Uncategorized

How Wall Street’s Relationship With Bitcoin Will Transform in 2025: 5 Predictions

When Michael Saylor announced MicroStrategy’s conversion of $250 million in Treasury reserves to bitcoin in August 2020, Wall Street analysts dismissed it as a reckless gamble. «Superior to cash,» Saylor declared of bitcoin at the time, drawing skepticism from traditional banking circles.

Yet today, those same banks that sneered at bitcoin’s corporate adoption are now scrambling to participate in bitcoin-collateralized lending as they race to capitalize on its superior characteristics as institutional-grade collateral and a thriving product-market fit.

Traditional collateral, such as real estate, requires manual appraisals, subjective valuations and complex legal frameworks that vary by jurisdiction. Bitcoin, by contrast, offers instant verification of collateral backing through public blockchain data, 24/7 real-time settlement and liquidation capabilities, uniform quality regardless of geography or counterparty, and the ability to enforce lending terms programmatically.

When a lender realizes that they can instantly verify and potentially liquidate bitcoin collateral at 3 a.m. on a Sunday — while real estate sits waiting for manual appraisals, subjective valuations, and potential evictions— there will be no going back.

1. Traditional banking bends the knee to bitcoin.

MicroStrategy’s (MSTR) approach fundamentally altered how public companies view bitcoin as a treasury asset. Rather than simply holding bitcoin, the firm has pioneered a treasury model of leveraging public markets to amplify its crypto position — issuing convertible notes and at the market equity offerings to finance purchases of bitcoin. This strategy has allowed MicroStrategy to significantly outperform spot bitcoin ETFs by harnessing the same financial engineering that made traditional banks powerful, but with bitcoin as the underlying asset instead of traditional financial instruments and real estate.

As a result, one of my predictions for 2025 is that MSTR will announce a 10-for-1 stock split to further its market share as it will allow many more investors to purchase shares and options contracts. MicroStrategy’s playbook demonstrates just how deeply bitcoin has penetrated traditional corporate finance.

I also believe financial services built around bitcoin are set to explode in popularity as long-term holders and new investors look to get more out of their positions. We expect to see rapid growth in bitcoin-collateralized loans and yield-generating products for bitcoin holders worldwide.

Moreover, there’s an almost poetic answer to why bitcoin-backed loans have become so popular — they are a true representation of financial inclusion, with a business owner in Medellín facing the same collateral requirements and interest rates as one in Madrid. Each person’s bitcoin carries identical properties, verification standards and liquidation processes. This standardization strips away the arbitrary risk premiums historically imposed on borrowers in emerging markets.

Traditional banks marketed «global reach» for decades while maintaining vastly different lending standards across regions. Now, bitcoin-backed lending exposes this inherited inefficiency for what it is: a relic of an antiquated financial system.

2. Borders fall as capital flows freely.

Nations are entering a new era of competition for bitcoin business and capital. Consequently, we expect to see new tax incentives specifically targeting bitcoin investors and businesses in 2025. These will happen alongside fast-track visa programs for crypto entrepreneurs and regulatory frameworks designed to attract bitcoin companies.

Nations historically competed for manufacturing bases or regional headquarters. Now they compete for bitcoin mining operations, trading venues and custody infrastructure.

El Salvador’s bitcoin treasury position represents early experimentation with nation-state bitcoin reserves. While experimental, their moves and the recent proposal for a U.S. Strategic Bitcoin Reserve forces traditional financial centers to confront bitcoin’s role in sovereign finance.

Other nations will study and attempt to replicate these frameworks, preparing their own initiatives to attract bitcoin-denominated capital flows.

3. Banks race against obsolescence.

In debt markets, necessity drives innovation. Public companies now routinely tap bond markets and convertible notes to finance bitcoin-related transactions. The practice has transformed bitcoin from a speculative asset into a cornerstone of corporate treasury management.

Companies like Marathon Digital Holdings and Semler Scientific have been successful in following MicroStrategy’s lead, and the market has rewarded them. This is the most important signal for treasury managers and CEOs. Bitcoin’s got their attention now.

Meanwhile, bitcoin lending markets have come a long way over the last two years. With the deadwood being cleared away, serious institutional lenders now demand proper collateral segregation, transparent custody arrangements and conservative loan-to-value ratios. This standardization of risk management practices attracts precisely the type of institutional capital that previously sat on the sidelines.

More regulatory clarity out of the U.S. should open the door for more banks to get involved in bitcoin financial products — this will benefit consumers the most, with new capital and competition driving rates down and making bitcoin-backed loans even more compelling.

4. Bitcoin and crypto M&A intensifies.

As regulatory clarity emerges through the SAB 121 resolution addressing crypto custody and other guidance, banks will face a critical choice: build or buy their way into the growing market of bitcoin & lending. As a result, we predict at least one of the top 20 U.S. banks will acquire a crypto business in the coming year.

Banks will want to move fast, and development timelines for cryptocurrency infrastructure stretch beyond competitive windows, while established firms already process billions in monthly volume through battle-tested systems.

These operational platforms represent years of specialized development that banks cannot rapidly replicate. The acquisition premium shrinks against the opportunity cost of delayed market entry.

The confluence of operational maturity, regulatory clarity and strategic necessity creates natural conditions for the banking industry’s acquisition of cryptocurrency capabilities.These moves mirror previous financial technology integration patterns in which banks historically acquired electronic trading platforms rather than building internal capabilities.

5. Public markets validate bitcoin infrastructure.

The cryptocurrency industry is poised for a breakthrough year in public markets. We expect to see at least one high-profile crypto initial public offering exceeding $10 billion in valuation in the U.S. Major digital asset companies have built sophisticated institutional service layers with revenue streams that now mirror those of traditional banks, processing billions in daily transactions, managing substantial custody operations with rigorous compliance frameworks and generating stable fee income from regulated activities.

The next chapter of finance will therefore be written not by those who resist this change but by those who recognize that their very survival depends on embracing it.

Uncategorized

Ethereum Surges After Holding $2,477, Fueled by Very Heavy Trading Volume

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with ETH showing resilience despite broader market uncertainty.

The second-largest cryptocurrency is currently navigating a critical technical zone between $2,500-$2,530, which analysts identify as immediate resistance that must be overcome for continued upward movement.

Institutional interest remains strong, with spot Ethereum ETFs recording consecutive days of positive inflows, signaling growing confidence from larger investors despite the recent volatility.

Technical Analysis Highlights

- 24-hour ETH price action revealed a substantial 3.5% range ($99.85).

- Sharp sell-off during midnight hour saw price plummet to $2,477.40, establishing a key support zone.

- Extraordinary volume (291,395 units, nearly 3x average) confirmed the significance of the support level.

- Buyers stepped in at the $2,467-$2,480 support band, confirmed by high-volume accumulation during the 08:00-09:00 period.

- Recent price action shows bullish momentum with ETH reclaiming the $2,515 level.

- Potential higher low pattern suggests the correction may have found its bottom.

- $2,520-$2,530 area remains the immediate resistance to overcome for continued upward movement.

- Significant bullish surge at 13:35 saw price jump from $2,515.85 to $2,521.79, accompanied by exceptional volume (5,839 units).

- Sharp reversal occurred at 14:00, with price dropping 5.07 points to $2,508.02 on heavy volume (4,043 units).

- Hourly range of 14.46 points ($2,508.02-$2,522.48) demonstrates market indecision.

External References

- «Ethereum Holds Above Key Prices – Data Points To $2,900 Level As Bullish Trigger«, NewsBTC, published May 24, 2025.

- «Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level«, Bitcoinist, published May 25, 2025.

- «Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?«, CryptoPotato, published May 25, 2025.

Uncategorized

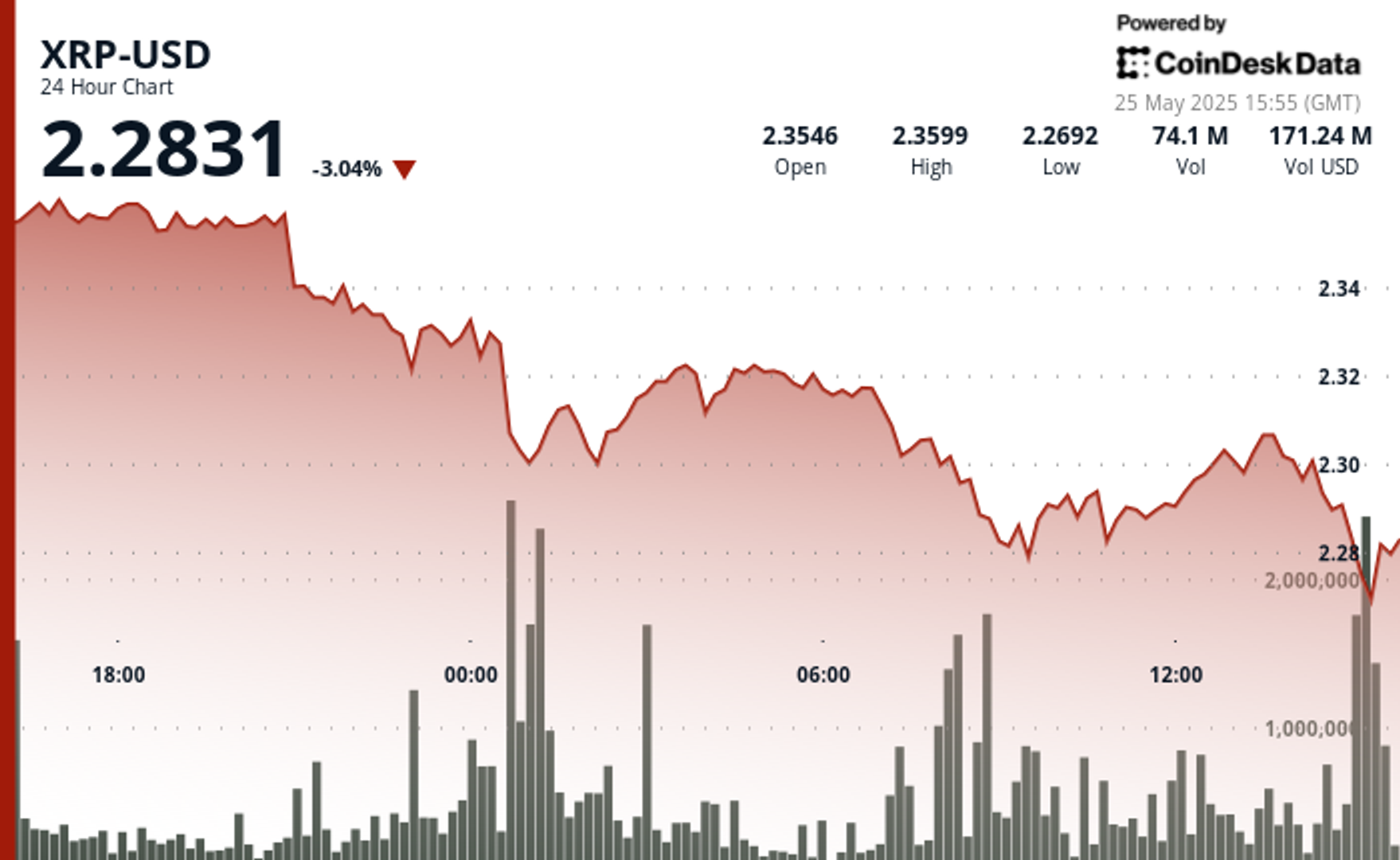

XRP Plunges Below $2.30 Amid Heavy Selling Pressure

Global economic tensions are weighing heavily on cryptocurrency markets as XRP experiences a significant correction amid heavy selling pressure.

The recent announcement of potential 50% tariffs on European Union imports by the US government has triggered widespread market uncertainty, with XRP falling alongside most major cryptocurrencies despite Bitcoin recently reaching new all-time highs.

Technical analysts point to critical support at the $2.25-$2.26 range, with market watchers warning that a break below this level could trigger deeper corrections toward the $1.55-$1.90 zone.

Meanwhile, institutional interest remains strong with Volatility Shares launching an XRP futures ETF and leveraged ETF inflows surging despite the price dip, suggesting Wall Street continues accumulating positions during market weakness.

Technical Analysis Highlights

- XRP underwent a notable 3.46% correction over the 24-hour period, with price declining from $2.361 to $2.303, creating an overall range of $0.084 (3.57%).

- The most significant price action occurred during the midnight hour (00:00), when XRP plummeted to $2.297 on exceptionally high volume (37.1M), establishing a strong volume-based support zone.

- A secondary sell-off at 08:00 saw price touch the period low of $2.280 with the highest volume spike (39.9M), confirming a double-bottom formation.

- In the last hour, XRP experienced significant volatility with a recovery attempt following the earlier correction.

- After reaching a low of $2.297 at 13:11, price formed a base around $2.298 before staging a substantial rally beginning at 13:27, peaking at $2.307 at 13:36-13:39 with exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $2.307, which was tested multiple times.

- The final 15 minutes saw profit-taking pressure emerge, with price retracing to $2.300, establishing a short-term support level that aligns with the psychological $2.30 threshold.

External References

- «XRP Price Watch: Consolidation or Collapse? Market Holds Breath Near $2.35«, Bitcoin.com News, published May 24, 2025.

- «XRP Price Prediction For May 25«, CoinPedia, published May 25, 2025.

- «XRP Risks Fall To $1.55 If This Support Level Fails – Analyst«, NewsBTC, published May 25, 2025.

Uncategorized

Bitcoin Drops Below $107.5K as Trump Tariff Threat Triggers Crypto Sell-Off

Bitcoin’s recent pullback has established strong volume-based resistance near $108,300, with support forming in the $106,700-$107,000 zone.

The correction accelerated with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal.

Technical analysis suggests Bitcoin is now trading within a compression zone, trapped between two major fair value gaps that will determine the upcoming market direction.

If bulls reclaim the $109K to $110K area, price could push toward resistance beyond $112K, while a break below $107,000 might test liquidity around $106K.

Technical Analysis Breakdown

- The decline accelerated during the 22:00-23:00 hour on May 24th with exceptionally high volume (16,335 BTC), establishing a strong volume-based resistance near $108,300.

- Support has formed in the $106,700-$107,000 zone where buyers emerged during the 09:00-10:00 period on May 25th, though recovery attempts have been modest with price consolidating around $107,500.

- The overall technical structure suggests a short-term bearish trend with potential for further consolidation before directional clarity emerges.

- Bitcoin experienced significant volatility with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal that saw prices decline to $107,393 by 14:00.

- The most substantial price movement occurred during the 13:35 minute candle where BTC jumped nearly $150 with exceptionally high volume (148.76 BTC), establishing temporary resistance around $107,630.

- Support formed near $107,400 where buyers emerged during the final minutes of the period, though the overall technical structure suggests continued consolidation within the broader correction from the $109,239 high.

External References

- «Bitcoin Price Prediction for May 25: Will Bulls Defend $108K or Is a Deeper Drop Ahead?«, Coin Edition, published May 24, 2025.

- «Why is Bitcoin Price Dropping Now? Will BTC Price Go Down to $100K?«, CoinPedia, published May 24, 2025.

- «Bitcoin Price Analysis: BTC Displays Signs of Weakness Following New All-Time High«, CryptoPotato, published May 25, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season