Uncategorized

Ethereum Staking Giant Lido Loses Just 1.4 ETH in Hacking Attempt

Lido, Ethereum’s largest liquid staking protocol, avoided a major security incident after one of its nine oracle keys was compromised in what appears to be a low-impact but serious breach involving validator operator Chorus One.

Lido secures over 25% of all ETH staked on Ethereum, making it one of the most systemically important protocols in the Ethereum ecosystem.

The compromised key was tied to a hot wallet used for oracle reporting, leading to the theft of just 1.46 ETH ($4,200) in gas fees. No user funds were affected, and no broader compromise was detected, per X posts from both Lido and Chorus One

Lido’s oracle system is a blockchain-based tool that supplies Ethereum consensus data to Lido’s smart contracts using a 5-of-9 quorum mechanism. This means that even if one or two keys are compromised, the system can function securely.

Contributors first detected the suspicious activity early Sunday after a low-balance alert triggered a closer look at the address. It revealed unauthorized access to an oracle private key used by Chorus One that was originally created in 2021 and not secured to the same standards as newer keys, the firm said in an X post.

In response, Lido has launched an emergency DAO vote to rotate the compromised oracle key across three contracts: the Accounting Oracle, the Validators Exit Bus Oracle, and the CS Fee Oracle. The new key has been generated using better security controls to avoid any repeat.

The hack occurred just as several other oracle operators were experiencing unrelated node issues, including a minor Prysm bug introduced by Ethereum’s recent Pectra upgrade, briefly delaying oracle reports on May 10.

The compromised address (0x140B) is being replaced by a new secure address (0x285f), with the on-chain vote already approved and in its 48-hour objection period as of Asian morning hours Monday.

Uncategorized

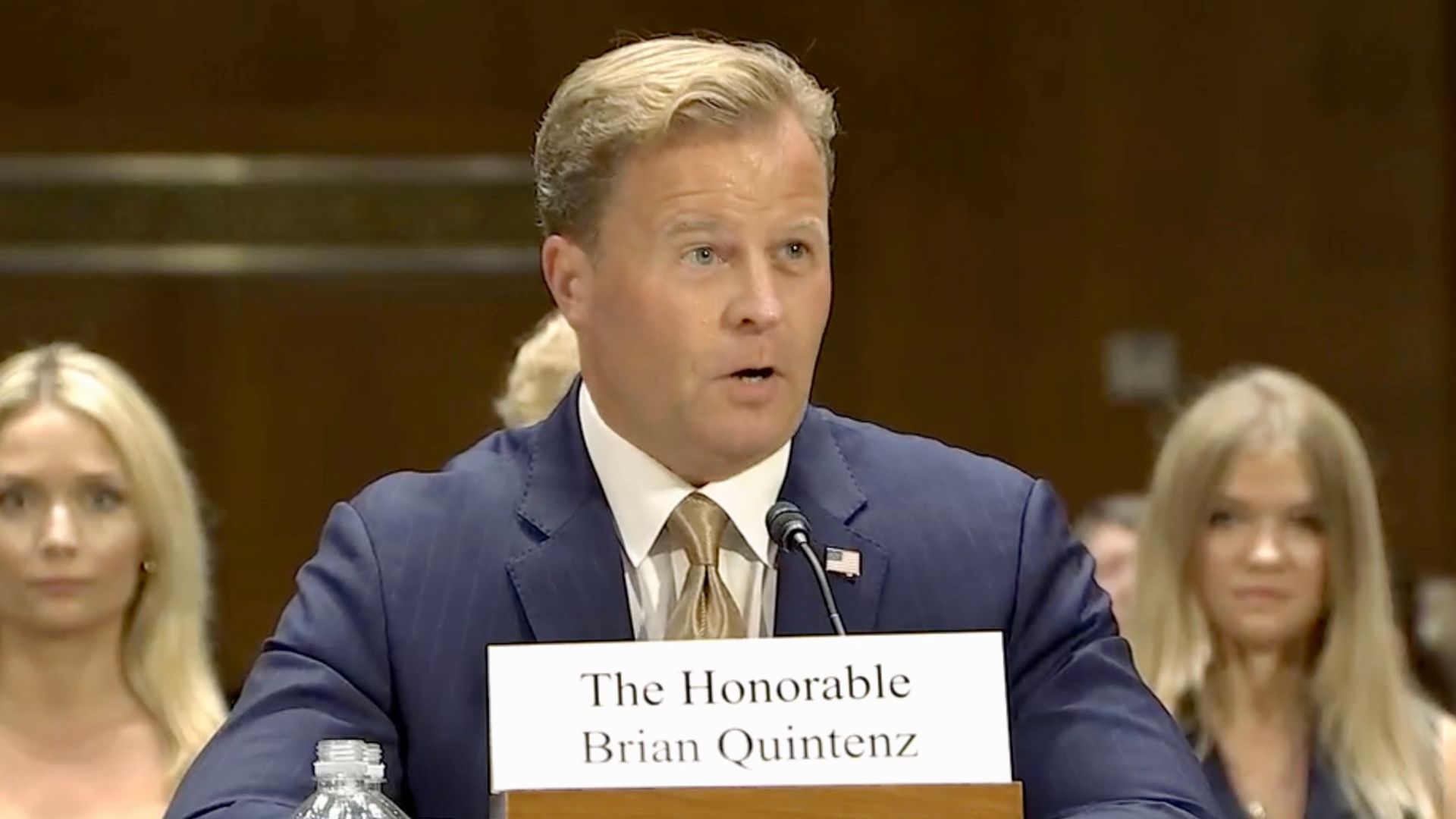

Trump’s CFTC Pick Says U.S. Can Boost Crypto Innovation and Shield Consumers

President Donald Trump’s pick to be chairman of the U.S. commodities watchdog, Brian Quintenz, fielded crypto questions more than any other topic at his Senate confirmation hearing on Tuesday, and he assured the lawmakers that the agency can walk a middle ground between unhampered innovation and robust consumer safeguards.

Even as Quintenz awaits the Senate Agriculture Committee’s vote on whether to advance his nomination as chairman of the Commodity Futures Trading Commission, Congress is working on market structure legislation that could elevate that agency as the marquee regulator of U.S. crypto activity. Quintenz, a former CFTC commissioner, is no stranger to that sector, having served as venture capital firm a16z’s head of policy.

«I have always viewed market structure legislation as an opportunity to be both pro-customer protection and pro-innovation at the same time,» he told the senators weighing his nomination, which ultimately needs to be approved by the overall Senate before he can take over the commission. He said the bill could «provide the clarity to buildings, entrepreneurs, innovators to develop products» while also ensuring the regulated firms are appropriately protecting the users of those products.

«Congress should create an appropriate market regulatory regime to ensure that this technology’s full promise can be realized, and I am fully prepared to use my experience and expertise to assist in that effort as well in executing any expanded mission should legislation pass into law,» Quintenz said, adding that he’s willing to work under the CFTC’s current powers «to provide clarity of how the agency’s statutory objectives could be successfully leveraged through this technology.»

Quintenz would join a commission that’s being abandoned by commissioners. By statute, the CFTC has five members — with three from the party in power — but the members have left or are in the process of leaving, including Acting Chairman Caroline Pham, who said she’s leaving when Quintenz starts work. The lone Democrat, Kristen Johnson, said she’ll depart «later this year,» leaving some uncertainty about her timing. So Quintenz may serve opposite a single Democrat before eventually working alone for a time, leaving potential legal vulnerability for any unilateral policies.

Some of the Democratic senators noted the Trump administration has been systematically stripping regulatory commissions of their Democratic members — described by Senator Raphael Warnock as «political purges» — and asked Quintenz if he would encourage the White House to fill both sides of the roster.

«The president is the head of the executive, and the president will make his own decisions. Quintenz said. He later added, «I don’t tell the president what to do.»

He granted that the agency may need more funding if it’s assigned the monumental new task as the regulator of digital commodities spot markets, which would include transactions of bitcoin BTC. Quintenz said that new staff would be made more efficient by «a technology-first approach» that makes the employees more efficient.

Quintenz also fielded a number of questions on the prediction markets, another area he’s had direct experience with as a board member of Kalshi, which fought a legal battle with the CFTC over the regulation of event contracts. He defended such event contracts as an appropriate «hedging tool.»

«I believe the Commodity Exchange Act is very clear about the purpose of derivatives markets, the purpose of risk management and price discovery, and that events [contracts] can serve a function in that mandate,» he said.

Read More: Trump to Tap Former CFTC Commissioner, a16z Policy Head Brian Quintenz for CFTC Head

Uncategorized

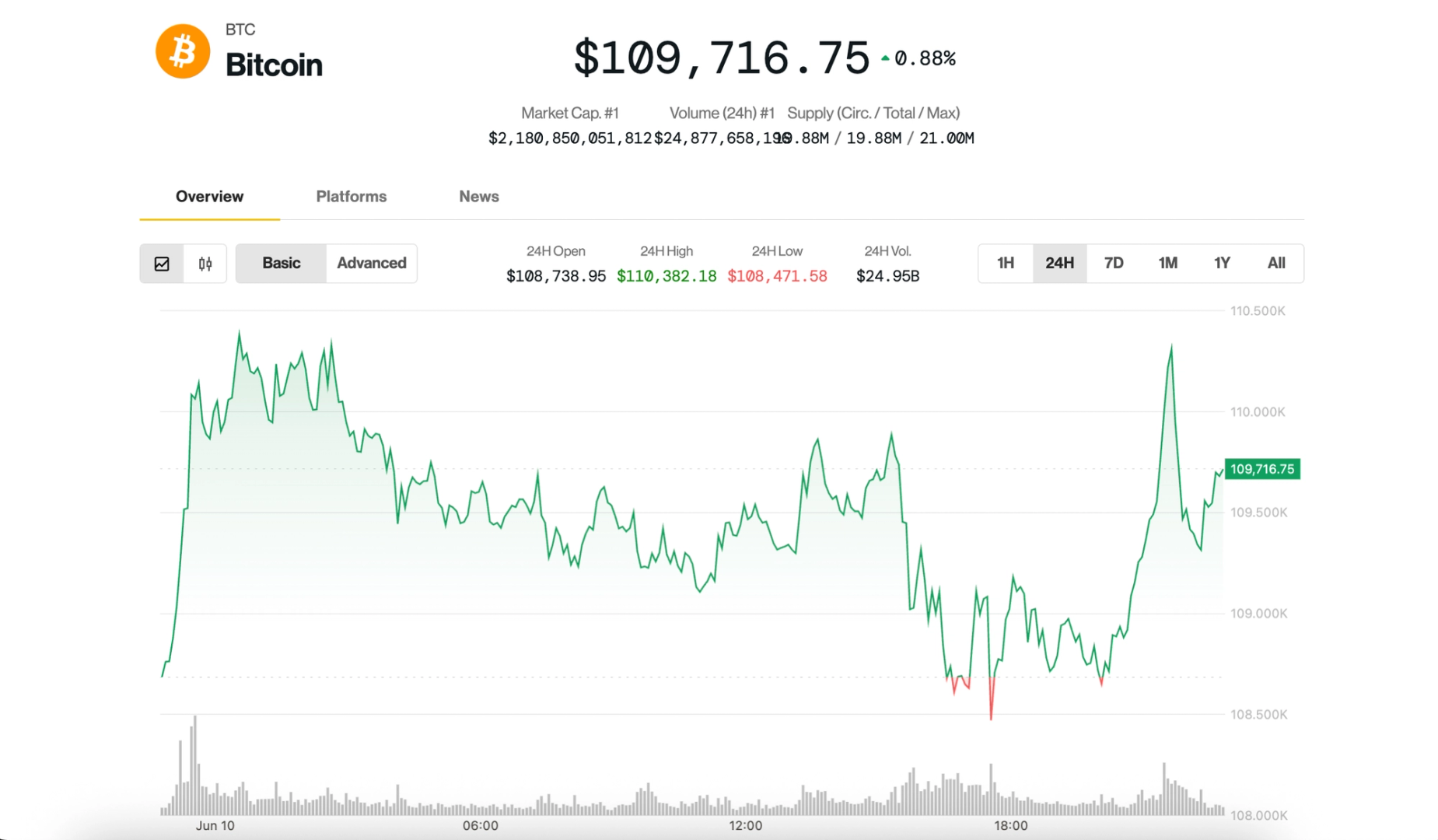

Bitcoin Rises to $110K as Altcoins Rally; Traders Skeptical of Breakout

Bitcoin recaptured the $110,000 level for the second consecutive day, perhaps dragged higher by even larger gains among altcoins.

Up 0.9% more than 1% in the last 24 hours, bitcoin was trading just above $110,000 shortly after the close of U.S. stock markets Tuesday. The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding stablecoins, exchange coins and memecoins — has risen 3.3% in the same period of time, mostly thanks to ether ETH, solana SOL, chainlink LINK all gaining 5%-7%.

The standout performances, however, were put on by uniswap UNI and aave AAVE, which soared a whooping 24% and 13%, respectively. The move was prompted by optimistic comments on the topic of DeFi by Securities and Exchange Commission (SEC) Chair Paul Atkins on Monday.

Things have remained relatively calm on the equities front, with most crypto stocks flat on the day. A notable exception is Semler Scientific (SMLR), a firm that aims to follow Strategy’s (MSTR) playbook and vacuum up as much bitcoin as possible. Shares fell another 10% today, with the stock now trading for less than the value of the bitcoin on its balance sheet.

Despite the day’s gains, positioning across crypto markets still reflects a largely defensive tone.

«Funding rates and other leverage proxies point toward a steadily cautious sentiment in the market,” Vetle Lunde, head of research at K33 Research, pointed out in a Tuesday report. «The broad risk appetite is remarkably weak, given that BTC is trading close to former all-time highs.»

Binance’s BTC perpetual swaps posted negative funding rates on multiple days last week, with the average annualized funding rate now sitting at just 1.3% — a level typically associated with local market bottoms rather than tops, Lunde noted.

«Bitcoin does not usually peak in environments with negative funding rates,» he wrote, adding that past instances of such positioning have more often preceded rallies than corrections.

Flows into leveraged bitcoin ETFs paint a similar picture. The ProShares 2x Bitcoin ETF (BITX) currently holds exposure equivalent to 52,435 BTC — well below its December 2023 peak of 76,755 BTC — and inflows remain muted. This defensive positioning, according to Lunde, leaves room for a potential «healthy rally» in BTC to develop.

Still, not all market watchers are convinced that the current price action marks the start of a sustainable breakout.

«Is this a true breakout that will continue? In my view, probably not,» said Kirill Kretov, senior automation expert at CoinPanel. «More likely, it’s part of the same volatility cycle where we see a rally now, followed by a sharp drop triggered by a negative announcement or some other narrative shift.»

According to Kretov, the current environment favors experienced traders who can navigate volatility-driven market structure. Technically, he sees BTC’s next key support levels at $105,000 and $100,000 — zones that could be tested if selling pressure returns.

Uncategorized

Aptos’ APT Rallies 4% Following Bullish Breakout on High Volume

Aptos’ APT token surged more than 4% following a bullish breakout, according to CoinDesk Research’s technical analysis model.

The token smashed through resistance at the $5 level and is currently 4.2% higher, trading around $5.065.

Despite facing a 19% monthly decline and competition from emerging blockchain platforms, APT’s recent price action suggests potential accumulation before its next significant move, according to the model.

The broader market gauge, the CoinDesk 20 was 3% higher at publication time.

Technical Analysis:

- APT established strong support at 4.927 after breaking through the 5.00 psychological resistance level.

- High-volume rally created a new resistance zone around 5.138, with subsequent consolidation forming a bull flag pattern between 5.00-5.10.

- Price action showed APT breaking through the 5.090 resistance on substantial volume exceeding 149,000 units.

- A pullback formed a higher low at 5.045, establishing a new support zone.

- Final 15 minutes showed price consolidation in the 5.045-5.062 range, suggesting potential accumulation.

- Total price range represented 0.261 (5.4%) from low to high during the analyzed period.

-

Business8 месяцев ago

Business8 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business8 месяцев ago

Business8 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Tech8 месяцев ago

Tech8 месяцев ago5 Crowdfunded products that actually delivered on the hype

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time