Uncategorized

HBAR Shares Drop 4% as Institutional Selling Intensifies

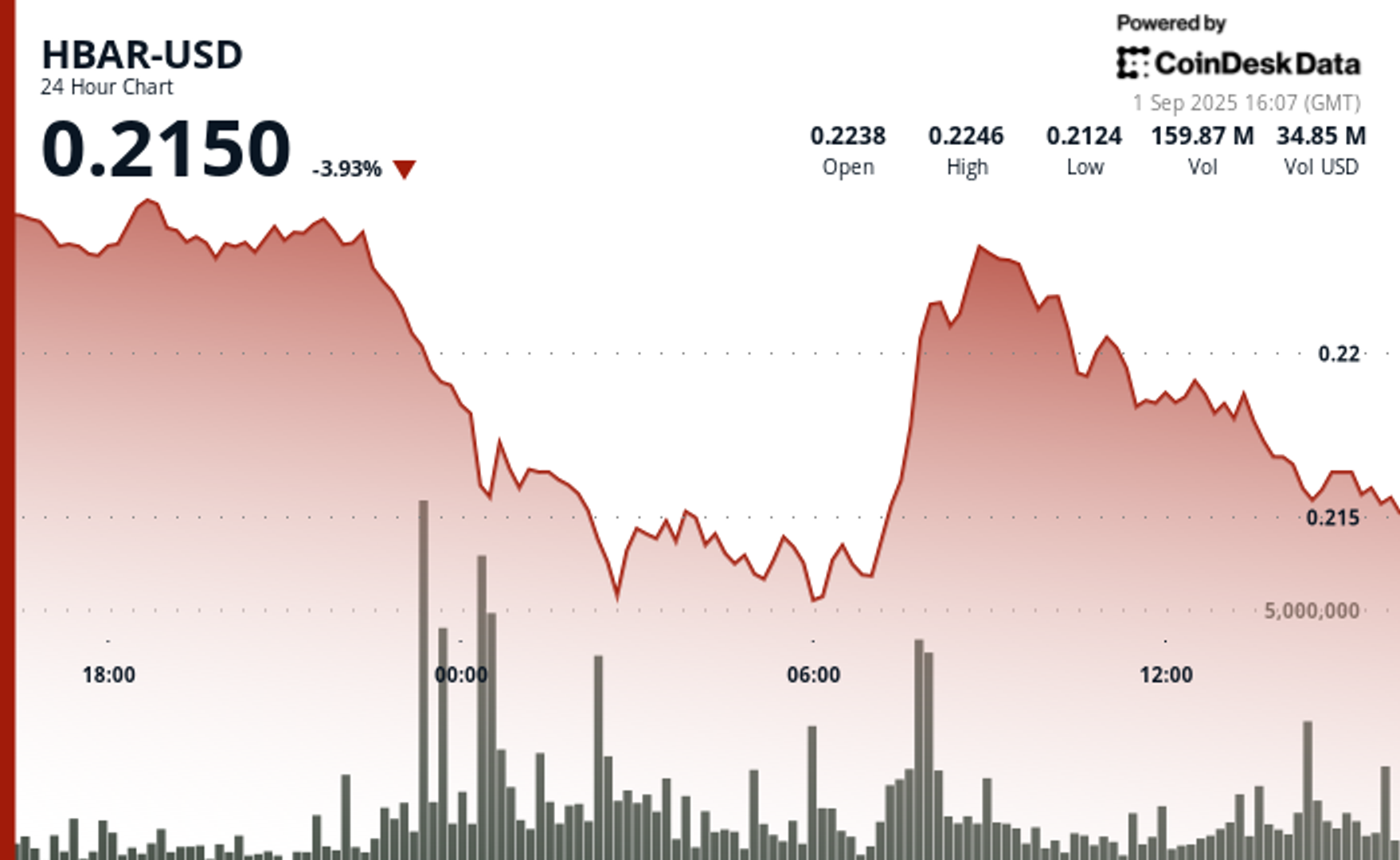

Hedera’s HBAR token faced renewed selling pressure as institutional investors trimmed exposure, pushing the asset down about 4% between Aug. 31 and Sept. 1. Trading activity was concentrated around the $0.22 mark, with intraday swings ranging from $0.23 highs to $0.22 lows.

The heaviest selling emerged during after-hours, when more than 110 million tokens exchanged hands, underscoring signs of coordinated divestment. Market makers sought to stabilize the price in the $0.21–$0.22 range, but resistance hardened just above $0.22, capping any meaningful recovery.

Despite the downturn, Hedera continues to position itself as a platform for enterprise adoption. Daily trading volume fell 46% to $172.85 million while the network maintained a market capitalization near $9.5 billion.

Selling pressure accelerated into the final hour of Sept. 1 trading, when HBAR briefly breached multiple support levels. Roughly 3.5 million tokens changed hands in a single minute as the token slid below its $0.22 resistance, closing the session near its lows. With sellers maintaining control and institutional flows leaning negative, the market is signaling that further corporate repositioning could continue in the near term.

Market Structure Analysis Reveals Institutional Repositioning

- Share price declined from $0.22 to $0.22 representing trading ranges of $0.01 or 5% between maximum and minimum session levels.

- Trading volume exceeded 110 million tokens during overnight hours indicating significant institutional activity and potential portfolio rebalancing.

- Support levels emerged around the $0.21-$0.22 range with subsequent recovery attempts failing to gain institutional backing.

- Resistance formed near $0.22-$0.23 levels where price discovery consistently encountered selling pressure throughout the trading period.

- Multiple support level breaches occurred at $0.22 and $0.22 with sellers maintaining market control.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts