Uncategorized

EigenLayer Adds Key ‘Slashing’ Feature, Completing Original Vision

Almost one year to the day after Ethereum protocol EigenLayer launched its “restaking” network to unprecedented industry fanfare, the network is finally adding a core feature that was, until now, glaringly absent: “slashing.”

Eigen Labs hopes slashing — EigenLayer’s system for keeping “restakers” honest by revoking collateral if they act maliciously — will finally realize the year-old protocol’s original pitch.

“We are happy to say now that the whole promise has been delivered,” said EigenLayer founder Sreeram Kannan.

EigenLayer became one of the buzziest protocols in Ethereum history when it introduced investors to the concept of restaking, an evolution of “proof-of-stake” on Ethereum.

Ethereum’s «proof-of-stake» system lets users «stake» ether (ETH) collateral with the chain to help run and secure it in exchange for interest. EigenLayer lets users stake ETH on Ethereum and then restake it again with other protocols for even more interest.

Despite launching its main network last year, slashing, a primary component of EigenLayer’s shared security technology, was missing until Thursday. This led to criticism that EigenLayer’s ambitious pitch didn’t match its technical reality.

Today, EigenLayer boasts more than $7 billion in restaked assets, making it one of the largest decentralized finance (DeFi) apps. It also supports an ecosystem of 39 actively validated services (AVSs) that use its security model.

The new slashing system will roll out on Thursday, but AVS teams will need to opt-in, meaning it may take some time before slashing is live in any applications. Eigen Labs announced April 17 as the launch date for slashing earlier this month.

Redesigning for Safety

EigenLayer users restake ether (ETH) and other tokens through third-party “operators” — infrastructure providers who delegate their pooled EigenLayer deposits across different AVSs.

Operators that delegate stake to an AVS help run it in exchange for rewards: the more they stake, the higher the rewards.

In theory, slashing ensures these operators are running AVSs correctly. If operators “are proven to be malicious according to an on-chain Ethereum contract, then they may lose their stake or a portion of their stake,” explained Kannan.

When slashing goes live on Thursday, AVSs will have the option to set slashing conditions and begin penalizing bad actors.

“Other than Ethereum and Cosmos, most proof-of-stake systems, including Solana, are running live without any slashing,” said Kannan. “Even though it is the core accountability mechanism, it’s not like every proof of stake system already has this—that’s not true. That’s what we’re building.”

As for why EigenLayer received so much blowback compared to other incomplete proof-of-stake systems: “We’ve talked a lot about slashing, so we are held to that bar,” said Kannan.

Removing leverage

EigenLayer’s slashing system was redesigned last year to address fears that the protocol introduced an unsafe form of leverage to the Ethereum ecosystem.

“I think we completely cured that problem with this redesign,” said Kannan.

The entire idea behind EigenLayer is to allow new protocols to immediately tap into a large security pool — the total pool of restaked assets.

In proof-of-stake systems, the amount of assets staked with a protocol roughly corresponds to how secure it is. In general, attacking a protocol like Ethereum requires controlling half or more of the assets staked, which can run into billions of dollars.

EigenLayer’s pooling model has led to fears that a poorly built slashing system could expose the entire protocol to new risks, where a single bad actor on one AVS could harm every operator.

The version of EigenLayer going live Thursday, which has been tested on Ethereum’s developer networks since December, was designed so operators can limit their exposure to a given AVS, meaning bad actors on one won’t necessarily impact another.

“You have unique attributability of stake to a particular AVS,” explained Kannan. “As an AVS, I know I have, like, 10 million of ‘slashable’ stake that is not double counted — so there is no leverage.”

Additionally, the system has been configured so that “even if my AVS has a small amount of slashable stake, it is still protected in some sense, by the large amount of capital,” said Kannan, since there are still systems in place to ensure the cost of attacking a system increases with the total value of the pool of restaked assets.

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

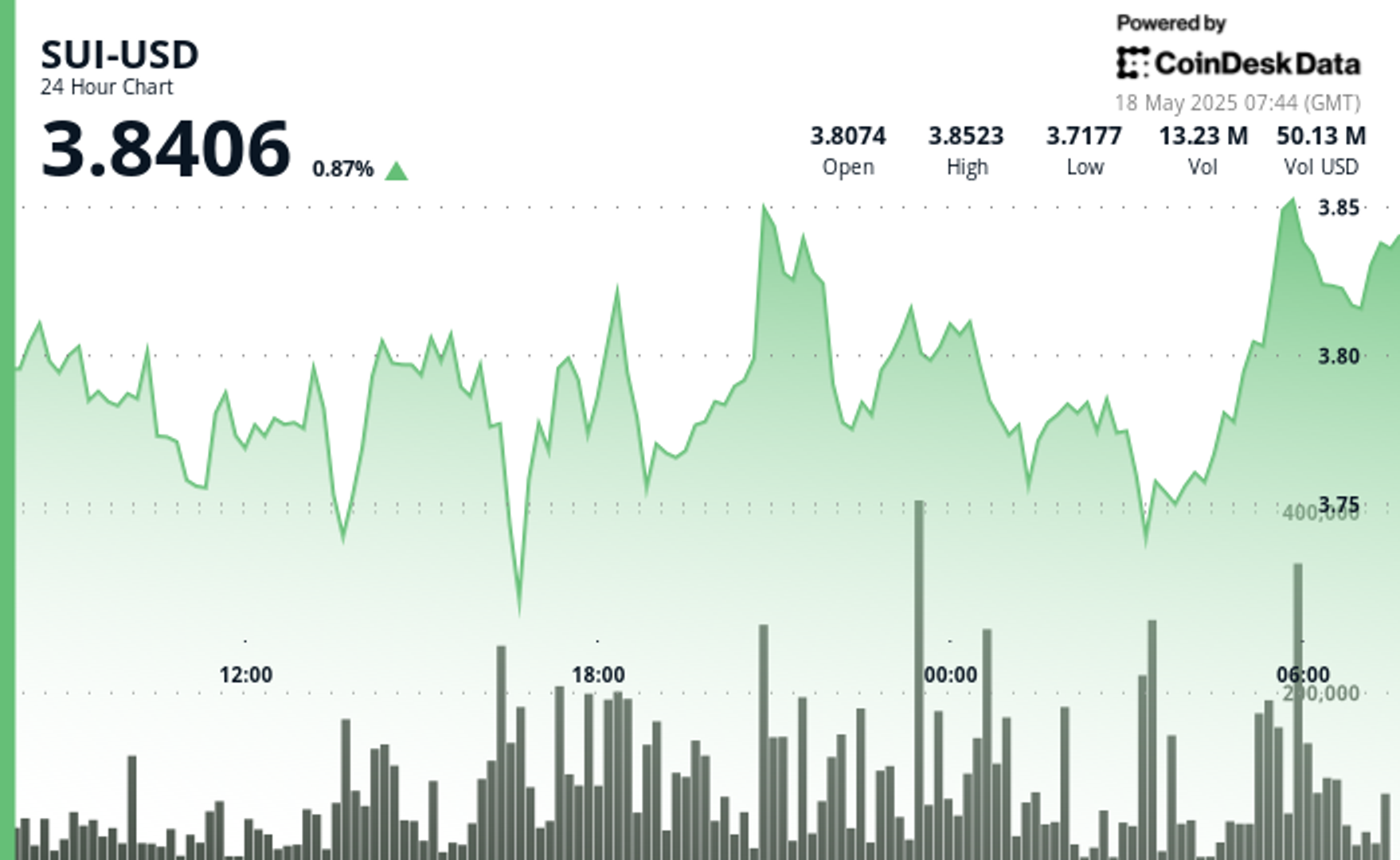

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

Uncategorized

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

Geopolitical tensions and evolving trade policies continue to influence cryptocurrency markets, with Dogecoin showing resilience amid broader economic uncertainty.

Despite macroeconomic headwinds, DOGE has maintained support above key moving averages while forming a potential bull flag pattern that could target $0.35 if validated by continued buying pressure.

Technical Analysis Highlights

- DOGE experienced significant volatility with a 4.3% range (0.211-0.220) over the past 24 hours, forming a key support zone around 0.212 validated by high volume rebounds at 13:00 and 22:00.

- The price action reveals a bullish recovery pattern from the 16:00 low, with resistance emerging at 0.217-0.220.

- The 20:00 candle’s strong volume surge above the 24-hour average confirms renewed buying interest, suggesting potential upward momentum if DOGE can maintain its position above the established support level.

- In the past hour, DOGE has demonstrated significant bullish momentum, climbing from 0.215 to 0.216 with notable volume spikes at 01:17, 01:21, and 01:54-01:55.

- The price established a strong support zone around 0.215 during the early minutes, followed by a decisive breakout at 01:16-01:17 where volume surged over 8 million.

- The uptrend continued with higher lows forming a clear ascending pattern, culminating in a new resistance test at 0.216-0.217 range.

- The final minutes saw particularly heavy trading activity with volumes exceeding 7 million at 02:01-02:02, confirming strong buyer interest and suggesting potential for further upside movement.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Dogecoin Eyes $0.35 as Whale Accumulation Signals Bull Flag Breakout«, The Crypto Basic, published May 16, 2025.

- «Dogecoin Hovers at $0.22 Following Weeks of Gains, Analysts Share Mixed Outlooks«, NewsBTC, published May 17, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors