Uncategorized

Dogecoin Jumps to 21-Cents Despite $200M Whale Transfer to Binance

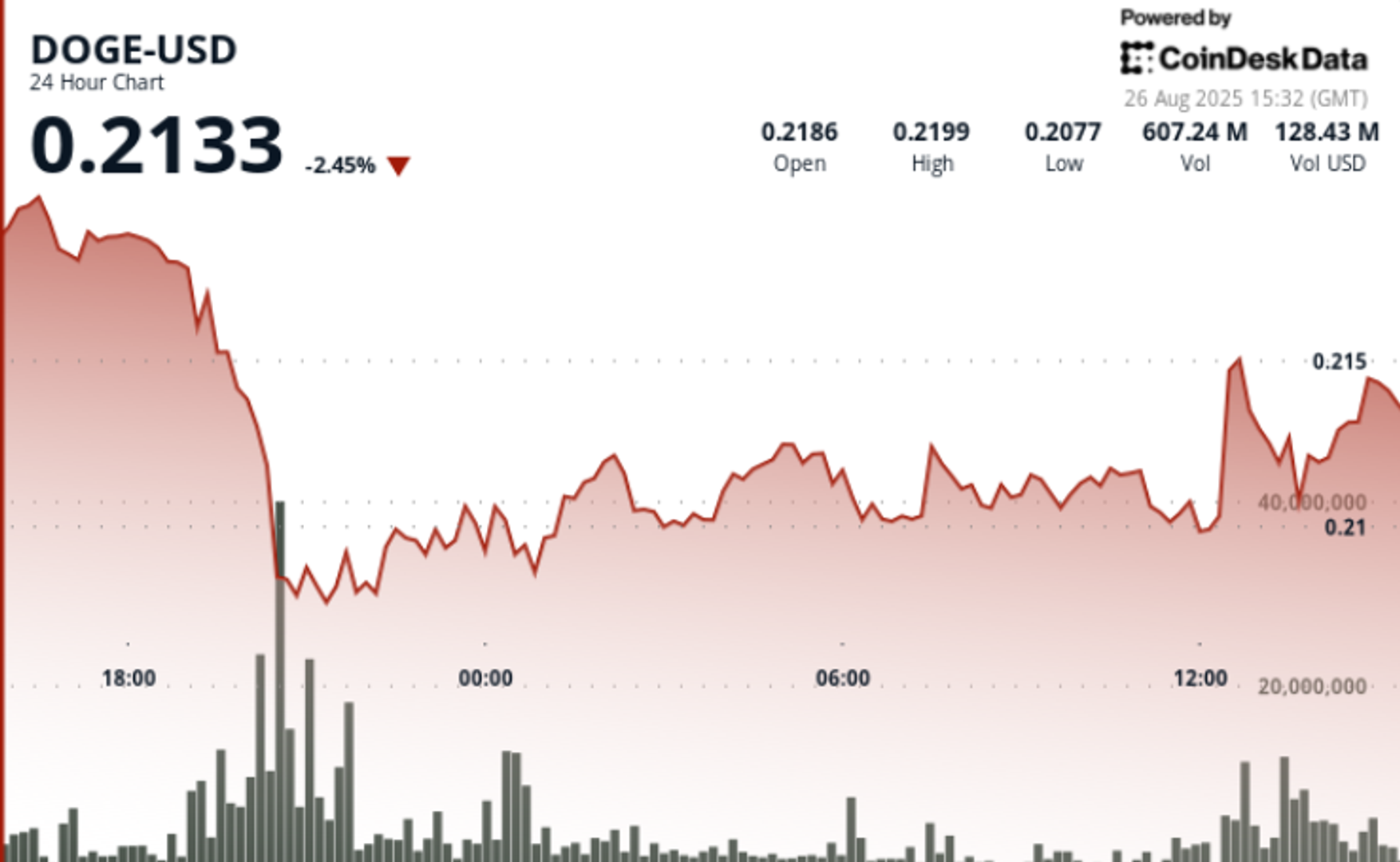

Dogecoin traded through heavy volatility over the August 24–26 window, swinging within a $0.013 range before consolidating near $0.21. A sharp drop from $0.218 to $0.208 on August 25 came amid massive 1.57 billion volume, while broader pressure was tied to a 900 million DOGE transfer to Binance that unsettled traders.

Despite near-term caution, whales continue accumulating, leaving sentiment split between breakdown risks and dip-buying optimism.

News Background

- Whale transfers added fuel to volatility: between August 24–25, a single 900 million DOGE ($200+ million) was moved to Binance from a long-term holding wallet.

- Market sentiment soured on fears of a sell-off, with open interest in DOGE futures dropping 8% as speculative traders pared exposure.

- Despite the inflow, on-chain data shows whales accumulated over 680 million DOGE in August, countering retail distribution.

- Fed Chair Powell’s Jackson Hole comments sparked a 12% meme coin sector rally, aligning DOGE with broader risk-on momentum.

Price Action Summary

- DOGE posted a 6.06% spread in the 23-hour session ending August 26 at 12:00, trading between $0.221 and $0.208.

- The sharpest move came during 19:00–20:00 GMT on August 25, when DOGE fell from $0.218 to $0.208 on 1.57 billion volume.

- Price also whipsawed after the whale transfer, swinging from a $0.25 high to test $0.23 support before stabilizing.

- A rebound lifted DOGE from $0.210 session lows to $0.211–$0.212 in the 11:27–12:26 GMT window on August 26, aided by a 17.85 million volume spike at 11:58.

Technical Analysis

- Support established at $0.208 following the high-volume drop.

- Resistance holds at $0.218–$0.221, capping rallies.

- Current consolidation between $0.210–$0.212 suggests accumulation.

- RSI recovered from oversold levels near 42 to mid-50s, showing stabilizing momentum.

- MACD histogram narrowing toward bullish crossover, signaling potential upside reversal.

- Open interest decline of 8% points to reduced speculative leverage, limiting volatility but also dampening near-term upside.

- Sustained trading above $0.21 with elevated volumes (+16% vs. 30-day averages) strengthens bullish case.

What Traders Are Watching

- Bulls target a breakout toward $0.23–$0.24 if consolidation resolves upward and whale buying persists.

- Bears highlight $0.208 as the key downside trigger, with a break opening risk toward $0.200.

- The tug-of-war between exchange inflows (distribution risk) and whale accumulation (supportive demand) remains the decisive factor for the next leg.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton