Uncategorized

Mango Markets Exploiter Avi Eisenberg Sentenced to 4+ Years in Prison for Child Porn

NEW YORK, NY — Mango Markets exploiter Avraham “Avi” Eisenberg, who stole $110 million from the now-defunct decentralized finance protocol in 2022, was sentenced to 52 months in prison on Thursday — on his guilty plea to possession of child sexual exploitation material, not for his conviction on the crypto theft.

The sentencing comes a year after a New York jury found Eisenberg guilty of wire fraud, commodities fraud and commodities manipulation for his Mango Markets stunt, and a year after he separately pleaded guilty to the possession of child sexual abuse material (CSAM), which was found on his devices after his arrest.

Defense attorneys moved for either a new trial or an acquittal on the Mango Markets-related charges last year, claiming that the Department of Justice pursued the case in the wrong venue (the Southern District of New York), that the government hadn’t properly proved that the MNGO Perpetual was a «swap,» that Eisenberg intended to manipulate the MNGO Perpetual’s price and that his «alleged deceptions … were immaterial.»

In a hearing in Manhattan on Thursday, Judge Arun Subramanian said he would sentence Eisenberg to more than four years in prison at FCI Otisville, a medium-security facility about two hours’ drive from Manhattan, but that there was a «non-zero chance I will grant that motion» related to the Mango Markets-related charges.

The bulk of any sentence would be related to the CSAM charge anyway, the judge said.

«I think that in this specific area, general deterrence has more weight … the only way to try to stem the tide of the distribution of this material» is through a prison sentence, the judge said, before reading three witness statements.

The judge also said he acknowledged to Eisenberg’s effort to better understand the impact of his crime, but that a prison sentence was still necessary. Eisenberg is sentenced to five years of probation with strict rules after he is released from prison, the judge said, but will have to install monitoring software on all of his electronic devices and go through a drug outpatient program.

Presentence filings

In their sentencing submission to the court, prosecutors asked for Eisenberg to serve between 6.5 and 8 years in prison, stressing the seriousness of his offenses. Though Eisenberg has maintained that his crypto trading actions on Mango Markets were “compliant” with the protocol and thus didn’t break the law (an argument a jury clearly did not buy), prosecutors say Eisenberg was well aware that what he was doing was a crime. Before his Mango Markets heist, he’d filed suit against someone else for crypto-related market manipulation, and fled the country for Israel once his identity as the attacker was unveiled.

Prosecutors also detailed Eisenberg’s child sexual abuse material charges, telling the judge that between 2017 and 2022, he downloaded 1,274 sexually-explicit images and videos of children — including toddlers and two-month-old infants — as well as “depictions of sadistic violence and masochism against children.”

In their own sentencing submission to the court, Eisenberg and his lawyers attempted to blame his strict religious upbringing and his lifelong “struggles to conform to social norms” for his crimes, calling him a “fundamentally decent person” and detailing his challenges adapting to the “daily horrors” of life in jail.

Uncategorized

Dogecoin, XRP ETF Hopes Are Fuelling Bullish Sentiment, Social Data Shows

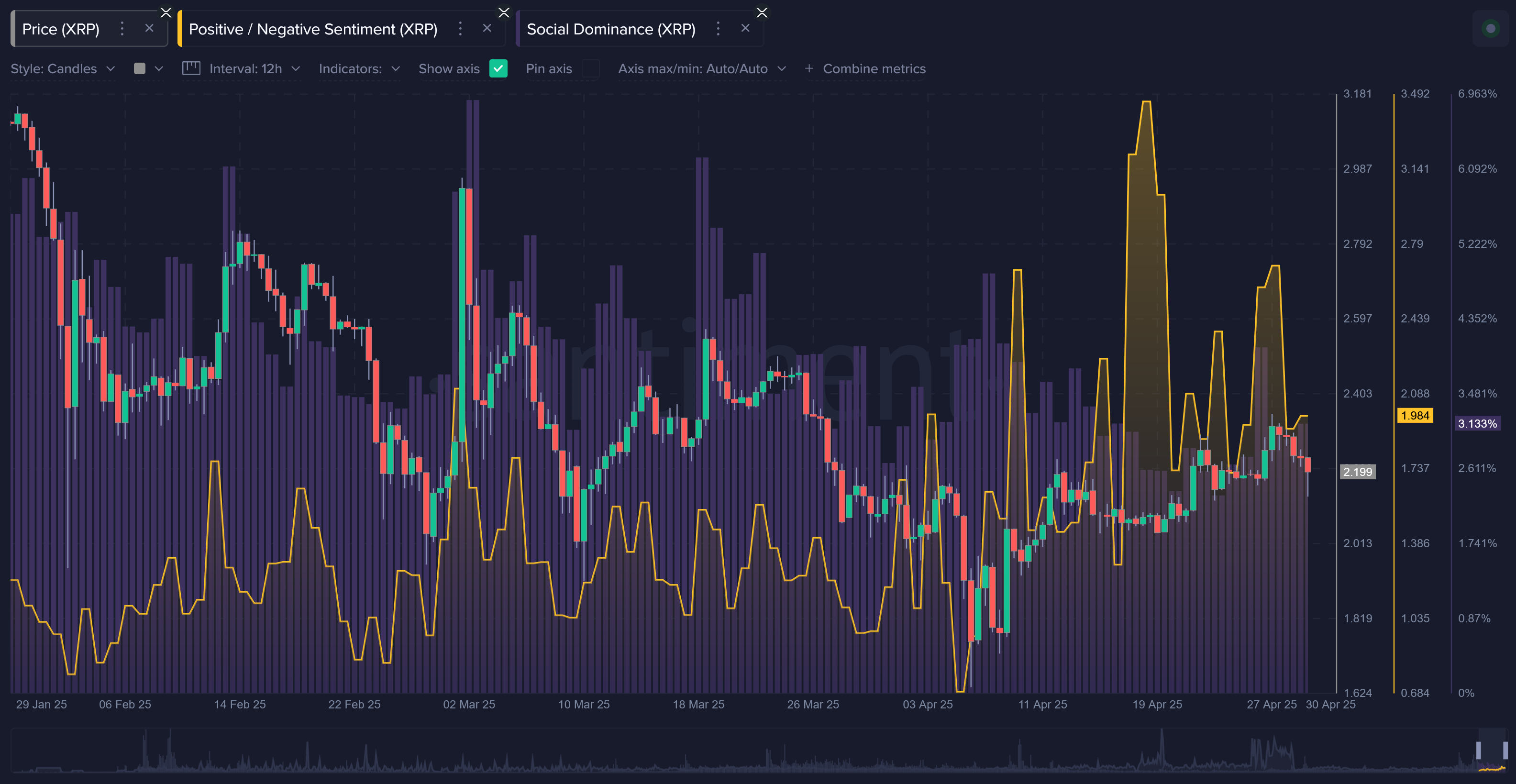

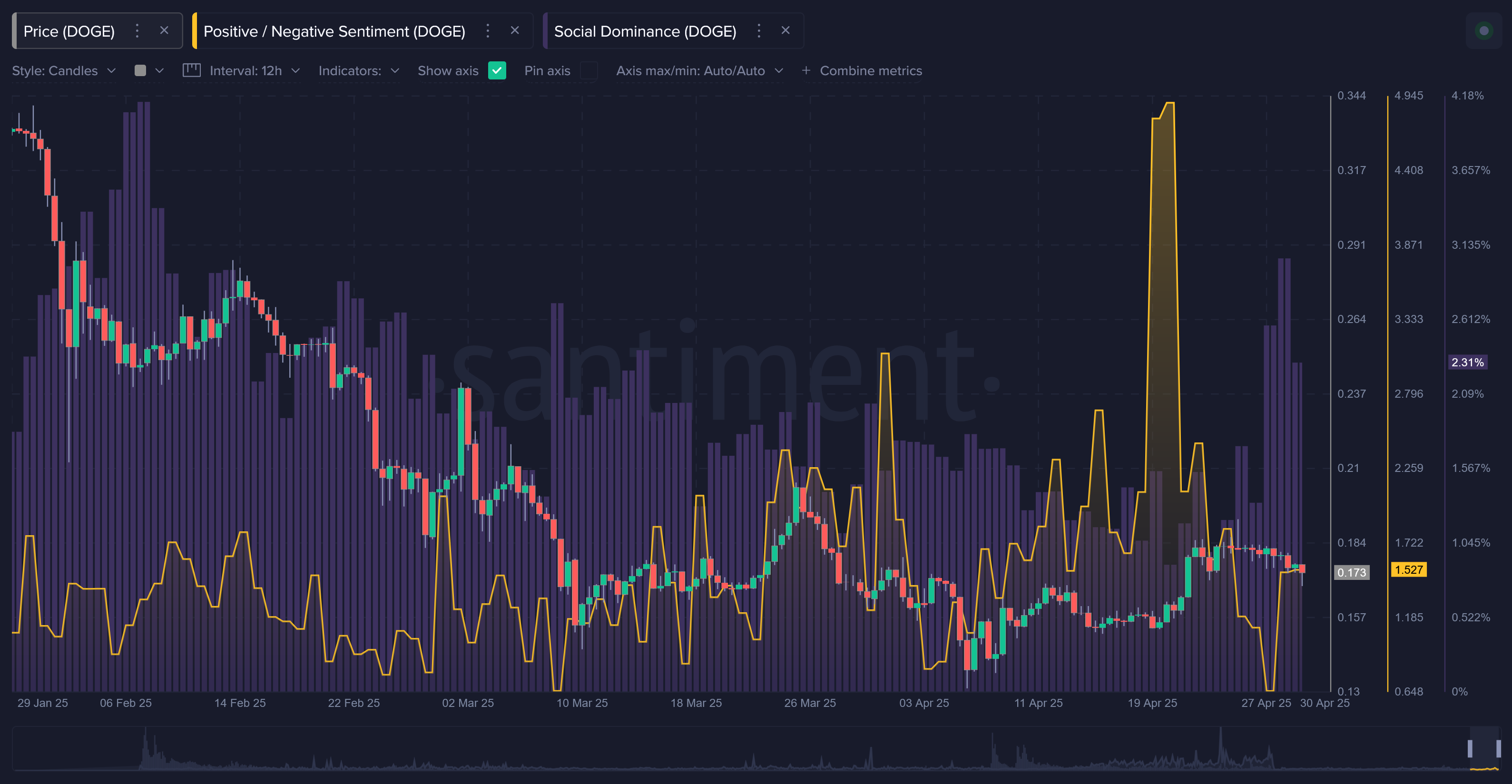

Optimism for dogecoin (DOGE) and XRP based exchange-traded funds (ETFs) is rising sharply with crowd sentiment shifting in favor of both tokens, social data from Santiment in a Thursday update shows.

Monitoring social commentary can be used alongside technical tools in a trading strategy, as positive chatter tends to support price rises, while negative chatter can fuel bearish trades.

Online discussions around XRP are skewed toward bulls with few bearish outlooks, despite an overall drop in social discussions for XRP compared to other majors. The perceived likelihood of a spot XRP ETF approval by the end of 2025 has risen to 85%, up from 65% just two months ago, per Polymarket.

Such a boost in confidence comes despite the SEC’s recent decision to delay rulings on spot DOGE and XRP ETF proposals until June 17. Technical analysis remains bullish, showing strong accumulation patterns in the current market lull.

Online tone for Dogecoin has shifted dramatically following the April filings by 21Shares and Bitwise for DOGE spot ETFs. Until late April, DOGE was in a prolonged lull in social attention, but its social dominance has now surged to a three-month high, Santiment noted.

The House of Doge and Dogecoin Foundation’s support for 21Shares’ application has added further credibility to the effort, helping DOGE shed some of its «memecoin» baggage.

“After being seen mainly as a meme or joke coin, DOGE is now viewed as a more serious investment option with potential for wider adoption,” Santiment said.

“Analysts and traders have noticed heavy accumulation by whales, with bullish patterns forming in the charts, which has added to the sense that Dogecoin may be entering a new growth phase,» it added.

Meanwhile, tokens like ether (ETH), Solana’s SOL and BNB show mixed social signals even as bitcoin staged a recovery above $97,000 early Friday.

Uncategorized

Bitcoin Jumps Above $97K as Traders Optimistic U.S.-China Trade Deal Possible

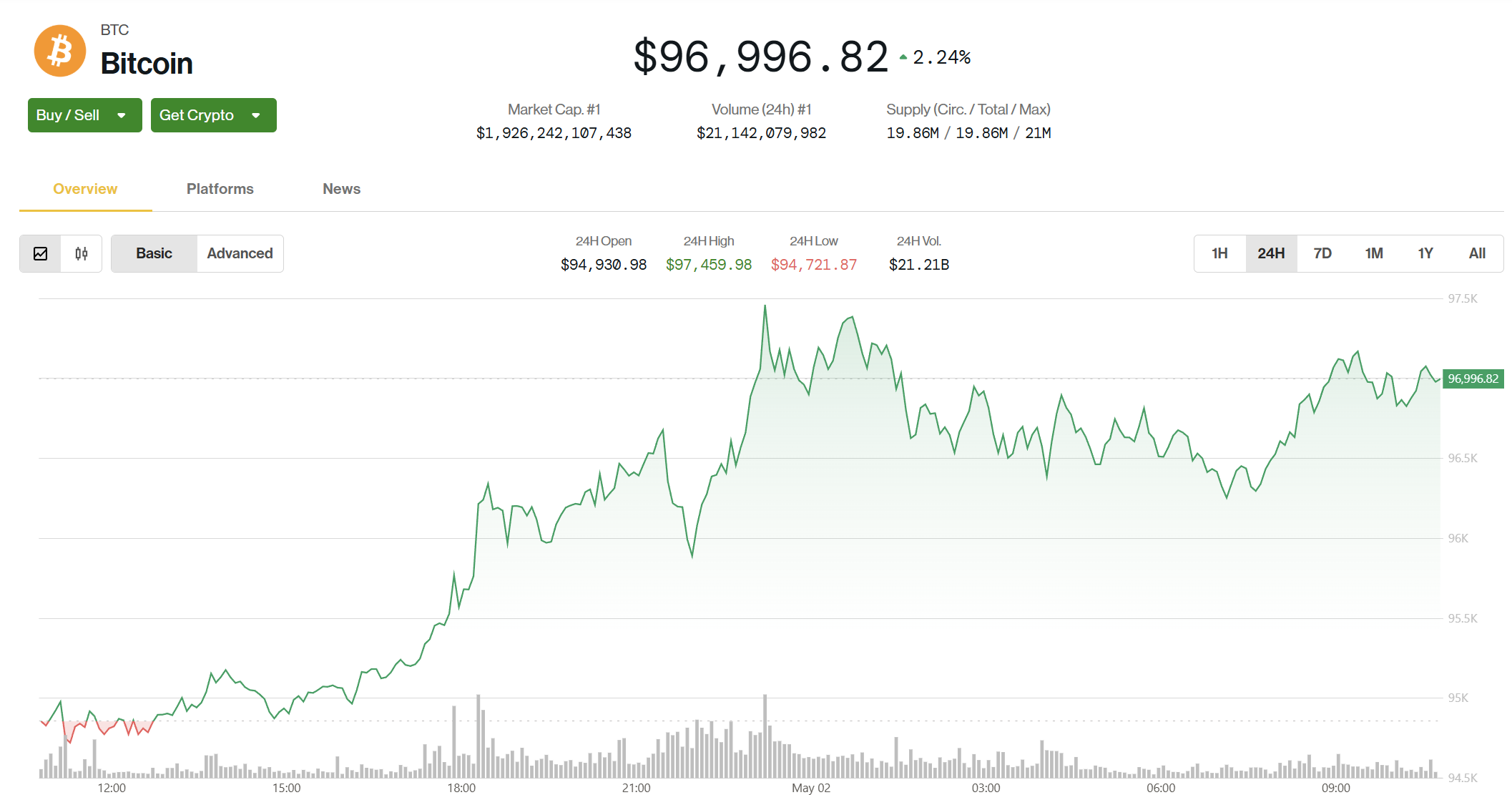

Bitcoin (BTC) is trading above $97,000 during the Asian morning hours as the market breathes a sigh of relief that the U.S. and China are said to be working on a trade deal, even if the market is also skeptical that a deal will be reached this month.

«The U.S. has proactively reached out to China through multiple channels, hoping to hold discussions on the tariff issue,» China state media posted on social media.

Dogecoin (DOGE) led gains among majors with a 4% rise in the past 24 hours. Cardano’s ADA, XRP, ether (ETH) and BNB rose between 1-3%, with the broad-based CoinDesk 20 (CD20) rising 2.2%.

Movement’s MOVE extended losses to 21% as the company confirmed founder Rushi Manche had been suspended following a CoinDesk exposé of possible token manipulation involving the 21-year-old.

On Polymarket, bettors are skeptical that a deal will come this month, giving it only a 20% chance of happening by June. Bettors are likely concerned that the hawkish rhetoric from the White House means a deal may take longer than a month to be reached.

The speed and intensity of the tariffs the White House announced earlier this year panicked the market, leading to a significant drop in BTC’s price, but with this apparent trade detente, $100,000 bitcoin is back on the agenda.

Other crypto metrics are looking healthy, market observers say, putting $100K bitcoin in sight.

«Momentum continues to build across crypto with spot flows broadening, alt activity heating up and subtle but meaningful shifts in market structure,» trading and technology group Flowdesk said in a recent market note.

«As BTC ranges above $90K, undercurrents of risk appetite are growing stronger within both spot and derivative markets. Liquidity remains strong with rising volumes, surging weekend activity, and improving altcoin depth. At the same time, broad-based spot buying continues, led by speculative alts and AI tokens, alongside $1.5B in Bitcoin ETF inflows as institutional demand grows,» Flowdesk also wrote.

The market is also likely optimistic about Strategy’s continued BTC buys, and push towards further institutionalization.

As CoinDesk recently reported, Michael Saylor announced that Strategy is raising $21 billion for more BTC buys.

In a recent note, Presto Research said investors are increasingly impressed by Strategy’s growing institutional sophistication, highlighted by new valuation frameworks like BTC Torque and a strong focus on accurately pricing its fixed-income instruments.

Kava milestone pushes AI tokens higher

Artificial Intelligence (AI) tokens are in the green on Friday as the market reacts positively to news from Kava Labs that it hit 100K users of its decentralized AI platform.

Data from CoinGecko shows the market segment is up 3%, beating the CoinDesk 20, a measure of the performance of the largest digital assets, which is up by 1.8%.

«People are turning to Kava AI because it offers two things most platforms don’t, verifiability and privacy,» Kava Labs’ Scott Stuart said to CoinDesk in an email. «That includes users who are deeply embedded in Web3 as well as those simply seeking an alternative to opaque, centralized AI systems.»

Interest in Kava and decentralized AI growing globally, Stuart said, as more users recognize the value of AI that’s both decentralized and transparent, not reliant on a black-box model governed by a handful of corporations.

Uncategorized

Movement Labs Suspends Rushi Manche Amid Coinbase Delisting, Token-Dumping Scandal

Movement Labs announced today on X that it had suspended co-founder Rushi Manche.

The move to suspend Manche comes as Coinbase delisted the MOVE token, after CoinDesk reported that Movement Labs is investigating how a market maker tied to Web3Port acquired and dumped over 5% of the token’s supply, triggering a price crash.

Binance had previously banned the market maker at the center of this, Web3Port, from its platform.

The MOVE token is down about 20% on the day, according to CoinDesk market data.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors