Uncategorized

How to Prepare for a Major Compliance Failure Settlement: The OKX Approach

Confidential protocols put in place to deal with news of regulatory failings by one of the top-five crypto exchanges, OKX, suggest that the company likely has been expecting a settlement with U.S. authorities for some time.

This happened on Monday when OKX announced a $500 million-plus settlement with the U.S. Department of Justice after failing to secure a money transmitter license and allegedly facilitating $5 billion in «suspicious transactions and criminal proceeds.»

OKX’s meticulous planning makes for some fascinating reading. The secret crisis management document seen by CoinDesk refers to a messaging “SWAT Team” that can be mobilized to implement various ways the firm’s top executives can communicate a settlement via social media and when speaking to reporters.

Well in advance of Monday’s large fine and forfeiture, OKX had produced specific guidance with regards to settling with the DOJ, as well as the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC, or sanctions watchdog), for example.

A favored approach is to point out that the entire crypto industry has been broadly under intense scrutiny and that OKX is cooperating fully with regulators, the document said. This was echoed in Monday’s press release which said OKX “appreciates” the DOJ’s “collaboration.”

Since the administration of President Donald Trump took over last month, the main focus for regulatory agencies in the crypto arena has been to reverse their previously aggressive enforcement stance, with the SEC dropping ongoing litigation and closing investigations. But not so in the case of OKX, which, like Kucoin with its recent $300 million penalty and Binance back in 2023, has been forced into costly settlements.

The guidance refers to what is expected from OKX founder Star Xu, President Hong Fang and other executives when it comes to “their social media actions in two scenarios: 1) Leak before OFAC settlement, 2) upon OFAC settlement.”

Also, on the issue of OFAC, if executives are asked if OKX has served sanctioned markets, one suggestion is to say: “Customers from sanctioned markets slipped through when we had immature compliance controls and systems […] It is a very small and insignificant part of the Okcoin or OKX customer base.”

Indeed, Monday’s press release from OKX acknowledged that U.S. customers were able to trade on the global exchange.

«The total number of U.S. customers involved – which are no longer on the platform – amounted to a small percentage of the Company’s worldwide customer population,» the release said.

Brand awareness

Another priority for OKX is how the firm choreographs its big-ticket sponsorship arrangements with the likes of Manchester City football club, F1 team McLaren and the Tribeca Film Festival. The firm estimates that around $100 million per annum has been spent on these partnerships over the past three years.

The action plan for brand partners involves the OKX marketing chief giving each partner a phone call “at the last hour before the news breaks.”

The recommended strategy here is to say OKX has prepared for a regulatory review, given the heightened scrutiny on crypto firms. If asked why the exchange did not share information about this before, the document states that these are pending inquiries and non-public matters. There is also a bullet point suggesting the CMO and OKX’s head of legal “review clauses in our brand partner contracts again.”

Don’t mention OKB

Another detail that gets attention in the OKX planning document is the exchange’s native cryptocurrency, OKB. An obvious concern in the aftermath of FTX is any suggestion that OKB has been used as collateral or to finance any operations of OKX, as was the case with FTX’s FTT token.

Of course, the OKB exchange token hasn’t been subject to anything like the iniquities of FTX’s exchange token. However, it was involved in a sudden flash crash in January 2024, after which OKX quickly offered to compensate users who had lost out. The token, which has a relatively thin trading volume and liquidity, saw 10 dormant wallets become active and begin trading just before the crash, according to Marina Khaustova, COO Crystal Intelligence, a blockchain analytics firm.

Not long after the OKB crash, OKX executives Tim Byun, the former CEO of OKcoin and head of global government relations, and Head of Product Wei Lan were let go by OKX. A source familiar with the situation said Byun was «sacrificed» following the OKB crash.

Unsurprisingly, the OKX comms protocol emphasizes that execs should “refrain from mentioning OKB and reference this only if asked.”

Media management

Another part of the puzzle is how the exchange should deal with media inquiries. Should OKX receive emails or a phone call from a journalist looking for comment about ongoing investigations, the SWAT Team and PR team should go into action to “buy time by offering up leadership schedules”

Meanwhile, the plan is “to contact key friendly publications for a parallel story to seed in a complimentary narrative to the originating story,” the document states.

“1. Push for delay 2. Confirm friendly publications 3. Asynchronously queue up internal / external comms, so we hit send as the story comes out,” it said.

OKX did not provide a comment by press time

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

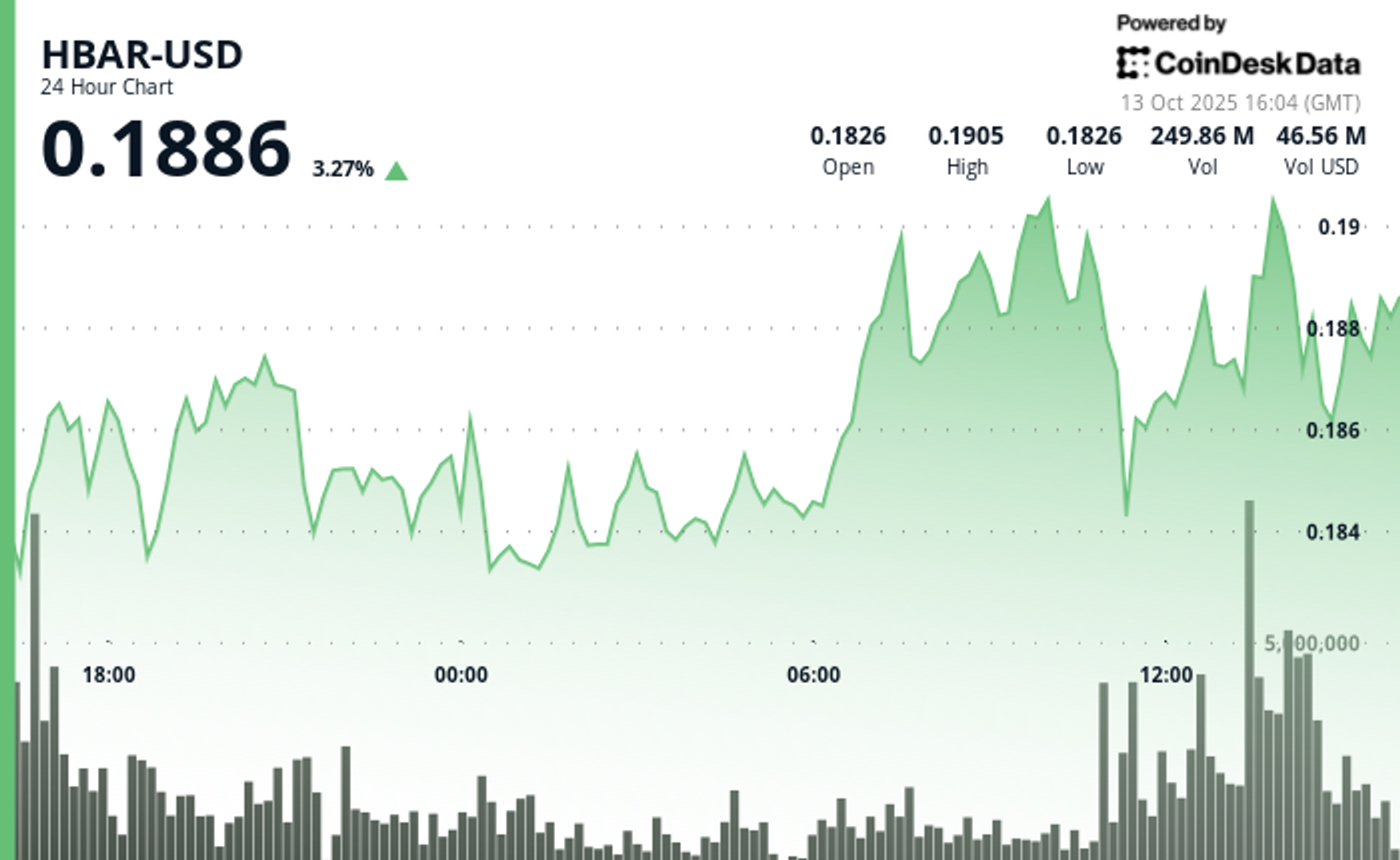

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton