Uncategorized

How Alpha-Generating Digital Asset Strategies Will Reshape Alternative Investing

Mainstream conversations around digital assets largely focus on the dramatic price performance of bitcoin and ether. For years, retail and institutional investors have targeted beta exposure, or returns that mirror the broader crypto market. However, the introduction of products like bitcoin exchange-traded funds (ETFs) and exchange-traded products (ETPs) have made achieving beta more accessible, with these products drawing over $100 billion in institutional capital.

But as the asset class matures, the conversation is shifting. More institutions are now pursuing alpha, or returns that exceed the market, through actively managed strategies.

The role of uncorrelated returns in diversification

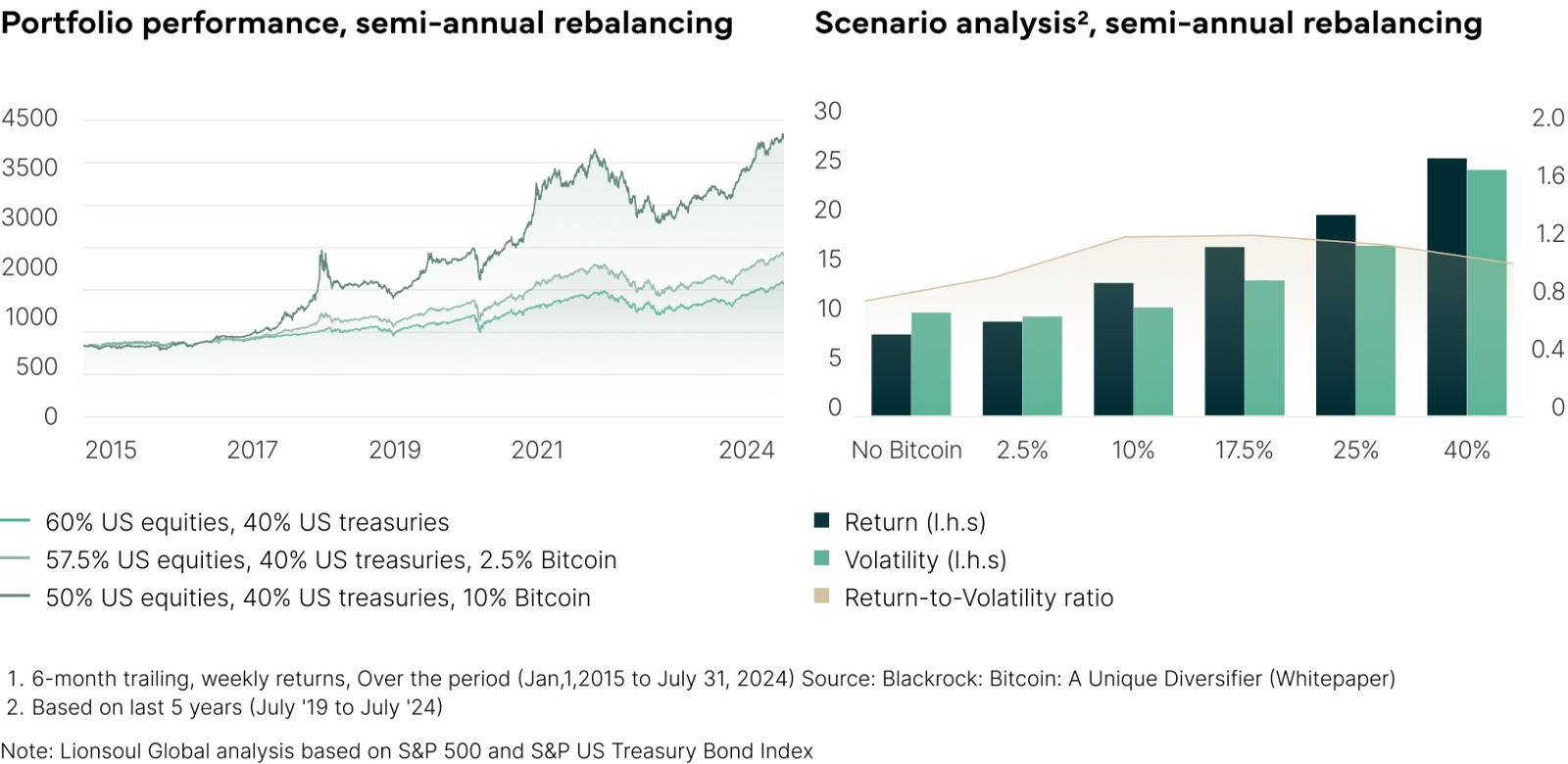

Low correlation to traditional assets enhances the role of digital assets in diversified portfolios. Since 2015, bitcoin’s daily correlation to the Russell 1000 Index has been just 0.231, meaning that bitcoin’s daily returns move only weakly in the same direction as the Russell 1000 Index, with gold and emerging markets remaining similarly low. A modest 5% allocation to bitcoin in a 60/40 portfolio, a portfolio containing 60% equities and 40% fixed income, has been shown to boost the Sharpe ratio (the measure of risk-adjusted return on a portfolio) from 1.03 to 1.43. Even within crypto itself, varying correlations allow for intra-asset diversification. This makes digital assets a powerful tool for risk-adjusted return enhancement [see exhibit 1].

Digital assets enter the active era

Just as hedge funds and private equity redefined traditional markets, digital assets are now evolving beyond index-style investing. In traditional finance, active management represents over 60% of global assets. With informational asymmetries, fragmented infrastructure and inconsistent pricing, digital assets present a compelling landscape for alpha generation.

This transition mirrors the early stages of the alternatives industry, when hedge funds and private equity capitalized on inefficiencies long before these strategies were adopted by the mainstream.

Market inefficiencies

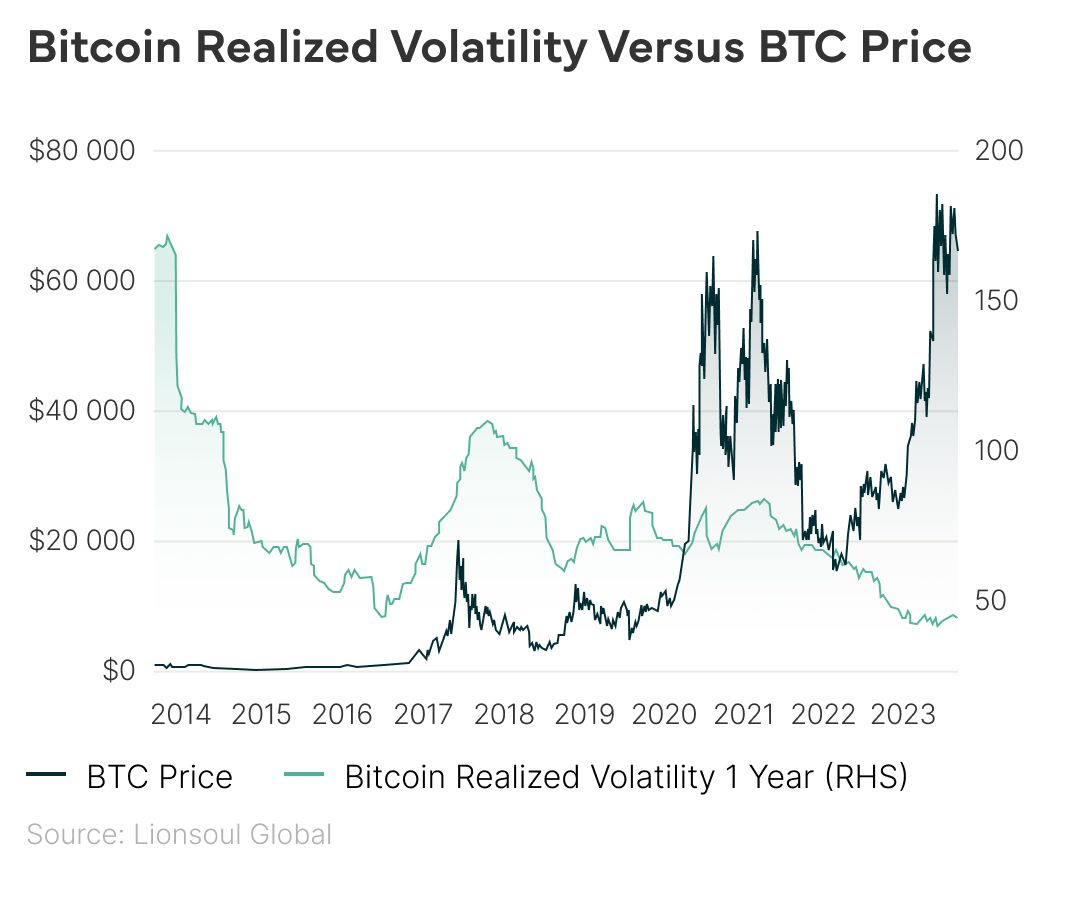

Crypto markets remain volatile and structurally inefficient. Though bitcoin’s annualized volatility fell below 40% in 2024, it remains more than twice that of the S&P 500. Pricing inconsistencies across exchanges, regulatory fragmentation and the dominance of retail behavior create significant opportunities for active managers.

These inefficiencies — combined with limited competition in institutional-grade alpha strategies — present a compelling case for specialized investment approaches.

- Arbitrage strategies: Utilization of trading strategies such as cash and carry, which captures spreads between spot and futures prices, or basis trading, which involves entering long positions in discounted assets and shorts in premium ones, enables alpha generation by utilizing market inefficiencies within the digital assets market.

- Market making strategies: Market makers earn returns by placing bid/ask quotes to capture spread. Success relies on managing risks like inventory exposure and slippage, especially in fragmented or volatile markets.

- Yield farming: Yield farming taps into Layer 2 scaling solutions, decentralized finance (DeFi) platforms and cross-chain bridges. Investors can earn yields through lending protocols or by providing liquidity on decentralized exchanges (DEXs), often earning both trading fees and token incentives.

- Volatility arbitrage strategy: This strategy targets the gap between implied and realized volatility in crypto options markets, offering market-neutral alpha through advanced forecasting and risk management.

High upside and an expanding universe

Meanwhile, new opportunities continue to emerge. Tokenized real-world assets (RWAs) are projected to exceed $10.9 trillion by 2030, while DeFi protocols, which have amassed 17,000 unique tokens and business models while accumulating $108 billion+ in assets, are expected to surpass $500 billion in value by 2027. All of this points towards an ever expanding, ever developing digital asset ecosystem that is ideal for investors to utilize as a legitimate alpha generating medium.

Bitcoin’s price has surged over the years, while its long-term realized volatility has steadily declined, signaling a maturing market.

Uncategorized

Crypto Rebounds From Early Declines Alongside Reversal in U.S. Stocks

There was a bit of volatility in crypto on Wednesday, but most of the market continued the weeks’ trend of trading in a very tight range.

Shortly after the close of the U.S. stock market, bitcoin (BTC) was changing hands at $94,700, down just 0.4% over the past 24 hours. BTC was lower by nearly 2% at one point alongside a sizable early decline in stocks.

Hit harder during the early decline, altcoins also rebounded, but underperformed bitcoin The CoinDesk 20 slumped 2% in the last 24 hours, with litecoin (LTC), ripple (XRP), avalanche (AVAX) and chainlink (LINK) all dropping roughly 4%.

Crypto equities were modestly lower, but bitcoin miner Hut 8 (HUT) was a notable underperformer, falling 5.7%.

The major U.S. stock averages tumbled 2% or more early in the session following less than stellar economic news. They retook ground throughout the day though, with the S&P 500 closing slightly in the green and the Nasdaq dipping just 0.1%.

The continuing string of lame economic data, however, has not seemed to deter U.S. President Trump from his tariff policies.

“Somebody said all the shelves are going to be open,” Trump said early Wednesday. “Well, maybe the children will have two dolls instead of 30 dolls, and maybe the two dolls will cost a couple of bucks more than they would normally. … They have ships that are loaded up with stuff, much of which we don’t need.”

Uncategorized

Robinhood Tops Q1 Earnings Estimates, Boosts Buyback Authorization by $500M

Robinhood (HOOD) topped tempered analyst estimates in the first quarter of 2025, reporting adjusted earnings per share of $0.37 against forecasts for $0.33.

The popular trading platform reported $927 million in total revenue, down from $1 billion in the fourth-quarter, but beating Street expectations of $920.1 million. Crypto-related revenue was $252 million, up 100% from year-ago levels.

Transaction-based revenue of $583 million slipped 13% from $672 million in the fourth quarter.

Robinhood had seen explosive numbers in the fourth quarter, in part thanks to a surge in crypto trading amid euphoria stemming from U.S. President Donald Trump’s presidential win. But the froth in crypto and traditional markets quickly reversed following Trump’s inauguration.

The company added $500 million to its existing $1 billion share repurchase program. To date, HOOD has bought back $667 million, leaving another$833 million under the authorization.

Robinhood’s monthly crypto volumes have historically shown high correlation with Coinbase’s (COIN) retail volumes, but Barclays analyst Benjamin Buddish believes the COIN will have seen a less meaningful decline in trading volumes in the first quarter.

Coinbase is reporting earnings on May 8 and is expected to post a slight decline in revenue to $2.1 billion from $2.27 billion in the previous quarter, while exchange volume is expected to have dropped to $403.8 from $439 billion, according to analysts at FactSet.

HOOD shares are down 2.2% in after hours action.

Uncategorized

Visa and Baanx Launch USDC Stablecoin Payment Cards

Cryptocurrency debit card firm Baanx has partnered with Visa to launch stablecoin payment cards tied to self-custodial wallets, starting in the U.S. with Circle’s USDC dollar pegged token, the companies said.

The Visa cards enable holders to spend USDC directly from their crypto wallets, using smart contracts to move a stablecoin balance upon card authorization from the consumer to Baanx in real time, with Baanx converting the balance into fiat for payment, according to a press release on Wednesday.

Allowing people to manage their money on-chain with the help of major card networks like Visa and Mastercard is a fast growing segment within crypto. Baanx, a firm that specializes in crypto debit cards, is also working with Mastercard on a card linked to MetaMask wallets.

The stablecoin payments is also heating up with Circle recently announcing its own payment network focused initially on cross-border payments and remittances.

Baanx’s stablecoin-linked Visa cards promise a global reach with low-cost cross border payments in the mix, according to the release.

“In many regions, access to stable currency is a luxury. We’re giving people the ability to hold and spend USD-backed stablecoins seamlessly — in a self-custodial, real-time way — anywhere Visa is accepted. This is what the future of finance looks like,” said Simon Jones, chief commercial officer at Baanx in a statement.

“We know the payments ecosystem is still in the early innings of stablecoin adoption, but real-world utility is coming to the forefront, and we’re excited for what’s next,” said Rubail Birwadker, Visa’s head of growth products and partnerships in a statement.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors