Uncategorized

How Some Bitcoin Mining Firms Try to Game U.S. Customs Controls

Some members of the bitcoin (BTC) mining industry are in the habit of routinely undervaluing mining rig shipments with the U.S. Customs and Border Protection (CBP) in order to reduce customs duties, multiple people familiar with the practice told CoinDesk.

Now that the Donald Trump administration is raising tariffs on most goods brought from around the world, these attempts at avoiding paying import charges are becoming more relevant than ever before.

“[Industry members] usually have ways around [tariffs] by declaring lower value on packages,” Jill Ford, the founder of BitFord Digital, a firm that specializes in procuring equipment to miners, told CoinDesk in an interview. “That’s risky, and I’m not suggesting it, but that is truly what they’re doing to bring them in.”

Bitcoin mining has flourished in the U.S. in recent years, especially since China — once the epicenter of Bitcoin’s mining activity — banned the practice in 2021, creating an industry exodus to jurisdictions like Texas. But the $30 billion application-specific integrated circuit (ASIC) market is dominated by Bitmain and MicroBT, two Chinese companies that manufacture the majority of these bitcoin mining machines in Southeast Asian facilities.

Firms like BitFord tend to act as a middleman between manufacturers and miners, though they can also acquire ASICs on the secondary market. The largest of these brokers provide all kinds of hardware and power infrastructure that miners may need.

The Trump administration’s new trade policy, unveiled on April 2, threatened to impose significant tariffs for Southeast Asian countries such as Malaysia, Thailand and Indonesia. A week later, the White House announced a 90-day moratorium on some of these tariffs to negotiate new trade deals. The resulting uncertainty has caused chaos for bitcoin miners located in the U.S., who now have to grapple with the possibility of paying huge taxes on their ASIC shipments.

Yet even before the tariffs were ever conceived, miners regularly under-reported the value of their shipments to U.S. customs, Ford and others said.

“There have been numerous entities that have played that game. We do not and never will,” Taras Kulyk, co-founder and CEO of mining hardware provider Synteq Digital, told CoinDesk. “Some very very well-known brokers too,” he added, without providing any names.

“It’s fraud. It is definitely illegal. But a lot of people rolled the dice and did it, and I don’t condone it,” Ford said. “If my client wants to do that, that’s on them … We ask, ‘What do you want to declare your package as? What amount?’ And if they’re like, ‘Just declare it as $300,’ then that’s what we’ll do. But if it gets stuck in customs, then it’s really on them.”

Tightening controls

In Ford’s telling, it used to be relatively easy to undervalue ASIC shipments — CBP would rarely check. But things started changing around November 2024 after Trump won the election, Ford said, while another source with an expertise in shipments, which spoke to CoinDesk on condition of anonymity, said that CBP’s recent investigation into whether imported mining rigs were breaking chip-related sanctions may have led the agency to take a deeper look at the mining sector as a whole.

“Before, a mining rig that was maybe worth $3,000, we would declare that it was worth $300. It would just pass on through. Now it’s like they’re looking it up on the internet to see what the value really is,” Ford said. “There really isn’t any way around it. I mean, you could under declare it by 20% or 30%, but not like we used to be able to do.”

The size of the shipment matters. Importing one or two machines will usually escape scrutiny, Ford said, but it’s when miners bring in machines in bulk that CBP takes a closer look. Hundreds of thousands of mining rigs are imported into the U.S. every year.

However, CBP appears to be stricter in some states than in others, because these controls have not been tightened uniformly across the country, according to Ford.

“I have a client in Oregon who has no problem under-declaring packages and bringing them right in, but I have another client in Kentucky who [had] 100 machines worth $9,000 apiece stuck in customs,” Ford said.

“What ultimately happened in Kentucky is that we had to return the goods back to Hong Kong, and now we’re like, ‘Well, where do we ship it through to get it in?’ And I was like, ‘We should probably just go through the CBP in Oregon or California,’ because it is just a nightmare to try to bring it into Kentucky.’”

Imports are also impacted by which carrier is used. DHL is easier to get through than UPS in Kentucky, while UPS tends to be less strict on the West Coast than the East Coast, Ford said — and that is common knowledge among her suppliers.

The discrepancy in enforcement is likely temporary, the shipments expert told CoinDesk. In their view, CBP likely decided to take a closer look at mining rig imports, but the enforcement of the new directive is simply being implemented at a varying speed from jurisdiction to jurisdiction.

CBP did not answer a request for comment.

In a subsequent email to CoinDesk, Ford appeared to qualify her comments, shifting blame away from operations based in the U.S.

“Just to be clear it wasn’t a miner-driven practice. For years, many Chinese mining suppliers routinely underreported the value of shipments — often declaring machines at the lowest possible value. This wasn’t a scheme driven by miners, but a widespread, supplier-controlled practice that became the norm due to lax enforcement. It was just the normal course of business — and largely ignored by regulators,” she wrote.

“We’ve always recommended declaring shipments properly — even when that has meant losing business to competitors. Now, with tighter enforcement, more partners are realizing why that approach matters,” she wrote.

BitFord is a relatively new enterprise in the bitcoin mining scene. Ford, who pled guilty to bank fraud and money laundering charges related to a COVID-related loan, was sentenced to 20 months in prison and had to pay $250,000 in restitution; she came out in August of last year and launched BitFord in October. The company has made over $20 million in sales since then (not all of which was from imported machines).

«I went to prison because I misspent a COVID loan,» she said, adding that she was «orange-pilling» fellow prisoners while behind bars.

From a legal perspective

Shipments to the U.S. are assigned their value by an importer of record, meaning an entity entrusted to move the cargo through customs, a trade lawyer, who requested anonymity to speak frankly about the matter, told CoinDesk.

The importer of record can be one of three entities: the supplier, the broker or the end-client. All three of these scenarios are relatively common.

CBP is in charge of auditing, and can potentially fine or demand back duties from importers that have mischaracterized the value of their shipments. The Department of Justice (DOJ) also has a unit charged with enforcing the False Claims Act (FCA) and going after parties that have defrauded the U.S. government.

Penalties on the civil side can be as much as three times the damages incurred by the U.S. government, while on the criminal side they can include incarceration, though that’s a rare occurrence.

Up until recently, penalties were usually seen as a sort of cost of doing business, the trade lawyer said, but with the Trump administration’s increased vigilance on the topic of tariffs, that may no longer be the case.

The effect of tariffs

The combination of tariff uncertainty and CBP’s increased vigilance is forcing some mining operations to reconsider their plans. Ford said that roughly 50% of her clients were still forging ahead, while others were hitting the pause button. One of her clients, she said, is holding a container coming from China in the hopes of not having to pay exorbitant tariffs on his shipment.

Tariffs will “likely cause a material slow down, if not halt in new projects and force projects being deployed currently to likely be reduced, or halted to re-evaluate capital needs and costing,” Kulyk said.

“Other jurisdictions that had previously looked higher cost [will] become sought-after targets for new infrastructure and capex deployment,” he added. “Canada, in particular, will likely be a benefactor to the implementation of the global tariff regime that’s been put in place by the White House.”

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

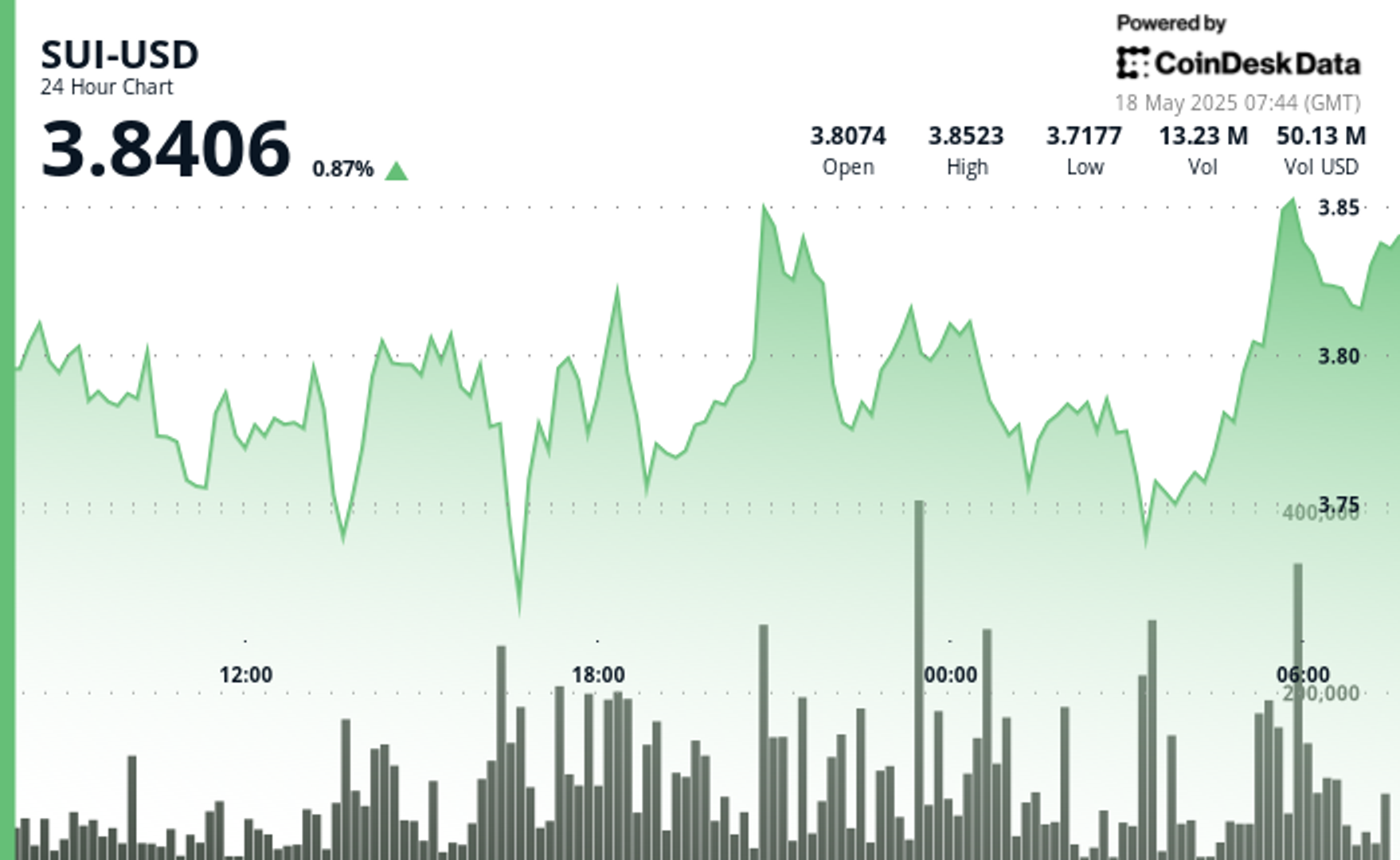

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

Uncategorized

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

Geopolitical tensions and evolving trade policies continue to influence cryptocurrency markets, with Dogecoin showing resilience amid broader economic uncertainty.

Despite macroeconomic headwinds, DOGE has maintained support above key moving averages while forming a potential bull flag pattern that could target $0.35 if validated by continued buying pressure.

Technical Analysis Highlights

- DOGE experienced significant volatility with a 4.3% range (0.211-0.220) over the past 24 hours, forming a key support zone around 0.212 validated by high volume rebounds at 13:00 and 22:00.

- The price action reveals a bullish recovery pattern from the 16:00 low, with resistance emerging at 0.217-0.220.

- The 20:00 candle’s strong volume surge above the 24-hour average confirms renewed buying interest, suggesting potential upward momentum if DOGE can maintain its position above the established support level.

- In the past hour, DOGE has demonstrated significant bullish momentum, climbing from 0.215 to 0.216 with notable volume spikes at 01:17, 01:21, and 01:54-01:55.

- The price established a strong support zone around 0.215 during the early minutes, followed by a decisive breakout at 01:16-01:17 where volume surged over 8 million.

- The uptrend continued with higher lows forming a clear ascending pattern, culminating in a new resistance test at 0.216-0.217 range.

- The final minutes saw particularly heavy trading activity with volumes exceeding 7 million at 02:01-02:02, confirming strong buyer interest and suggesting potential for further upside movement.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Dogecoin Eyes $0.35 as Whale Accumulation Signals Bull Flag Breakout«, The Crypto Basic, published May 16, 2025.

- «Dogecoin Hovers at $0.22 Following Weeks of Gains, Analysts Share Mixed Outlooks«, NewsBTC, published May 17, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors