Uncategorized

Paul Veradittakit: 8 Predictions For Crypto in 2025

Every year, bulls and bears use short-term case studies to forecast crypto armageddon or exponential growth. And every year, neither group is right.

Some notable events this year: Ethereum’s Dencun Upgrade, the U.S. election, crypto ETFs, Wyoming’s DUNA, the wBTC controversy, Robinhood’s Well’s notice, Hyperliquid’s near $2 billion airdrop, Bitcoin hitting $100,000, and SEC Chair Gary Gensler’s January resignation announcement.

2024 was a year with no major market shocks. And, though it didn’t bring in an explosion of new capital, it proved that a growing number of companies in the crypto ecosystem are sustainable. Bitcoin is worth $1.9 trillion and all other cryptos are worth $1.6 trillion. The market cap of all crypto has doubled since the start of 2024.

The diversification of crypto has strengthened its ability to react to shocks. Payments, DeFi, gaming, ZK, infrastructure, consumer, and more, are all growing sub-sections. Each of these now have their own funding ecosystems, their own markets, their own incentives, and their own bottlenecks.

This year, at Pantera, we’ve invested in companies that target these ecosystem-specific problems. Crypto gaming companies face issues adopting Web3 data analysis tools, so we invested in Helika, a gaming analysis platform. Web3 AI products often face adoption challenges because of the fragmentation of the AI stack, so Sahara AI aims to create an all-in-one platform to allow permissionless contribution while keeping a seamless Web2-like user experience.

Intent infrastructure is messy and orderflow is fragmented, so Everclear standardizes the process by connecting all stakeholders. zkVM’s are complicated to integrate, so Nexus uses modularity in order to cater to customers who want only parts of their hyper-scalable layer. Building consumer apps faces the issue of attracting users, so we made our largest ever investment in TON, the blockchain that directly plugs into Telegram’s 950 million monthly active users.

We enter 2025 on tailwinds of possible regulatory clarity, continued mainstream interest, and rising crypto prices. Even after a bit of a summer slump this year, crypto users are entering the new year with strong optimism (or “greed”).

Review of 2024 Predictions:

Before we dive into 2025 predictions, let’s take a look back at how I did predicting 2024. I’ll score myself with 1 being the least accurate and 5 being the most accurate.

The resurgence of Bitcoin and “DeFi Summer 2.0.” Accuracy: 4/5

Tokenized social experiences for new consumer use cases. Accuracy: 2/5

An increase in TradFi-DeFi “bridges” such as stablecoins and mirrored assets. Accuracy: 5/5

The cross-pollination of modular blockchains and Zero Knowledge Proofs. Accuracy: 4/5

More computationally intensive applications moving on-chain, such as AI and DePIN. Accuracy: 2/5

Consolidation of public blockchain ecosystems and a “Hub-and-Spoke” model for app-chains. Accuracy: 2/5

2025 Predictions

This year, I enlisted the help of investors on the Pantera team. I’ve split my predictions into two categories: rising trends and new ideas.

Rising Trends:

By year-end, RWAs (excluding stablecoins) will account for 30% of on chain TVL (15% today)

RWAs on-chain has increased over 60% this year, to $13.7 billion. Around 70% of RWAs are private credit and the majority of the rest are in T-Bills and commodities. Inflows from these categories are accelerating, and 2025 may see the introduction of more complex RWAs.

Firstly, private credit is accelerating because of improving infrastructure. Figure accounts for almost all of this, increasing by almost $4 billion worth of assets in 2024. As more companies enter this space, there is increasing ease to use private credit as a means to move money into crypto.

Secondly, there are trillions of dollars worth of T-Bills and commodities off-chain. There is only $2.67 billion worth of T-Bills on-chain, and their ability to generate yield (as opposed to stablecoins, which allow the ones who mint the coin to capture the interest), makes it a more attractive alternative to stablecoins. Blackrock’s BUIDL T-Bill fund only has $500 million on-chain, as opposed to the tens of billions of government bills it owns off-chain. Now that DeFi infrastructure has thoroughly embraced stablecoins and T-Bill RWAs (integrating them into DeFi pools, lending markets, and perps), the friction to adopt them has drastically decreased. The same goes for commodities.

Finally, the current extent of RWAs is limited to these basic products. The infrastructure to mint and maintain the RWA protocols has drastically simplified and operators have a much better understanding of the risks and appropriate mitigations that come with on-chain operations. There are specialized companies that manage wallets, minting mechanisms, sybil sensing, crypto neo-banks, and more, meaning it may finally be possible and feasible to introduce stocks, ETFs, bonds, and other more complex financial products on-chain. These trends will only accelerate the use of RWA’s heading into 2025.

Bitcoin-Fi

Last year, my prediction of Bitcoin finance was strong but didn’t reach the 1-2% of all Bitcoins TVL mark. This year, pushed by Bitcoin-native finance protocols that do not require bridging (like Babylon), high returns, high Bitcoin prices, and increased appetite for more BTC assets (runes, Ordinals, BRC20), 1% of Bitcoins will participate in Bitcoin-Fi.

Fintechs become crypto gateways

TON, Venmo, Paypal, Whatsapp have seen crypto growth because of their neutrality. They are gateways where users can interact with crypto, but do not push specific apps or protocols; in effect, they can act as simplified entryways into crypto. They attract different users; TON for its existing 950 million Telegram users, Venmo and Paypal for their respective 500 million payments users, and Whatsapp for its 2.95 billion monthly active users.

Felix, which operates on Whatsapp, allows instant money transfers via a message, to be either digitally transferred or can be picked up in cash at partner locations (like 7-Eleven). Under the hood, they use stablecoins and Bitso on Stellar. Users can now buy crypto on Metamask using Venmo, Stripe acquired Bridge (a stablecoin company), and Robinhood acquired Bitstamp (a crypto exchange).

Whether intentionally or because of their ability to support third-party apps, every fintech will become a crypto gateway. Fintechs will grow in prevalence and may perhaps rival smaller centralized exchanges in crypto holdings.

Unichain becomes leading L2 by transaction volume

Uniswap has a TVL of almost $6.5b, 50-80k transactions per day, and volume of $1-4 billion daily. Arbitrum has ~$1.4 billion of transaction volume a day (a third of which is Uniswap) and Base has ~$1.5 billion of volume a day (a fourth of which is Uniswap).

If Unichain captures just half of Uniswap’s volume, it would easily surpass the largest L2s to become the leading L2 by transaction volume.

NFT resurgence but in a application specific way

NFTs were meant as a tool in crypto — not a means to an end. NFT’s are being used as a utility in on-chain gaming, AI (to trade ownership of models), identity, and consumer apps.

Blackbird is a restaurant rewards app that integrates NFTs into customer identification in their platform of connecting Web3 into dining. By integrating the open, liquid, and identifiable blockchain with restaurants, they can provide consumer behavior data to restaurants, and easily create/mint subscriptions, memberships, and discounts for customers.

Sofamon creates web3 bitmoji’s (which are NFTs), called wearables, unlocking the financial layer of the emoji market. They recognize the increasing relevance of IP on chain and embrace collaboration with top KOL’s and K-pop stars, for example, to fight digital counterfeiting. Story Protocol, which recently raised $80 million at a $2.25 billion valuation, has the broader goal of tokenizing the world’s IP, putting originality back as the centerpiece of creative exploration and creators. IWC (the Swiss luxury watch brand) has a membership NFT that buys access to an exclusive community and events.

NFTs can be integrated to ID transactions, transfers, ownership, memberships, but can also be used to represent and value assets, leading to monetary, possibly speculative growth. This flexibility is what brings NFTs power. The use-cases will only increase.

Restaking launches

In 2025, restaking protocols like Eigenlayer, Symbiotic, and Karak will finally launch their mainnets which would pay operators from AVS and slashing. It seems that through this year, restaking lost relevance.

Restaking draws power as more networks use it. If protocols use infra that is powered by a particular restaking protocol, it derives value from that connection, even if it is not direct. It is by this power that protocols can lose relevance but still hold huge valuations. We believe restaking is still a multi billion dollar market and as more apps become appchains, they harness restaking protocols, or other protocols that are built on restaking protocols.

New Ideas:

zkTLS bringing offchain data on-chain

zkTLS uses zero knowledge proofs to prove the validity of data from the Web2 world. This new technology has yet to be fully implemented, but when it (hopefully) does this year, it will bring in new types of data.

For example, zkTLS can be used to prove that data came from a certain website to others. Currently, there is no way to do this. This tech takes advantage of advancements made in TEE’s and MPC’s, and may be further improved to allow some of the data to be private.

This is a new idea, but we predict that companies will step up to begin building this and integrating it into on-chain services, like verifiable oracles for non-financial data or cryptographically secured data oracles.

Regulatory support

For the first time, the U.S. regulatory environment seems crypto-positive. 278 pro-crypto house candidates were elected versus 122 anti-crypto candidates. Gary Gensler, an anti-crypto SEC chair, announced that he will be resigning in January. Reportedly, Trump is set to nominate Paul Atkins to lead the SEC. He was previously an SEC Commissioner from 2002-2008 and is outspokenly supportive of the crypto industry and an advisor to the Chamber of Digital Commerce, an institution focused on promoting the acceptance of crypto. Trump also named David Sacks, a tech investor and former CEO of Yammer and COO of PayPal, to head the new role of “AI & crypto czar.” Trump’s announcement said that “[David Sacks] will work on a legal framework so the Crypto industry has the clarity it has been asking for.”

We hope for a winding down of SEC lawsuits, clear definitions of crypto as a particular asset class, and tax considerations.

Uncategorized

BNB Hovers Above $648 as Maxwell Hard Fork Upgrade Set to Double Block Production Speed

BNB BNB traded in a narrow range on Sunday, reflecting resilience amid low volatility as the BNB Chain community gears up for a significant infrastructure upgrade, according to CoinDesk Research’s technical analysis model.

The Maxwell hard fork upgrade scheduled for June 30 is poised to enhance the performance of the BNB Smart Chain (BSC) mainnet by cutting block times from 1.5 seconds to 0.75 seconds—doubling the chain’s throughput potential.

This upgrade builds on earlier milestones like the Lorentz fork, which reduced block time from 3 seconds and introduced enhanced network stability. Maxwell moves BSC into sub-second block speeds, helping it compete more directly with faster chains such as Solana.

The hard fork will be powered by three protocol improvement proposals: BEP-524, BEP-563 and BEP-564. These measures overhaul key components of validator coordination and consensus mechanics. Notably, validators will now serve longer block proposal turns (16 blocks per turn), and the epoch length is being extended from 500 to 1,000 blocks — changes expected to stabilize performance even under accelerated conditions.

To avoid network congestion and excessive state growth, the per-block gas limit will be halved from 70 million to 35 million. Improvements on the networking side are also expected, with faster block propagation among validators — within 400 milliseconds —and improved range synchronization for lagging nodes.

Named after physicist James Clerk Maxwell, the upgrade is designed to balance speed with stability, aiming to elevate BNB Chain’s standing across DeFi, GameFi, and enterprise blockchain sectors. By delivering more responsive block finality and smoother validator participation, the Maxwell hard fork could help drive future adoption and developer growth across the ecosystem.

Technical Analysis Highlights

- Between June 28 15:00 UTC and June 29 14:00 UTC, BNB climbed from $646.29 to $650.25, a 0.61% gain with a $5.75 (0.89%) trading range.

- The price found key support at $647.11 during the 02:00 UTC hour on June 29, with above-average volume of 10,034 units.

- Resistance emerged at $651.30 during the 12:00 UTC hour, capping further gains.Notable volume spikes at 07:00 and 09:00 UTC (18,696 and 22,494 units, respectively) confirmed persistent buyer interest above $648.

- From 13:05 to 14:04 UTC on June 29, BNB dipped slightly from $650.85 to $650.25, posting a 0.09% intraday loss.

- Price briefly hit a session peak of $651.07 at 13:23 UTC before rejecting lower, with a volume spike of 957.81 units at 13:25 UTC.

- As of 21:24 UTC, BNB traded at $648.37, paring earlier gains and holding below resistance near the $651 level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Ondo Finance: ‘2025 Will Be the Year of Tokenized Stocks’

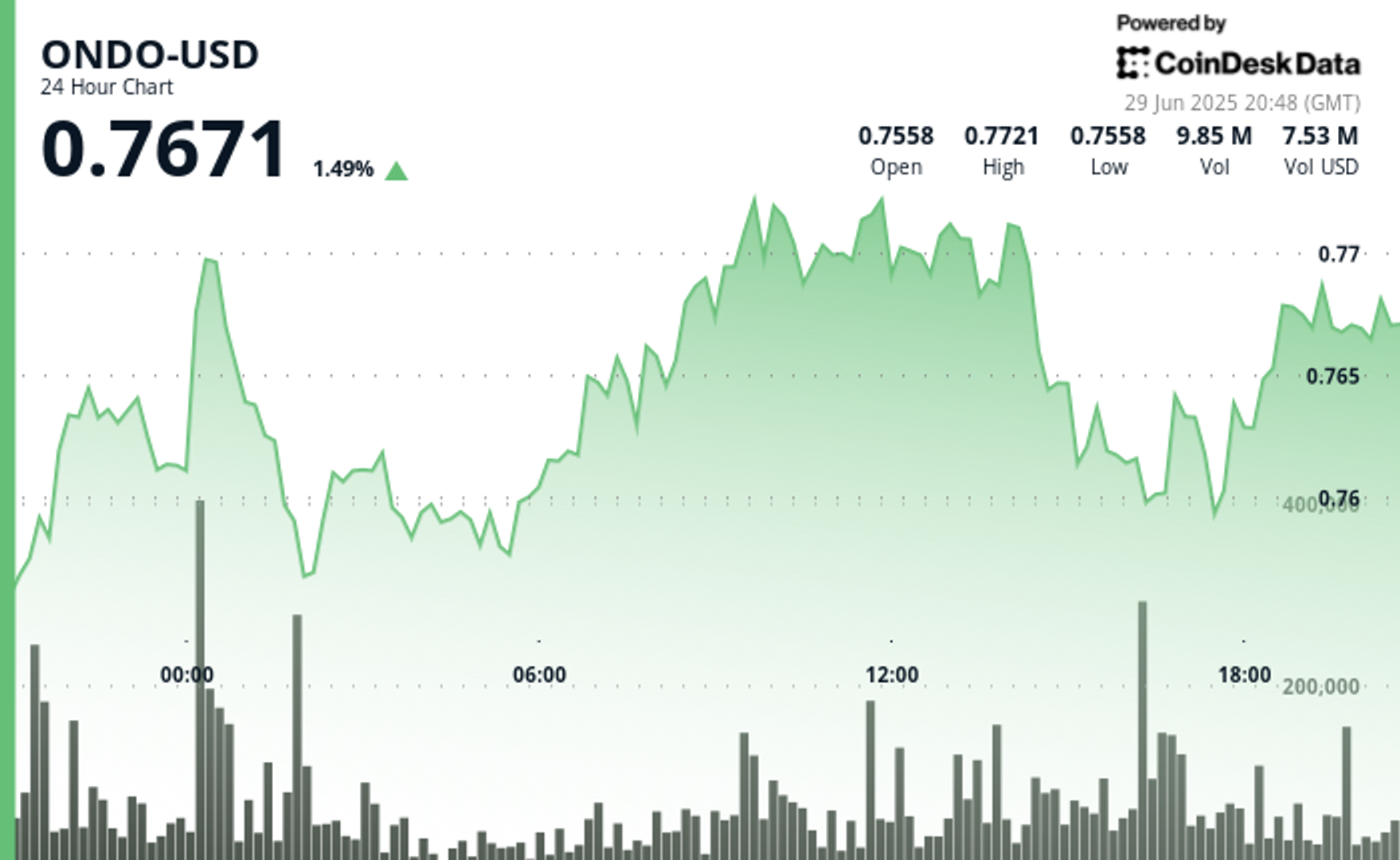

Ondo (ONDO) ONDO rose 1.5% to $0.7671 over the past 24 hours, holding near recent highs after a week of gains, according to CoinDesk Research’s technical analysis model.

The move comes roughly two weeks after Ondo Finance disclosed a new industry collaboration focused on setting standards for tokenized securities.

In a June 17 blog post, the firm announced the creation of the Global Markets Alliance, a group of wallets, exchanges, and custodians working together to improve interoperability, investor protections, and access to tokenized real-world assets. Participants include the Solana Foundation, BitGo, Fireblocks, Jupiter, 1inch, Trust Wallet, Bitget Wallet, Rainbow Wallet, and Alpaca.

The announcement comes ahead of Ondo’s planned launch of Ondo Global Markets, a platform aimed at allowing crypto wallets and applications to offer tokenized exposure to U.S. publicly traded securities, such as stocks, ETFs, and mutual funds, for users based outside the U.S. According to the company, the initiative is intended to reduce frictions associated with traditional capital market infrastructure and broaden global access.

Each member of the alliance is contributing in a different capacity. Wallet providers like Trust Wallet and Rainbow Wallet are integrating Ondo’s tokenized asset standards, while exchanges such as Jupiter and aggregators like 1inch are expected to support programmatic access to tokenized assets. BitGo and Fireblocks are providing institutional custody and infrastructure, and Alpaca is handling brokerage and regulatory services tailored to tokenized securities.

The firm said the group will work to align technical and compliance standards for tokenized securities, improve cross-platform access and liquidity, and support use cases such as self-custody and onchain trading. While the alliance has not committed to a specific timeline, its members have framed the initiative as part of a longer-term shift toward integrating traditional financial products into blockchain-based systems.

In a post on X dated June 28, Ondo Finance wrote that “2025 will be the year of tokenized stocks,” indicating the team’s belief that adoption of tokenized financial instruments may accelerate in the coming quarters.

Technical Analysis Highlights

- Between June 28 15:00 UTC and June 29 14:00 UTC, ONDO rose from $0.749 to $0.769, a 2.67% gain within a 3.33% trading range.

- Strong support was confirmed at $0.755 with high volume during the 21:00 UTC hour on June 28.

- Key resistance at $0.765 was broken during the 00:00 UTC hour on June 29, when volume spiked to 8.9 million.

- From 13:05 to 14:04 UTC on June 29, ONDO fell slightly from $0.773 to $0.769, a 0.58% drop, with notable selling at 13:33 UTC.

- A temporary support level formed at $0.768 as multiple recovery attempts above $0.769 failed in the final minutes.

- Price action during the final hour formed a descending channel with lower highs, but the last candle hinted at potential reversal.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Coinbase Outpaces S&P 500 With 43% June Rise as Stablecoin Narrative Grows: CNBC

Shares of Nasdaq-listed cryptocurrency exchange Coinbase (COIN) rose 43% this month, making the firm the top performer in the S&P 500 since it joined the index at the end of last month.

June’s run is already the stock’s best since November and caps three straight monthly gains. Coinbase’s shares reached their highest level since their public debut.

COIN hit a $382 high this week before enduring a slight correction, ending the week at $353 and seeing a slight 0.7% drop in after-hours trading to $351.

The wider S&P 500 index rose roughly 5% in June as geopolitical tensions eased.

Washington’s progress on the GENIUS Act, Congress’s first rulebook for dollar-pegged stablecoins, helped shift investor focus from trading fees to stablecoin revenue.

The bill brightened the outlook for Circle, whose shares hit a record high and saw its market cap near that of Coinbase this week.

Coinbase keeps all yield on USDC balances held on its platform and nearly half of other USDC income, equal to about 99 percent of Circle’s revenue, giving shareholders indirect exposure at no added cost, CNBC reported Friday, citing analysts including Citizens’ head of financial technology research Devin Ryan.

Trading, however, remains subdued. Average daily volume on Coinbase has drifted lower since April.

-

Business9 месяцев ago

Business9 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion9 месяцев ago

Fashion9 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business9 месяцев ago

Business9 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Tech9 месяцев ago

Tech9 месяцев ago5 Crowdfunded products that actually delivered on the hype