Uncategorized

From Airdrop to Freefall: Celestia’s Tokenomics Under Fire

When Celestia airdropped its TIA token to 580,000 users in 2023 it was the plat du jour among traders and investors, with the project saying the release aligned with a new «modular era.»

However, despite rallying to a dizzying $20 price point in September, 2024, it has since slumped to less than $1.65 in a desperate plight spurred by a series of massive cliffs in the token’s vesting schedule.

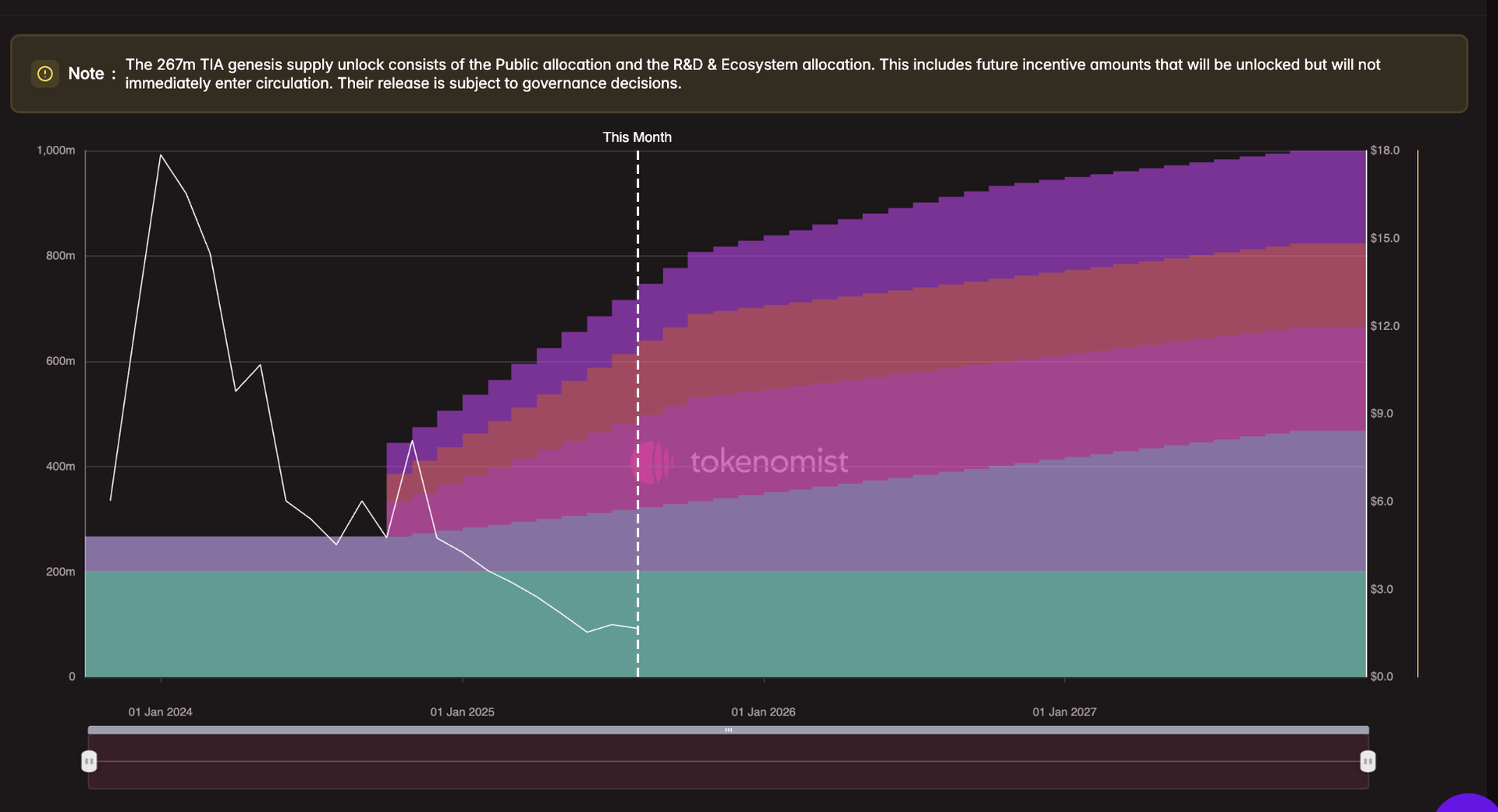

Data from Tokenomist shows that core contributors and early backers, notably a slew of venture capitalists, could sell tokens purchased for relatively cheap in early fundraising rounds onto the open market.

This coincided with TIA’s precipitous move to the downside, although it’s worth noting that the token’s market cap, currently at $1.2 billion, actually increased by 50% despite the token losing 90% of its value due to the sheer scale of supply increase.

Other examples

TIA’s price collapse mirrors similar drawdowns across newer tokens. Blast’s 10.5 billion token unlock in June, over half of its supply, sent prices tumbling to all-time lows as investors struggled to absorb the sudden flood of liquidity.

Berachain also suffered heavy losses after its airdrop and early vesting cliffs triggered a long squeeze, cutting its token nearly in half from launch highs. Meanwhile, Omni Network’s token dropped over 50% within a day of its debut as early recipients rushed to sell.

These cases underscore how aggressive vesting schedules and poor post-launch liquidity continue to weigh on token performance, even among the most hyped projects.

What’s next for TIA: a squeeze or slow unwind?

With Celestia’s TIA token down over 90% from its highs, investors are now watching whether the asset is bottoming, or unraveling. Following an October 2024 cliff unlock that released 176 million tokens (nearly doubling circulating supply), TIA has entered a phase of steady linear emissions. Roughly 409 million more tokens are scheduled to vest through early 2027, adding continuous pressure on price.

Some traders see a setup for a short squeeze. According to Stix’s head of trading Taran Sabharwal, a significant portion of unlocked tokens were sold over-the-counter, with buyers hedging via perpetuals. This has led to elevated open interest and negative funding, a dynamic that, if reversed, could force shorts to cover. “Funding is deeply negative,” Sabharwal said. “If that resets, you could see a pop.”

But barring a squeeze, fundamentals remain weak. Monthly vesting continues, liquidity is thin, and new demand for TIA is limited. Without a fresh catalyst, such as growth in Celestia’s modular ecosystem, TIA risks further downside as each unlock adds to sell pressure in an already oversupplied market.

Uncategorized

CoinDesk 20 Performance Update: Index Drops 2.5% as Nearly All Constituents Decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

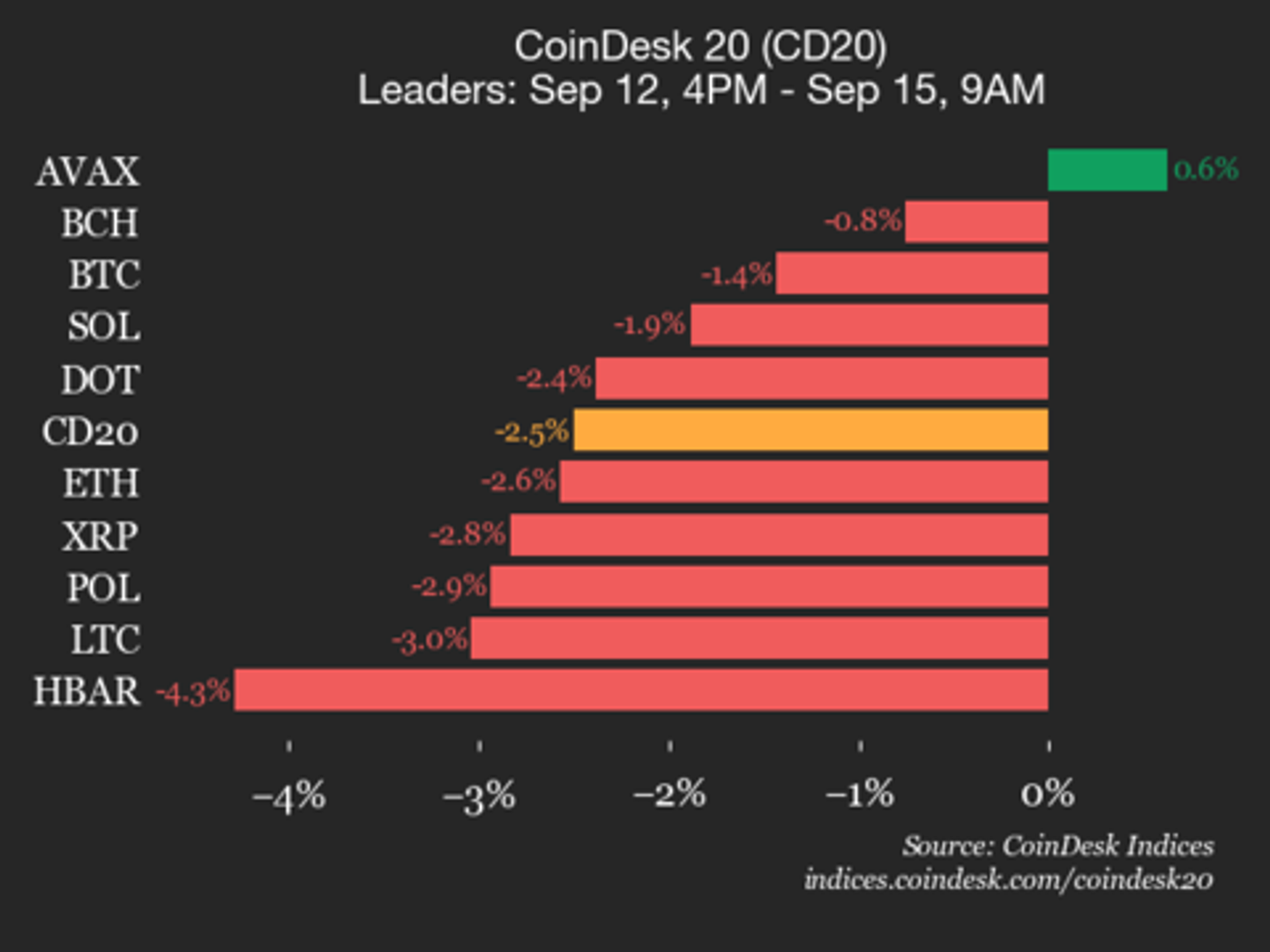

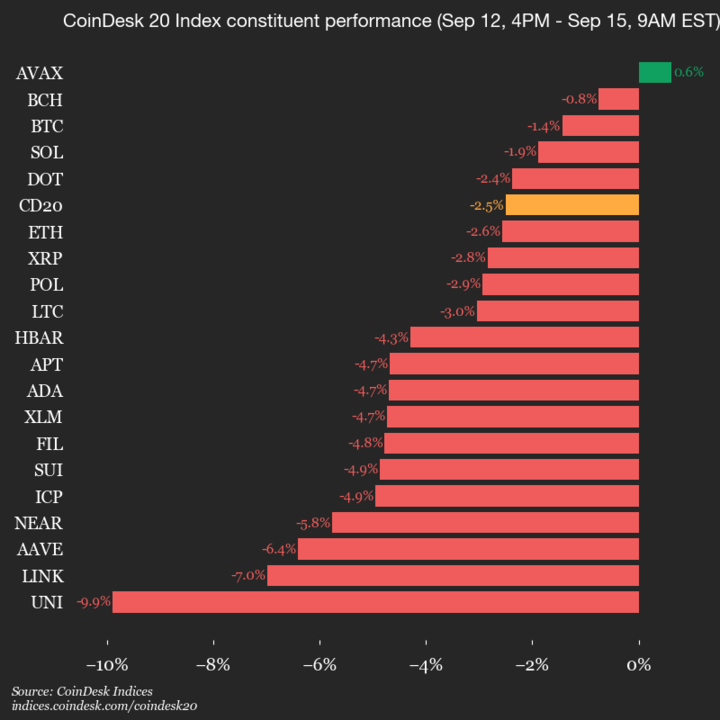

The CoinDesk 20 is currently trading at 4248.74, down 2.5% (-109.09) since 4 p.m. ET on Monday.

One of 20 assets is trading higher.

Leaders: AVAX (+0.6%) and BCH (-0.8%).

Laggards: UNI (-9.9%) and LINK (-7.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200%

Helius Medical Technologies (HSDT) announced on Monday it’s raising more than $500 million in a private financing round to create a Solana-focused treasury company.

The vehicle will hold SOL, the native token of the Solana blockchain, as its reserve asset and aims to expand to more than $1.25 billion via stock warrants tied to the deal, the press release said.

The financing was led by Pantera Capital and Summer Capital, with participation from investors including Animoca Brands, FalconX and HashKey Capital.

Shares of the firm rallied over 200% above $24 in pre-market trading following the announcement. Solana was down 4% over the past 24 hours.

The firm is joining the latest wave of new digital asset treasuries, or DATs, with public companies pivoting to raise funds and buy cryptocurrencies like bitcoin (BTC), ether (ETH) or SOL.

Helius is set to rival with the recently launched Forward Industries (FORD) with a $1.65 billion war chest backed by Galaxy Digital and others. That firm confirmed on Monday that has already purchased 6.8 million tokens for roughly $1.58 billion last week.

Helius’ plan is to use Solana’s yield-bearing design to generate income on the holdings, earning staking rewards of around 7% as well as deploying tokens in decentralized finance (DeFi) and lending opportunities. Incoming executive chairman Joseph Chee, founder of Summer Capital and a former UBS banker, will lead the firm’s digital asset strategy alongside Pantera’s Cosmo Jiang and Dan Morehead.

«As a pioneer in the digital asset treasury space, having participated in the formation of the strategy at Twenty One Capital (CEP) with Tether, Softbank and Cantor, Bitmine (BMNR) with Tom Lee and Mozayyx as well as EightCo (OCTO) with Dan Ives and Sam Altman, we have built the expertise to set up the pre-eminent Solana treasury vehicle,» Cosmo Jiang, general partner at Pantera Capital, said in a statement.

«There is a real opportunity to drive the flywheel of creating shareholder value that Michael Saylor has pioneered with Strategy by accelerating Solana adoption,» he added.

Read more: Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges

Uncategorized

American Express Introduces Blockchain-Based ‘Travel Stamps’

American Express has introduced Ethereum-based ‘travel stamps’ to create a commemorative record of travel experiences, as part of the firm’s revamped travel app.

The travel experience tokens, which are technically NFTs (ERC 721 tokens), are minted and stored on Coinbase’s Base network, said Colin Marlowe , VP, Emerging Partnerships at Amex Digital Labs.

The travel stamps, which can be collected anytime a traveler uses their card, are not tradable NTF tokens, Marlowe explained, and neither do they function like blockchain-based loyalty points – at least for the time being.

“It’s a valueless ERC-721, so technically an NFT, but we just didn’t brand it as such. We wanted to speak to it in a way that was natural for the travel experience itself, and so we talk about these things as stamps, and they’re represented as tokens,” Marlowe said in an interview.

“As an identifier and representation of history the stamps could create interesting partnership angles over time. We weren’t trying to sell these or sort of generate any like short term revenue. The angle is to make a travel experience with Amex feel really rich, really different, and kind of set it apart,” he said.

The Amex travel app also includes a range of tools for travels and Centurion Lounge upgrades, the company said.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars