Uncategorized

Justin Sun Defends TRUMP After Presidential Dinner, Says ‘Memecoins Have Merit’

The last time Justin Sun set foot in the U.S. he was Grenada’s WTO ambassador and was navigating the rocky waters of former President Biden’s crypto crackdown.

Times have changed. Now, he’s dining at an event hosted by President Donald Trump for the largest holders of his TRUMP memecoin and celebrating a regulatory breakthrough, as issuers eye a potential Tron ETF, signaling a striking reversal in crypto’s American fortunes.

Speaking exclusively with CoinDesk after the Presidential dinner, which was met by protestors, the Tron founder dismissed allegations that the token is a vehicle for bribery. He called skeptics short-sighted, arguing Trump’s embrace of crypto could spark a new era of digital asset innovation in America.

«All the haters need to really pay attention,» Sun told CoinDesk, describing Trump’s support for crypto as one of the President’s best decisions.»There are positive things happening in the industry.»

Sun’s relationship with Trump’s affiliated crypto ventures stretches back to just after last year’s election, when he bought up to $75 million worth of World Liberty Financial tokens across multiple tranches.

Shortly after Trump took office, his Securities and Exchange Commission (SEC) paused a civil fraud case against Sun, alongside crypto exchange Binance; the SEC also withdrew from or dropped a dozen other cases, though it just filed a fresh civil fraud lawsuit against Unicoin earlier this week. And earlier on Thursday, the Wall Street Journal reported that the Department of Justice, which pursues criminal cases, had been investigating the Tron founder since 2021.

Read more: Where All the SEC Cases Are

He described the dinner as a clear sign the U.S. is regaining its status as the crypto’s global hub, marking a sharp reversal from the Biden administration’s war on the industry, which had previously prompted crypto firms to consider offshore moves.

«At the Trump dinner, some supporters told me they were thinking of leaving the U.S. because of the Biden administration, moving to places like Hong Kong or Singapore,» Sun said. «Even Consensus started holding events outside of the United States.»

«But now they’ve changed their minds. It brings everybody back into the U.S.,» he continued.

Criticism of Trump’s decision to launch a memecoin has come fast and furious from mainstream media, including attempts to link holders of the token to white nationalism.

Sun dismissed this criticism by emphasizing that critics have every right to express their views under the First Amendment.

‘Memecoins have merit’

While protesters met the memecoin faithful who attended the TRUMP dinner, skepticism about meme coins isn’t limited to outsiders.

At a fireside chat during Consensus 2025, Barstool Sports founder Dave Portnoy described meme coins as essentially «gambling,» questioning their longevity.

«I get why people like it,» Portnoy said. «It’s a form of gambling, it’s a Ponzi scheme. I don’t mean that in a negative way.»

Sun disagrees. Rather than viewing meme coins as gambling or Ponzi schemes, he positions them as legitimate segments of digital asset markets.

Sun pointed to tokens like DOGE and SHIB as examples of success stories that have helped onboard users into crypto. He emphasized that Tron’s goal is to support «every single piece in crypto to grow and become mainstream.»

«I totally think memecoins have merit,» Sun told CoinDesk. «It’s just like doing business. Some succeed, some go to zero. That’s entrepreneurship.»

UPDATE (May 23, 06:15 UTC): Adds details on Sun’s previous investigations and additional background.

Uncategorized

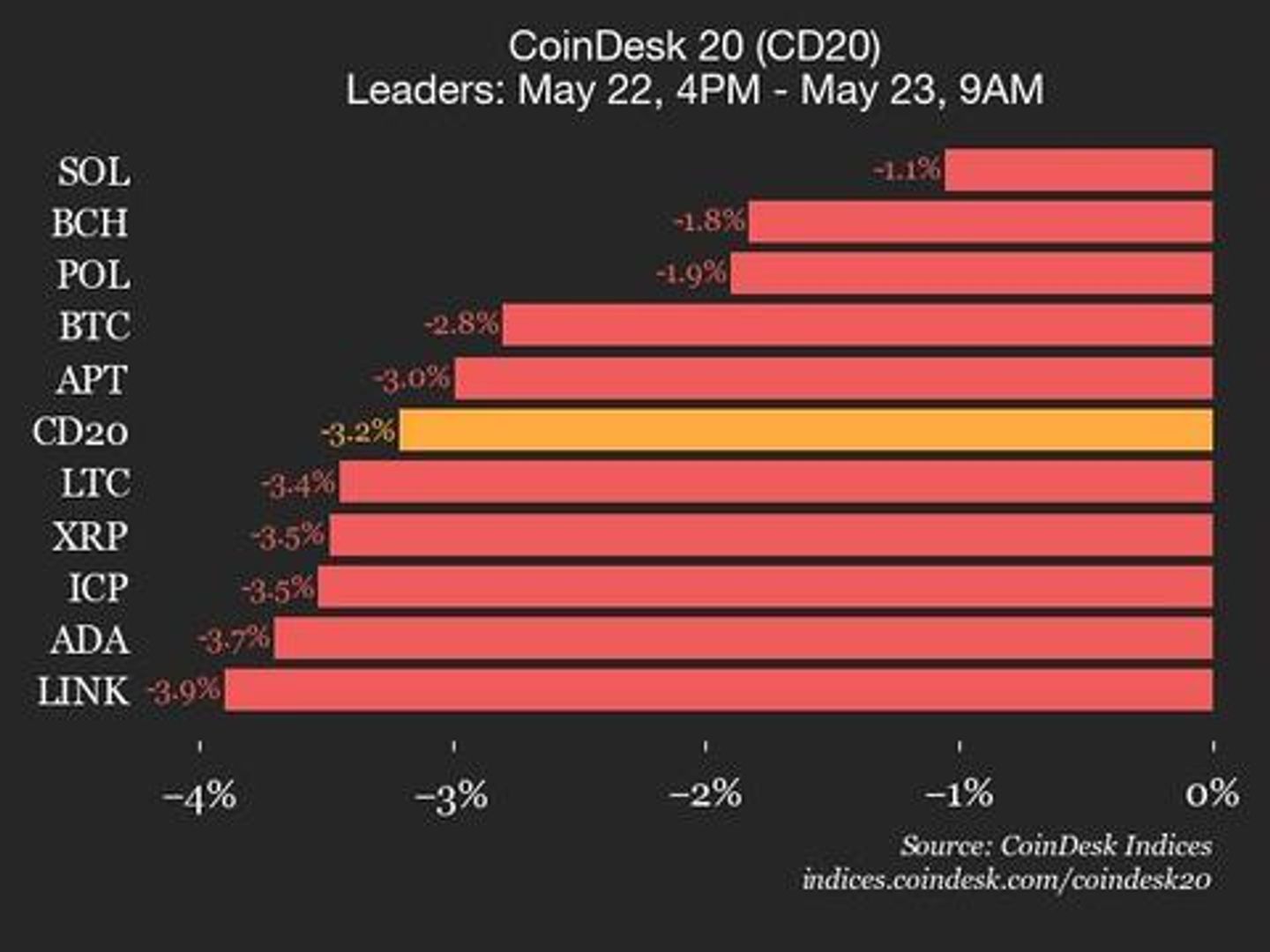

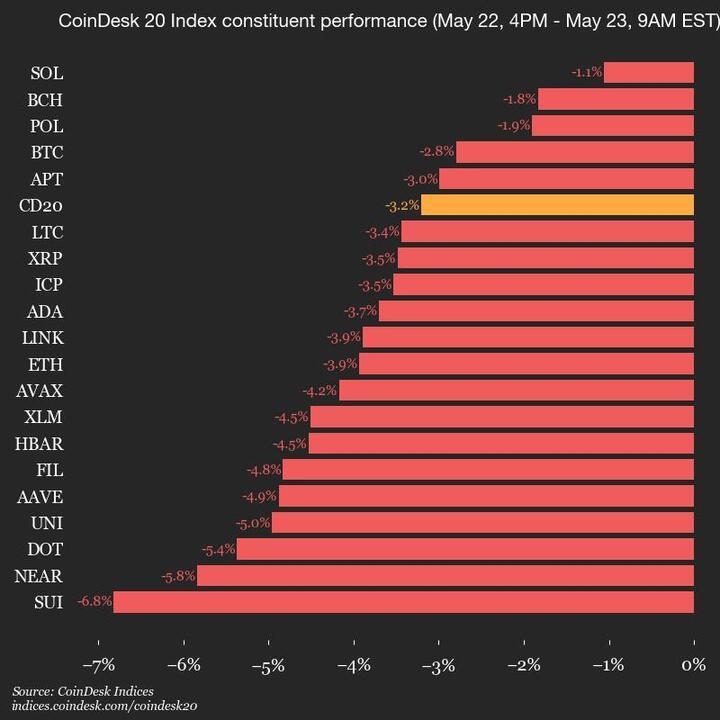

CoinDesk 20 Performance Update: Index Declines 3.2% as All Assets Trade Lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3239.11, down 3.2% (-107.44) since 4 p.m. ET on Thursday.

None of the 20 assets are trading higher.

Leaders: SOL (-1.1%) and BCH (-1.8%).

Laggards: SUI (-6.8%) and NEAR (-5.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Semler Scientific Bolsters Bitcoin Holdings with $50M Acquisition

Medical equipment company Semler Scientific (SMLR) announced its third-largest bitcoin BTC purchase since adopting a bitcoin standard roughly one year ago.

The company in the ten days ending May 22 acquired 455 BTC for $50 million, averaging $109,801 per bitcoin. This acquisition, funded through its at-the-market (ATM) equity offering program, brings Semler’s total holdings to 4,264 BTC, purchased for $390 million and currently valued at more than $450 million.

To date, the company has issued 3,003,488 shares under its April 15 $500 million ATM program, raising $114.8 million.

Now roundly used as a key performance indicator by most companies adding bitcoin to their balance sheet, Semler’s BTC Yield, has risen to 25.8% in 2025. BTC Yield measures the year-to-date percentage change in the ratio of total bitcoin holdings to assumed diluted shares outstanding.

SMLR shares are lower by 5.3% in premarket trading alongside a sizable decline in the price of bitcoin Friday morning to $108,300.

Uncategorized

Crypto Lender Ledn Goes Full Bitcoin Maxi as It Seeks to Reduce Client Asset Risk

Cryptocurrency lender Ledn is removing support for ether ETH and will begin offering a bitcoin-only loan model starting July 1 as it looks to simplify its product and sharpen its focus around bitcoin BTC.

The Cayman Islands-registered company may be attempting to broaden its appeal among the corners of the crypto community that say BTC is the only cryptocurrency that is needed. Such BTC advocates are often referred to as «Bitcoin Maxis.»

“With our new hyper-focus on Bitcoin-only lending, we’re going back to our roots and principles that inspired Bitcoin to begin with,” co-founder Adam Reeds said in an emailed announcement on Friday.

Ledn will also stop lending client assets to generate yield as it seeks to remove risk from its business model. Bitcoin offered to Ledn as collateral for loans will remain fully in its custody or that of its partners, Ledn said.

«Traditional finance relies on constantly reusing client assets to create leverage and, ultimately, inflation,» Reeds said. «Bitcoiners instinctively reject that model.»

Cryptocurrency lending was a major casualty of crypto winter in 2022, with the companies including BlockFi, Voyager, Celsius and Genesis going to the wall.

Ledn managed to survive and is now attempting to resurrect the BTC-backed lending sector, with its simplified product offering and helped by the friendlier regulatory approach to crypto in the U.S, co-founder Mauricio Di Bartolomeo told CoinDesk in a recent interview.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors