Uncategorized

Out With the “Altcoin,” in With the Asset Class

Following the U.S. presidential election, crypto’s headwinds have seemingly dissipated. Since early November bitcoin has reached $100K amid regulatory wins such as the nomination of crypto-friendly Paul Atkins to replace Gary Gensler as SEC chair, the naming of crypto advocate David Sacks as the incoming White House “AI and Crypto Czar,” and Congressman French Hill’s appointment to head the House Financial Services Committee. With election season coming to a crypto-favorable close in 2024, some are forecasting “altcoin” season, a period of outperformance for non-BTC crypto assets, to continue in 2025 — but is this the right way to characterize digital assets broadly?

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Market commentators sometimes hastily sort the crypto economy into two oversimplified groups: 1) bitcoin (and now for some, ether) and 2) alternative or “alt” coins. In the early innings of digital assets, this dual categorization made sense as bitcoin was pioneering the use of blockchain technology and other use cases were still finding their footing. Nearly 16 years since bitcoin’s inception, an explosion of crypto innovation and sector-specific applications has pushed blockchain assets beyond the binary classification of bitcoin and “everything else.” Investors must now treat crypto as a diverse multi-sector asset class.

Putting the constituents of the digital asset class in perspective

The “altcoin” moniker may give the impression that digital assets other than bitcoin lack in size and industry-specific purpose compared to components of other asset classes such as equity markets. Figure 1 below compares the market caps of similarly sized constituents of the S&P500 Index to those of prominent crypto assets ex-BTC, and shows similarities between these asset classes not only in terms of component size, but also in terms of sector diversification:

Figure 1: Market Caps of Top 25 (ex-BTC) Crypto Assets vs. S&P 500 Constituents Smaller than ETH

Not only do the stocks of certain well-known companies highlighted above resemble the top 25 crypto assets in size (ex: Solana has a market cap similar to that of UPS), but both asset classes also span a variety of industries within their respective markets. While the number of digital assets shown above is relatively sparse compared to the number of stocks, these crypto assets alongside the market’s new and innovative crypto projects are likely to continue expanding the size and breadth of the asset class even further over time.

Constructing diversified digital asset portfolios for the long-run

Taking a binary “bitcoin vs. alts” approach to digital asset investing may forgo portfolio construction benefits both within crypto investments and across your overall asset allocation. Obtaining thoughtfully constructed, diversified, and intentional exposure to all crypto sectors and use cases helps defray the risks of asset concentration, ensures your portfolio is exposed to the full value proposition of the asset class, and provides a larger number of return sources within your broader asset allocation. Given the fast-changing, innovative nature of the digital asset landscape, it is crucial to construct crypto allocations that can adapt alongside the breadth of the asset class. This can be accomplished by adopting a process to choose the universe of assets to include in your portfolio, adjusting this universe over time, and allocating sensibly to these assets via either passive or active management. Embracing the broader crypto economy as an asset class within your investment portfolio means allocating to digital assets via strategies that are built for the long-term.

Conclusions for an evolving asset class

Focusing on bitcoin vs. “everything else” may obscure the already meaningful and fast-growing footprint of many crypto assets and could cause investors to miss out on longer-term portfolio benefits associated with comprehensive investment within the asset class.

Uncategorized

Ethereum Surges After Holding $2,477, Fueled by Very Heavy Trading Volume

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with ETH showing resilience despite broader market uncertainty.

The second-largest cryptocurrency is currently navigating a critical technical zone between $2,500-$2,530, which analysts identify as immediate resistance that must be overcome for continued upward movement.

Institutional interest remains strong, with spot Ethereum ETFs recording consecutive days of positive inflows, signaling growing confidence from larger investors despite the recent volatility.

Technical Analysis Highlights

- 24-hour ETH price action revealed a substantial 3.5% range ($99.85).

- Sharp sell-off during midnight hour saw price plummet to $2,477.40, establishing a key support zone.

- Extraordinary volume (291,395 units, nearly 3x average) confirmed the significance of the support level.

- Buyers stepped in at the $2,467-$2,480 support band, confirmed by high-volume accumulation during the 08:00-09:00 period.

- Recent price action shows bullish momentum with ETH reclaiming the $2,515 level.

- Potential higher low pattern suggests the correction may have found its bottom.

- $2,520-$2,530 area remains the immediate resistance to overcome for continued upward movement.

- Significant bullish surge at 13:35 saw price jump from $2,515.85 to $2,521.79, accompanied by exceptional volume (5,839 units).

- Sharp reversal occurred at 14:00, with price dropping 5.07 points to $2,508.02 on heavy volume (4,043 units).

- Hourly range of 14.46 points ($2,508.02-$2,522.48) demonstrates market indecision.

External References

- «Ethereum Holds Above Key Prices – Data Points To $2,900 Level As Bullish Trigger«, NewsBTC, published May 24, 2025.

- «Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level«, Bitcoinist, published May 25, 2025.

- «Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?«, CryptoPotato, published May 25, 2025.

Uncategorized

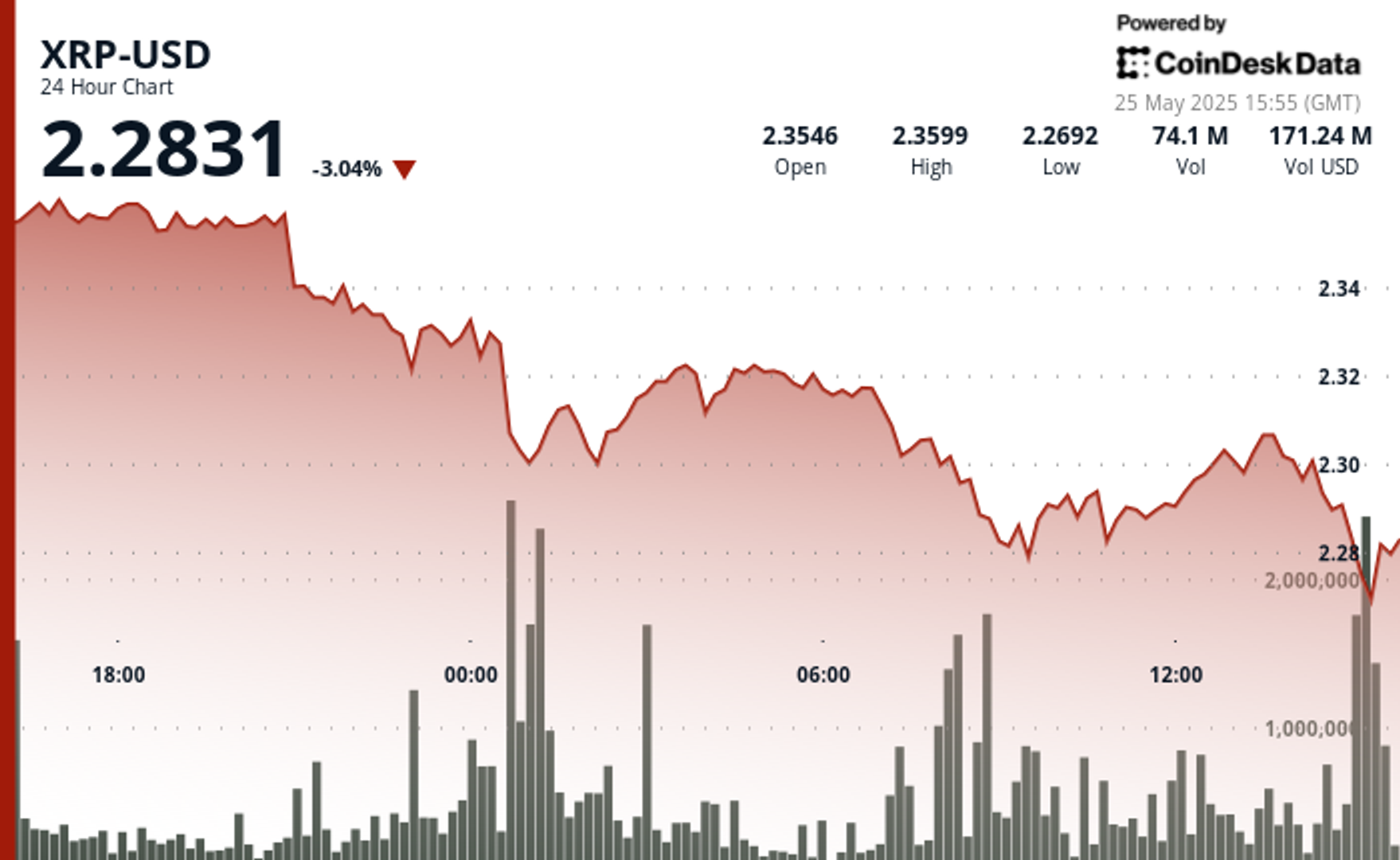

XRP Plunges Below $2.30 Amid Heavy Selling Pressure

Global economic tensions are weighing heavily on cryptocurrency markets as XRP experiences a significant correction amid heavy selling pressure.

The recent announcement of potential 50% tariffs on European Union imports by the US government has triggered widespread market uncertainty, with XRP falling alongside most major cryptocurrencies despite Bitcoin recently reaching new all-time highs.

Technical analysts point to critical support at the $2.25-$2.26 range, with market watchers warning that a break below this level could trigger deeper corrections toward the $1.55-$1.90 zone.

Meanwhile, institutional interest remains strong with Volatility Shares launching an XRP futures ETF and leveraged ETF inflows surging despite the price dip, suggesting Wall Street continues accumulating positions during market weakness.

Technical Analysis Highlights

- XRP underwent a notable 3.46% correction over the 24-hour period, with price declining from $2.361 to $2.303, creating an overall range of $0.084 (3.57%).

- The most significant price action occurred during the midnight hour (00:00), when XRP plummeted to $2.297 on exceptionally high volume (37.1M), establishing a strong volume-based support zone.

- A secondary sell-off at 08:00 saw price touch the period low of $2.280 with the highest volume spike (39.9M), confirming a double-bottom formation.

- In the last hour, XRP experienced significant volatility with a recovery attempt following the earlier correction.

- After reaching a low of $2.297 at 13:11, price formed a base around $2.298 before staging a substantial rally beginning at 13:27, peaking at $2.307 at 13:36-13:39 with exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $2.307, which was tested multiple times.

- The final 15 minutes saw profit-taking pressure emerge, with price retracing to $2.300, establishing a short-term support level that aligns with the psychological $2.30 threshold.

External References

- «XRP Price Watch: Consolidation or Collapse? Market Holds Breath Near $2.35«, Bitcoin.com News, published May 24, 2025.

- «XRP Price Prediction For May 25«, CoinPedia, published May 25, 2025.

- «XRP Risks Fall To $1.55 If This Support Level Fails – Analyst«, NewsBTC, published May 25, 2025.

Uncategorized

Bitcoin Drops Below $107.5K as Trump Tariff Threat Triggers Crypto Sell-Off

Bitcoin’s recent pullback has established strong volume-based resistance near $108,300, with support forming in the $106,700-$107,000 zone.

The correction accelerated with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal.

Technical analysis suggests Bitcoin is now trading within a compression zone, trapped between two major fair value gaps that will determine the upcoming market direction.

If bulls reclaim the $109K to $110K area, price could push toward resistance beyond $112K, while a break below $107,000 might test liquidity around $106K.

Technical Analysis Breakdown

- The decline accelerated during the 22:00-23:00 hour on May 24th with exceptionally high volume (16,335 BTC), establishing a strong volume-based resistance near $108,300.

- Support has formed in the $106,700-$107,000 zone where buyers emerged during the 09:00-10:00 period on May 25th, though recovery attempts have been modest with price consolidating around $107,500.

- The overall technical structure suggests a short-term bearish trend with potential for further consolidation before directional clarity emerges.

- Bitcoin experienced significant volatility with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal that saw prices decline to $107,393 by 14:00.

- The most substantial price movement occurred during the 13:35 minute candle where BTC jumped nearly $150 with exceptionally high volume (148.76 BTC), establishing temporary resistance around $107,630.

- Support formed near $107,400 where buyers emerged during the final minutes of the period, though the overall technical structure suggests continued consolidation within the broader correction from the $109,239 high.

External References

- «Bitcoin Price Prediction for May 25: Will Bulls Defend $108K or Is a Deeper Drop Ahead?«, Coin Edition, published May 24, 2025.

- «Why is Bitcoin Price Dropping Now? Will BTC Price Go Down to $100K?«, CoinPedia, published May 24, 2025.

- «Bitcoin Price Analysis: BTC Displays Signs of Weakness Following New All-Time High«, CryptoPotato, published May 25, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors