Uncategorized

If You’re in Crypto, Pivot to AI Now

For years, crypto’s positioned itself as the next great technological revolution. But as we witness the explosive rise of AI, it’s time for crypto to face the truth: the true technological revolution of our era is artificial intelligence, and crypto will play a supporting role rather than be the star.

This isn’t about diminishing the industry’s importance or the quality of what it’s built. I helped pioneer institutional investing in Bitcoin, and I’ve operated and invested in numerous companies building on-chain. I also earned a Ph.D in AI. The simple truth is that building intelligent systems that solve real-world problems should be the mission, whether or not blockchain rails are included.

With respect to pure crypto, the only segment left standing is DeFi. Objectively a better version of TradFi, DeFi boasts better engineering, programmability, and composability. This is properly captured with the meme: Internet Capital Markets. Stablecoins and tokenization have shown exceptional product-market-fit, and they remain crypto’s truest (read: only) demonstration of real tangible value to date. As such, the institutions are coming, and for good reason. BlackRock, Robinhood, and even crypto-native stalwarts like Coinbase are building out crypto products in the expectation of imminent regulatory clarity. Moving instant global payments and settlement along with more complex financial instruments on-chain is a no-brainer.

Otherwise, there’s AI. There’s TradAI like the big labs, model builders, and LLM providers. There’s open-weight AI like DeepSeek and Mistral. There’s open-source AI like Nous. AI apps like Cursor and Lovable. Agents like Manus. Robotics. And even Decentralized AI or Crypto x AI (we’ll get to that in a minute…). In short, there’s already more demand for AI products and services than there has ever been for pure crypto applications.

This is captured by another meme: if you’re in crypto, pivot to AI.

This shouldn’t surprise us. While crypto has struggled to find mainstream use cases beyond speculation and gambling, AI is already improving productivity and working its way into transforming industries everywhere across the world.

What’s more? A sobering reality for crypto – further accentuated by recent memecoin activity and what’s been colloquially called “crime szn” – has been the disconnect between token values and actual technological utility. While decentralized technology itself is revolutionary, the value captured by tokens has historically been driven more by memetic appeal than by genuine technological value creation (there have been calls to get grounded in “fundamentals” as of late, but we’ll see if it has legs…). This isn’t necessarily a criticism – meme value is real value in many ways – but it highlights a fundamental weakness of crypto as a standalone industry.

This doesn’t mean crypto’s rekt. In fact, blockchain and crypto protocols may become essential components of a future AI tech stack. But they’ll serve as infrastructure underlying AI-first products and services, rather than as standalone products.

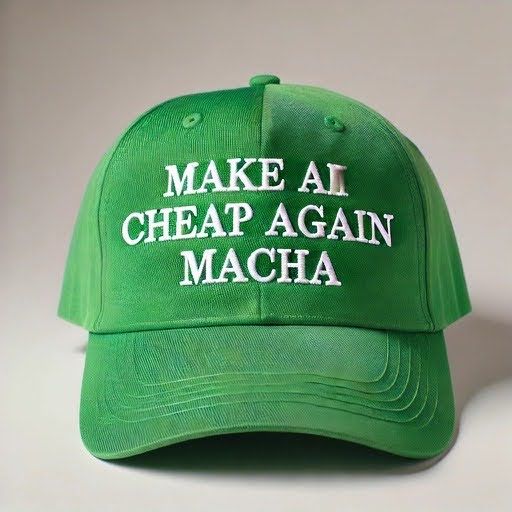

Consider ways to Make AI Cheap Again: distributed computing power for training and inference, verifiable computation and data provenance, tokenized access to computational resources, decentralized storage of training data, and transparent reward mechanisms for contribution. Distributed computing and DePIN architectures as well as transparent verification systems have proven their utility. But – and this is crucial – they’ll do so in service of AI products and services that solve real problems for mainstream users who neither know nor care about the underlying technical infrastructure.

We could envision protocols built using blockchains generating revenue through licensing or usage and being paid in other tokenized forms of value like stablecoins – a model in stark contrast to the token-as-the-product model currently a la mode.

For founders and teams currently focused on crypto-native applications, this represents both a challenge and an opportunity. The challenge is expanding beyond the comfortable but limited crypto ecosystem, represented primarily by Crypto Twitter and [Insert Your Favorite Conference Here]. The opportunity is participating in the genuine technological revolution that AI represents.

What does this mean in practice? First, teams need to start thinking bigger. Founders should be asking themselves how AI can transform their target market, and then consider how crypto technology might help enable that transformation. This means fundamentally changing how we approach building and marketing crypto products.

Instead of starting with tokenization, tokenomics, or even blockchains in general, begin with real-world problems that AI could solve. Only then should teams identify where decentralized systems could enhance the AI, and implement these pieces of the stack where they genuinely add value.

Leverage crypto where it makes sense, especially where it can mitigate costs or improve efficiency, but keep the focus squarely on delivering value through intelligence and automation.

For example, companies could use blockchains to create decentralized marketplaces for critical processes, making AI more accessible and cost-effective (Vast.ai, a Nazaré portfolio company, does this for GPUs, and Orchid has been re-defining the internet and privacy with decentralized markets for years).

Agents might also use cryptographic verification or privacy systems to safely and securely act on our behalf online using our login information, identities and credit cards, or even private keys and wallets on-chain.

In both cases, crypto serves the larger goal of making AI systems more effective and trustworthy.

The companies that will thrive in this new landscape are those that understand this dynamic. They will either build AI-first products that incorporate crypto where it adds genuine value, or they will build crypto services explicitly designed to improve AI-based products or services. The market won’t support teams running around wielding the hammer that is blockchains treating everything like a nail.

Ultimately, this is about properly understanding the relationship between crypto and AI. The future belongs to AI as the primary framework while thoughtfully incorporating crypto where appropriate.

For much of the crypto industry, this is a moment of truth and a profound recalibration. We can either cling to the narrative of crypto as a standalone revolution and speculative tokens as retail products, or we can embrace crypto’s supporting role as excellent technology in service of AI.

The latter may be less glamorous (and perhaps less valuable to investment portfolios), but it’s ultimately more likely to create real lasting value and impact.

The sooner we accept this reality, the better positioned we’ll be to contribute meaningfully to the technological transformation that’s already underway. It’s time for the crypto industry to think bigger than itself.

If you’re in crypto, pivot to AI.

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars