Uncategorized

Ether-Bitcoin ‘Squeeze’ Hints at Imminent Volatility as Ethereum Pectra Upgrade Nears

Crypto traders aiming to profit from a volatility surge should watch the Binance-listed ether-bitcoin (ETH/BTC) ratio, which could soon experience wild swings, according to a key indicator called Bollinger Bands.

Bollinger Bands are volatility bands placed two standard deviations above and below the 20-day simple moving average of an asset’s price.

The so-called Bollinger band squeeze occurs when the bands contract tightly around the price, suggesting low volatility and a period of consolidation. The market typically builds energy during the squeeze, which is eventually released in either direction, leading to a volatility explosion.

The Bollinger Bands on the ETH-BTC chart are now the tightest they have been since June 2020, according to TradingView.

The squeeze indicates that ether could soon experience increased volatility against BTC. Traders watch closely to see which way the price breaks out of the bands because, often, the big move happens in the same direction.

The volatility bullish signal comes as Ethereum’s Pectra upgrade, which aims to improve the blockchain’s scalability and validator operations and may sput market activity.

The impending upgrade, due May 7, greatly increases the maximum ETH a validator can stake, from 32 ETH up to 2,048 ETH. It also raises the number of «blob» data units per block from 3 to 6, allowing for a maximum of 9. Additionally, the upgrade will start the transition to the EVM Object Format (EOF), a new structure designed to make smart contracts more efficient.

«Layer-2 networks stand to benefit the most. By doubling blob capacity and making call data more expensive, Pectra solidifies blobs as the standard for rollup data posting. This reinforces Ethereum’s role as a data availability layer and strengthens its rollup-centric scaling strategy,» analytics firm Nansen said in a report shared with CoinDesk.

«DeFi will also see a lift,» the firm noted, saying, NFTs and blockchain games may benefit from the broader improvements.

Uncategorized

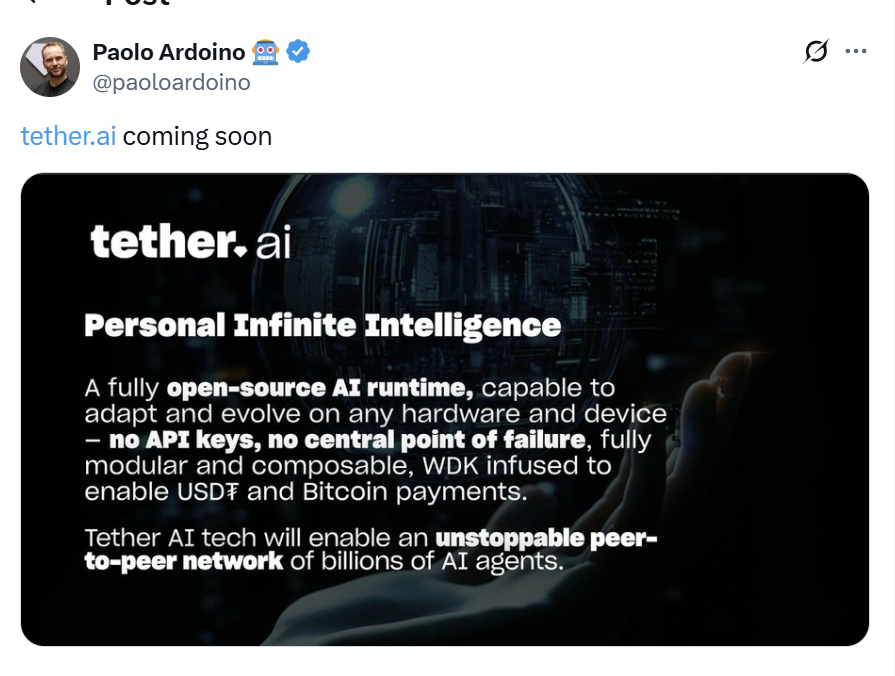

Tether Enters AI Arena With Tether.AI

Tether is about to enter the $25 billion crypto artificial intelligence sector, according to a post by its CEO Paolo Ardoino on X.

Tether AI, according to Ardoino, is a “fully open-source AI runtime, capable of adapting and evolving on any hardware and device, no API keys, no central point of failure, fully modular and composable, WDK-infused to enable USDT and Bitcoin payments.”

WDK is Tether’s Wallet Development Kit, a modular software development kit that enables businesses and developers to integrate non-custodial wallets and user experiences for Bitcoin and USDT across any app, website, or device, Ardoino explained in a November post on X.

On its Tether.ai website, Tether says its AI platform will integrate Keet, a peer-to-peer chat platform. Not much else is known about Tether’s AI initiative.

CoinGecko’s index of AI tokens is trading flat after the announcement.

Uncategorized

Donald Trump Denies Claims of Profiting From TRUMP Token

Donald Trump is pushing back against claims that he’s profiting from the TRUMP memecoin, his official cryptocurrency that launched days before his presidential inauguration.

Chainalysis recently reported that the TRUMP token earned $900,000 in fees in a two day span for its backers.

The wallets of the largest holders of the token are controlled by CIC Digital LLC, an entity also used for his NFT collection, and Fight Fight Fight LLC, which is co-owned by CIC Digital. Collectively, they own 80% of the TRUMP tokens.

“I’m not profiting from anything,” Trump said during an interview with NBC News, adding that he hadn’t looked at the token’s performance and that any financial benefits would be incidental. “If I own stock in something, and I do a good job, and the stock market goes up, I guess I’m profiting,” he said.

The TRUMP token has seen strong market activity in recent weeks. It’s currently trading around $11.20, a significant drop from its all-time high of $44.19, but still up 20% over the past month.

Recently, the White House announced that the largest 220 holders of the $TRUMP token would be invited for dinner with the President.

Eric Trump, the son of President Trump, will be a headline speaker at Consensus 2025 in Toronto.

Uncategorized

Solana Quietly Fixes Bug That Could Have Let Attackers Mint and Steal Certain Tokens

The Solana Foundation has disclosed a previously unknown vulnerability in its privacy-focused token system that could have allowed attackers to forge fake zero-knowledge proofs, enabling unauthorized minting or withdrawals of tokens.

The vulnerability was first reported on April 16 through Anza’s GitHub security advisory, accompanied by a working proof-of-concept. Engineers from Solana development teams Anza, Firedancer, and Jito verified the bug and began working on a fix immediately, per a post-mortem published Saturday,

The issue stemmed from the ZK ElGamal Proof program, which verifies zero-knowledge proofs (ZKPs) used in Solana’s Token-22 confidential transfers. These extension tokens enable private balances and transfers by encrypting amounts and using cryptographic proofs to validate them.

ZKPs are a cryptographic method that lets someone prove they know or have access to something, such as a password or age, without revealing the thing itself.

In crypto applications, these can be used to prove a transaction is valid without showing specific amounts or addresses (which can otherwise be used by malicious actors to plan exploits).

The bug occurred because some algebraic components were missing from the hashing process during the Fiat-Shamir transformation — a standard method to make zero-knowledge proofs non-interactive. (Non-interactive means turning a back-and-forth process into a one-time proof anyone can verify.)

A sophisticated attacker could forge invalid proofs that the on-chain verifier would still accept.

This would have allowed unauthorized actions such as minting unlimited tokens or withdrawing tokens from other accounts.

As such, the vulnerability did not affect standard SPL tokens or the main Token-2022 program logic.

Patches were distributed privately to validator operators beginning April 17. A second patch was pushed later that evening to address a related issue elsewhere in the codebase.

Both were reviewed by third-party security firms Asymmetric Research, Neodyme, and OtterSec. By April 18, a supermajority of validators had adopted the fix.

There is no indication that the bug was exploited, and all funds remain secure, according to the post-mortem.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors