Business

PEPE Meme Coin Jumps 6% as Trading Volume Triples and Whale Activity Builds

Meme-inspired cryptocurrency PEPE has seen its price jump more than 6% in less than 24 hours as traders piled in during a breakout rally that saw trading volumes nearly triple, according to CoinDesk Research’s technical analysis data model.

The token rose from $0.000009138 to $0.000009627 during the session, with volatility expanding over 7%. Volume surged to 5.61 trillion tokens, far above the 1.89 trillion daily average, pushing the price through established resistance and holding above $0.000009600 by the close of the move.

The rally came amid a broader shift in the crypto market. The broader CoinDesk 20 (CD20) has risen by more than 4.3% over the past 24-hour period.

Some of the capital entering the market appears to have flowed into high-risk altcoins like PEPE and speculative presale projects, lifting prices across the memecoin space. The CoinDesk Memecoin Index (CDMEME) saw a near 5% rise in the same period.

According to data from Nansen, PEPE’s price rally comes after whale accumulation took over in the last 30 days. The top 100 non-exchange addresses on Ethereum have added 3.4% to their holdings in the period, while exchange wallets saw a 2% drop in PEPE holdings.

Support now sits near $0.00000900, with resistance forming around the session high of $0.000009681. Price consolidation toward the end of the rally may hint at another move ahead.

Open interest for PEPE futures products has meanwhile kept on rising to now stand near the $600 million market according to CoinGlass data.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

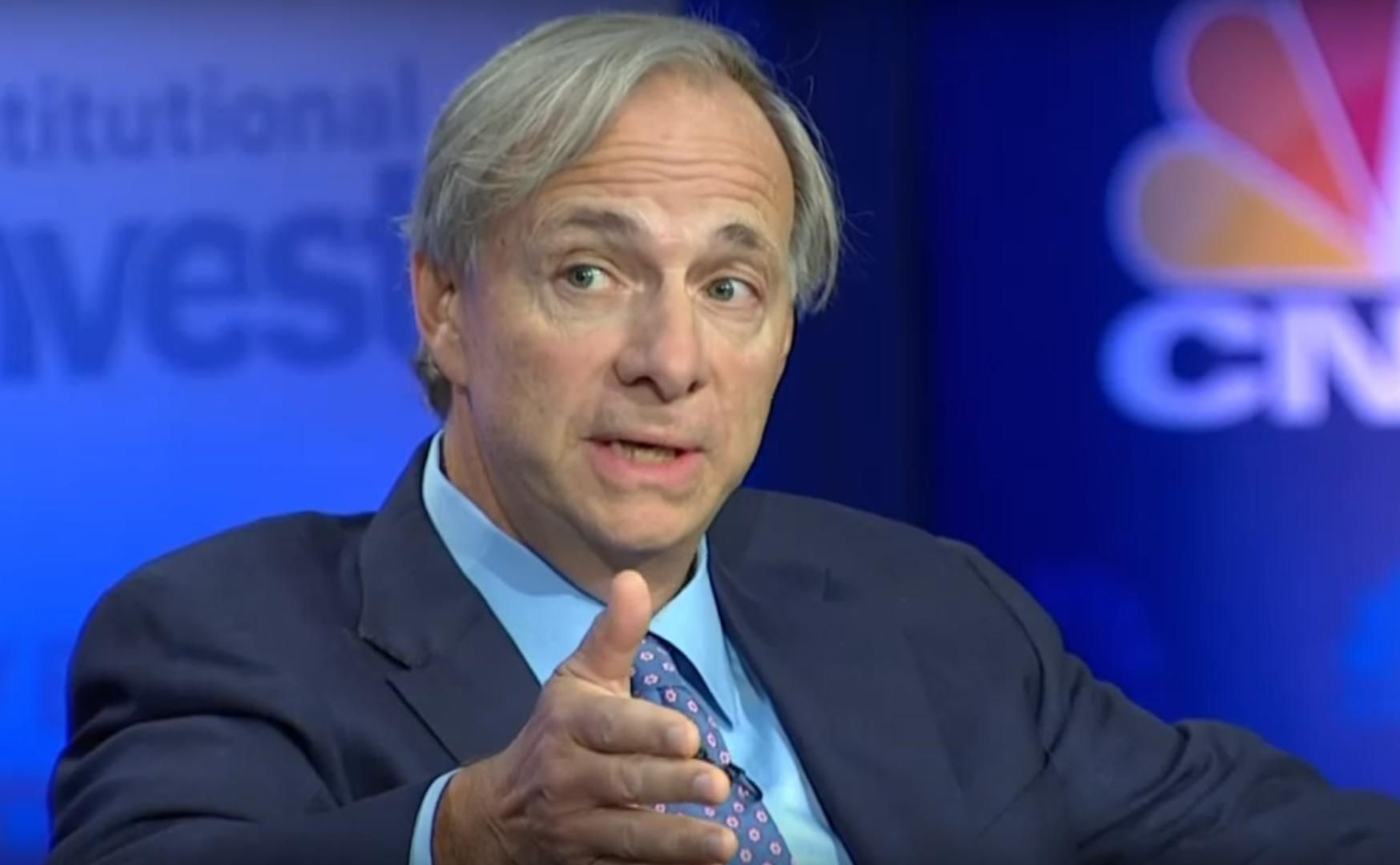

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

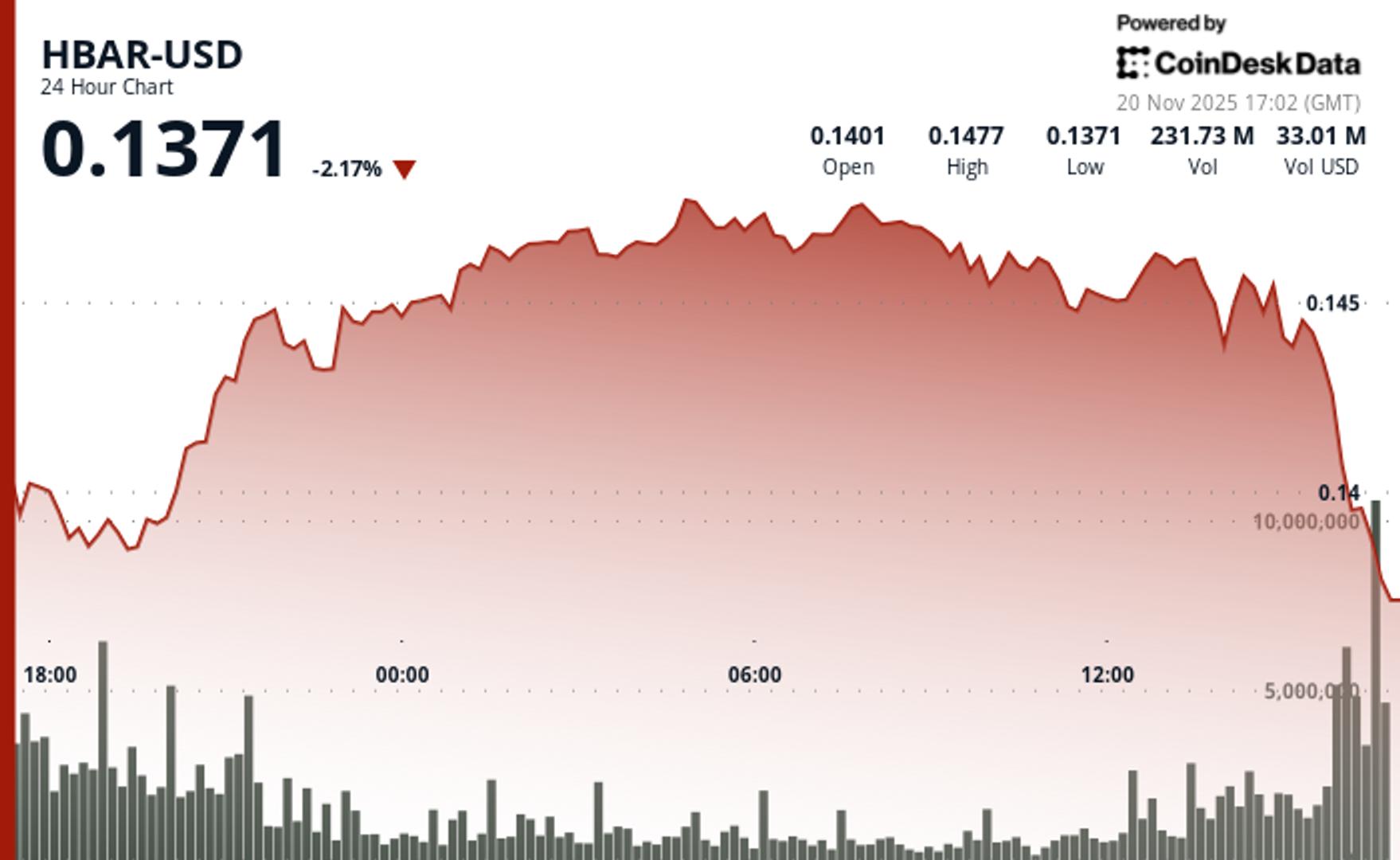

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton