Business

Grvt Raises $19M to Bring Privacy and Scale to On-Chain Finance

Grvt (pronounced «gravity»), a decentralized exchange (DEX) focused on privacy in on-chain finance, has raised $19 million in Series A funding.

The round was co-led by ZKsync, its foundational technology partner, along with Further Ventures, EigenCloud (formerly EigenLayer) and 500 Global, the company announced via email on Thursday.

Built on the ZKsync Validium L2, Grvt uses zero-knowledge (ZK) proofs to ensure transactions inherit Ethereum-level security while keeping trade details private and settlement costs low. The company says this architecture addresses long-standing barriers to mainstream adoption of on-chain finance: privacy, scalability and accessibility.

ZK technology is a cryptographic method in which one party can demonstrate to another that a certain piece of information is true, without revealing anything about said information. This is an important facet of blockchain-based finance as it allows users to verify transactions and transfers without revealing anything about the sender, receiver, amount.

“Privacy is uncompromising for the future of on-chain trading and investing,” said co-founder and CEO Hong Yea, adding that Grvt aims to set the standard for how zero-knowledge cryptography powers financial markets.

The raise comes amid a resurgence in Ethereum activity, with August’s on-chain volume topping $320 billion, its highest since mid-2021. Backers see Grvt as a potential liquidity hub for a trillion-dollar on-chain finance market, with applications spanning cross-exchange vaults, cross-chain interoperability, real-world assets, and structured options, according to the announcement.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

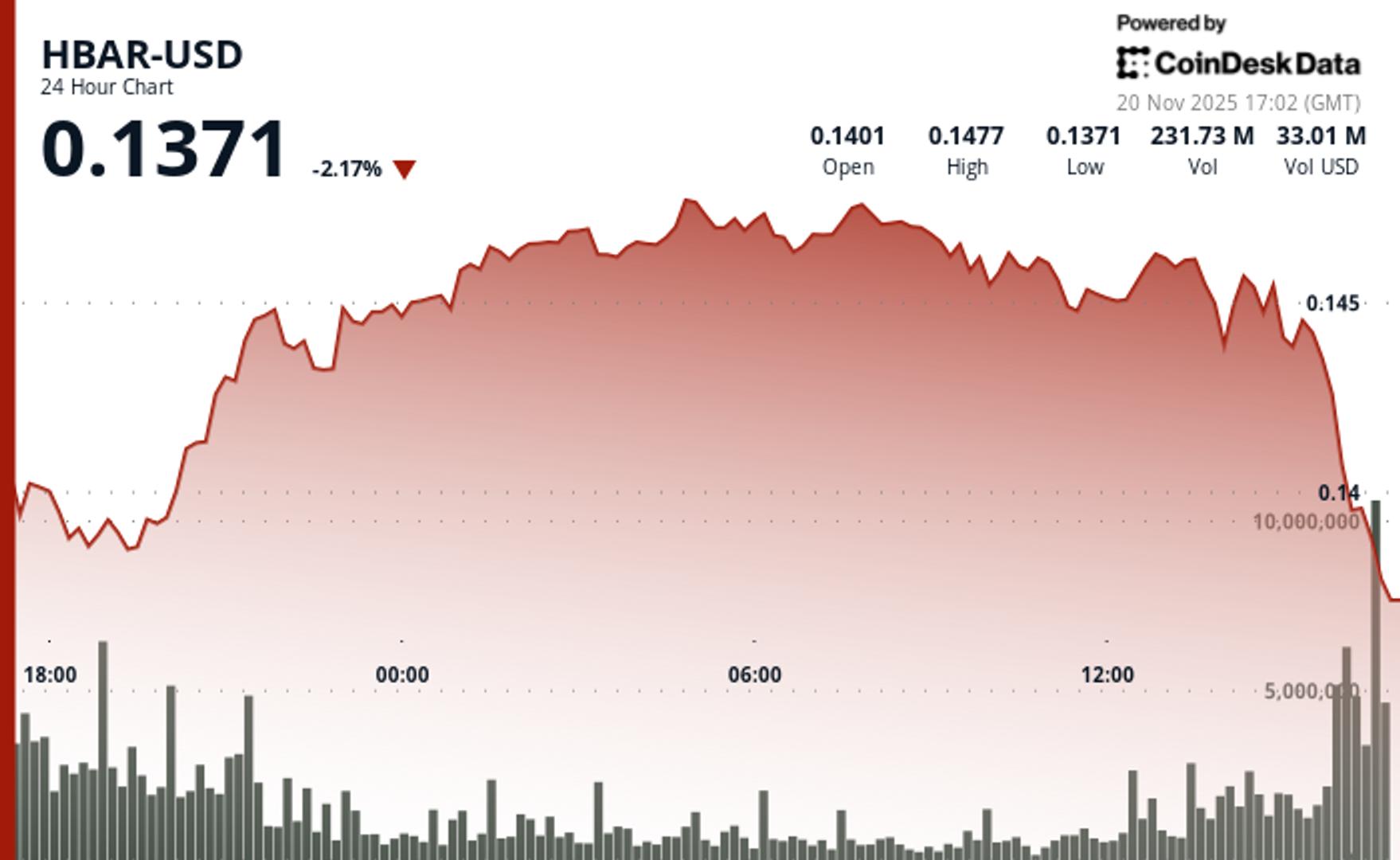

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton