Uncategorized

Kraken Sheds ‘Hundreds’ of Jobs to Streamline Business Ahead of IPO, Sources Say

Crypto exchange giant Kraken has laid off hundreds of staffers across all areas of the business over the past several months, as the firm continues to streamline its operations ahead of a potential public listing in the U.S., according to two people familiar with the situation.

Kraken was reported to have laid off 400 staff, or about 15% of its workforce, at the end of October last year, when Silicon Valley investor and Kraken board member Arjun Sethi became co-CEO alongside David Ripley, who took the reins when former CEO Jesse Powell stepped down in 2023.

Since Sethi became co-CEO, “hundreds more have gone,” said a person familiar with the situation, who pointed to a rolling program of firings over and above the 15% cut late last year.

“They’re culling aggressively across all functions, and it’s a constant and ongoing thing. It’s about improving Kraken’s EBITA [earnings before interest, tax and amortization],” the person said.

When the CEO role was split last year, Sethi and Ripley said in a blog post that there was a need to shed “organizational layers” that had accumulated in Kraken, and make the business “leaner and faster.”

Several crypto firms are currently getting their houses in order to launch an initial public offering (IPO) this year or early next year. Kraken has also been pushing for increased revenues by acquiring businesses such as derivatives platform Ninja Trader, for instance, and recently announcing the addition of stock trading.

«Kraken’s business is thriving. We’re launching more new products than ever before, driving strong revenue growth, and rapidly expanding across our entire product portfolio — including through the agreement to acquire NinjaTrader, announced earlier this year,” a Kraken representative told CoinDesk.

«At the same time, we continuously evaluate our workforce to ensure it aligns with our strategic priorities. We’re approaching this with discipline and intention, making the difficult decision to eliminate certain roles and consolidate teams where redundancies exist, while continuing to hire in key areas of the business,» the Kraken spokesperson said.

Uncategorized

Bitcoin Nears Golden Cross Weeks After ‘Trapping Bears’ as U.S. Debt Concerns Mount

Bitcoin’s BTC price chart is echoing a bullish pattern that foreshadowed the late 2024 price surge from $70,000 to $100,000 amid mounting concerns over the sustainability of the U.S. debt.

The leading cryptocurrency by market value appears on track to confirm a «golden cross» in the coming days, according to charting platform TradingView. The pattern occurs when the 50-day simple moving average (SMA) of prices crosses above the 200-day SMA to suggest that the short-term trend is outperforming the broader trend, with the potential to evolve into a major bull run.

The moving average-based golden cross has a mixed record of predicting price trends. The impending one, however, is worth noting because it’s about to occur weeks after its ominous-sounding opposite, the death cross, trapped bears on the wrong side of the market.

A similar pattern unfolded from August through September 2024, setting the stage for a convincing move above $70,000 in early November. Prices eventually set a record high above $109K in January this year.

The chart on the left shows that BTC bottomed out at around $50,000 in early August last year as the 50-day SMA moved below the 200-day SMA to confirm the death cross.

In other words, the death cross was a bear trap, much like the one in early April this year. Prices turned higher in subsequent weeks, eventually beginning a new uptrend after the appearance of the golden cross in late October 2024.

The bullish sequence is being repeated since early April, and prices could begin the next leg higher following the confirmation of the golden cross in the coming days.

Past performance does not guarantee future results, and technical patterns do not always deliver as expected. That said, macro factors seem aligned with the bullish technical setup.

Moody’s amplifies U.S. debt concerns

On Friday, credit rating agency Moody’s downgraded the U.S. sovereign credit rating from the highest ”Aaa” to ”Aa1”, citing concerns over the increasing national debt, which has now reached $36 trillion.

The bond market has been pricing fiscal concerns for some time. Last week, CoinDesk detailed how persistent elevated Treasury yields reflected expectations for continued fiscal splurge and sovereign risk premium, both bullish for bitcoin.

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

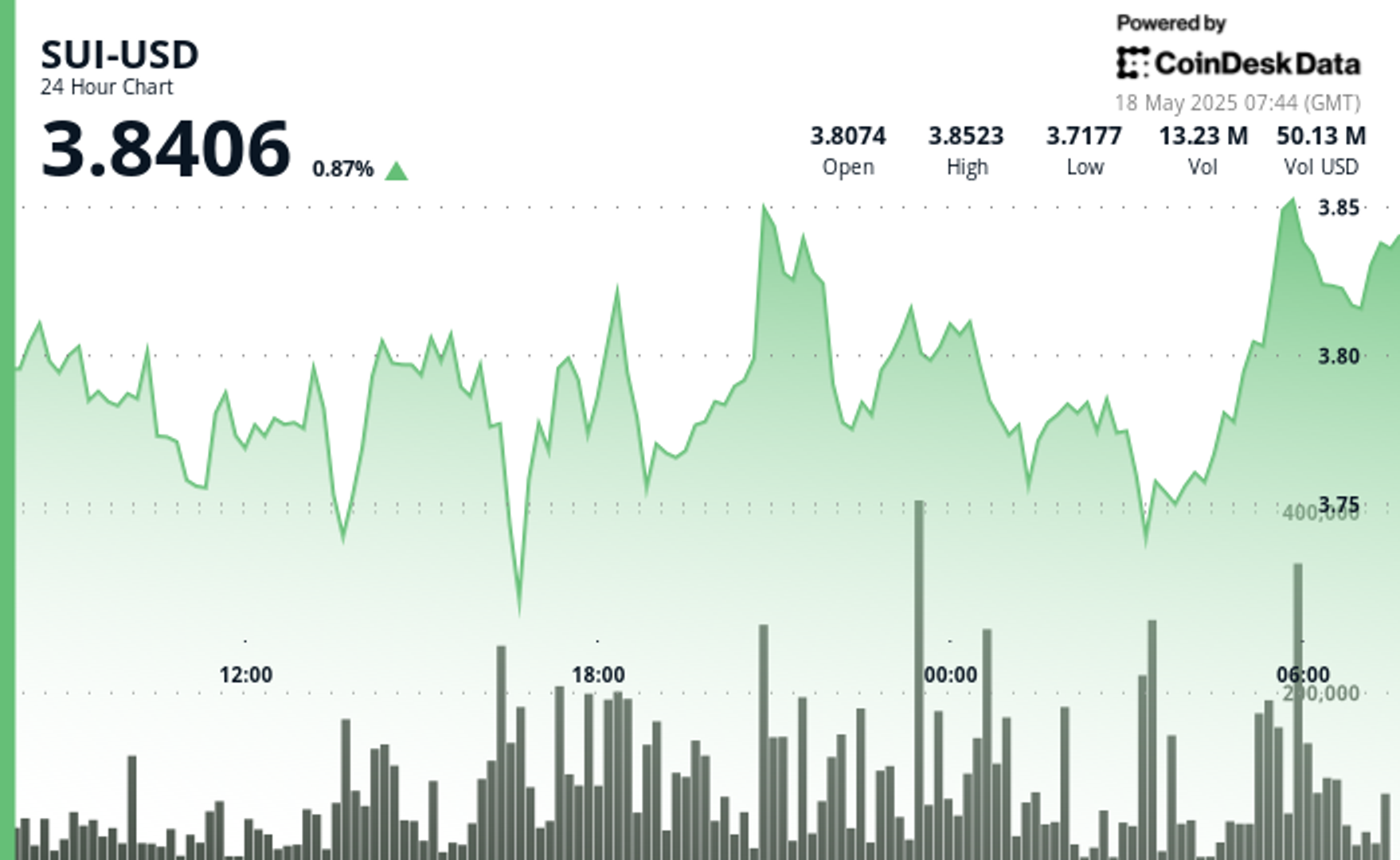

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors