Uncategorized

MicroStrategy’s Dismal December Still Keeps It at Top of 2024 Bitcoin-Tied Asset Rankings

Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR)

It’s been a tough month for MicroStrategy (MSTR), the software developer turned bitcoin (BTC) accumulator. Its stock has tumbled almost 50% since November, when it joined the Nasdaq 100 index and peaked at a 600% gain since the start of the year.

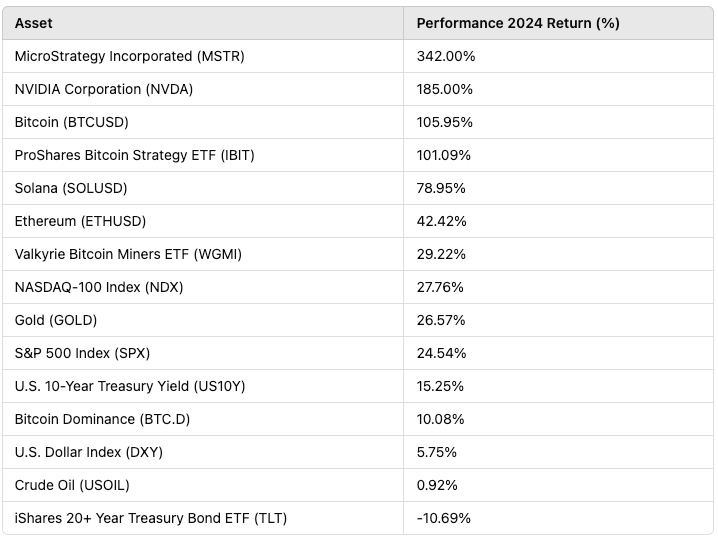

That still leaves the Tysons Corner, Virginia-based company a whopping 342% ahead in 2024, the biggest return among the highest-profile crypto-linked assets in traditional finance (TradFi).

It’s been a volatile year, packed with geopolitical and technological developments to rattle financial markets. The continuing wars in eastern Europe and the Middle East, elections across the globe, the unwinding of the yen carry trade in August and the growth of artificial intelligence (AI) have all left their marks.

MicroStrategy’s gain is almost double that of Nvidia (NVDA), the chipmaker whose production of integrated circuits needed for AI applications fueled a 185% return, the best among the so-called magnificent seven tech stocks. The next best, Meta Platforms (META), turned in 71%.

Bitcoin itself rose 100% in a year that included April’s reward halving and multiple record highs. Demand for the largest cryptocurrency was driven by the January approval of spot exchange-traded funds (ETFs) in the U.S. Bitcoin outperformed two of its biggest competitors, ether (ETH), up 42%, and Solana (SOL), up 79%.

Among the ETF’s iShares Bitcoin Trust (IBIT) also returned over 100% and became the fastest ETF in history to hit $50 billion in assets.

Bitcoin mining companies, on the whole, disappointed. Valkyrie Bitcoin Miners ETF (WGMI), a proxy for mining stocks, rose just under 30%. That’s despite demand for the miners’ computing capabilities and power supply agreements from artificial intelligence and high-performance computing (HPC) companies. Still, individual companies benefited, in particular, Bitdeer (BTDR),which added 151%, and WULF (WULF), which gained 131%.

Nevertheless, the miners’ gains beat the broader equities market. The tech-heavy Nasdaq 100 Index (NDX) added 28% while the S&P 500 Index (SPX) rose 25%. The S&P 500 also trailed behind gold’s 27% increase. The precious commodity has now topped the equity gauge in three of the past five years.

Concerns about U.S. inflation and the country’s budget deficit added to the geopolitical uncertainties to prompt a massive rise in U.S. treasury yields, which move in the opposite direction to price.

The yield on the 10-Year Treasury added 15% to 4.5% over the course of the year, and surprisingly gained a full 100 basis points since the Federal Reserve started cutting interest rates in September.

The iShares 20+ Year Treasury Bond ETF (TLT), which tracks bond prices, dropped 10% this year and has lost 40% in the past five years.

The dollar, on the other hand, showed its strength. The DXY Index (DXY), a measure of the greenback against a basket of the currencies of the U.S.’ biggest trading partners, rose to the highest since September 2022.

West Texas Intermediate (USOIL), the benchmark oil price in the U.S., ends the year little changed, up less than 1% to around $71 a barrel. But it was a bumpy ride, with the price rising to almost $90 at some points in the past 12 months.

As we head into the new year, all eyes will be on the debt ceiling discussion, the policies of President-elect Donald Trump and whether the U.S. can continue with its impressive growth story.

Uncategorized

Bitcoin Faces Risk of Pullback to $100K as Momentum Indicator Diverges Bearishly: Technical Analysis

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin’s BTC bull run has stalled, with emerging technical signals pointing to a possible price pullback.

The leading cryptocurrency by market value traded near $108,000 at press time, probing the bullish trendline, characterizing the sharp rise from $75K to record highs over $110K, TradingView data show.

There has been little bullish action in the past 24 hours despite reports that the Trump family media company plans to raise $3b billion to buy cryptocurrencies such as bitcoin.

A key momentum indicator called the 30-day rate of change (ROC), which measures the percentage increase or decrease in bitcoin’s price over the past month, has chalked out a «bearish divergence.»

The bearish pattern happens when an asset’s price rises, but momentum indicators like the 30-day rate of change (ROC) fail to confirm the same, hinting at potential weakness and price correction.

Although bitcoin remains within a bullish upward channel, the 30-day ROC is forming lower highs, signaling a bearish divergence and weakening momentum.

Additionally, the daily chart moving average convergence divergence (MACD) histogram, an indicator widely used to gauge trend strength and changes, has flipped negative, indicating a bearish shift in momentum.

All this means that BTC could dive out of the bullish ascending channel, potentially revisiting the major psychological resistance-turned-support at $100,000.

The broader outlook remains constructive, consistent with the recent golden cross of the 50- and 200-day simple moving averages (SMAs).

Uncategorized

Asia Morning Briefing: Thai Banks May Soon Hold Crypto, SCB10X CEO Signals Sandbox Push

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Uniswap’s UNI token surged from $6.00 to $6.65 over the past 24 hours, pushing the token up 5%, while the broader market gauge CoinDesk20 Index fell 1.8% in the last 24 hours. This momentum coincides with Uniswap recording its highest monthly transaction volume since February, processing over $73 billion in trades and generating more than $380 million in revenue this year, as institutional interest grows and a notable whale re-entered the market by acquiring nearly $4 million worth of UNI.

SCB10X’s New CEO Sees US-Asia Crypto Dealflow, AI Opportunities

Kaweewut Temphuwapat, the new CEO of SCB10X, the venture arm of Thailand’s SCB bank, sees significant opportunities emerging at the intersection of AI, crypto, and Web3. «We definitely [are] going more on AI and also crypto and AI plus crypto,» Temphuwapat told CoinDesk, highlighting these hybrid investments as firmly «under our radar.»

He predicts clearer crypto regulation in the U.S. will fuel increased deal flow into resilient Asian markets, noting SCB10X’s early success investing in Ripple: «We are an early investor in Ripple of 10 years ago… we’ve used that technology for the last five to six years in our SCB App.»

Temphuwapat praised Thailand’s proactive and innovative regulators, highlighting the country’s robust payments infrastructure. He expects Thai banks, including SCB, could soon directly hold crypto tokens on their balance sheets, initially through regulatory sandboxes: «The intention is there… they allow us to do [it] in a small scale.»

Trader James Wynn Shifts From Billion-Dollar Bitcoin Bets to Memecoins, Goes Long Pepe

Pseudonymous trader «James Wynn,» known for high-stakes crypto bets on decentralized platform Hyperliquid, has shifted focus from billion-dollar bitcoin positions to memecoins, recently placing a leveraged $1 million bet on Pepe (PEPE), CoinDesk reported earlier.

Previously, Wynn closed a massive $1.2 billion bitcoin long position at a $17.5 million loss, before pivoting to a $1 billion short position at 40x leverage, effectively wagering their entire $50 million wallet balance on bitcoin’s downside. That short briefly netted Wynn about $3 million in profit before closing, marking one of the largest trades ever executed fully on-chain.

Wynn announced stepping back from perpetual trading after securing a cumulative profit of $25 million, earned from an initial investment of just over $3 million. The trader’s latest high-leverage PEPE position has already gained $500,000 amid a nearly 6% rise in the memecoin’s value.

Strategy Buys Another 4,020 Bitcoin for $427M, Total Holdings Surpass 580K BTC

Strategy (MSTR), the largest corporate holder of bitcoin, purchased an additional 4,020 BTC between May 19 and May 25 for roughly $427 million, bringing its total holdings to 580,250 BTC, CoinDesk previously reported. The acquisition was funded through three separate at-the-market equity programs, including sales of common and preferred stock totaling approximately $427 million.

These latest bitcoin purchases were executed at an average price of $106,237 per coin, pushing Strategy’s total investment in bitcoin to over $40.6 billion, at an average cost basis of $69,979 per coin. The acquisitions reflect the company’s ongoing commitment to expanding its sizable bitcoin holdings through regular capital raises and share issuances.

Market Movements:

- BTC: Bitcoin holds steady near record levels around $109,000, consolidating gains despite tariff-induced volatility, as long-term investors continue accumulating amid macroeconomic uncertainty.

- ETH: Ethereum maintains resilience above $2,500 amid volatility and cautious whale behavior, supported by continued institutional inflows into spot ETH ETFs.

- Gold: Gold dips slightly on tariff delay but stays above $3,310 as deficit concerns fuel bullish outlook.

- Hang Seng: Hong Kong’s Hang Seng opened lower, trading above 23,304, led by tech losses, including Meituan’s 4.9% decline.

- Nikkei: Japan’s Nikkei 225 dipped 0.13% Tuesday morning as markets assessed Trump’s tariff delay.

- S&P 500: Closed for Memorial Day.

Elsewhere in Crypto…

Uncategorized

Bitlayer Joins Forces With Antpool, F2Pool, and SpiderPool to Supercharge Bitcoin DeFi

Bitlayer, a Bitcoin Layer 2 built on the BitVM paradigm, has partnered with three of the world’s largest bitcoin BTC mining pools — Antpool, F2Pool, and SpiderPool — in a first-of-its-kind collaboration to accelerate the real-world adoption of BitVM, a breakthrough technology focused on enabling Bitcoin-native DeFi.

Bitcoin’s ecosystem has lagged behind other Layer 1s like Ethereum for years due to technical limitations — especially its lack of support for Turing-complete smart contracts. Bitlayer’s BitVM paradigm addresses this by offering Bitcoin-equivalent security and Turing completeness without altering Bitcoin’s core protocol or compromising its foundational design.

But turning that vision into reality requires the cooperation of miners — the entities that create new blocks and validate transactions in exchange for BTC. That’s precisely what this new partnership secures.

The three mining pools, representing over 36% of Bitcoin’s total computing power (hashrate), have agreed to support non-standard transactions (NSTs) — a critical piece of BitVM’s challenge-response mechanism, the firms said. Their support removes a key bottleneck to BitVM deployment and brings the system closer to widespread use.

NSTs are transactions that are valid under Bitcoin’s consensus rules but are not relayed by the default Bitcoin Core software, making them hard to get confirmed on-chain without miner cooperation.

Under this partnership, Antpool, F2Pool, and SpiderPool will serve as guardians of the BitVM Bridge, ensuring NSTs are reliably included in blocks and become part of Bitcoin’s immutable ledger.

The BitVM bridge is a special tool that facilitates secure and reliable movement of BTC into other blockchain ecosystems — such as rollups, cross-chain protocols, and smart contracts — without relying on centralized intermediaries. It opens the door for broader Bitcoin DeFi applications while preserving the network’s robust security guarantees.

“BitVM represents the most credible path to bring on-chain validation to Bitcoin while maintaining its core security. This partnership solves the critical last-mile challenge of getting Non-Standard Transactions included on-chain,” said Kevin He, co-founder of Bitlayer, in a press release shared with CoinDesk.

A win for miners

This isn’t just a milestone for Bitlayer — it’s a strategic win for miners as well, especially as they face dwindling income due to per-block BTC rewards being cut in half every four years.

Andy, CEO of Antpool, noted that Bitlayer’s BitVM can help drive new economic activity and fee-based income for miners.

«Built on BitVM, Bitlayer enables BTC to flow into DeFi and Layer 2 ecosystems. That means more use, more fees, and long-term sustainability for miners,» Andy said in the press release.

Leon Liang, chief strategy officer at F2Pool, emphasized the importance of innovation, saying, «we want to support high-quality projects like Bitlayer that expand what Bitcoin can do.”

SpiderPool CTO Kenway spoke to the broader potential of Bitcoin as a financial services platform, stating, «This partnership lets us unlock new possibilities for Bitcoin DeFi. It enhances Bitcoin’s utility while reinforcing miners’ central role in the ecosystem.”

Demand for bitcoin DeFi is growing rapidly

Bitlayer’s collaboration with mining giants follows recent integrations with major Layer 1 ecosystems like Sui, Base, Arbitrum, and Starknet. Together, these partnerships reflect a growing demand for secure, Bitcoin-native DeFi infrastructure that scales.

Bitlayer is actively onboarding more validators and early adopters to help secure and expand the BitVM Bridge — and to build what could become the cornerstone of Bitcoin’s next evolution.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors