Business

Nvidia to Invest $5B in Intel and Develop Data Centers, PCs; AI Tokens Climb

Nvidia (NVDA), the world’s largest public company by market cap, said it will invest $5 billion in Intel (INTC) and work with the chipmaker on developing custom data-center and PC products as artificial intelligence becomes more pervasive. AI crypto tokens rose on the news.

The Santa Clara, California-based maker of the graphic processing units (GPUs) that underpin AI computing will buy shares of its neighbor at $23.28 each, 6.5% lower than Wednesday’s closing price of $24.90, according to an announcement on Thursday.

NEAR, the largest AI crypto token by market cap, climbed to over $2.95, its highest in a month, gaining more than 10% in 24 hours. TAO advanced 5.75% and FET 6.75%, outperforming the broader crypto market. The CoinDesk 20 Index added 3.41%.

While Nvidia is known for its GPU production, Intel was a leader in developing microprocessors and entered public consciousness as the provider of central processing units (CPUs) that drove IBM-compatible microcomputers. Its fortunes have declined as AI, with its intensive computing requirements, has taken root.

Intel stock surged 24% on Thursday, taking its market cap to $143 billion. That’s just a fraction of the $500 billion it boasted in 2000, according to companiesmarketcap.com. Nvidia, with a value of $4.23 trillion, rose 1.85%.

The U.S. government bought a 10% stake in Intel last month for $8.9 billion in an attempt to shore up the future of American chip manufacturing.

The crypto industry watches Nvidia’s performance with a keen eye as a proxy for market sentiment, which may reflect in AI tokens and the broader crypto market.

UPDATE (Sept. 18, 14:26 UTC): Adds AI crypto tokens’ performance in third paragraph.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

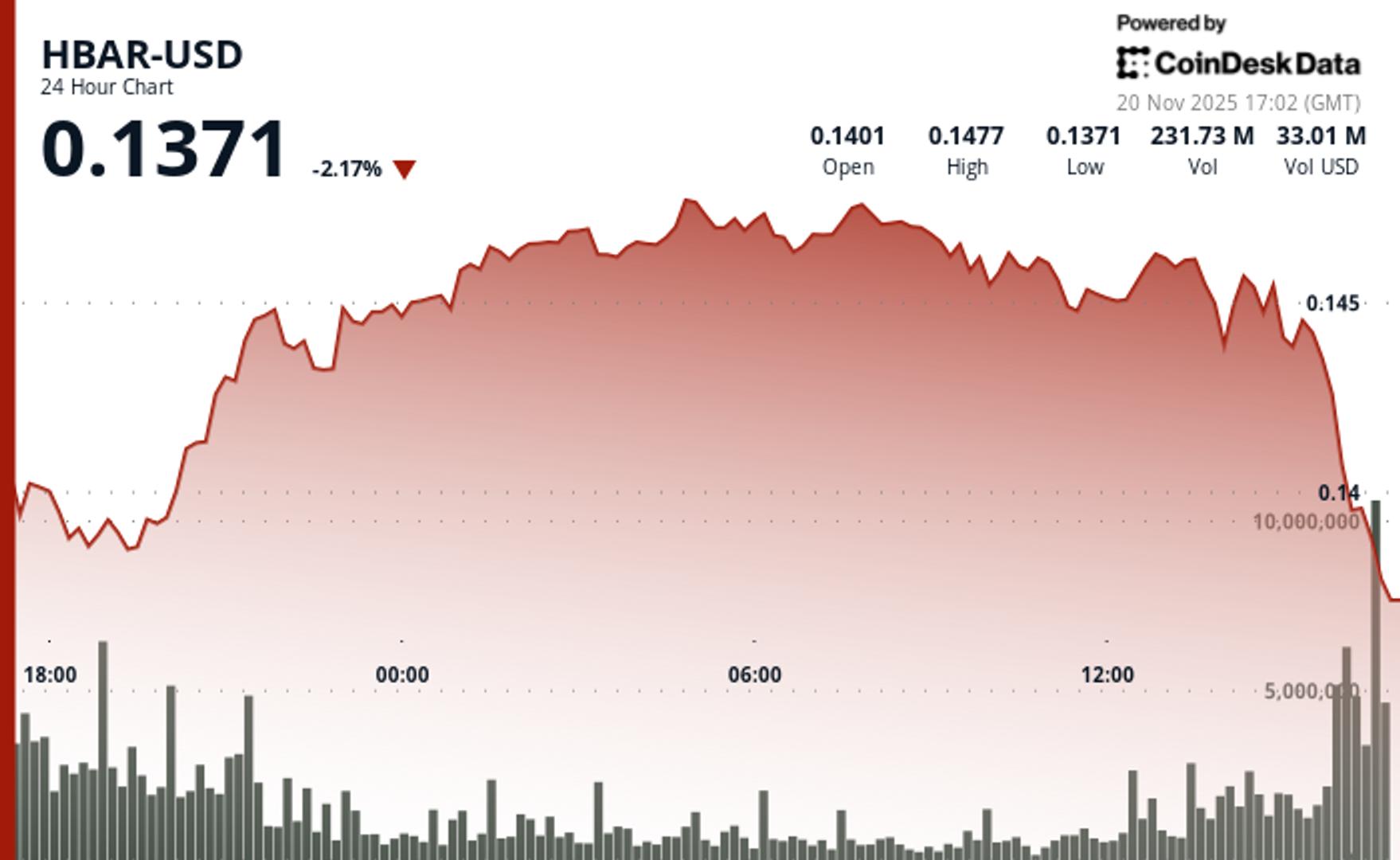

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton