Uncategorized

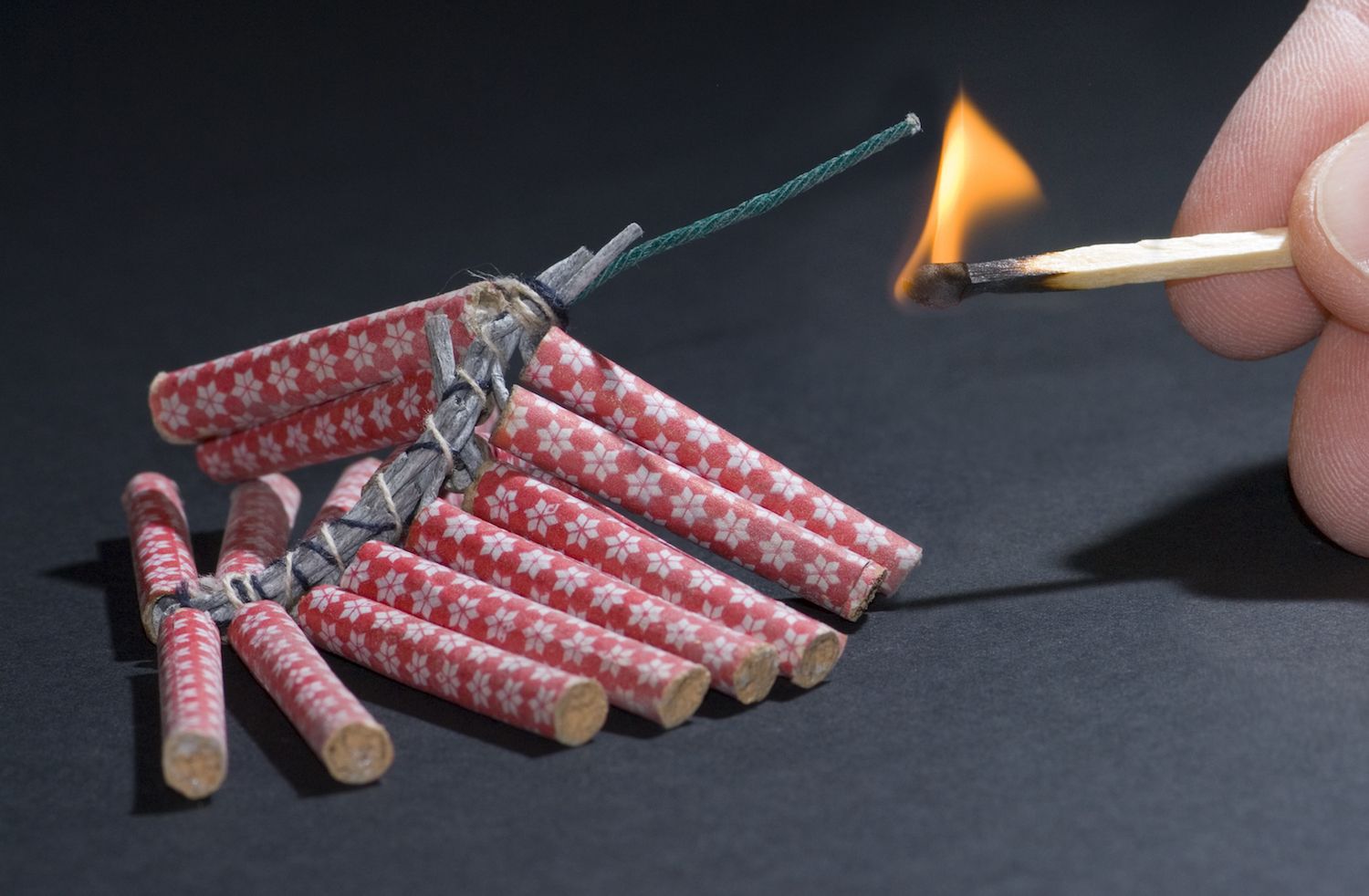

Don’t Expect Bitcoin Fireworks Ahead of New Year, Traders Say, as BTC ETFs Lose $420M

Bearish trading in bitcoin (BTC) markets continued late Monday as the asset briefly fell under $92,000 on profit-taking despite another mammoth MicroStrategy purchase, recovering to just over $92,800 as of Asian morning hours Tuesday.

Some traders expect the current price action to likely continue until February, weeks after president-elect Donald Trump takes office in the U.S. and sets into motion a barrage of policies that may help the market.

«We are skeptical of any New Year fireworks especially with funding healthy,» traders at Singapore-based QCP Capital said in a Telegram broadcast. «January’s average returns (+3.3%) are relatively similar to December’s (+4.8%), and we could expect spot to remain in this range in the near-term before things start to pick from Feb onwards.»

«Options flows are also reflecting similar sentiments with frontend vols drifting lower and risk-reversals most bid for Calls in March, partly due to significant March (120k-130k) Calls bought last Friday,» they added. This means traders are betting on bitcoin prices going up in March. They’re buying more call options (which profit if the stock rises) than put options. The cost of these options is going down, showing optimism for the March period.

BTC is on track to end December down 4%, its worst since 2021, as both retail investors and long-term holders cash out positions after a 117% yearly surge. Elsewhere, readings of the U.S. Chicago PMI indicate an economic slowdown, adding pressure on the market that tends to be correlated to such data.

In what looks to have been its final purchase of the year, Bitcoin development company MicroStrategy increased its BTC stash for the eighth consecutive week on Monday, adding another 2,138 BTC for $209 million in the week ended Dec. 29. That brought its total holdings to 446,400 BTC.

But news of the buying did little to stem losses. BTC prices slumped in the hours following MicroStrategy’s announcement, while shares of the company fell 8% to their lowest since early November.

The fall spread over to majors, with ether (ETH), XRP, Solana’s SOL and Cardano’s ADA falling as much as 3% before recovering. BNB Chain’s BNB was little changed, while memecoins dogecoin (DOGE) and shiba inu (SHIB) fell 5%.

The broad-based CoinDesk 20 (CD20), an index tracking the largest tokens by market capitalization, minus stablecoins, lost 2.7% in the past 24 hours.

Exchange-traded funds (ETFs) holding the asset recorded $420 million in outflows in their second-last day of trading ahead of the new year, data shows. Fidelity’s FBTC lost $154 million to lead outflows, followed by Grayscale’s GBTC at $130 million and BlackRock’s IBIT at $36 million.

The products have recorded more than $1.5 billion in net outflows since Dec. 19, pausing an impressive run in the first half of the month that saw nearly $2 billion in net inflows. Large outflows can reflect a shift in investor sentiment, possibly moving toward a more cautious or bearish outlook on bitcoin’s short-term performance.

Uncategorized

MARA’s Fred Thiel Says U.S. Should Start Mining Bitcoin to Fill Strategic Reserve

LAS VEGAS, Nevada — Marathon Digital Holdings (MARA) CEO Fred Thiel has an idea for how U.S. President Donald Trump’s administration can make good on its promises to build out a strategic bitcoin reserve: start mining.

Speaking on a panel at Bitcoin 2025 in Las Vegas on Tuesday, Thiel said that the U.S. government has many potential ways to generate bitcoin to fill the strategic bitcoin reserve that would adhere to the “budget-neutral” acquisition strategy laid out in Trump’s March executive order, including using excess hydroenergy to mine bitcoin domestically.

Though it’s been nearly three months since Trump authorized the establishment of a strategic bitcoin reserve, it remains unclear exactly how — and when — the government will take steps to actually begin filling it, a source of evident frustration among a number of speakers at the conference.

“I think it’s critical,” Thiel said of acquiring bitcoin for the reserve. “The U.S. making a statement that we’re going to have a strategic reserve is an empty statement unless you start putting stuff into it.”

At this point, the reserve is supposed to hold all of the bitcoin that has been sized by the government in civil and criminal forfeitures — estimated to be approximately 200,000 bitcoins. But many in the industry and government, including Sen. Cynthia Lummis (R-Wyo.), think that getting the government’s existing stockpile of bitcoin into a strategic reserve is merely a first step, to be followed by bigger, more meaningful acquisitions.

In March, Lummis re-introduced legislation — the so-called BITCOIN Act of 2025 — aimed at codifying Trump’s plans for a strategic bitcoin reserve. Under Lummis’ plan, after getting all of the forfeited bitcoin into the reserve, the U.S. government would spend the next two to five years converting a portion of its gold certificates into bitcoin.

“We have enough assets in under performing assets that we can get five percent of the world’s bitcoin without spending a single dime,” Lummis said.

However, Lummis acknowledged that it’s unlikely that any real movement on the BITCOIN Act — or, more broadly, taking any significant steps to fill the strategic reserve with anything other than forfeited assets — will come before Congress works its way through stablecoin and market structure legislation.

“It’s going to be a heavier lift than I thought because so many people don’t understand bitcoin,” Lummis said.

Uncategorized

XRP Bounces Back as Bulls Defend Key Technical Support

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with XRP demonstrating remarkable resilience despite recent capital outflows.

The digital asset saw its market capitalization fluctuate from $137.5 billion to $133.39 billion before partially recovering to $135.86 billion, highlighting the ongoing volatility.

Despite these challenges, XRP maintains position above critical technical support levels including the 50-day SMA at $2.26, suggesting underlying strength in its market structure.

Technical Analysis Highlights

- Price range: XRP traded between $2.275 and $2.356, representing a 3.56% range over 24 hours.

- Volume support: Significant volume spike to 71.18M at the $2.275 level during the 01:00 hour on May 27.

- Consolidation pattern: Hours following the initial support showed price consolidation before renewed buying.

- Secondary volume surge: Another high-volume increase to 74.36M during the 13:00 hour pushed prices toward range highs.

- Key resistance: Established at $2.355-$2.356 level.

- Support zone: Strong support identified at $2.275-$2.290 range.

- Hourly volatility: Notable price surge from $2.330 to $2.356 between 13:08-13:18.

- Volume confirmation: Exceptional volume spike of 6.28M at 13:13 supported the rally.

- Correction support: Price found support at $2.324 around 13:51 before recovering.

- Bullish pattern: Formation of a channel pattern with higher lows suggesting continued positive momentum.

External References

- «Possible Scenarios for XPR Once it Breaks Out of Consolidation: Ripple Price Analysis«, CryptoPotato, published May 26, 2025.

- «XRP price prediction as over $4 billion outflows in a day«, Finbold, published May 27, 2025.

- «XRP ($XRP) Price Prediction for May 28: Can Bulls Reclaim $2.32 After Prolonged Decline?«, Coin Edition, published May 27, 2025.

- «XRP Price Prediction For May 27«, CoinPedia, published May 27, 2025.

Uncategorized

KindlyMD Acquires 21 Bitcoin Ahead of Merger with Nakamoto

KindlyMD (NAKA), an integrated healthcare services provider, has pulled the trigger on its bitcoin BTC treasury strategy.

The acquired 21 bitcoin for roughly $2.3 million at an average cost of $109,027, according to a Tuesday press release. The purchase was funded by exercising some of the company’s outstanding warrants.

“Our first 1/millionth of all bitcoin, on our way to owning 1,000,000 bitcoin,” David Bailey, founder and CEO of Nakamoto Holdings, posted on X. “1 Nakamoto = 1m Bitcoin,” he added.

NAKA is higher by 3.9% on Tuesday.

KindlyMD announced on May 12 that it had agreed to merge with Nakamoto Holdings in order to pursue a bitcoin accumulation strategy mirrored after Strategy’s (MSTR) playbook. The combined entity secured $710 million in financing.

KindlyMD and Nakamoto will also partner up with custody firm Anchorage Digital to provide exclusive custody and trading services to the company post-merger, KindlyMD announced on May 21.

The merger is expected to close in the third quarter of 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors