Uncategorized

Filmmaker David Goyer Bets on Blockchain for Next Sci-Fi Franchise

TORONTO — David Goyer, the filmmaker whose credits include the Blade trilogy, The Dark Knight, and Apple TV’s Foundation series, said Friday he is building a new blockchain-based science-fiction universe called Emergence.

The world of Emergence, according to Goyer, features spaceships, relic-hunting and white holes — science-fiction staples that will serve as the foundation for a sprawling transmedia project built inside Incention, Goyer’s new blockchain platform.

In a panel discussion at CoinDesk’s Consensus conference in Toronto, Goyer appeared alongside SY Lee of Story Protocol, the intellectual property-focused blockchain upon which Incention and Emergence are based. There, Goyer laid out his vision for Incention, saying the platform will allow fans to co-create the Emergence universe alongside professional storytellers.

“The idea is that we’re going to involve the community in all of this, and they’ll have an opportunity to create characters who will be joining the podcast, joining the animation, etc.,” he said.

Goyer criticized Hollywood’s approach to IP-building, calling it “very top down” and slow to adapt. “Franchises are built in the film and television industry [on] models that are a century old,” he said. “It’s very hard to innovate. It’s very hard to break into Hollywood if you’re a newcomer.” Web3, he added, could help change that.

Story Protocol, launched in 2023, has raised more than $80 million from backers including a16z, Hashed, and Endeavor. The platform offers tools for registering, tracking and monetizing intellectual property on the blockchain.

“Each intellectual property has its own program, licensing and royalty-sharing rights,” Lee explained on Friday. “Without any middleman, someone can remix, license, and basically build upon someone else’s IP,” he added. “According to the rules set by the IP owner […] they could share the upside together.”

Goyer said he wrote a 2,500-page story bible to anchor the Emergence universe. “We hired a bunch of really talented concept artists that had worked on the Harry Potter and Star Wars franchises, and a number of Hugo and Nebula Award-winning science fiction authors to write stories within the universe using the bible that I created,” he said.

That material also served as the training data for an AI agent, dubbed “Atlas,” which Goyer said will help contributors co-create within a pre-defined narrative framework.

“This is what I would say is sort of a sanctioned use of AI, where we’re not just scraping information,” he said.

Visitors to the Emergence platform can read about its characters and settings or generate their own. The community may then upvote user-generated stories and visuals. An editorial board — chaired by Goyer — will determine which submissions become part of the official canon.

“We’ll let our community up-vote the characters that the community themselves have created,” he said. “Then the editorial board — which is myself and a few other people — will decide which of these characters best suits the overall franchise.”

“AI, Web3, blockchain — none of this stuff is going away, right? The whole world’s becoming tokenized,” Goyer said. “So, for my sake, I just thought this is something I need to learn about and get involved in.”

While AI and blockchain have raised fears of job loss and the commodification of creative labor, Goyer said his hope is to use the technology in ways that empower artists.

“It’s really about deciding whether I’m going to stick my head in the sand, or I’m going to have a seat at the table and see, in my own small way, whether or not I can help guide this in a way that’s beneficial to creative types like myself,” he said.

Uncategorized

Trump Media and Semler Scientific Could Be Cheapest Bitcoin Treasury Companies by This Metric

A tsunami of new bitcoin BTC treasury companies — firms that almost exclusively dedicate themselves to accumulating bitcoin — is flooding the market.

Since all of them are more or less following Strategy’s (MSTR) playbook, questions are rising about the best ways to value them, and compare them to each other.

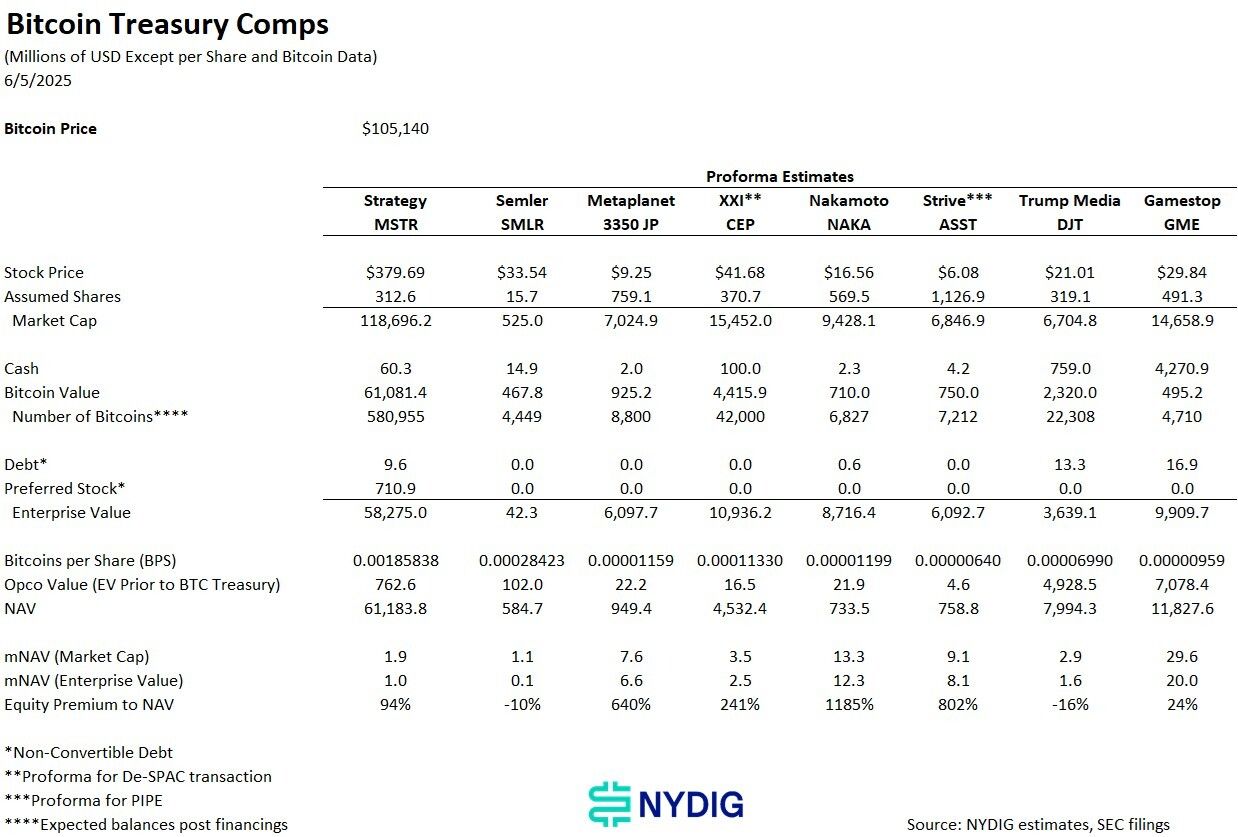

“The most important metric for a bitcoin treasury is the premium it trades at relative to its underlying net assets, including any operating company,” Greg Cipolaro, global head of research at bitcoin financial firm NYDIG, wrote in a June 6 report.

On the surface, that means adding up the company’s bitcoin, cash and enterprise value excluding the bitcoin stuff, and subtracting obligations such as debt and preferred stock. “It’s this premium that allows these companies to convert stock for bitcoins, effectively acting as a money changer converting shares for bitcoins,” Cipolaro said.

One of the most popular metrics, mNAV, measures a company’s valuation to its net asset value — in these cases, their bitcoin treasuries. An mNAV above 1.0 signals that investors are interested in paying a premium for exposure to the stock relative to its bitcoin stash; however, an mNAV below 1.0 means the equity is now worth less than the company’s holdings.

But mNAV alone is “woefully deficient” to analyze the strengths and weaknesses of these firms, Cipolaro said. The research report made use of other metrics such as NAV, mNAV measured by market capitalization, mNAV by enterprise value, and equity premium to NAV to provide a more complex picture.

The table shows, for example, that Semler Scientific’s (SMLR) and Trump Media’s (DJT) equity premium to NAV (which measures the percentage difference between a fund’s market price and its net asset value), are the lowest of the eight measured companies, coming in at -10% and -16% respectively, despite the fact that both companies have an mNAV above 1.1.

Alas, both SMLR and DJT are little-changed on Monday even as bitcoin climbs to $108,500 versus Friday evening’s $105,000 level. MSTR is higher by just shy of 5%.

Uncategorized

U.S. SEC Chair Says Working on ‘Innovation Exemption’ for DeFi Platforms

The U.S. Securities and Exchange Commission is working on policy to exempt decentralized finance (DeFi) platforms from regulatory barriers, said Chairman Paul Atkins.

Software developers building DeFi tools have no business being blamed for how they’re used, Atkins and other SEC Republicans contended at the final of five crypto roundtables that have been held at the agency since the leadership turnover under President Donald Trump.

The chairman told a roundtable of DeFi experts on Monday that he’s directed the SEC staff to look into changes to agency rules «to provide needed accommodation for issuers and intermediaries to seek to administer on-chain financial systems.» Atkins called that potential exemptive relief «an innovation exemption» that would let entities under SEC jurisdiction bring on-chain products and services to market «expeditiously.»

«Many entrepreneurs are developing software applications that are designed to function without administration by any operator,» Atkins said in remarks at the event. While he noted the technology enabling private peer-to-peer transactions can «sound like science fiction,» he said «blockchain technology makes possible an entirely new class of software that can perform these functions without an intermediary.»

«We should not automatically fear the future,» Atkins said.

DeFi is a subsection of the broader cryptocurrency industry that seeks to recreate financial tools and products with code that replaces the role of traditional intermediaries such as banks and brokerages.

The Republican members of the commission — currently outnumbering the Democrat 3-1 — have been eager to move forward with crypto-friendly policy. While DeFi is often given short shrift in policy discussions that focus more on regulation of the higher-volume industry of crypto exchanges, brokers and custodial services. Though DeFi developers have faced years of distrust from U.S. government agencies, Republicans now in power are seeking to lighten those pressures.

«The SEC must not infringe on First Amendment rights by regulating someone who merely published code on the basis that others use that code to carry out activity that the SEC has traditionally regulated,» said Commissioner Hester Peirce, who has led the SEC Crypto Task Force established this year. However, she also noted that «centralized entities can’t avoid regulation simply by rolling out the decentralized label.»

Erik Voorhees, the founder of decentralized exchange ShapeShift, joked that when he got his first SEC subpoena 12 years ago, he didn’t think he’d be invited to speak at the agency years later.

«I appreciate the change of tone and the change of stance for the commission,» he said. «I think that’s absolutely a positive for America.»

Read More: U.S. SEC’s Crypto Trading Roundtable Delves Into Easing Path for Platforms

Uncategorized

Plasma’s XPL Token Sale Attracts $500M as Investors Chase Stablecoin Plays

Plasma, a crypto startup developing a blockchain optimized for stablecoins, attracted $500 million in deposits for its token sale on Monday — 10 times more than originally planned.

The fundraising cap was filled in five minutes as investors scrambled to earn an allocation for the token distribution, according to blockchain data from Arkham Intelligence. The ceiling was lifted from $250 million, which had already been increased from a $50 million original target announced just two weeks ago.

Over 1,100 wallets participated in the sale of Plasma’s XPL token, with a median allocation of roughly $35,000, the company said in an X post. The offering was conducted on Sonar, a public token sale platform built by Echo, a crypto-focused private fundraising startup led by prominent investor Cobie.

The outsized demand underscores surging investor interest in stablecoins — cryptocurrencies pegged to traditional currencies like the U.S. dollar — and the infrastructure that supports them. Stablecoins have become a dominant force in crypto, with total supply surpassing $250 billion, and are increasingly used for everyday finances like payments, remittances and savings.

While Bitcoin BTC remains the oldest and most secure blockchain, most stablecoin activity today occurs on newer networks such as Ethereum, Tron, and Solana. Plasma aims to bring native stablecoin utility to Bitcoin by building a sidechain fully compatible with the Ethereum Virtual Machine (EVM), the software standard that underpins much of decentralized finance.

The team says the Plasma chain will address key challenges faced by stablecoins on existing blockchains — including high fees and scalability limits — by leveraging Bitcoin’s security and enabling zero-fee transactions for Tether’s USDT USDT.

Plasma’s fundraising follows a string of market signals pointing to rising appetite for stablecoin exposure. Just last week, Circle (CRCL), issuer of the $60 billion USDC stablecoin, completed a blockbuster public market debut, with shares surging over $110 from a $31 IPO price.

«Circle up another 20% at the open and Plasma’s $500M public token sale sold out in the first block. The people want exposure to stablecoins,» crypto analyst Will Clemente posted.

-

Business8 месяцев ago

Business8 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business8 месяцев ago

Business8 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Tech8 месяцев ago

Tech8 месяцев ago5 Crowdfunded products that actually delivered on the hype

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time