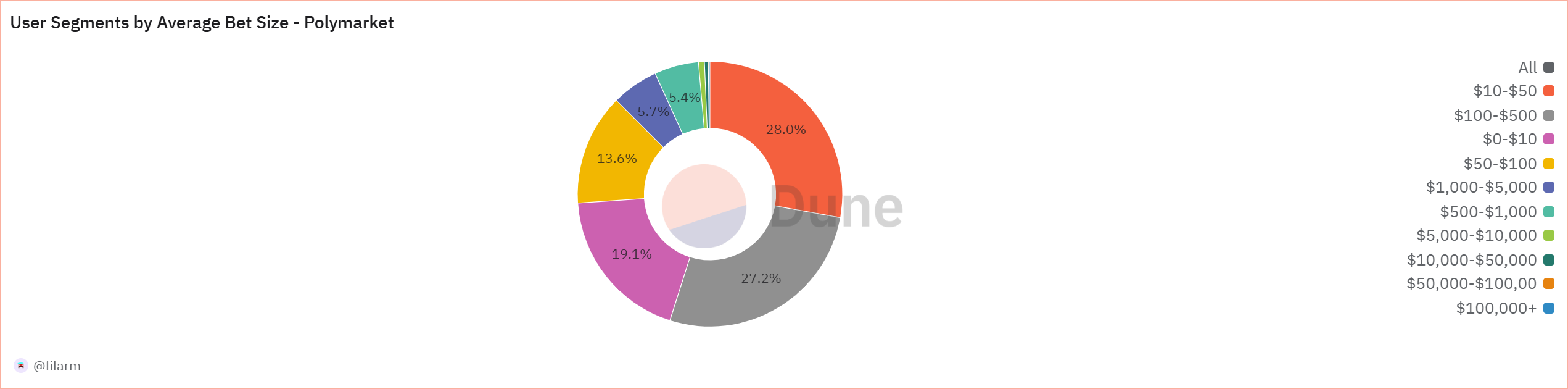

And is Polymarket reliant on a few whales to drive volume? Not really.

<a href=»https://dune.com/queries/4061600/6839023″ target=»_blank»>Data shows</a> that around 60% of all bets are coming in under $100, and only 5.8% of bets are between $1,000 and $5,000.

Polymarket is here to stay, but dark clouds remain. It needs to <a href=»https://www.coindesk.com/business/2024/11/13/fbi-reportedly-raids-polymarket-ceos-home» target=»_blank»>work through its legal issues</a>, which may soon be resolved if President-elect Trump installs a crypto-friendly financial regulatory regime.

Influencer Mea Culpa

A social media influencer <a href=»https://www.coindesk.com/markets/2024/11/25/mudslinging-sullies-prediction-markets-just-as-sectors-prospects-brighten» target=»_blank»>involved in a Kalshi plot to bash Polymarket and its founder</a>, Shayne Coplan, has apologized for a post in which he called Coplan the «n-word» and said he «look[ed] guilty.»

«I was doing other business with Kalshi and just tweeted it,» Antonio Brown wrote on X (formerly Twitter) Saturday. «I want to say sry to Shayne Coplan.»

Earlier, Clown World, an influencer account that regularly tweets Kalshi-related content, deleted a post calling Coplan and convicted fraudster Sam Bankman-Fried lookalikes.

Kalshi’s CEO, Tarek Mansour, has previously declined to comment on the record.

Markets Missed Biden Pardon

Hunter Biden, the wayward son of President Joe Biden, <a href=»https://www.nytimes.com/live/2024/12/01/us/hunter-biden-pardon-live» target=»_blank»>was pardoned Sunday</a>, a move that surprised many – including traders on Polymarket.

The pardon covers all offenses committed in a ten-year period between January 1, 2014, and December 1 of this year, a statement from the White House reads. This covers Hunter’s tax and gun charges – in addition to any undetected crimes.

Before the pardon announcement, contracts representing the yes side of the question were trading around 28 to 30 cents, reflecting a 28% to 30% chance a pardon would happen. Now that the White House has confirmed the executive grant of clemency, these contracts shot up to 100%, which means they will pay out 1 USDC, each worth $1, per share.

The market was skeptical a pardon would happen, <a href=»https://apnews.com/article/biden-son-hunter-charges-pardon-pledge-24f3007c2d2f467fa48e21bbc7262525″ target=»_blank»>given multiple pledges</a> by the President that it would not.

<a href=»https://apnews.com/article/president-joe-biden-hunter-biden-18efb958a5365eebda5bb3da411c4326″ target=»_blank»>In June</a>, the elder Biden promised to respect a jury decision regarding a gun charge and not pardon his son. At the time, the market was giving a 12% chance of a pardon.

Data aggregator <a href=»https://www.polymarketanalytics.com/markets?event=10882″ target=»_blank»>Polymarket Analytics</a> shows that the top holder of the yes side, a user who goes by «<a href=»https://polymarket.com/profile/0x008bf350637ce1ea308b3622a0d44116f9f3b476″ target=»_blank»>PollsR4Dummies</a>» took home $223,472 on his bet of $87,740.

The polling skeptic is also holding two long-shot yes positions, betting that Fox News personality Pete Hegseth will be confirmed as Secretary of Defense, currently at 32% <a href=»https://www.cnn.com/2024/11/21/politics/pete-hegseth-police-report-defense-secretary-trump/index.html» target=»_blank»>given recent sexual assault allegations</a>, and that the Fed will cut interest rates three times in 2024 (the market gives this a 29% chance).

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars