Uncategorized

Ethereum Turns 10 — Time to Leave the Trilemma Behind

Decentralized systems like the electric grid and the World Wide Web scaled by solving communication bottlenecks. Blockchains, a triumph of decentralized design, should follow the same pattern, but early technical constraints caused many to equate decentralization with inefficiency and sluggish performance.

As Ethereum turns 10 this July, it’s evolved from a developer playground into the backbone of onchain finance. As institutions like BlackRock and Franklin Templeton launch tokenized funds, and banks roll out stablecoins, the question now is whether it can scale to meet global demand—where heavy workloads and millisecond-level response times matter.

For all this evolution, one assumption still lingers: that blockchains must trade off between decentralization, scalability, and security. This “blockchain trilemma” has shaped protocol design since Ethereum’s genesis block.

The trilemma isn’t a law of physics; it’s a design problem we’re finally learning how to solve.

Lay of the Land on Scalable Blockchains

Ethereum co-founder Vitalik Buterin identified three properties for blockchain performance: decentralization (many autonomous nodes), security (resilience to malicious acts), and scalability (transaction speed). He introduced the “Blockchain Trilemma,” suggesting that enhancing two typically weakens the third, especially scalability.

This framing shaped Ethereum’s path: the ecosystem prioritized decentralization and security, building for robustness and fault tolerance across thousands of nodes. But performance has lagged, with delays in block propagation, consensus, and finality.

To maintain decentralization while scaling, some protocols on Ethereum reduce validator participation or shard network responsibilities; Optimistic Rollups, shift execution off-chain and rely on fraud proofs to maintain integrity; Layer-2 designs aim to compress thousands of transactions into a single one committed to the main chain, offloading scalability pressure but introducing dependencies on trusted nodes.

Security remains paramount, as financial stakes rise. Failures stem from downtime, collusion, or message propagation errors, causing consensus to halt or double-spend. Yet most scaling relies on best-effort performance rather than protocol-level guarantees. Validators are incentivized to boost computing power or rely on fast networks, but lack guarantees that transactions will complete.

This raises important questions for Ethereum and the industry: Can we be confident that every transaction will finalize under load? Are probabilistic approaches enough to support global-scale applications?

As Ethereum enters its second decade, answering these questions will be crucial for developers, institutions and billions of end users relying on blockchains to deliver.

Decentralization as a Strength, Not a Limitation

Decentralization was never the cause of sluggish UX on Ethereum, network coordination was. With the right engineering, decentralization becomes a performance advantage and a catalyst to scale.

It feels intuitive that a centralized command center would outperform a fully distributed one. How could it not be better to have an omniscient controller overseeing the network? This is precisely where we would like to demystify assumptions.

Read more: Martin Burgherr — Why ‘Expensive’ Ethereum Will Dominate Institutional DeFi

This belief started decades ago in Professor Medard’s lab at MIT, to make decentralized communication systems provably optimal. Today, with Random Linear Network Coding (RLNC), that vision is finally implementable at scale.

Let’s get technical.

To address scalability, we must first understand where latency occurs: in blockchain systems, each node must observe the same operations in the same order to observe the same sequence of state changes starting from the initial state. This requires consensus—a process where all nodes agree on a single proposed value.

Blockchains like Ethereum and Solana, use leader-based consensus with predetermined time slots in which nodes must come to agreement, let’s call it let’s call it “D”. Pick D too large and finality slows down; pick it too small and consensus fails; this creates a persistent tradeoff in performance.

In Ethereum’s consensus algorithm each node attempts to communicate its local value to the others, through a series of message exchanges via Gossip propagation. But due to network perturbations, such as congestion, bottlenecks, buffer overflow; some messages may be lost or delayed and some may be duplicated.

Such incidents increase the time for information propagation and hence, reaching consensus inevitably results in large D slots, especially in larger networks. To scale, many blockchains limit decentralization.

These blockchains require attestation from a certain threshold of participants, such as two-thirds of the stakes, for each consensus round. To achieve scalability, we need to improve the efficiency of message dissemination.

With Random Network Linear Coding (RLNC), we aim to enhance the scalability of the protocol, directly addressing the constraints imposed by current implementations.

Decentralize to Scale: The Power of RLNC

Random Linear Network Coding (RLNC) is different from traditional network codes. It is stateless, algebraic, and entirely decentralized. Instead of trying to micromanage traffic, every node mixes coded messages independently; yet achieves optimal results, as if a central controller were orchestrating the network. It has been proven mathematically that no centralized scheduler would outperform this method. That’s not common in system design, and it is what makes this approach so powerful.

Instead of relaying raw messages, RLNC-enabled nodes divide and transmit message data into coded elements using algebraic equations over finite fields. RLNC allows nodes to recover the original message using only a subset of these coded pieces; there’s no need for every message to arrive.

It also avoids duplication by letting each node mix what it receives into new, unique linear combinations on the fly. This makes every exchange more informative and resilient to network delays or losses.

With Ethereum validators now testing RLNC through OptimumP2P — including Kiln, P2P.org, and Everstake — this shift is no longer hypothetical. It’s already in motion.

Up next, RLNC-powered architectures and pub-sub protocols will plug into other existing blockchains helping them scale with higher throughput and lower latency.

A Call for a New Industry Benchmark

If Ethereum is to serve as the foundation of global finance in its second decade, it must move beyond outdated assumptions. Its future won’t be defined by tradeoffs, but by provable performance. The trilemma isn’t a law of nature, it’s a limitation of old design, one that we now have the power to overcome.

To meet the demands of real-world adoption, we need systems designed with scalability as a first-class principle, backed by provable performance guarantees, not tradeoffs. RLNC offers a path forward. With mathematically grounded throughput guarantees in decentralized environments, it’s a promising foundation for a more performant, responsive Ethereum.

Read more: Paul Brody — Ethereum Has Already Won

Uncategorized

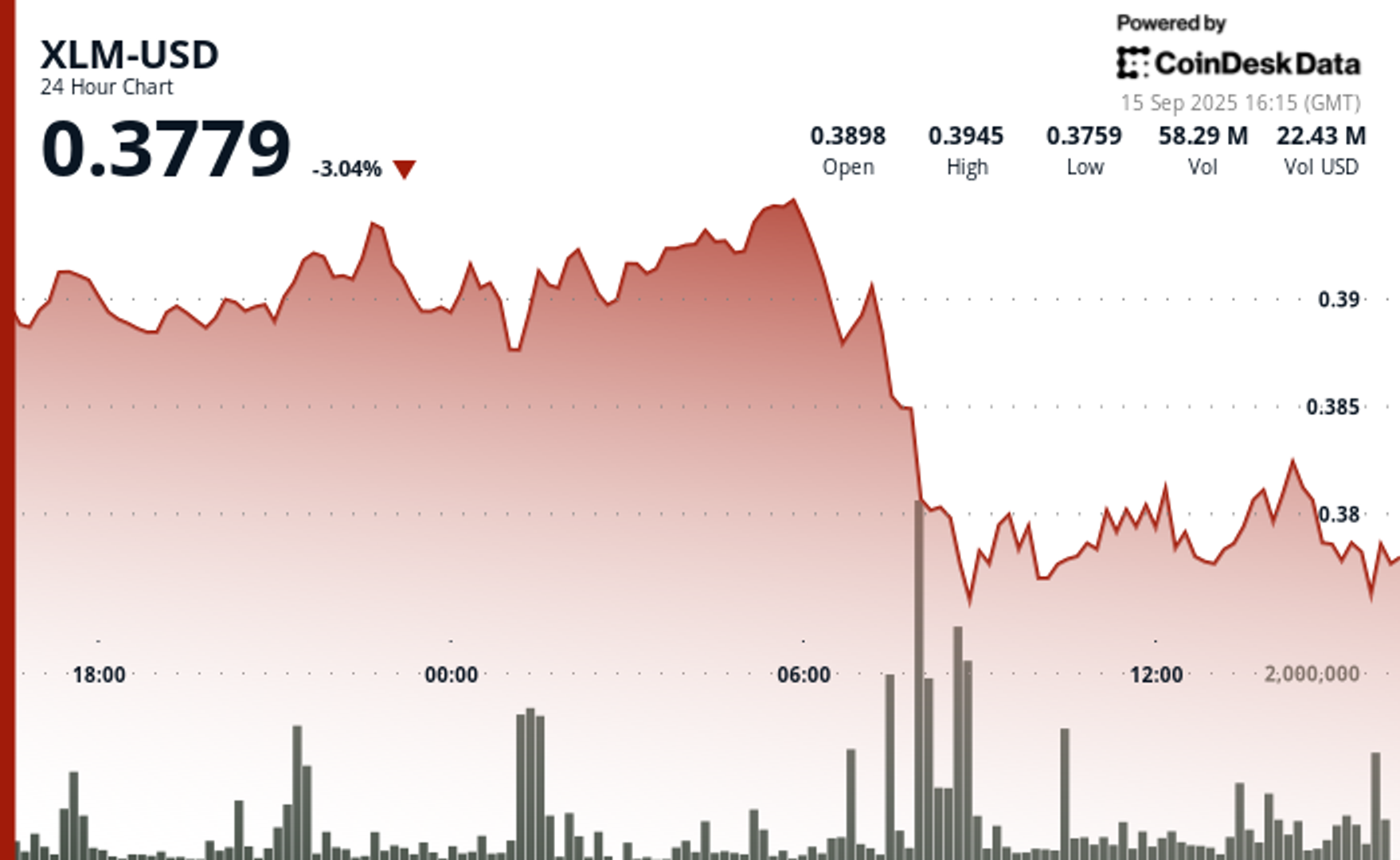

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

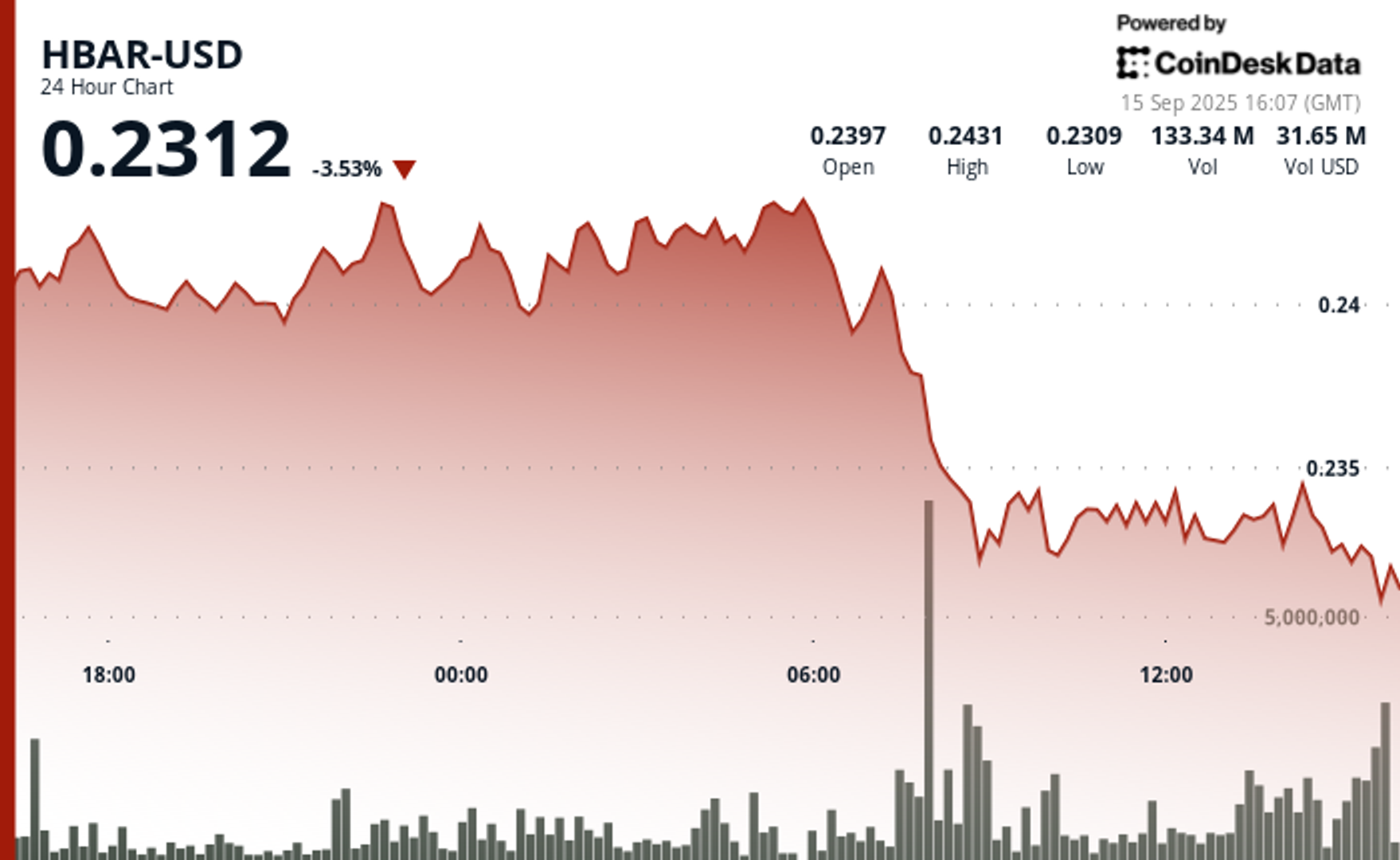

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Dogecoin Inches Closer to Wall Street With First Meme Coin ETF

The first exchange-traded fund (ETF) built around a meme coin could hit the market this week, after multiple delays and much speculation.

The DOGE ETF — formally called the Rex Shares-Osprey Dogecoin ETF (DOJE) — was originally slated to debut last week, alongside a handful of politically themed and crypto-related ETFs. Those included funds tied to Bonk (BONK), XRP, Bitcoin (BTC) and even a Trump-themed fund. But DOJE’s debut never materialized.

Now, Bloomberg ETF analysts Eric Balchunas and James Seyffart believe Wednesday is the most likely launch date, though they caution nothing is certain.

“It’s more likely than not,” Seyffart said. “That seems like the base case.”

Ahead of the introduction of the ETF, DOGE has been among the top performers over the past month, ahead 15% even including a decline of 3.5% over the past 24 horus.

If launched, DOJE would mark a milestone as the first U.S. ETF to focus on a meme coin — cryptocurrencies that generally lack utility or a clear economic purpose. These include tokens like Dogecoin, Shiba Inu (SHIB) and Bonk, which often surge in popularity thanks to internet culture, celebrity endorsements and speculative trading.

Balchunas described DOJE’s significance in a post on X: “First-ever US ETF to hold something that has no utility on purpose.”

DOJE is not a spot ETF. That means it won’t hold DOGE directly. Instead, the fund will use a Cayman Islands-based subsidiary to gain exposure through futures and other derivatives. This approach sidesteps the need for physical custody of the coin while still offering traders a way to bet on its performance within a traditional brokerage account.

The ETF was approved earlier this month under the Investment Company Act of 1940, which is typically used for mutual funds and diversified ETFs. That sets it apart from the wave of bitcoin ETFs that received green lights under the Securities Act of 1933, a framework used for commodity-based and asset-backed products. In short, DOJE is structured more like a mutual fund than a commodity trust.

More direct exposure may be coming soon. Several firms have filed applications to launch spot DOGE ETFs, which would hold the meme coin itself rather than derivatives. These applications are still under review by the U.S. Securities and Exchange Commission (SEC), which has grown more comfortable with crypto ETFs since approving a slate of bitcoin products in early 2024.

The broader crypto market has shown that investor demand can outweigh fundamental critiques. Meme coins have long drawn skepticism for having no underlying value or use case, but that hasn’t kept them from drawing billions in speculative capital.

Seyffart said the ETF market is likely to follow the same path. “There’s going to be a bunch of products like this, whether you love it or need it, they’re going to be coming to market,” he said.

He added that many existing financial products serve no deeper purpose than providing a vehicle for short-term bets. “There’s plenty of products out there that are just being used as gambling or short-term trading,” he said. “So if there’s an audience for this in the crypto world, I wouldn’t be surprised at all if this finds an audience in the ETF and TradFi world.”

Whether the DOJE ETF opens the door to more meme coin funds — or just proves the concept is viable — may depend on how the market responds this week. Either way, it signals a new phase in the merging of internet culture and traditional finance.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars