Uncategorized

Fed Holds Rates Steady, Says Risks of Higher Unemployment, Higher Inflation Have Risen

As was widely expected, the U.S. Federal Reserve held its benchmark fed funds rate range steady on Wednesday at 4.25%-4.50%, extending its pause on monetary easing for the third consecutive meeting.

«Uncertainty about the economic outlook has increased further,» said the Fed in its accompanying statement. «The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.»

Bitcoin (BTC), which slipped back below $97,000 during the day paring gains from a late Tuesday rally on U.S.-China trade talks, was trading at $96.600 shortly after the Fed’s decision.

The decision comes as policymakers are navigating a treacherous macroeconomic landscape amid the Trump administration’s global tariff rollout. Inflation remained sticky above the 2% target and questions abound of how tariffs will translate into consumer prices, while the economy showed signs of decelerating.

Market participants anticipate three rate cuts this year targeting July as the most likely first meeting to lower rates. However, Fed members have been vocal about waiting for more clarity on the impact of tariffs before changing course.

All eyes are now on Powell’s upcoming remarks at 2:30 pm ET (18:30 UTC), which could offer crucial clues on the Fed’s thinking for the upcoming months.

Uncategorized

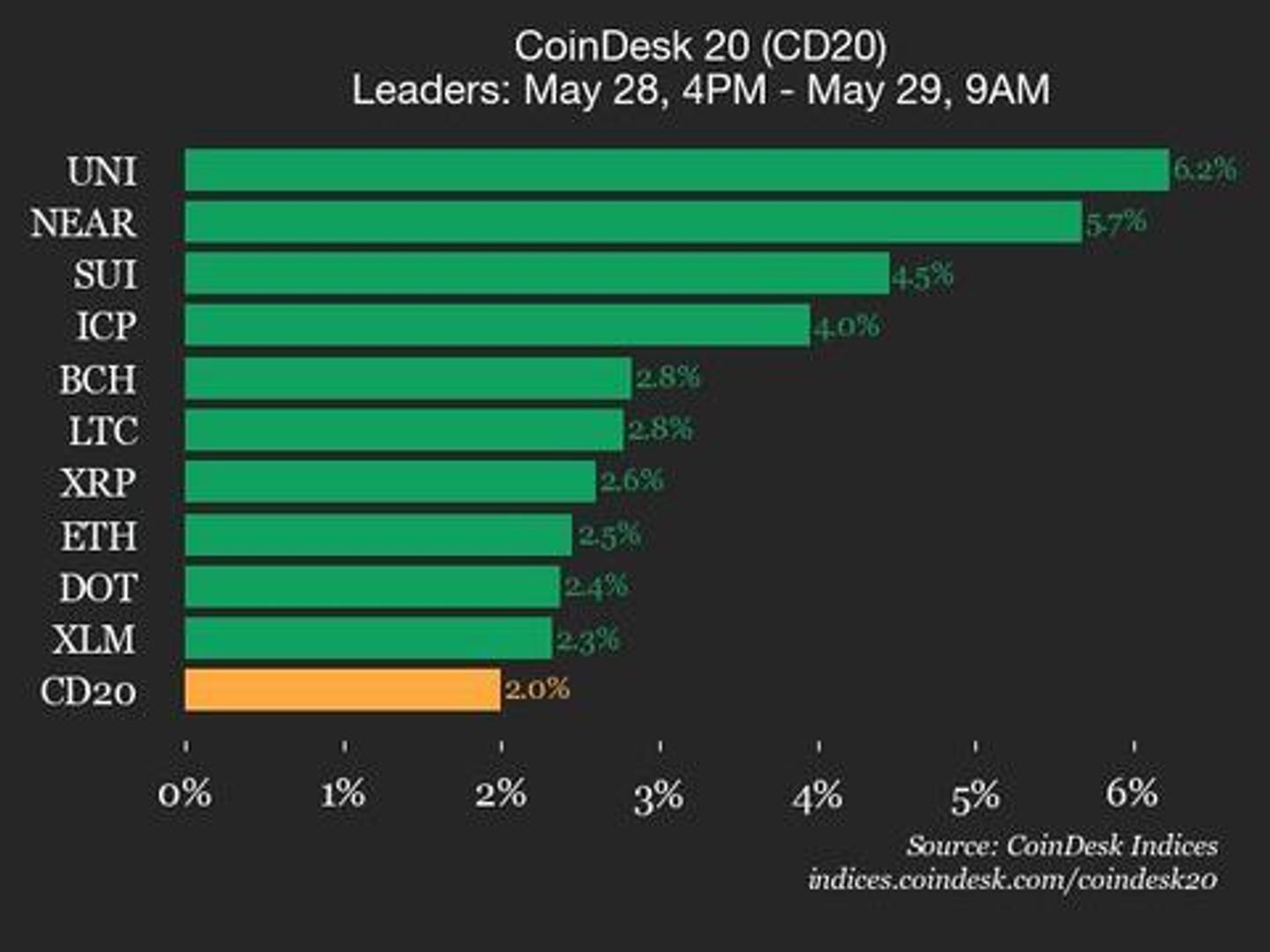

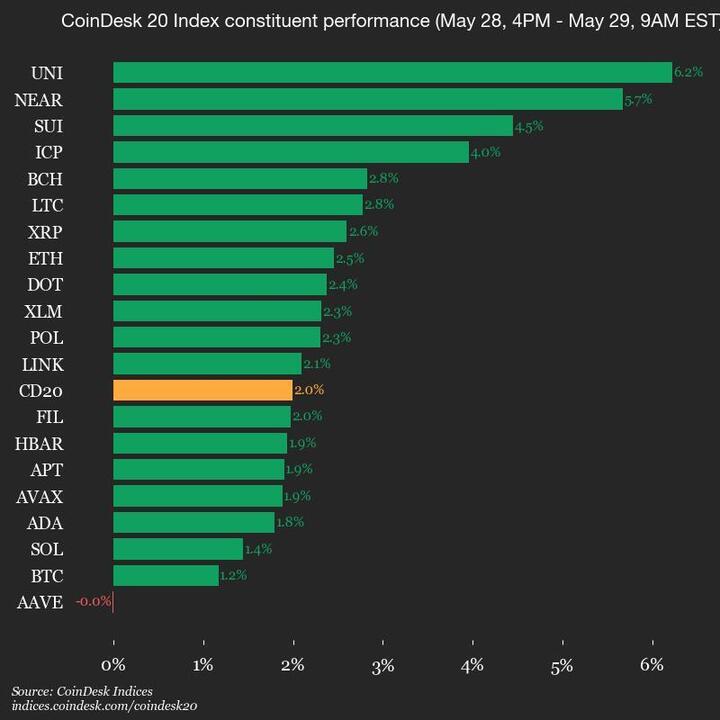

CoinDesk 20 Performance Update: Uniswap (UNI) Gains 6.2%, Leading Index Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3264.85, up 2.0% (+63.87) since 4 p.m. ET on Wednesday.

Nineteen of 20 assets are trading higher.

Leaders: UNI (+6.2%) and NEAR (+5.7%).

Laggards: AAVE (+0.0%) and BTC (+1.2%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Solana’s 18 Month Long Bull Run Against Ether is Over; XRP Ends Mini-Uptrend

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Programmable blockchain Solana is on course to flip its rival and leading smart contract blockchain Ethereum in terms of market capitalization, several observers have said it in recent months.

However, for now, Ethereum’s native token ether ETH seems to have an upper hand over Solana’s SOL SOL , according to technical analysis.

The SOL/ETH ratio has dived out of an upward sloping trendline connecting lows in September 2023, June 2024 and December 2024, per data source TradingView. In other words, tables have turned in ETH’s favor and the token could outperform SOL in the near-term.

Additionally, the weekly chart MACD histogram is printing red, indicating a strengthening of the downside momentum.

The immediate support is seen at 0.055 (the Feb. 25 low). The pair needs to move back above the Ichimoku cloud to negate the SOL bearish outlook.

XRP loses uptrend

Another coin showing a shift in market trend is XRP, the cryptocurrency designed for cross-border payments.

XRP has dived out of a bullish ascending channel, marking the recovery from the early April lows near $1.6.

The breakdown has exposed support at $2, which acted as floor several times early this year. Should the buyers fail to defend that, a deeper slide to $1.60 could be seen.

On the higher side, the recent high of $2.65 is the level to beat for the bulls.

Uncategorized

Vaulta, Fosun Team Up to Power Blockchain Infrastructure in Hong Kong

Vaulta, formerly known as EOS Network, and its digital banking platform have teamed up with Fosun Wealth Holdings to bring blockchain infrastructure to Hong Kong’s financial sector, the companies said.

The partnership centers around “FinChain,” a virtual asset business launched by Fosun Wealth Holdings, which is part of the Fosun International conglomerate.

That conglomerate includes various businesses, including regional insurance and healthcare leaders in Europe, Asia, and the Americas.

Vaulta will supply its full BankingOS suite, while exSat, Vaulta’s digital banking platform, will serve as the on-chain banking layer for asset issuance, yield generation, and crypto payments, according to a press release shared with CoinDesk.

The deal allows Vaulta and exSat to tap into Fosun’s existing financial licenses and real-world asset (RWA) issuance capabilities, giving them a regulatory springboard to scale blockchain-native banking services.

For Zhao Chen, Director of Digital Assets at Fosun Wealth, the collaboration brings the necessary infrastructure to roll out next-gen financial products.

«Vaulta and exSat bring the product vision and digital banking capabilities we need to make FinChain a reality,» he said in the announcement.

The initiative is part of Vaulta’s broader rebrand and expansion into institutional-grade blockchain finance. The partnership is expected to lead to more collaborations focused on Web3 financial infrastructure across Asia and beyond.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors