Uncategorized

Nasdaq Seeks SEC Approval to List 21Shares Dogecoin ETF

The Nasdaq exchange filed a 19b-4 form with the Securities and Exchange Commission (SEC) on Tuesday to approve listing and trading shares of the 21Shares Dogecoin ETF.

Asset manager 21Shares submitted an S-1 registration with the SEC on April 10, as reported, in partnership with the House of Doge — the Dogecoin Foundation’s corporate arm — to help promote the fund.

The ETF aims to track the performance of dogecoin, as measured by the CF DOGE-Dollar US Settlement Price Index, adjusted for the Trust’s expenses and other liabilities.

It is a passive investment vehicle that will hold DOGE directly. The Trust will not utilize leverage, derivatives, or any similar arrangements to meet its investment objective, the filing mentioned.

Coinbase Custody Trust will hold the fund’s tokens and serve as the official custodian for the ETF.

The filing comes as the SEC postponed its decision on Bitwise’s spot DOGE ETF application, extending the review period until June 15.

Uncategorized

How Alpha-Generating Digital Asset Strategies Will Reshape Alternative Investing

Mainstream conversations around digital assets largely focus on the dramatic price performance of bitcoin and ether. For years, retail and institutional investors have targeted beta exposure, or returns that mirror the broader crypto market. However, the introduction of products like bitcoin exchange-traded funds (ETFs) and exchange-traded products (ETPs) have made achieving beta more accessible, with these products drawing over $100 billion in institutional capital.

But as the asset class matures, the conversation is shifting. More institutions are now pursuing alpha, or returns that exceed the market, through actively managed strategies.

The role of uncorrelated returns in diversification

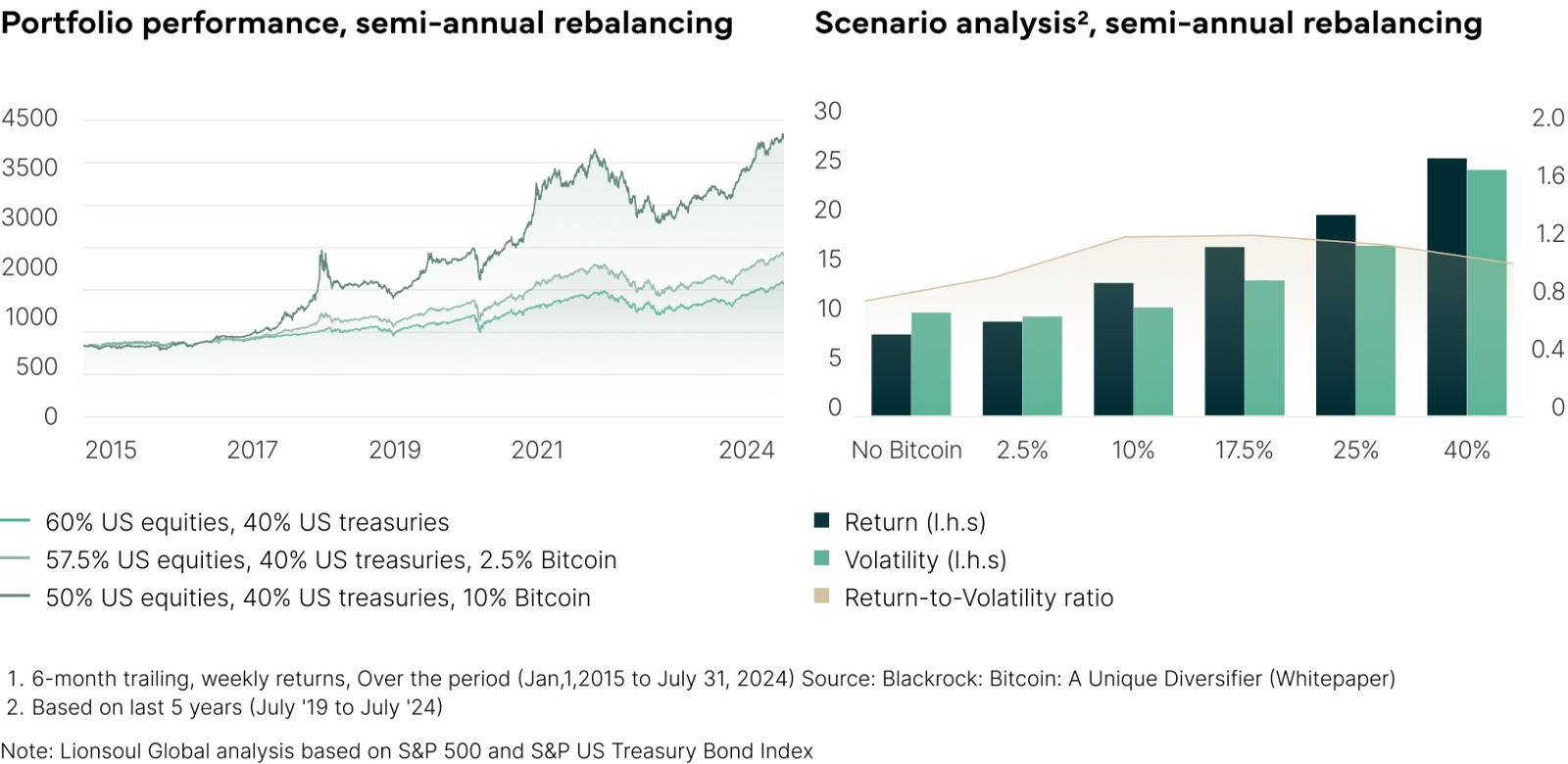

Low correlation to traditional assets enhances the role of digital assets in diversified portfolios. Since 2015, bitcoin’s daily correlation to the Russell 1000 Index has been just 0.231, meaning that bitcoin’s daily returns move only weakly in the same direction as the Russell 1000 Index, with gold and emerging markets remaining similarly low. A modest 5% allocation to bitcoin in a 60/40 portfolio, a portfolio containing 60% equities and 40% fixed income, has been shown to boost the Sharpe ratio (the measure of risk-adjusted return on a portfolio) from 1.03 to 1.43. Even within crypto itself, varying correlations allow for intra-asset diversification. This makes digital assets a powerful tool for risk-adjusted return enhancement [see exhibit 1].

Digital assets enter the active era

Just as hedge funds and private equity redefined traditional markets, digital assets are now evolving beyond index-style investing. In traditional finance, active management represents over 60% of global assets. With informational asymmetries, fragmented infrastructure and inconsistent pricing, digital assets present a compelling landscape for alpha generation.

This transition mirrors the early stages of the alternatives industry, when hedge funds and private equity capitalized on inefficiencies long before these strategies were adopted by the mainstream.

Market inefficiencies

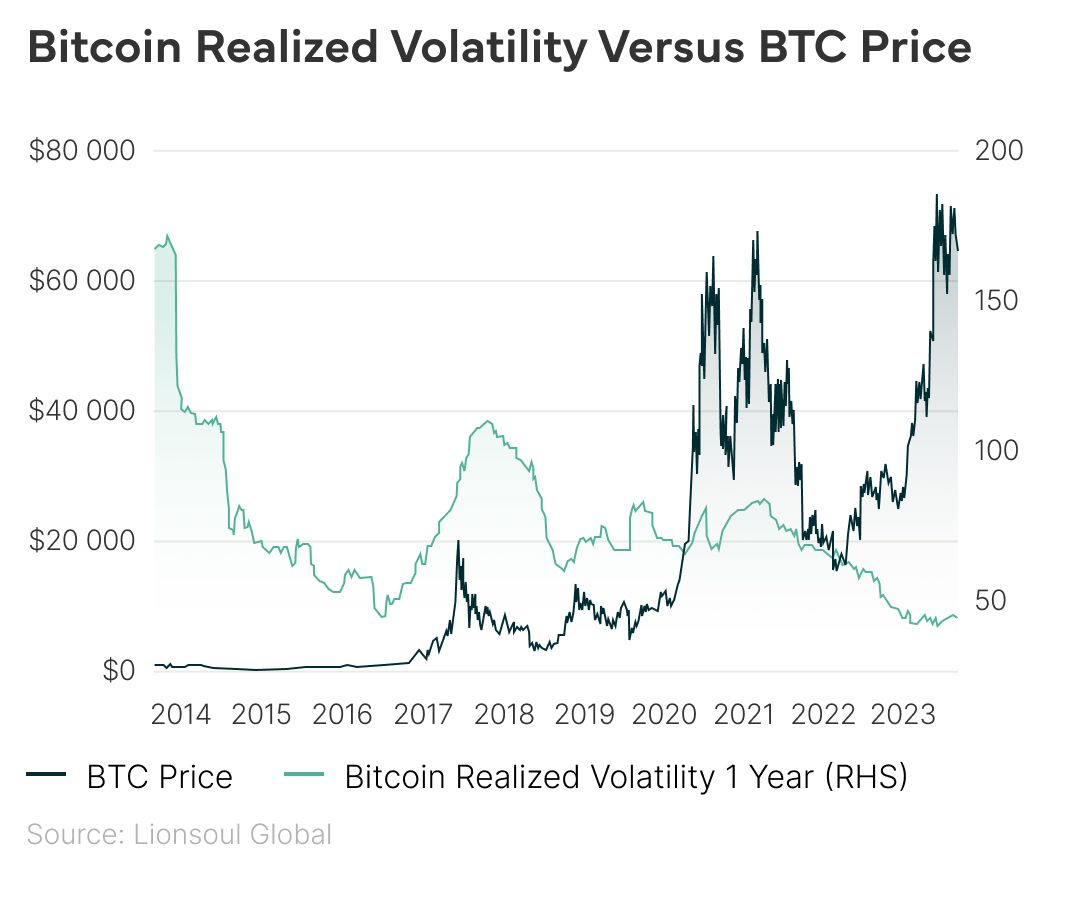

Crypto markets remain volatile and structurally inefficient. Though bitcoin’s annualized volatility fell below 40% in 2024, it remains more than twice that of the S&P 500. Pricing inconsistencies across exchanges, regulatory fragmentation and the dominance of retail behavior create significant opportunities for active managers.

These inefficiencies — combined with limited competition in institutional-grade alpha strategies — present a compelling case for specialized investment approaches.

- Arbitrage strategies: Utilization of trading strategies such as cash and carry, which captures spreads between spot and futures prices, or basis trading, which involves entering long positions in discounted assets and shorts in premium ones, enables alpha generation by utilizing market inefficiencies within the digital assets market.

- Market making strategies: Market makers earn returns by placing bid/ask quotes to capture spread. Success relies on managing risks like inventory exposure and slippage, especially in fragmented or volatile markets.

- Yield farming: Yield farming taps into Layer 2 scaling solutions, decentralized finance (DeFi) platforms and cross-chain bridges. Investors can earn yields through lending protocols or by providing liquidity on decentralized exchanges (DEXs), often earning both trading fees and token incentives.

- Volatility arbitrage strategy: This strategy targets the gap between implied and realized volatility in crypto options markets, offering market-neutral alpha through advanced forecasting and risk management.

High upside and an expanding universe

Meanwhile, new opportunities continue to emerge. Tokenized real-world assets (RWAs) are projected to exceed $10.9 trillion by 2030, while DeFi protocols, which have amassed 17,000 unique tokens and business models while accumulating $108 billion+ in assets, are expected to surpass $500 billion in value by 2027. All of this points towards an ever expanding, ever developing digital asset ecosystem that is ideal for investors to utilize as a legitimate alpha generating medium.

Bitcoin’s price has surged over the years, while its long-term realized volatility has steadily declined, signaling a maturing market.

Uncategorized

AI Crypto Agents Are Ushering in a New Era of ‘DeFAI’

Imagine your investments working around the clock, scanning global markets for the best opportunities — all without you having to lift a finger. Sound futuristic? It’s already a reality.

In traditional finance (TradFi), algorithms handle nearly 70% of U.S. stock trades. Now, artificial intelligence (AI) agents are stepping up. These aren’t just basic bots but innovative systems that learn, adapt and make real-time decisions. VanEck predicts the number of AI agents will skyrocket from 10,000 to over a million by the end of 2025.

What this means for you

AI agents are already at work behind the scenes analyzing market trends, balancing portfolios and even managing liquidity across decentralized exchange platforms like SaucerSwap and Uniswap. They’re blurring the lines between TradFi and decentralized finance (DeFi), with cross-chain transactions expected to jump 20% in 2025.

Can we really trust AI with our money?

Autonomous finance isn’t new, but today’s AI agents operate with increased autonomy and sophistication. So, can we trust these agents to manage billions in digital assets? What safeguards exist when decisions come from algorithms, not humans? Who would be held responsible for market manipulation performed by an agent?

These concerns are valid. As AI agents take on more responsibility, and especially as the convergence between crypto and TradFi accelerates, worries around transparency and market manipulation will grow. For example, some blockchains enable front running trades and sandwich attacks that can exploit blockchain consensus in a process known as Maximal Extractable Value (MEV). These transaction strategies harm fairness and market trust. Operating at machine speed, AI agents could supercharge these risks.

Enter DLT: the trust layer we need

Trust is key, and distributed ledger technology (DLT) offers a solution. DLT provides real-time transparency, immutability and decentralized consensus, ensuring decisions are trackable and auditable. The Identity Management Institute reported companies that integrated blockchain identity systems have already cut fraud by 40% and identity theft by 50%. Applying these guardrails to AI-driven finance can counter manipulation and promote fairness. Moreover, the use of DLTs with fair ordering is growing rapidly, ensuring transactions are sequenced fairly and unpredictably, addressing MEV concerns and promoting trust in decentralized systems.

DeFAI: where finance is headed

A blockchain-powered, trust-centric model could unlock a new paradigm, “DeFAI”, in which autonomous agents can operate freely without sacrificing oversight. Open-source protocols like ElizaOS, which have blockchain plugins, are already enabling secure and compliant AI interactions between agents across DeFi ecosystems.

Bottom line: trust will define the future of AI

As AI agents take on more complex roles, verifiable trust becomes non-negotiable. Verifiable compute solutions are already being built by firms like EQTY Lab, Intel and Nvidia to anchor trust on-chain. DLT ensures transparency, accountability and traceability. This is already in motion; on-chain agents are now operating that offer services ranging from trade execution to predictive analytics. We can trust AI when we have trust in the model input and output.

The question now isn’t if institutions will adopt autonomous finance, but whether frameworks can evolve fast enough. For this revolution to thrive, trust must be embedded into the foundation of the system.

Uncategorized

Coinbase Leaps Into Supreme Court Case in Defense of User Data Going to IRS

Coinbase (COIN) filed a brief in the U.S. Supreme Court case involving an Internal Revenue Service request for data on hundreds of thousands of its customers back in 2016, arguing the court should «protect Americans’ privacy interests in digital information stored by third-party service providers.»

The U.S. tax agency — in an action during the first administration of President Donald Trump — had been seeking financial records under the stance that the individuals’s transaction records should be made available once they’d shared their information with a third party. In this instance, that party was Coinbase. The exchange fought to narrow the request through court battles and eventually was compelled to deliver a much narrower scope of data.

«The court should intervene to clarify that the third-party doctrine does not allow the IRS to conduct dragnet searches,» Coinbase contended in its amicus brief filed on Wednesday in the case that has wide privacy implications.

In 2020, one of the customers, James Harper, a Bitcoin (BTC) researcher, filed a lawsuit against the IRS, accusing it of improper overreach in its demand for records. Years later, Harper — a lawyer and fellow and the American Enterprise Institute — has his argument before the high court.

«User anonymity vanishes — and the blockchain becomes susceptible to easy surveillance — when the government acquires information that allows it to match a public key or wallet address to a user’s identity,» Coinbase noted.

«This John Doe summons invaded a sphere in which over 14,000 Americans had a reasonable expectation of privacy against a warrantless IRS trawl for extensive personal and financial information,» the company argued.

Representing the government’s case, the Department of Justice had previously argued that «a person lacks a reasonable expectation of privacy in information voluntarily provided to a third party, including bank records pertaining to him.»

Read More: How a Lawsuit Against the IRS Is Trying to Expand Privacy for Crypto Users

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors