Uncategorized

Figment Eyes Up to $200M Worth of Acquisitions in Crypto M&A Push: Report

Figment, a major player in blockchain staking services, is actively looking to buy companies in a spree of crypto industry consolidation sparked by renewed optimism over U.S. regulatory clarity.

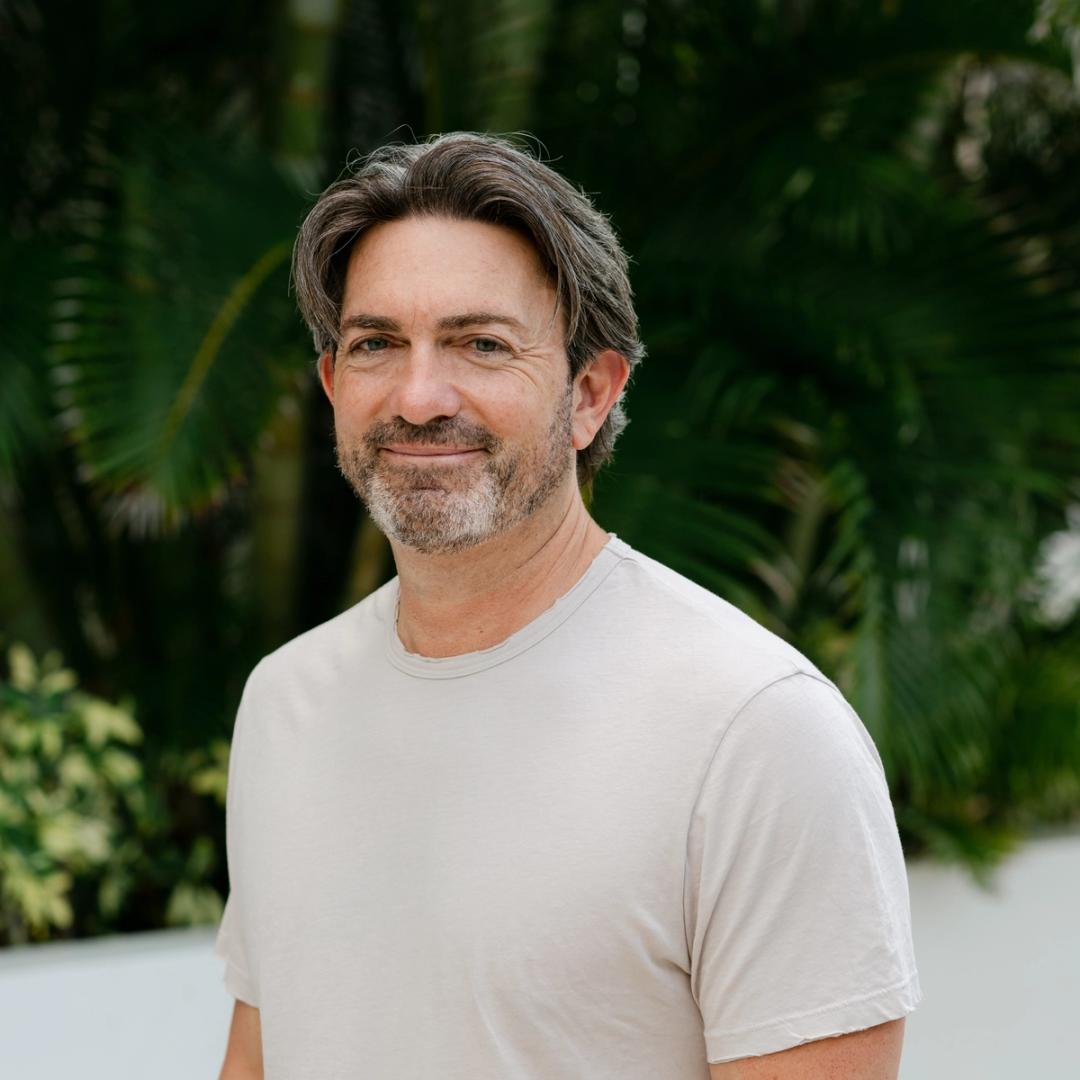

The Toronto-based firm is targeting acquisitions between $100 million and $200 million, with a strong regional presence or within blockchain ecosystems, such as Cosmos and Solana, CEO Lorien Gabel told Bloomberg. He said the firm already has term sheets out for some deals, the report added.

Figment helps institutions earn yield by staking, whereby tokens are locked to help secure blockchain networks and validate transactions supported by networks. The company currently manages around $15 billion in staked assets and employs about 150 people, Gabel said.

The flurry of crypto deals, which include Kraken’s $1.5 billion purchase of NinjaTrader and Ripple’s $1.25 billion acquisition of Hidden Road, comes as the Trump administration brought on a more crypto-friendly regulatory environment. That environment saw the U.S. Securities and Exchange Commission drop cases against various crypto firms, with crypto ally Paul Atkins recently taking over the commission.

Despite the acquisition strategy, Figment isn’t seeking additional funding and has ruled out a sale. Gabel, who co-founded the firm and has launched three prior startups, said he’s committed to building Figment for the long term. “I’d rather go to zero,” he said.

The company has raised $165 million to date, according to data from TheTie. Its latest Series C funding round was led by Thoma Bravo and saw participation from giants including Morgan Stanley, StarkWave, and Franklin Templeton India.

Read More: Kraken to Buy NinjaTrader for $1.5B to Enter U.S. Crypto Futures Market

Uncategorized

Bitcoin Rebounds Above $104,300 as Tariff Chaos Triggers Nearly $1B in Liquidations

Global economic tensions and trade policy uncertainties continue to influence cryptocurrency markets as Bitcoin recovers from a recent correction.

Despite the pullback, institutional interest remains strong with firms like Strategy (formerly MicroStrategy) and GameStop adding BTC to their corporate treasuries.

Technical Analysis Highlights

- The 24-hour period shows a clear bottoming pattern with strong volume support emerging around the $103,200-$103,400 zone, where buyers consistently stepped in, according to CoinDesk Research’s technical analysis data model.

- The subsequent recovery phase gained momentum after breaking above the $104,000 resistance level, with increasing volume confirming buyer conviction.

- This technical structure suggests the correction has likely completed, with the price now establishing a new support base for potential continuation of the broader uptrend.

- In the last hour, Bitcoin demonstrated a notable recovery pattern, climbing from $104,146 to $104,303, with significant bullish momentum emerging at 14:01.

- Price surged from $104,188 to $104,323 on substantially higher volume (429 BTC traded).

- The price action formed a clear consolidation range between $104,077 and $104,263 before the breakout, with key support established around $104,080-$104,090.

External References

- «Bitcoin Price Extends Losses — Is More Downside on the Horizon?«, NewsBTC, published May 30, 2025.

- «Bitcoin at Risk of Breakdown if Major Support Level Fails, Says Trader Justin Bennett – Here Are His Targets«, The Daily Hodl, published May 30, 2025.

- «Bitcoin price prediction 2025-2031: Will BTC hit $150k soon?«, Cryptopolitan, published May 31, 2025.

Uncategorized

Bitcoin Cash Rebounds 6.4% as Bulls Defend Key Support Zone

The cryptocurrency market is navigating choppy waters amid escalating geopolitical tensions, with Bitcoin Cash (BCH) showing resilience despite broader market pressure.

BCH recently demonstrated strong technical performance, forming a V-shaped recovery after testing critical support at $391.656, with substantial buying volume establishing a high-volume support level.

This comes as the global cryptocurrency market faces headwinds from the ongoing US-China trade disputes, which continue to introduce uncertainty across financial markets worldwide.

Meanwhile, traditional financial indicators like rising US Treasury yields signal systemic stress that historically creates mixed environments for risk assets like cryptocurrencies.

Technical Analysis Highlights

- BCH tested critical support at $391.656, triggering substantial buying volume particularly during the 01:00-04:00 timeframe.

- A powerful breakout occurred during the 13:00 hour, with BCH surging to $416.958 on the highest hourly volume (28,068 units).

- Price established a new resistance-turned-support level at $409.800, with momentum indicators suggesting potential for continued upside.

- A bull flag pattern formed after the initial impulse move, with decreasing volume during consolidation suggesting potential continuation.

- The $413.000-$413.500 zone represents a key support level that bulls need to defend to maintain upward momentum.

External References

- «What’s Happening in Crypto Today? Daily Crypto News Digest«, Cryptonews, published May 29, 2025.

Uncategorized

Crypto’s Most Watched Whale Gets Fully Liquidated After Placing Billions in Risky Bets

James Wynn, the trader whose risky moves on Hyperliquid captivated crypto watchers this month, has been fully liquidated.

He ended a volatile month with just $23 left in his account, according to HyperDash data.

Wynn built his reputation and following by placing massive, leveraged on-chain trades across bitcoin BTC, PEPE PEPE, and other tokens.

His downfall began with a $1.25 billion long position on BTC that unraveled as prices dropped below $105,000 amid growing geopolitical uncertainty. That trade alone cost him more than $37 million after fees.

The trader briefly pivoted to memecoins like PEPE, where one long position initially gained over 10%, before market swings liquidated him again.

Over the course of the month, Wynn cycled through assets including ETH, SUI, TRUMP, and even FARTCOIN. His trades at one point saw him achieve an unrealized gain of $85 million.

An account associated with Wynn on X commented on the liquidation and dismissed the losses. “I’ll run it back, I always do. And I’ll enjoy doing it. I like playing the game,” the account wrote on X. “I took a large and calculated bet at making billions.”

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars